Table of contents

ARR (annual recurring revenue)

Founders care about ARR because it's the fastest way to answer one question investors, candidates, and your own team will ask constantly: how big is the recurring engine right now, and is it compounding or leaking? If ARR is rising for the right reasons (new customers and expansion, not short-term discounting), you can hire and invest with confidence. If it's flat or volatile, you're usually one churn wave away from painful cuts.

ARR (Annual Recurring Revenue) is the annualized value of your active recurring subscriptions at a point in time. It's a run rate, not the revenue you recognized or the cash you collected this month.

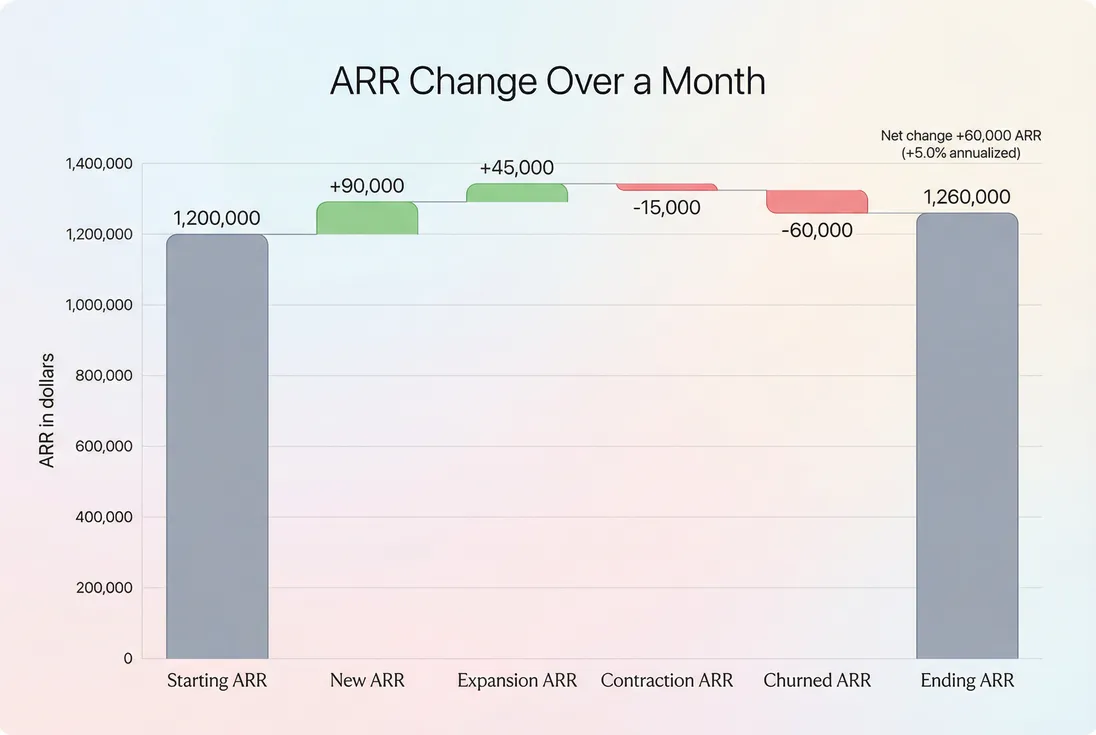

An ARR bridge forces clarity on what actually moved: new business and expansion versus contraction and churn.

What ARR includes (and excludes)

ARR is simple in concept, but messy in real life because billing systems mix recurring, one-time, and variable charges.

Typically included

- Subscription fees that recur (monthly, quarterly, annual) for active customers.

- Contracted recurring add-ons (extra seats, additional modules) as long as they are recurring.

- Committed minimums (for hybrid usage plans) if they are truly contractual.

Typically excluded

- One-time payments and setup fees (see One Time Payments).

- Pure usage overages that are not committed (see Usage-Based Pricing and Metered Revenue).

- Taxes like VAT (see VAT handling for SaaS).

- Pass-through fees (see Billing Fees).

