Table of contents

Number of upsells

Founders care about number of upsells because it's the earliest, clearest signal that existing customers can grow your revenue without more acquisition spend. When upsells are consistent, you can forecast expansion, justify customer success and sales coverage, and reduce dependence on top-of-funnel volatility.

Definition (plain English): Number of upsells is the count of customer expansion events in a given period—upgrades, added seats, add-ons, or higher tiers—that increase recurring revenue for existing customers.

An upsell is about customer expansion behavior. It is not automatically the same thing as more revenue overall (that's why you pair it with Expansion MRR).

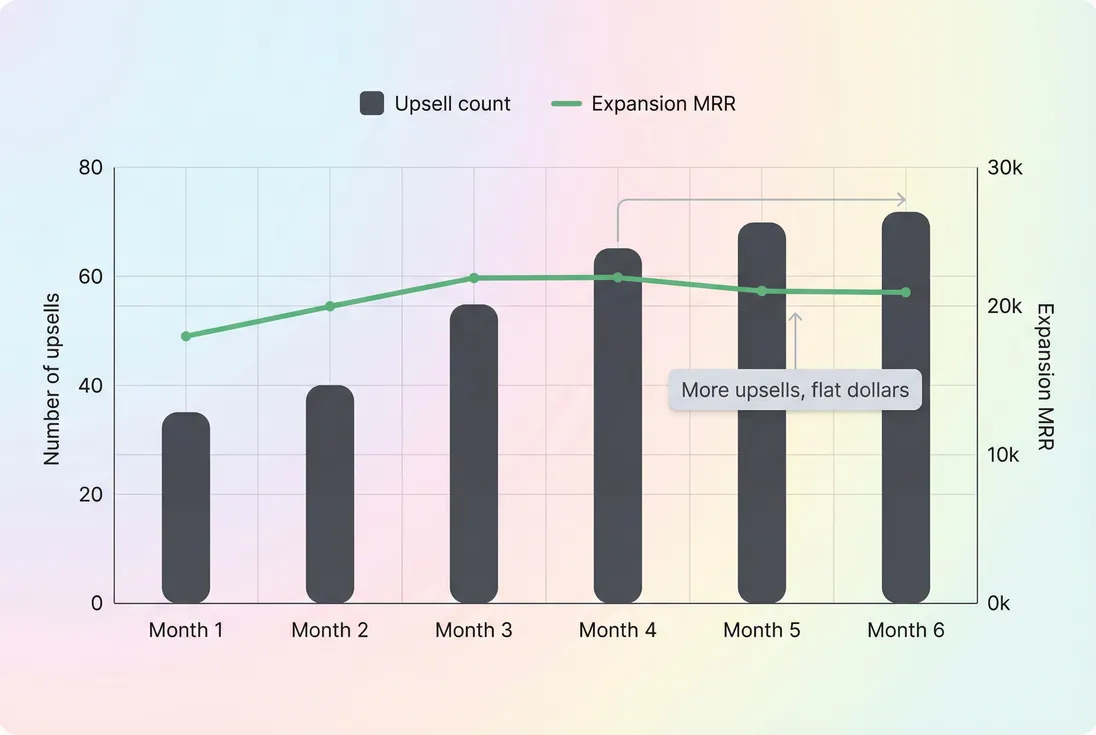

Upsell volume can rise while Expansion MRR stays flat—an immediate cue to investigate upsell size, packaging, and discounting.

What counts as an upsell

Before you track anything, decide what you mean by "upsell," because different definitions produce very different numbers.

Common upsell event types

Most SaaS teams count an upsell when recurring revenue increases for an existing customer due to:

- Tier upgrade (Starter → Pro)

- Seat increase (10 seats → 25 seats)

- Add-on purchase (security pack, extra workspace)

- Usage-based expansion that increases the recurring baseline (common in usage-based pricing with committed floors)

What typically should not be counted as an upsell:

- New customer purchases (that's acquisition)

- Reactivations (use Number of Reactivations)

- One-time fees (implementation, training; see One Time Payments)

- Broad price increases applied to many customers at once (track separately as pricing actions)

- Billing frequency changes (monthly → annual) if the underlying recurring value didn't change (this affects cash timing, not expansion)

The Founder's perspective: If you mix "price migration revenue" with true upsells, you'll think your expansion motion is healthy when it isn't. That leads to the wrong hires (more CSMs) and the wrong roadmap (more enterprise features) because the metric is lying about customer intent.

