New reports: Failed payments, failure rate, and recovery rate

Failed payments are one of the most underappreciated reasons SaaS companies lose revenue. A customer doesn't actively cancel – their card just expires, or a bank declines a charge, and suddenly you're leaking MRR without anyone noticing.

Today we're launching three new reports to help you understand and act on payment failures: Failed payments, Failure rate, and Recovery rate.

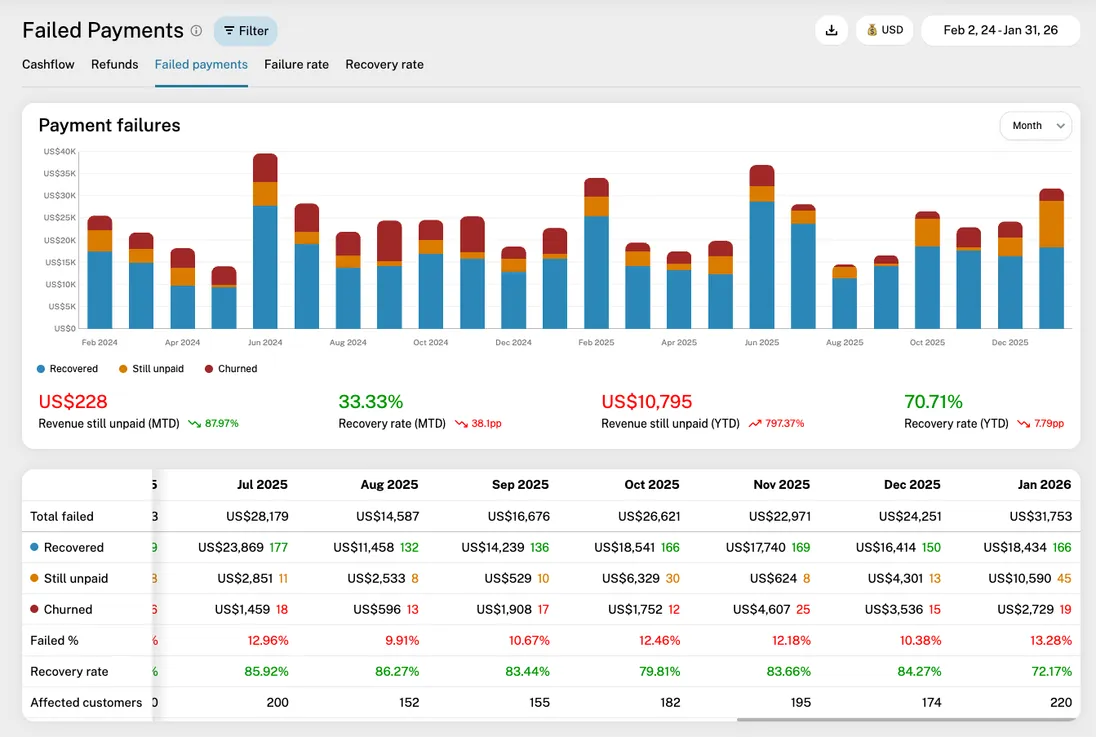

The Failed payments report

The new Failed payments report gives you a clear bar chart showing the outcome of every failed invoice: recovered, still unpaid, or churned.

