Table of contents

MRR churn rate

Founders rarely fail because they can't acquire customers. They fail because they can't keep the revenue they already paid to acquire. MRR churn rate is the speed at which your existing recurring revenue base is leaking. If it's high, you're on a treadmill: your new sales mostly replace what you lost instead of compounding.

Definition (plain English): MRR churn rate is the percentage of starting monthly recurring revenue you lose from existing customers during a period, typically a month, due to cancellations and downgrades.

If you're new to the basics, start with MRR (Monthly Recurring Revenue)—MRR churn rate only makes sense once your MRR definition is consistent.

What this metric reveals

MRR churn rate answers a practical founder question:

"Of the revenue I started the month with, how much did I bleed out?"

It's a stronger operational signal than top-line growth because it's hard to fake. You can buy growth with spend. You can't sustainably buy your way out of poor retention without eventually breaking your CAC Payback Period and Burn Multiple.

What it reveals in practice:

- Product value delivery gaps: customers pay once, then realize it doesn't stick.

- Customer mismatch: you're selling to the wrong ICP, even if conversion looks good.

- Pricing and packaging stress: downgrades after price increases, or "seat shedding" behavior.

- Support and reliability problems: churn clustered after incidents or onboarding failures.

- Revenue quality issues: discounting or short-term deals that don't renew.

The Founder's perspective

If MRR churn is rising, your "growth plan" is mostly a replacement plan. The right move is usually not "increase pipeline." It's to isolate which revenue is failing to retain and fix the failure mode before scaling acquisition.

How it's calculated (and where teams get it wrong)

The most useful operating definition treats MRR churn as lost MRR from existing customers, including both cancellations and downgrades.

Where:

- Starting MRR = MRR at the beginning of the period (for example, 12:00 a.m. on the first day of the month).

- Churned MRR = MRR lost from customers who fully cancel during the period.

- Contraction MRR = MRR lost from downgrades, seat reductions, or plan changes downward during the period (see Contraction MRR).

This is why many operators track MRR churn alongside Net MRR Churn Rate, which also accounts for expansion (see Expansion MRR).