Event count vs account count (pick one)

You need to choose whether "number of upsells" is:

- Upsell events (recommended for operations): Every discrete expansion event counts, even if the same account upgrades twice in a month.

- Upsold accounts (recommended for strategy): Each account counts at most once per period, even if multiple expansions occur.

Both are valid. Just don't mix them in the same dashboard.

A practical approach:

- Use event count to manage workload and instrumentation (how many expansions happened).

- Use account count to manage reach (how many customers are expanding at all).

How to calculate it

At its simplest, it's just a count in a period. The hard part is defining the period and the "event."

Basic calculation

If you use the "upsold accounts" definition:

Add two companion metrics (so it's actionable)

On its own, upsell count is easy to misread. Pair it with:

Upsell rate (how widespread expansion is):

Average expansion per upsell (how meaningful each upsell is):

Where "eligible accounts" usually means active paying customers at the start of the period, excluding churned customers and (often) excluding customers still in an onboarding window where upgrades are structurally unlikely.

A concrete example

Say you start April with 1,000 paying accounts.

- Upsell events in April: 60

- Expansion MRR in April: $12,000

Then:

- Upsell rate = 60 / 1,000 = 6% per month

- Average expansion per upsell = $12,000 / 60 = $200 MRR per upsell

If May shows 80 upsells but still $12,000 Expansion MRR, your average expansion falls to $150. That's not "good" or "bad" by itself—but it tells you where to look: packaging, plan boundaries, discounting, or whether upgrades are mostly tiny seat bumps.

What drives number of upsells

Upsell count is downstream of three forces: opportunity, ability, and motion.

1) Opportunity: who can expand?

This is structural and shows up in segmentation.

- Customer size distribution (SMB vs mid-market vs enterprise)

- Pricing model (per-seat vs flat vs usage-based)

- Plan ceilings and paywalls (is there a meaningful next step?)

- Product modularity (can customers add value incrementally?)

If your product is "one-and-done" (single tier, no add-ons), upsells will always be rare even with great retention.

Related metrics to sanity-check opportunity:

- ASP (Average Selling Price) and ARPA (Average Revenue Per Account) to understand where accounts sit today

- Active Customer Count to know the expansion base

2) Ability: do customers get more value over time?

Upsells require customers to hit limits or discover additional value.

Common product drivers:

- Strong activation and fast Time to Value (TTV)

- Sustained adoption (see Feature Adoption Rate)

- Natural growth loops (more users, more data, more workflows)

- Clear upgrade moments (limits, advanced permissions, reporting, integrations)

A classic anti-pattern: customers love the product, retention is fine, but upsells are flat because the product doesn't create incremental value as usage increases.

3) Motion: do you consistently capture expansion?

Even when opportunity exists, you won't see upsells without a functioning expansion motion:

- In-product upgrade prompts at the right time

- Lifecycle messaging tied to usage thresholds

- Sales assist for "high intent" accounts

- CSM-led account reviews for expansion candidates (typically mid-market+)

The Founder's perspective: Upsell count is a management metric. If it drops for two months, the question isn't "do customers love us?" The question is "did we break the path to expansion—pricing pages, paywalls, notifications, sales follow-up, or packaging?"

How to interpret changes

Upsell count is most useful when you interpret it alongside revenue impact and retention. Here are the patterns founders run into most often.

Pattern A: upsells up, Expansion MRR flat

Likely explanations:

- Customers are upgrading, but only by small amounts (seat creep, tiny add-ons)

- You introduced a lower-priced expansion option (more upgrades, less money)

- Discounting increased on upgrades (especially with sales-led motions)

- Instrumentation is counting "events" that aren't meaningful (plan migrations, proration artifacts)

What to do:

- Check average expansion per upsell

- Break out upsells by type (seats vs tier vs add-on)

- Review discount policy and approvals (see Discounts in SaaS)

Pattern B: upsells down, Expansion MRR up

Likely explanations:

- Fewer but larger expansions (enterprise expansions, annual expansions recognized as MRR)

- A small number of "whale" accounts are driving expansion (concentration risk)

What to do:

- Segment by customer size and evaluate Customer Concentration Risk

- Look at cohort behavior using Cohort Analysis to see if expansion is broad-based or isolated

Pattern C: upsells up, churn up

This happens more than founders expect. It can mean:

- You're upselling too early (before customers are successful)

- Upgrades create complexity or cost shocks

- Customers expand briefly, then realize they don't need it (followed by downgrades and churn)

What to do:

- Pair upsell count with Logo Churn and MRR Churn Rate

- Watch Contraction MRR for "undo" behavior after upgrades

- Add a post-upgrade success path (training, templates, onboarding for the upgraded capability)

Pattern D: upsells stable, NRR falling

If upsells are steady but NRR (Net Revenue Retention) is declining, the math is telling you downsells + churn are growing faster than expansion.