- Refunds and chargebacks are not "excluded" as a category, but they usually indicate a correction to what was billed rather than what is truly recurring (see Refunds in SaaS and Chargebacks in SaaS).

The Founder's perspective

If you can't explain what counts in ARR in one sentence, you'll make hiring and pricing decisions off a number that silently changes definition month to month. Pick a policy, document it, and treat any definition change like a metric migration.

How to calculate ARR consistently

For most SaaS companies, ARR is derived from MRR. If you already trust your MRR definitions, ARR should be mechanically consistent.

If you want to express ARR as a sum across customers (useful for audits and segmentation):

The practical rules that prevent bad ARR

Use the current run rate, not the invoice schedule.

A customer paying annually is still just their annual price in ARR—don't multiply it again because cash arrived upfront.Annualize based on the recurring unit.

If you have quarterly billing, annualize it. If you have annual contracts billed monthly, annualize the contracted recurring amount (not the cash collected).Handle proration the same way every time.

If a customer upgrades mid-month, your MRR system should allocate the new run rate going forward. ARR follows.Separate contract value from run rate.

ARR answers "what is the recurring engine today?" not "how much is this contract worth over its full term?" That's closer to ACV (Annual Contract Value) or bookings.

ARR vs related metrics (what founders mix up)

| Metric | What it measures | Best for | Common trap |

|---|---|---|---|

| ARR | Annualized recurring run rate at a point in time | Company sizing, valuation narratives, planning | Confusing ARR with cash or GAAP revenue |

| MRR (Monthly Recurring Revenue) | Monthly recurring run rate | Operational cadence, weekly/monthly decisions | Not normalizing annual plans properly |

| CMRR (Committed Monthly Recurring Revenue) | Recurring revenue you can rely on, including commitments | Forecasting and runway planning | Treating non-committed usage as committed |

| Recognized Revenue | Revenue recognized under accounting rules | Financial statements | Using it to judge growth when billing terms shift |

| Deferred Revenue | Cash collected for service not yet delivered | Cash planning and obligations | Thinking deferred revenue equals ARR |

What drives ARR up or down

ARR changes for the same reasons MRR changes: customer adds, expansions, contractions, and churn. But founders often miss two hidden drivers: pricing/packaging and discount policy.

A clean way to express ARR movement is a roll-forward:

Where the underlying levers are:

New ARR (acquisition)

- More new customers (volume)

- Higher conversion rates (see Conversion Rate)

- Bigger deals (see ASP (Average Selling Price) and ARPA (Average Revenue Per Account))

- Shorter sales cycle (see Sales Cycle Length)

Expansion ARR (land and expand)

- Seat growth (see Per-Seat Pricing)

- Upgrades to higher tiers

- Add-ons and cross-sells

- Usage minimums increasing (in hybrid models)

Expansion quality shows up downstream in NRR (Net Revenue Retention) and is operationalized via Expansion MRR.

Contraction ARR (downgrades)

- Seat reductions

- Tier downgrades

- Discounting at renewal to "save" accounts

This is often a product value problem or a packaging mismatch. If customers routinely downgrade after onboarding, revisit time-to-value (see Time to Value (TTV)) and onboarding activation.

Churned ARR (cancellations)

- Voluntary churn (customer chooses to leave) (see Voluntary Churn)

- Involuntary churn (failed payments) (see Involuntary Churn)

- Competitive displacement or budget cuts

Don't evaluate churn in aggregate only. A small number of high-ARR customers can dominate your net change (see Customer Concentration Risk and Cohort Whale Risk).

The Founder's perspective

When ARR slows, most teams yell "pipeline." Founders who win ask: did new ARR slow, did expansion weaken, or did churn tick up? Those are three different root causes and three different operating plans.

How to interpret ARR changes (without fooling yourself)

ARR is a snapshot. That makes it powerful for sizing the business—but also easy to misread when your billing terms or customer mix shifts.