A concrete example

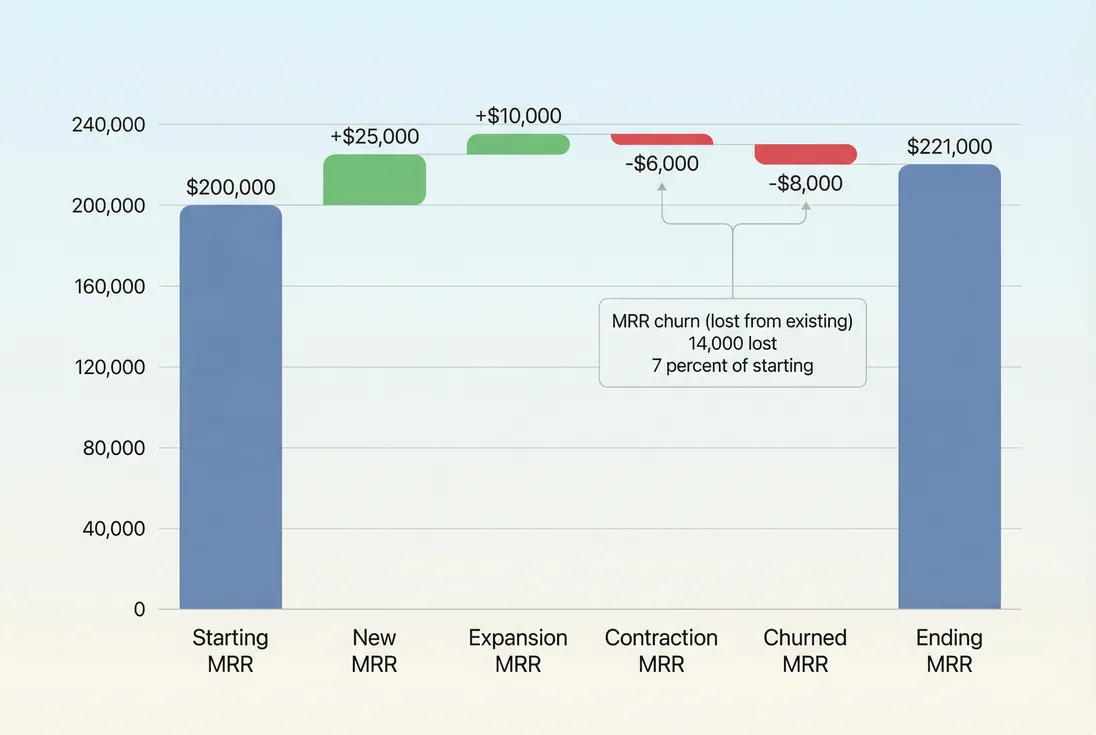

You start April with $200,000 in MRR.

During April:

- Customers cancel: $8,000 churned MRR

- Customers downgrade: $6,000 contraction MRR

That 7% is a red flag for most B2B SaaS—unless you're very early, very SMB-heavy, or your measurement period doesn't match your contract structure (more on that below).

Common calculation mistakes

1) Using average MRR instead of starting MRR

Average MRR can be fine for some finance use cases, but founders need a consistent "base" for leakage. Starting MRR makes month-to-month comparisons more interpretable.

2) Counting new customer churn as churn

If someone signs up and cancels in the same month, decide your rule and be consistent. Many teams include it (because it's real revenue loss), but operationally you should segment it because it's often an onboarding and activation issue.

3) Mixing refunds and churn

Refunds are cash events; churn is a subscription state change. Keep your churn definition tied to subscription MRR movements. (If refunds are distorting your view of revenue quality, treat them separately using Refunds in SaaS.)

4) Mis-timing churn recognition

Annual contracts can make churn look "flat" for months and then spike at renewal. If you sell annual, your monthly churn chart may be less useful than cohort and renewal-based views (see Renewal Rate and Cohort Analysis).

The Founder's perspective

Don't argue about the one perfect definition. Pick the definition that best predicts future ARR and forces accountability. Then document it and stick to it—especially when you start reporting to investors.

What drives MRR churn rate

MRR churn rate isn't a single problem. It's the combined output of customer mix, product value, pricing, and operational execution. The fastest way to make it actionable is to break it into drivers.

Customer mix and revenue concentration

- SMB-heavy pricing typically increases churn pressure: budgets are tight, usage is bursty, switching costs are low.

- Enterprise concentration often lowers "average" churn but adds whale risk: one churn event can blow up a month (see Cohort Whale Risk and Customer Concentration Risk).

A founder mistake: celebrating a lower MRR churn rate after landing one big customer, without noticing that retention is now dependent on a handful of renewals.

Value realization and onboarding

If customers don't reach meaningful value quickly, you'll see:

- High churn in months 1–2

- High downgrades after initial adoption

- Low expansion later

This is why MRR churn should be paired with onboarding and adoption indicators like Time to Value (TTV) and Onboarding Completion Rate.

Pricing and packaging mechanics

MRR churn is highly sensitive to how you monetize:

- Per-seat pricing can create contraction churn during budget cuts (see Per-Seat Pricing).

- Usage-based pricing can blur the line between "contraction" and normal usage variability—your definition of "recurring" needs discipline (see Usage-Based Pricing).

- Discounts can create "sticker shock" churn when they expire (see Discounts in SaaS).