What to do:

- Decompose retention with GRR (Gross Revenue Retention) vs NRR

- Focus on churn drivers and reasons (see Churn Reason Analysis) before pushing harder on upsell tactics

How founders use it in decisions

This metric is most valuable when it drives a specific decision, not when it becomes a scoreboard.

1) Packaging and pricing decisions

Upsell count is feedback on whether your packaging creates a natural ladder.

Use it to answer:

- Do customers have a clear "next purchase"?

- Are paywalls in the right place (usage limits, admin controls, security)?

- Is the price delta between tiers too small (cheap upgrades) or too big (upgrade friction)?

A practical diagnostic table:

| Situation | What you'll see | Likely fix |

|---|---|---|

| No clear next step | Low upsell rate, flat ARPA | Add-ons or meaningful tier boundaries |

| Upgrades too cheap | High upsell count, low Expansion MRR | Rework tier deltas, seat pricing, add-on pricing |

| Upgrades too hard | Low upsell count, high feature usage | Improve upgrade UX, sales assist, clearer value messaging |

Related reading: Price Elasticity and Per-Seat Pricing.

2) Forecasting expansion with fewer surprises

Upsells are a leading indicator compared to revenue recognition and renewals.

If you track:

- Upsell rate (breadth)

- Average expansion per upsell (depth)

- Mix by segment (where upsells come from)

…you can build a forecast that doesn't assume a magical expansion number.

The Founder's perspective: When investors ask if expansion is "repeatable," they're asking if your upsell count comes from a consistent customer behavior pattern. One big expansion quarter isn't repeatable; a stable upsell rate by cohort often is.

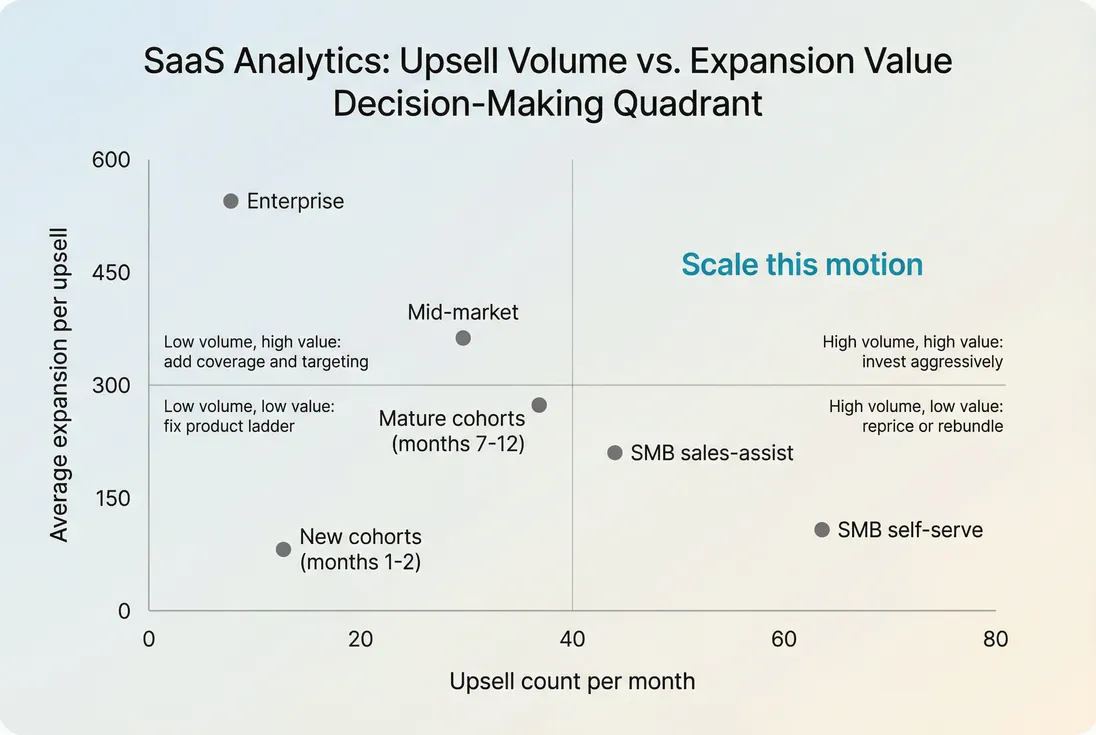

3) Deciding on PLG vs sales assist

Upsell count also tells you whether product-led upgrades are working or whether you need people involved.

