CMRR

The CMRR (Committed Monthly Recurring Revenue) report provides a forward-looking view of your subscription revenue, incorporating all known future changes such as scheduled churn, planned upgrades/downgrades, and expiring discounts. Some may also refer to this metric as "Contracted MRR."

It is a vital forecasting tool in GrowPanel for assessing revenue predictability and future cash flow.

For an in-depth explanation of CMRR as a metric, see the CMRR guide in the SaaS Metrics Academy.

Overview

The CMRR report includes a chart showing the current MRR and a projection into the future, a breakdown table of committed movements, and optionally a detail table. Each is described here:

Timeline chart

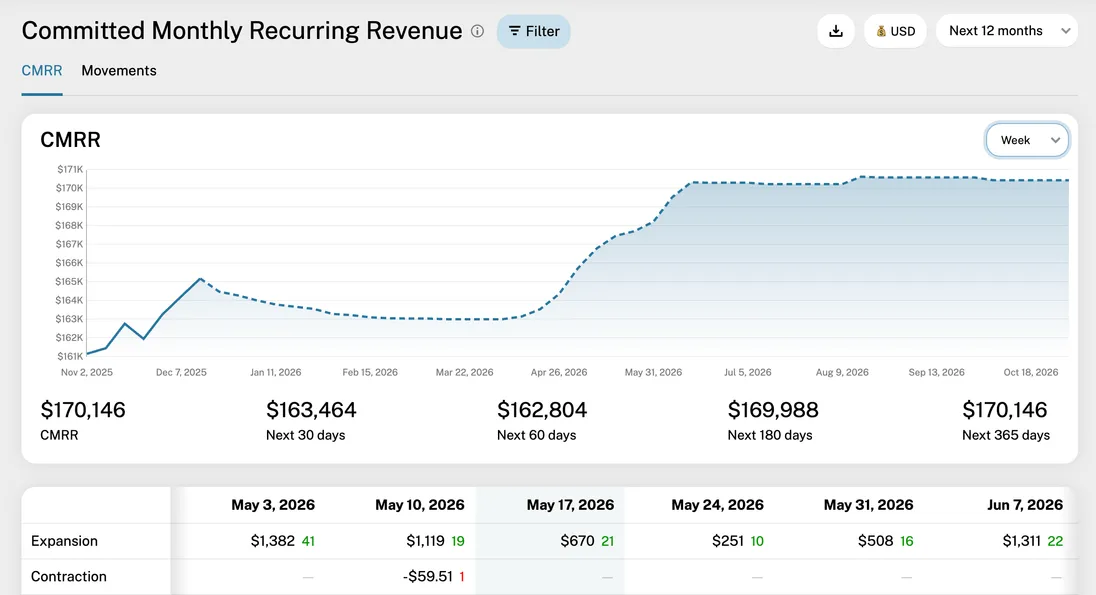

The timeline chart shows your current MRR and the projected CMRR for a selected future period, typically the next 12 months. This projection includes all future contractual changes. If you hover the chart, a tooltip will appear, detailing the committed MRR movements (explained under the Breakdown table), and the corresponding future period will be highlighted in the table underneath. The current period is marked with a dashed line. You can adjust the chart data using the date picker, currency picker, interval selector, and the wealth of filters, explained in the Filters section underneath.

Note that the numbers for a given future period show the projected MRR at the end of that period.

Breakdown table

The table underneath the chart shows the future MRR movements that are already known and committed, broken down into movement types: Scheduled Expansion, Scheduled Contraction, and Scheduled Churn. It also shows the Net Committed Movements and the projected CMRR. The table scrolls horizontally and if you hover the columns, you'll see a line in the chart showing the corresponding period. Each type is explained here:

- Scheduled Expansion Known future recurring revenue growth from existing customers due to pre-scheduled events like planned plan upgrades or the expiration of a time-limited discount.

- Scheduled Contraction Known future reductions in recurring revenue due to pre-scheduled events like a planned plan downgrade or the application of a future, pre-agreed discount.

- Scheduled Churn Known future recurring revenue loss from customers who have already scheduled their cancellation (e.g., end-of-contract date).

- Net Committed Movements The net change in MRR from all scheduled/committed movements for the given period.

- CMRR The projected MRR at the end of the period, based on the current MRR plus all cumulative committed movements up to that point.

Each cell of the table shows two numbers - an amount and a number. The amount shows the sum of the committed MRR movement type in the given period. Negative amounts are typically marked with a minus in front, depending on your locale. The number next to the amount shows the number of unique customers contributing to this future movement. If a customer has multiple committed movements during the period, it's still only counted as one unique customer. Red numbers indicate customers contributing negative committed MRR, and green numbers indicate positive committed MRR movements.