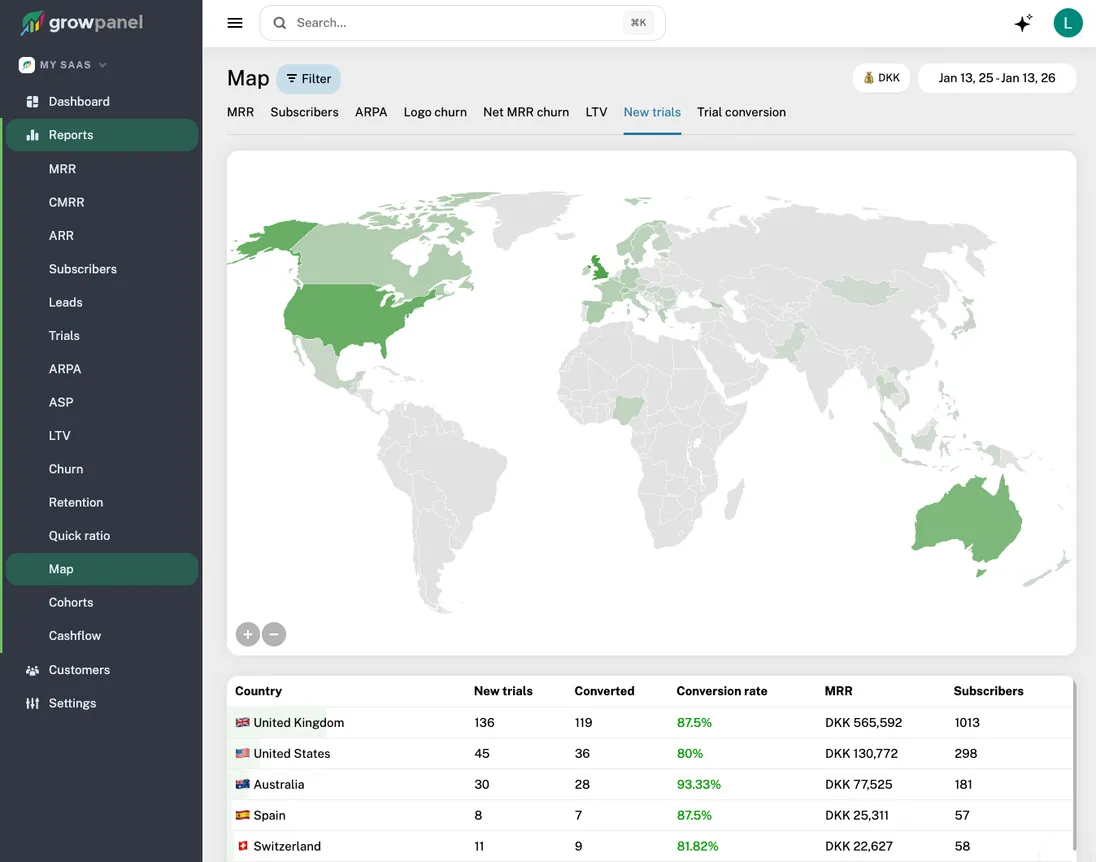

You can filter by date range, plan, currency, country, and any other dimension you're used to in GrowPanel. This makes it easy to answer questions like "How much revenue did we lose to failed payments last quarter?" or "Are annual customers more likely to recover than monthly ones?"

The report shows actual amounts, so you're not guessing – you can see exactly how much was at stake, how much came back, and how much walked out the door.

Failure rate and recovery rate

Alongside the bar chart, two new line chart reports track these metrics over time:

Failure rate shows what percentage of your invoices had at least one failed payment attempt, compared to total invoices in the period. This is your early warning system. If the line is trending up, something is going wrong – maybe you're accumulating customers with outdated payment methods, or a specific payment processor is having issues.

Recovery rate shows what percentage of failed payments were eventually recovered. This tells you how effective your dunning process is. If you're using Stripe's Smart Retries or a dedicated recovery tool, this is where you measure whether it's actually working.

Both reports support the same filters and grouping options as every other GrowPanel report, so you can slice by plan, currency, billing frequency, or any custom variable.

Why this matters

Involuntary churn is fixable churn. Unlike a customer who actively decides to leave, a failed payment is a mechanical problem with a mechanical solution. But you can't fix what you can't see.

These reports give you the visibility to:

- Spot trends early – A rising failure rate might mean it's time to prompt customers to update their payment details

- Measure your dunning – Know whether your retry logic and recovery emails are actually bringing revenue back

- Quantify the impact – Put a real number on how much revenue you're losing (or saving) through payment recovery

Getting started

The three new reports are available now under the Reports section in GrowPanel. If you're already tracking payments through Stripe, Chargebee, or Recurly, the data is there – no setup needed.

As always, feedback is welcome. If you see something that could be better, just let me know.

Founder & CEO

Lasse is the founder of GrowPanel. He previously founded Mouseflow, scaling it from $0 to $10M ARR before exiting. He also co-founded Soundvenue and actively invests in SaaS startups.

View full profile →