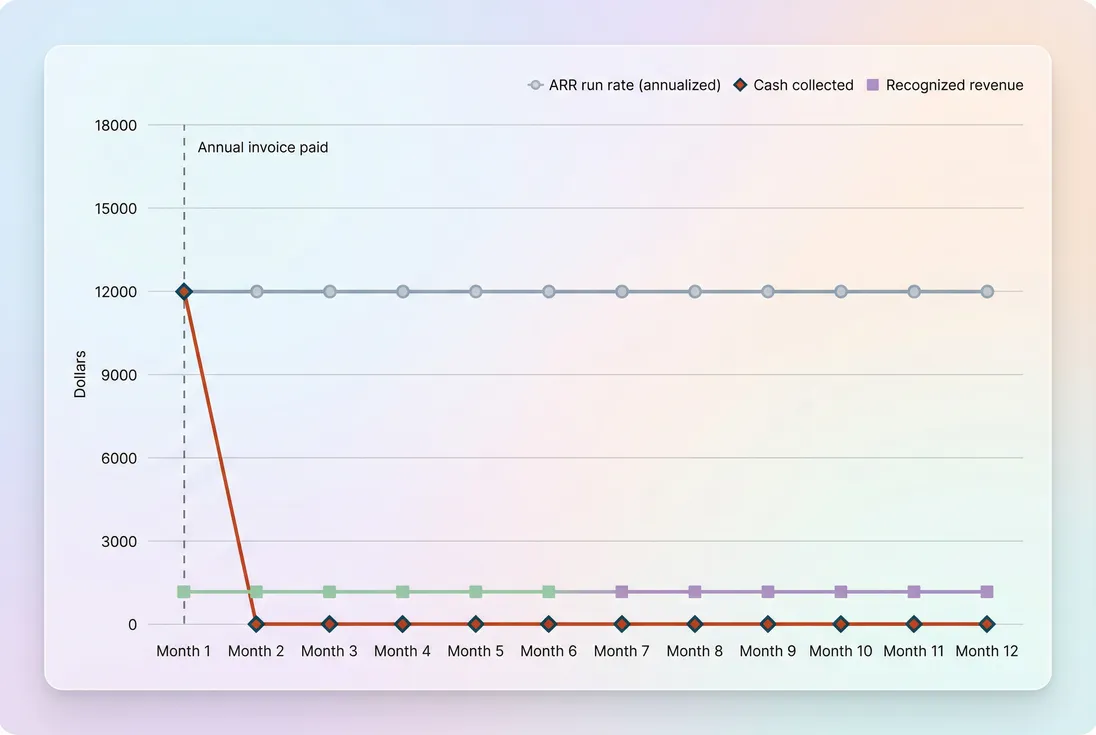

Scenario 1: Annual prepay looks like growth (but isn't)

If you push customers from monthly billing to annual upfront, cash goes up immediately, but ARR only changes if pricing or quantity changes. This is a great move for runway, but it doesn't automatically mean your product got stickier.

ARR stays flat while cash timing and recognized revenue timing change—this is why ARR is a run rate, not a cash metric.

What to do instead:

- Track ARR alongside cash (burn/runway) and collections health (see Accounts Receivable (AR) Aging).

- If you're pushing annuals, monitor retention and save rates so you don't buy short-term runway at the cost of long-term churn.

Scenario 2: Discounting "grows" ARR but weakens durability

Discounts can increase new ARR in the short run (more deals closed) while setting you up for:

- Renewal shock (customers churn when price resets)

- Lower expansion potential (customers benchmark value to discounted price)

- Messy segmentation (enterprise deals priced like mid-market)

If discounts are material, treat them intentionally (see Discounts in SaaS) and track whether discounted cohorts churn faster using Cohort Analysis.

Scenario 3: Price increases lift ARR, but watch churn elasticity

A well-executed price increase is one of the cleanest ways to grow ARR because it doesn't require new acquisition. But it can trigger contraction and churn if value perception is weak.

Practical approach:

- Raise prices where value is obvious (power users, high usage tiers).

- Monitor contraction and churn in the 30–120 days after changes.

- Pair ARR movement with retention indicators like GRR (Gross Revenue Retention) and NRR (Net Revenue Retention).

When ARR breaks down

ARR is most reliable when your revenue is truly recurring and relatively stable. It gets less reliable when commitment and variability diverge.

