Table of contents

Voluntary churn

Voluntary churn is the churn that hurts your strategy, not just your billing. When customers actively choose to leave, they're telling you your product's value, fit, or economics didn't hold up long enough to become durable revenue. Founders feel it as widening forecast error, rising CAC pressure, and a team stuck "replacing revenue" instead of compounding it.

Voluntary churn is the share of customers or recurring revenue that is lost because customers intentionally cancel (or choose not to renew), excluding losses caused by payment failures.

To understand the whole churn picture, you should always separate voluntary churn from Involuntary Churn. They have different root causes, owners, and fixes.

What voluntary churn reveals

Voluntary churn is a signal about customer intent. When it moves, it usually means one (or more) of these shifted:

- Perceived value fell (product didn't deliver outcomes, or competitors did better).

- Fit is wrong (you acquired customers outside your ideal profile, use case, or maturity level).

- Economics broke (pricing, packaging, or ROI changed—often after an upgrade, seat growth, or renewal).

- Trust eroded (reliability, security posture, support quality, or roadmap credibility).

- Stakeholders changed (champion leaves, budget owner changes, internal priorities shift).

Voluntary churn is also where most actionable retention improvement lives. Payment failures can be optimized with billing operations. Voluntary churn forces sharper decisions: product, positioning, pricing, and customer success motion.

The Founder's perspective

If voluntary churn is high, you don't have a "growth" problem—you have a compounding problem. Every new dollar is working against a leaky base, which inflates CAC payback, slows hiring confidence, and makes revenue forecasting less trustworthy.

Voluntary churn vs related metrics

Voluntary churn is not a replacement for your other retention views; it's a cut of churn that makes decisions clearer.

- Total churn blends voluntary and involuntary. Useful for cash planning, but ambiguous for fixing root causes.

- Logo Churn counts customers lost; voluntary logo churn tells you how often customers actively leave.

- MRR Churn measures revenue lost; voluntary MRR churn tells you the revenue impact of intentional exits.

- Net MRR Churn Rate can look "fine" even when voluntary churn is worsening, if expansion offsets it.

- GRR (Gross Revenue Retention) is the cleanest roll-up of churn + contraction impact; voluntary churn is typically the biggest driver of GRR deterioration.

How to calculate it (without confusion)

There are two common ways to express voluntary churn: logo-based and revenue-based. Track both.

Voluntary logo churn rate

Practical notes:

- "Customers at start of period" should exclude brand-new customers acquired during the period.

- Count a customer once per period even if they had multiple subscriptions (you may also track subscription-level churn separately for billing complexity).

Voluntary MRR churn rate

Where founders get tripped up is not the division—it's classification and timing.

Classification: what qualifies as "voluntary"

Include:

- Customer-initiated cancelation (self-serve or through CS).

- Non-renewal at the end of a contract term (annual renewals are "voluntary churn" when the customer chooses not to renew).

Exclude (track separately):

- Card failures, bank debit failures, charge failures (that's involuntary).

- Refunds and chargebacks (these are cash and revenue accounting topics; see Refunds in SaaS and Chargebacks in SaaS).

Also separate churn from downgrades:

- A downgrade is not churn; it's Contraction MRR.

- Many teams mistakenly label "downgrade to free" as churn. Decide your policy upfront: if "free" is a real plan with ongoing service obligations, that's contraction; if access is effectively removed, treat as churn.

Timing: when do you recognize voluntary churn?

Two common approaches:

- At cancellation request (good for customer intent and early warning).

- At end of paid-through period (good for revenue recognition alignment and cash expectations).

Pick one primary rule and stick to it. If you change the rule, annotate your historical trend. If you want a deeper treatment, the internal post when should you recognize churn in saas is a useful reference point.

The Founder's perspective

For operating decisions (save plays, outreach, onboarding fixes), recognizing churn at cancellation request is usually more actionable. For board reporting and cash planning, recognizing at end of paid term typically matches financial reality better. Many teams keep both views.

What influences voluntary churn most

Voluntary churn is a lagging number. By the time it rises, the causes usually started weeks or months earlier. The goal is to connect churn back to leading indicators you can actually change.

1) Time-to-value and activation quality

If customers don't reach their first "aha" quickly, churn becomes a default outcome—especially on monthly plans. Tie voluntary churn analysis to:

- Onboarding completion and setup milestones (see Onboarding Completion Rate)

- Product usage and engagement (see Active Users (DAU/WAU/MAU) and DAU/MAU Ratio (Stickiness))

- Time to first meaningful outcome (see Time to Value (TTV))

2) Pricing and packaging pressure

Voluntary churn spikes often follow:

- Price increases without value communication

- Packaging changes that push customers to higher tiers

- Misaligned value metric (e.g., per-seat pricing for a workflow tool used by a small set of operators)

Pair voluntary churn with:

- ARPA (Average Revenue Per Account) to see whether churn is concentrated in low-ARPA or high-ARPA segments

- Price Elasticity when you run pricing tests

- Discounts in SaaS if churn is driven by discount roll-offs

3) Support burden and product reliability

If voluntary churn correlates with:

- high ticket volume,

- long resolution times,

- recurring bugs,

- or availability incidents,

…you're often seeing a "trust tax." Tie churn analysis to operational metrics and consider whether uptime and responsiveness are meeting expectations (see Uptime and SLA).