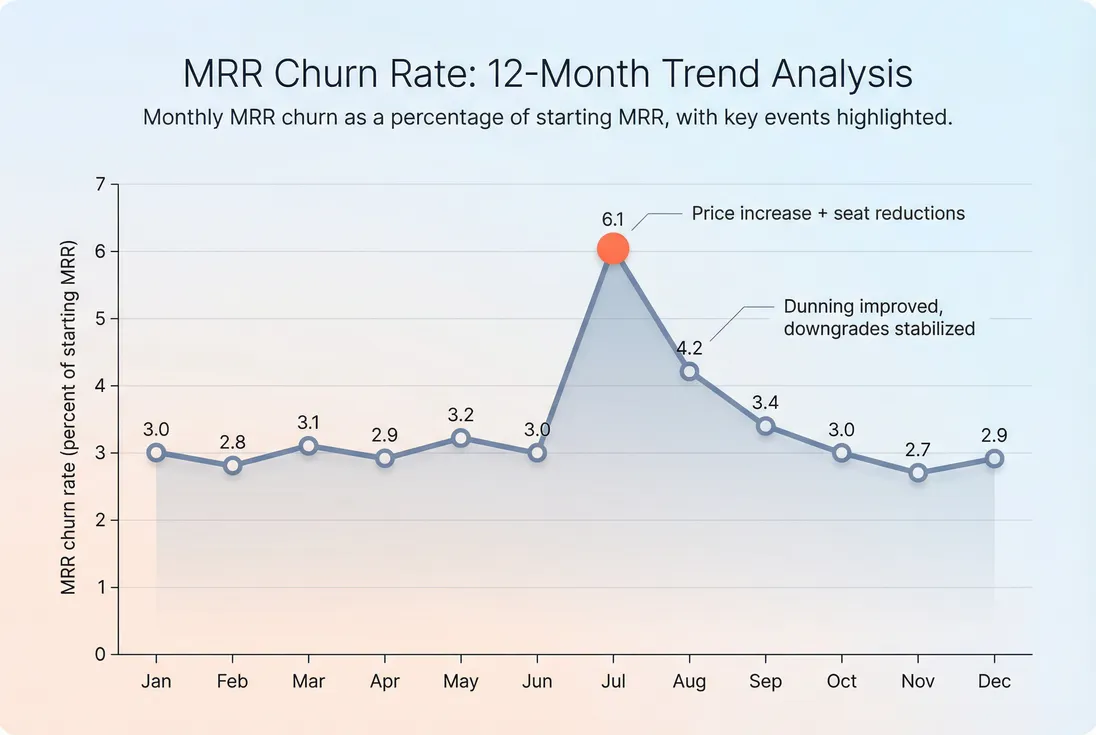

If your MRR churn rises right after pricing changes, segment by plan and cohort before concluding "pricing is broken." Often the issue is who you sold the new pricing to, and whether they were successfully migrated.

Involuntary vs voluntary churn

A portion of churn is operational: failed payments, expired cards, bank issues. This is involuntary churn (see Involuntary Churn).

Voluntary churn is the harder, more existential type: customers actively decide you aren't worth it.

Why this matters: if involuntary churn is rising, your fix is mostly billing workflows and dunning. If voluntary churn is rising, your fix is product value, onboarding, support, or ICP.

How to interpret changes without fooling yourself

Start with a trend, not a point

A single month is noisy. Use:

- A trailing view like T3MA (Trailing 3-Month Average) to smooth out one-off events

- Segment cuts (SMB vs mid-market, monthly vs annual, self-serve vs sales-led)

Decompose churn before you decide

When MRR churn moves, avoid guessing. Ask:

Is it churned MRR or contraction MRR?

If contraction is rising, investigate plan downgrades, seat reductions, and value metric friction. If churned MRR is rising, investigate cancellations and renewal losses.Is it concentrated or broad?