Usage-heavy or seasonal businesses

If 30–60% of revenue is usage-based, a single ARR number can understate upside or overstate stability. In those cases:

- Use ARR for committed components.

- Use CMRR (Committed Monthly Recurring Revenue) for planning.

- Forecast variable revenue separately with scenarios.

Multi-year contracts with ramps

If you sign a 3-year deal that ramps from $5k/month to $15k/month, "ARR" can mean two different things:

- Run-rate ARR today: annualized current recurring amount.

- Committed future value: closer to bookings or a committed schedule.

Be explicit in board decks about which one you're showing.

Currency and policy noise

International SaaS can see ARR "move" due to FX, not customer behavior. Also, changes in churn recognition timing (when you consider a customer churned) can create artificial volatility. If you change the policy, annotate your trend lines so you don't draw false conclusions (see /blog/when-should-you-recognize-churn-in-saas/).

The Founder's perspective

ARR should change when customers change behavior: buy, expand, downgrade, or leave. If ARR changes because you changed billing intervals, FX assumptions, or definitions, you're not learning—you're repainting the dashboard.

How founders use ARR to make decisions

ARR is not just a scoreboard. Used correctly, it's a control system.

1) Hiring and burn planning

ARR helps you sanity-check whether your operating plan matches revenue reality:

- Combine ARR growth with burn to understand efficiency (see Burn Multiple and Burn Rate).

- A fast-growing ARR number can still hide weak unit economics; pair it with CAC (Customer Acquisition Cost) and CAC Payback Period.

What to look for:

- If ARR growth is driven mostly by new ARR but churn is rising, you may be "running uphill."

- If ARR growth is driven by expansion with stable churn, you can often scale more confidently.

2) Sales strategy and segmentation

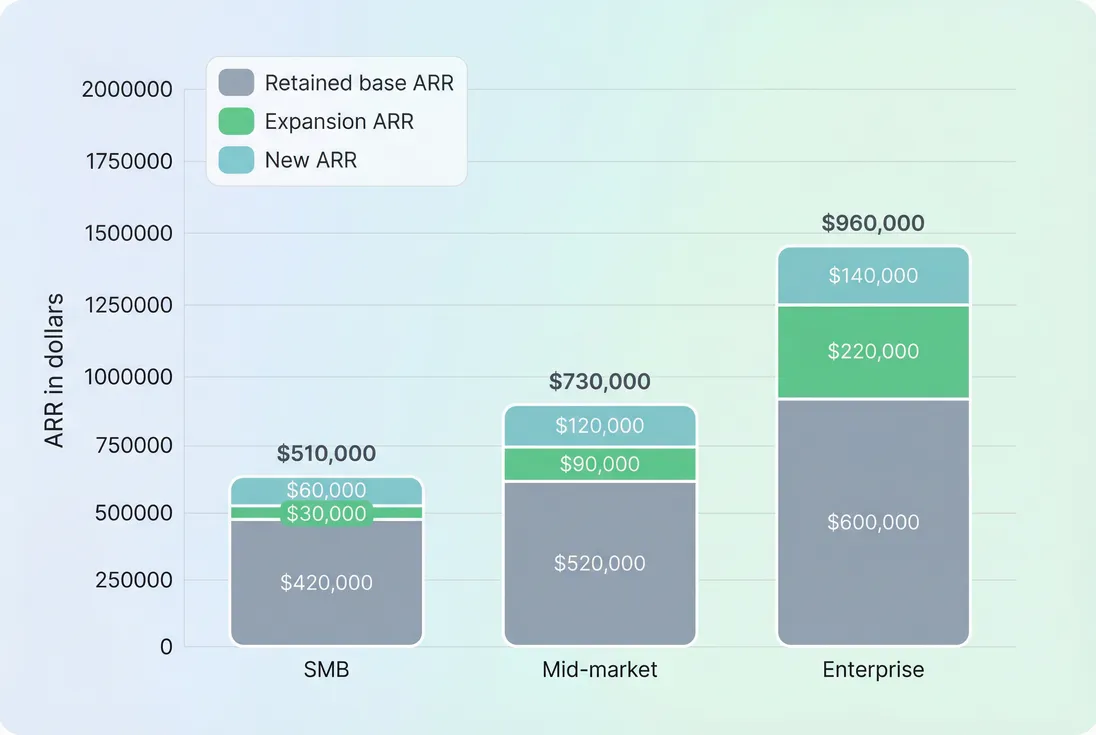

ARR becomes far more actionable when broken down by segment:

- SMB vs mid-market vs enterprise

- Monthly vs annual plans

- Self-serve vs sales-led (see Product-Led Growth and Sales-Led Growth)

The goal: identify which segment produces durable ARR (low churn, high expansion) and concentrate investment there.

Segmenting ARR by retained base, expansion, and new ARR shows where growth is durable versus where it is constantly being replaced.

3) Retention priorities (save ARR, not just logos)

Two churn metrics can both be "bad," but only one may be existential:

- Losing many small customers (logo churn) (see Logo Churn)

- Losing a few large customers (ARR churn concentration)

Operationally:

- Use customer lists and segmentation to protect whales and high-expansion accounts.

- Track revenue churn explicitly via MRR Churn Rate and Net MRR Churn Rate.

4) Fundraising and valuation narratives

Investors use ARR as a shorthand for scale and momentum, often paired with:

- Growth rate (YoY ARR growth)

- Retention quality (NRR/GRR)

- Efficiency (burn multiple, sales efficiency)

ARR won't save weak retention. High ARR with poor Customer Churn Rate often leads to flatlining and painful resets.

A simple ARR operating cadence

If you only implement one workflow, make it this monthly cadence:

Confirm ARR definition is unchanged.

Note any pricing, packaging, or billing policy changes that affect comparability.Review ARR roll-forward.

New vs expansion vs contraction vs churn. Don't stop at the net number.Drill into the top drivers.

- Top churned ARR accounts and why (see Churn Reason Analysis)

- Expansion sources (seats, tier upgrades, add-ons)

- Discounted deals and renewal exposure

Decide one action per driver.

Example: "Reduce involuntary churn by fixing dunning" or "Ship the feature blocking mid-market expansion."

If you're using GrowPanel, the most direct way to operationalize this is to review the ARR report and then break changes down using the movements view and filters (see /docs/reports-and-metrics/arr/ and /docs/reports-and-metrics/mrr-movements/, plus /docs/reports-and-metrics/filters/).

ARR is only "one number," but it's a high-leverage one: it compresses acquisition, retention, pricing, and expansion into a single run-rate view of the business. Treat it like an instrument panel—then use the roll-forward to identify which lever actually moved, and what you're going to do about it next.

Frequently asked questions

It depends on stage and go to market, but founders typically track ARR growth as a trailing monthly and YoY trend. Pre product market fit, consistency matters more than percent. Post fit, many strong companies aim for 2x to 3x YoY. Pair growth with retention metrics like NRR and churn.

No. ARR is about the recurring revenue run rate, not cash timing. A customer paying 12000 upfront for a 12 month subscription is still 12000 ARR, the same as 1000 billed monthly for 12 months. Prepay improves cash flow and reduces collections risk, but it does not change run rate economics.

Be conservative and consistent. Many teams exclude pure usage revenue from ARR and instead report it separately, because it is not committed. If you have contractual minimums, you can include the minimum committed amount in ARR and treat overages as variable. For forecasting, use CMRR or scenario based ranges.

ARR can rise from new bookings, expansions, or price increases even while cash falls due to refunds, chargebacks, higher payment failure, longer invoicing terms, or fewer annual prepayments. ARR is a run rate snapshot; cash is a flow. Reconcile with Deferred Revenue, collections, and churn timing to isolate the driver.

ARR should reflect the actual recurring amount you will invoice under the current contract terms. If a discount is contractually locked for 12 months, ARR should include the discounted price during that period. If the discount expires automatically, decide whether to model current ARR at discounted run rate and track uplift separately to avoid surprise churn at renewal.