Rules of thumb:

- If upsells are frequent but small, you likely have PLG-style upgrades working. Optimize pricing page, in-app prompts, and trial-to-paid flows (see Product-Led Growth).

- If upsells are infrequent but large, you likely need sales assist: account identification, outreach, negotiation (see Sales-Led Growth).

A helpful operational split is to define:

- Self-serve upsells: upgraded without human involvement

- Assisted upsells: upgraded after sales or CSM touch

Then you can staff accordingly.

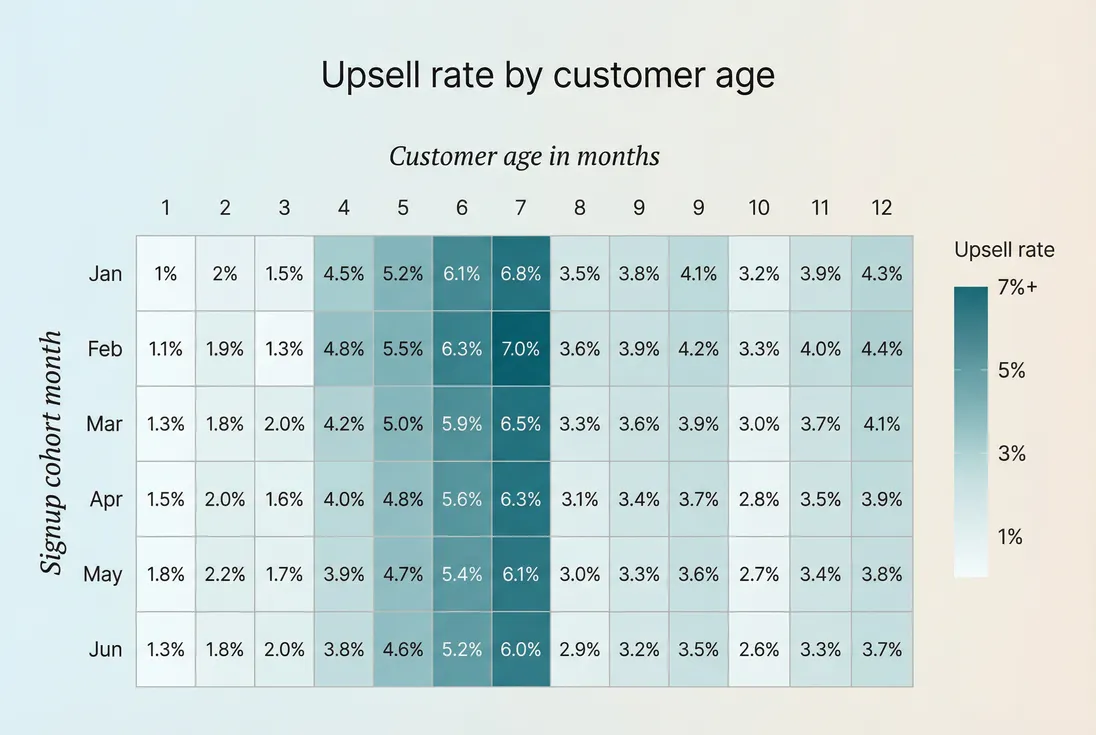

4) Finding the "when" of expansion

Upsells usually cluster at predictable times: after onboarding, after a team rollout, after renewal, or after hitting a usage limit.

The most useful view is upsells by customer age (months since first payment).

Upsells often follow a lifecycle pattern; knowing the typical month of expansion helps you time prompts, CSM touches, and plan-limit messaging.