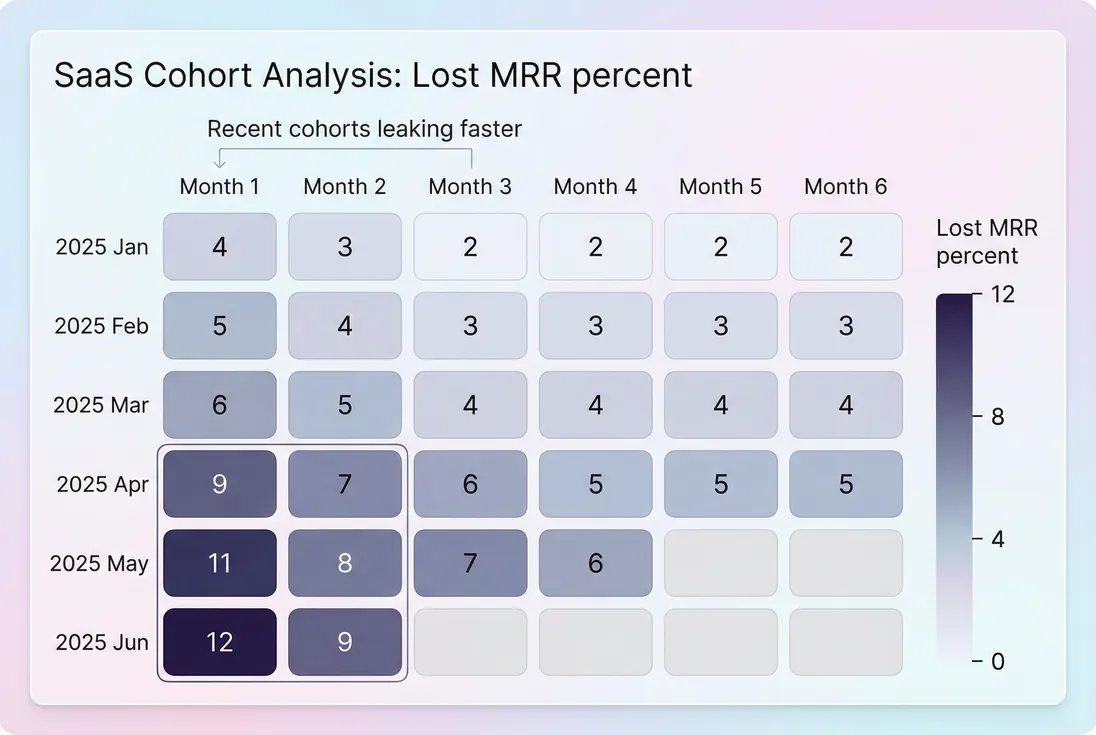

One enterprise churn demands account-level analysis. Broad SMB downgrades demand product and packaging analysis.Is it cohort-driven?

If only recent cohorts churn, your acquisition quality or onboarding may be the culprit. If older cohorts churn, your product may be losing relevance or you've saturated the easy wins.

Cohorts are usually where the truth is (see Cohort Analysis and GRR (Gross Revenue Retention)).

Translate churn into growth headroom

MRR churn rate isn't just a retention KPI—it's a growth constraint.

Example: if your monthly MRR churn is 4%, then even if you add 4% new MRR each month, you'll barely grow. That's why teams that ignore churn end up with "big sales months" and disappointing net growth.

To connect this to board-level reporting, pair churn with:

- Revenue Growth Rate

- NRR (Net Revenue Retention)

- ARR (Annual Recurring Revenue)

- LTV (Customer Lifetime Value) (since churn heavily impacts lifetime)

The Founder's perspective

If churn is high, you don't have a scaling problem—you have a compounding problem. Reducing churn by one point can be worth more than adding a new channel, because it improves every future month's base.

What "good" looks like (benchmarks with context)

Benchmarks vary by ICP, contract type, and pricing model. Use these as directional ranges, then validate against your own segment cuts and sales motion.

| SaaS motion | Typical monthly MRR churn rate | Notes |

|---|---|---|

| SMB self-serve | ~3% to 7% | High volume, low switching cost; focus on onboarding and involuntary churn control |

| SMB to mid-market PLG | ~2% to 5% | Expansion can offset churn; segmentation and lifecycle messaging matter |

| Mid-market sales-led | ~1% to 3% | Downgrades often signal seat value issues; watch contraction MRR |

| Enterprise | ~0.5% to 2% (but lumpy) | Monthlies can mislead; focus on renewals, cohorts, and concentration |

Two founder warnings:

- Low churn can hide stagnation. If you're not expanding and not adding new customers, churn won't tell the full story.

- Churn improvement can be "mix shift," not product improvement. If you moved upmarket, churn may drop even if onboarding still leaks for smaller customers.