If you click a cell, a detail table under the breakdown table is revealed, showing all committed MRR movements in the selected period and type.

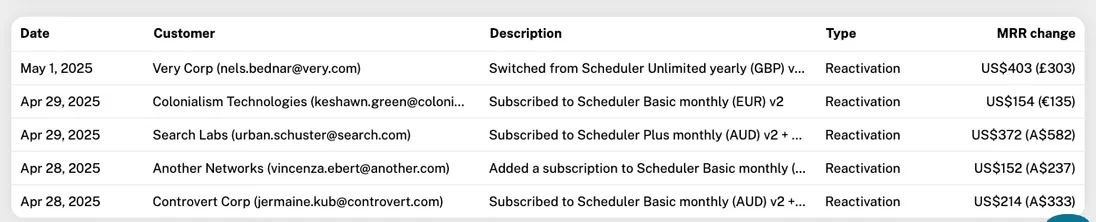

Detail table

This table is shown when you click a cell in the breakdown table. The table shows each committed MRR movement in the selected future period and type. You see the date of the scheduled event, customer name/email, the description of the committed MRR movement, the type (Scheduled Expansion/Scheduled Contraction/Scheduled Churn), and the MRR change.

Clicking the customer sends you to that customer's detail page.

Filters

The report supports a wide range of filters to help you focus on specific segments of your committed revenue. These include:

- Projection period Select how far into the future you want to project CMRR (e.g., next 3, 6, 12 months).

- Interval Choose how CMRR movements are aggregated: monthly, quarterly, or yearly.

- Currency Select your reporting currency. All committed movements are converted using the current exchange rate, as future FX movements cannot be reliably committed.

- Additional filters – plan, region/country, billing frequency, payment method, customer age, etc. (see all filters)

Filters are applied to both the chart and the table simultaneously.

Exporting the data

You can export the table as a CSV file for offline analysis or reporting by clicking the "Export" icon next to the date picker.

Practical tips

- Use the Projection period to align your CMRR view with your business planning cycles (e.g., quarterly budgets).

- A high level of Scheduled Churn in the near future signals an urgent need for customer success intervention and proactive retention efforts.

- Analyze Scheduled Expansion to identify future upsell opportunities that are already in the pipeline, which helps in planning capacity.

- Combine multiple filters (e.g., by 'Plan' or 'Region') to assess the predictability of revenue streams from specific products or markets.

❓ Frequently Asked Questions

How is CMRR different from MRR?

MRR (Monthly Recurring Revenue) is a snapshot of your currently active, normalized, recurring revenue. It tells you what your business is earning right now.

CMRR (Committed Monthly Recurring Revenue) is a forward-looking projection of your MRR. It starts with your current MRR and then adds or subtracts all future, known revenue changes that are already contractually agreed upon (e.g., scheduled downgrades, pre-booked cancellations, or expiring discounts). CMRR shows you what your MRR is guaranteed to be in the future, assuming no new sales or non-scheduled events occur.

Does CMRR include New Sales or new Upsells?

No. CMRR only includes revenue movements that are already contractually committed based on your existing customer base. It does not include:

- New Sales: Revenue from brand new customers that you expect to acquire.

- Future Upsells/Expansion: Revenue from upgrades you hope existing customers will make, but haven't yet signed a contract for.

CMRR is a guarantee, not a sales forecast.

Why does my CMRR sometimes drop significantly in a future month?

A significant drop in a future month's CMRR is often due to a "renewal cliff," specifically a large amount of Scheduled Churn that is known to occur at that time. This usually happens when:

- A large cohort of customers is on contracts that all expire in the same month and have already signaled they will not renew.

- A major, temporary discount for many customers is scheduled to expire, leading to a large amount of Scheduled Contraction if the customer has a contractual right to the reduced price (less common).

This drop is a critical warning sign that your business needs to focus on retention for that cohort before that month arrives.

Is high CMRR always a good thing?

A high and stable CMRR projection is excellent, as it indicates revenue predictability. However, you should inspect the composition of the committed movements. If a high CMRR is being maintained primarily by large amounts of Scheduled Expansion being offset by equally large Scheduled Contraction and Scheduled Churn (a high volume of scheduled change), it suggests high churn risk and complex contract management, even if the net number looks stable. Aim for high CMRR with minimal negative committed movements.

If a customer's discount expires, is that Scheduled Expansion or Contraction?

If a customer is currently paying a lower rate due to a limited-time discount and their contract states the price will revert to the full price on a specific future date:

- This is an increase in revenue on that date.

- It is counted as Scheduled Expansion because the MRR from that customer is scheduled to grow.