Once you see the "expansion window," you can act:

- Put upgrade prompts and sales-assisted outreach in the months where upsells actually happen

- Improve onboarding if upsells never appear after month 3 (customers may not be reaching value)

- If upsells only happen at renewal, your in-term upgrade path may be too hidden or too hard

When this metric breaks down

Number of upsells is simple—but it's fragile. Here are the most common ways teams accidentally corrupt it.

Counting billing artifacts as upsells

If you rely on raw billing events, you may count:

- Proration adjustments

- Plan renames (same price, new SKU)

- Invoice corrections and credits (see Refunds in SaaS and Chargebacks in SaaS)

Fix: define an upsell as a net increase in recurring run-rate after the change, not just "subscription updated."

Mixing expansion and contraction in the same month

Some accounts upgrade and downgrade within the period. If you only count "an upsell happened," you'll overstate successful expansion.

Fix options:

- Count upsells as events but also track net change via Expansion MRR and Contraction MRR

- Add a "reversed within 30 days" flag as a quality check

Hiding segment-level reality

Overall upsell counts can look fine while a key segment is failing (e.g., mid-market never expands).

Fix: always segment by at least:

- Plan / tier

- Customer size band (proxy from current ARPA or seats)

- Acquisition channel (if you have it)

- Customer age

If you're using GrowPanel, segmenting and drilling into movements typically starts with MRR movements and narrowing views with Filters.

A practical way to operationalize upsells

To make this metric drive action, build a small "upsell control panel" you review monthly:

- Number of upsells (events and/or accounts)

- Upsell rate (per eligible accounts)

- Average expansion per upsell

- Mix by type (tier vs seats vs add-on)

- Segment cuts (plan, size, age)

Then use a simple diagnostic map:

Upsell count becomes a decision tool when paired with average upsell size—different quadrants suggest pricing changes, product work, or sales/CS coverage.

The Founder's perspective: Your goal isn't "more upsells." Your goal is repeatable expansion in the segments you want to win. If SMB has lots of tiny upgrades, fix packaging. If enterprise has huge upgrades but low volume, invest in targeting and account coverage.

Benchmarks and expectations (use carefully)

Upsell behavior varies massively by model, so treat benchmarks as directional and focus on deltas vs your baseline.

Typical patterns:

- SMB self-serve: higher upsell counts, lower dollars per upsell, more sensitive to UX and paywalls.

- Mid-market: moderate counts and moderate dollars; lifecycle messaging plus light sales assist often wins.

- Enterprise: lower counts, high dollars; expansions show up around renewals, rollouts, or new departments.

Instead of chasing an external "good number," set internal targets like:

- Increase upsell rate in months 3–6 cohorts by 1–2 points

- Increase average expansion per upsell by improving tier deltas (without harming churn)

- Reduce "reversed within 30 days" upgrade events

These targets tie directly to product, pricing, and CS actions.

Wrap-up: what to watch next

Number of upsells tells you how often customers expand—not how much revenue they add or whether expansion offsets churn. To make it decision-grade:

- Pair it with Expansion MRR and Contraction MRR

- Interpret it through retention with NRR (Net Revenue Retention) and GRR (Gross Revenue Retention)

- Segment by plan, customer age, and customer size so you know where to act

When upsells become predictable by segment and lifecycle, you've moved from "hoping for expansion" to running an expansion engine.

Frequently asked questions

Number of upsells counts how many expansion events happened. Expansion MRR measures the dollars added from those events. You can grow upsell count while Expansion MRR stays flat if upgrades are small, discounted, or mainly seat bumps. Track both to understand volume versus impact.

There is no universal benchmark because pricing model and customer size dominate the outcome. Self-serve SMB often sees higher upsell volume but smaller dollars per upsell; enterprise sees fewer upsells but larger contract expansions. Compare to your own historical baseline by segment and cohort age.

Usually no. A price increase applied broadly is pricing power, not customer-driven expansion. Counting it as upsells inflates the metric and hides whether customers are choosing higher tiers or buying add-ons. Keep price migrations in a separate category and measure customer-initiated upgrades independently.

Common causes are higher downsells, churn, or smaller average upsell size. A surge of low-value upgrades can raise upsell count without moving Net Revenue Retention. Pair number of upsells with Contraction MRR, churn, and average expansion per upsell to see what is offsetting growth.

Segment by plan, customer size, acquisition channel, and customer age since start. You want to know where upsells are easy and where they never happen. Tie segments to product adoption and account health, then prioritize packaging changes, lifecycle messaging, and sales coverage where expansion is most likely.