How founders use MRR churn to make decisions

1) Prioritize retention work by revenue impact

A practical retention backlog should map to MRR churn drivers:

- If churned MRR is high: cancellation reasons, save plays, success outreach (see Churn Reason Analysis)

- If contraction MRR is high: packaging, seat value, feature gating, usage education

- If involuntary churn is high: billing retries, card updater, failed payment flows

The goal isn't "do more retention." The goal is reduce lost MRR per month in the segments that matter.

2) Set realistic acquisition targets

Once you know your leakage, you can set sane targets for new MRR.

Example: Start MRR is $200k and MRR churn rate is 5% → you lose ~$10k/month. If your growth target is +$20k net MRR/month, you actually need about $30k in new plus expansion MRR just to clear the bar.

This is where churn ties directly to sales capacity planning and spend.

3) Prevent churn from corrupting unit economics

High churn quietly destroys:

If you're scaling spend while churn is climbing, you're usually buying short-lived revenue. That can look fine for two quarters and then blow up cash flow and morale.

4) Build a churn "debug loop"

Founders need a consistent cadence:

- Weekly: top churn and contraction accounts, categorized by reason

- Monthly: MRR churn trend, segmented by plan, size, channel, tenure

- Quarterly: cohort retention review, packaging and ICP decisions

If you use GrowPanel, the fastest path is to review churn in the context of MRR movements and segment using filters, then drill into the customer list for the accounts driving the change. Documentation: MRR churn, MRR movements, and Filters.

The Founder's perspective

The win isn't "a nice churn dashboard." The win is shortening the time between a churn signal and a concrete change: onboarding fix, product improvement, pricing adjustment, or customer success playbook.

When MRR churn rate "breaks"

MRR churn is powerful, but there are scenarios where it misleads unless you adjust your lens.

Annual billing and renewal spikes

If most revenue renews annually, monthly churn can look artificially calm, then spike. Use:

- renewal-period views (Renewal Rate)

- cohort retention

- revenue concentration analysis

Small bases exaggerate noise

At $20k MRR, losing one $1k customer is a 5% churn month. Use trailing averages and segmenting to avoid overreacting.

Usage volatility masquerades as churn

For usage-based revenue, a drop in usage may show as contraction, but it might be normal seasonality. Consider whether a portion of "MRR" is actually variable and should be analyzed differently (see Metered Revenue).

The bottom line

MRR churn rate is the founder metric for revenue durability. It tells you whether your growth is compounding or constantly being replaced. Calculate it consistently from starting MRR, break it into churned versus contraction drivers, segment it aggressively, and use it to set realistic growth and spend plans.

For the complementary view that accounts for expansion, read Net MRR Churn Rate.

Frequently asked questions

Logo churn counts how many customers you lost. MRR churn rate measures how much recurring revenue you lost. If you lose a few large accounts, MRR churn can spike while logo churn stays low. If you lose many small customers, logo churn spikes while MRR churn may look manageable.

It depends on segment and maturity, but many healthy B2B SaaS businesses aim for roughly 1 to 3 percent monthly MRR churn. Early stage SMB SaaS often runs higher. Enterprise models can be lower monthly but "lumpy" around renewals. Track trends and segment drivers, not just one benchmark.

For most operators, yes: treat downgrades as lost recurring revenue, since they reduce your starting base just like cancellations. Many teams define MRR churn as churned MRR plus contraction MRR divided by starting MRR. If you exclude downgrades, you will understate retention risk in seat based or usage plans.

This often happens when you tighten discounts, move upmarket, or reduce low quality acquisition. You lose less MRR, but you may also add new MRR more slowly. Pair MRR churn with new MRR and expansion MRR to see whether you are trading off acquisition velocity for higher quality revenue and better unit economics.

First, determine whether it was concentrated in one account, one segment, or one billing event such as annual renewals. Then separate voluntary from involuntary drivers. A one off enterprise churn needs a different response than broad SMB downgrades. Use trailing averages and cohort views before changing strategy.