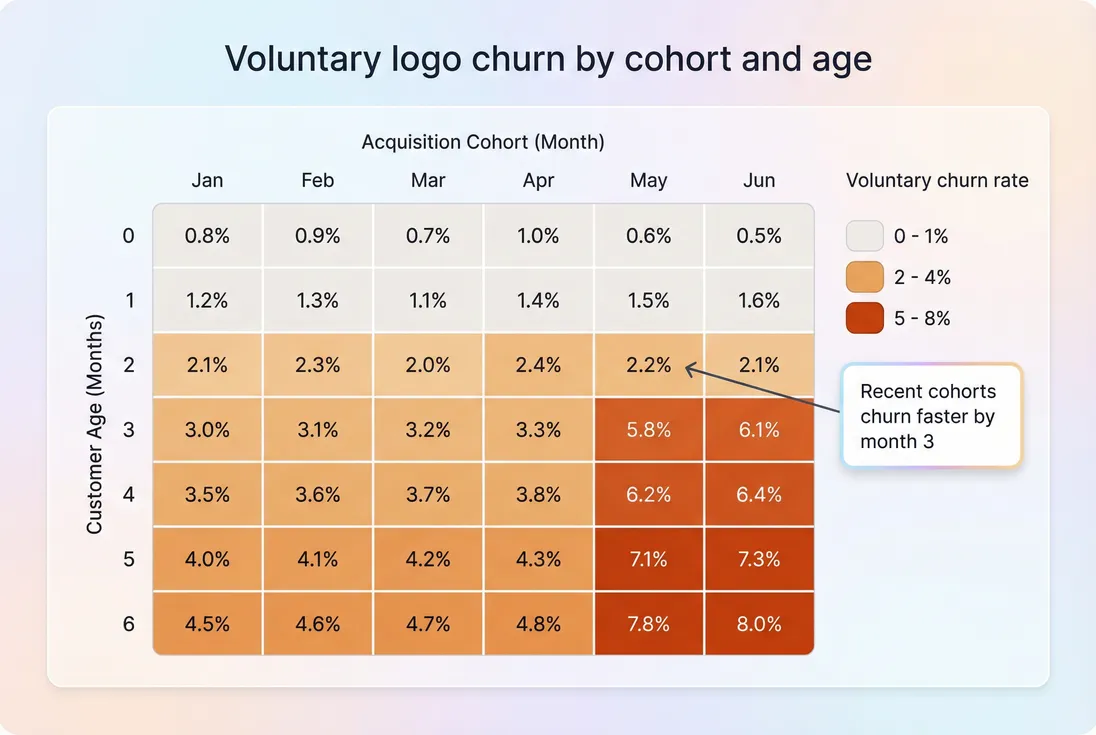

4) Acquisition quality and ICP drift

A common founder pattern:

- Growth targets rise

- Targeting broadens

- Sales closes "maybe fits"

- Voluntary churn rises 60–120 days later

Use cohort cuts to validate: churn by channel, plan, industry, and sales rep. If newer cohorts churn faster, it's usually acquisition quality or onboarding—not the core product suddenly breaking.

How to interpret changes (and avoid bad conclusions)

A spike in voluntary churn is not automatically a product emergency. First determine whether it's:

- A mix shift (you added more low-commitment monthly customers)

- A cohort issue (a specific signup month/channel is failing)

- A segment issue (one plan, use case, or customer size is churning)

- A true base degradation (long-tenured customers leaving at higher rates)

Segment first: logos vs MRR

A classic scenario:

- Voluntary logo churn rises from 3% to 5% monthly

- Voluntary MRR churn stays flat

This often means smaller customers are leaving more, while larger customers remain stable. That can be acceptable if your strategy is moving upmarket—but it can also create brand and support noise that distracts teams.

The opposite is more dangerous:

- Voluntary logo churn flat

- Voluntary MRR churn rises

That usually means fewer customers are leaving, but they're bigger—often pointing to pricing/ROI pressure, competition in core accounts, or failed renewals.

Use cohorts to find where it broke

Voluntary churn becomes actionable when you can answer: who is churning sooner than expected?

Link cohort analysis to churn investigation:

- Use Cohort Analysis to compare voluntary churn curves by signup month.

- If the curve worsens for recent cohorts only, look at recent changes: onboarding, pricing, positioning, acquisition channels, product releases.

- If all cohorts worsen at the same tenure point (e.g., month 4), look for lifecycle triggers: renewal reminders, team adoption plateau, reporting needs, or integration gaps.

Benchmarks (use carefully)

Benchmarks are only useful when you match:

- monthly vs annual contracts,

- SMB vs mid-market vs enterprise,

- and PLG vs sales-led motion.

A practical reference table many founders find useful:

| Segment (typical) | Voluntary logo churn expectation | How to interpret |

|---|---|---|

| Early SMB, monthly | 3–7% monthly | Often driven by onboarding gaps and weak ICP. Improve activation before scaling acquisition. |

| Mature SMB, monthly | 1–3% monthly | Focus on lifecycle retention, product depth, and pricing alignment. |

| Mid-market, annual | 5–12% annual (renewal-based) | Concentrated in renewals; churn reason discipline matters. Watch for champion change and ROI proof. |

| Enterprise, annual | 3–8% annual (logo) | A few renewals swing the number. Use account-level narratives, not just rates. |

If you want a broader churn benchmark discussion, the internal post what is a good customer churn rate provides additional context—but always normalize for your contract terms and customer size.

How founders diagnose a voluntary churn spike

The fastest path is a structured breakdown that combines metrics with customer truth.

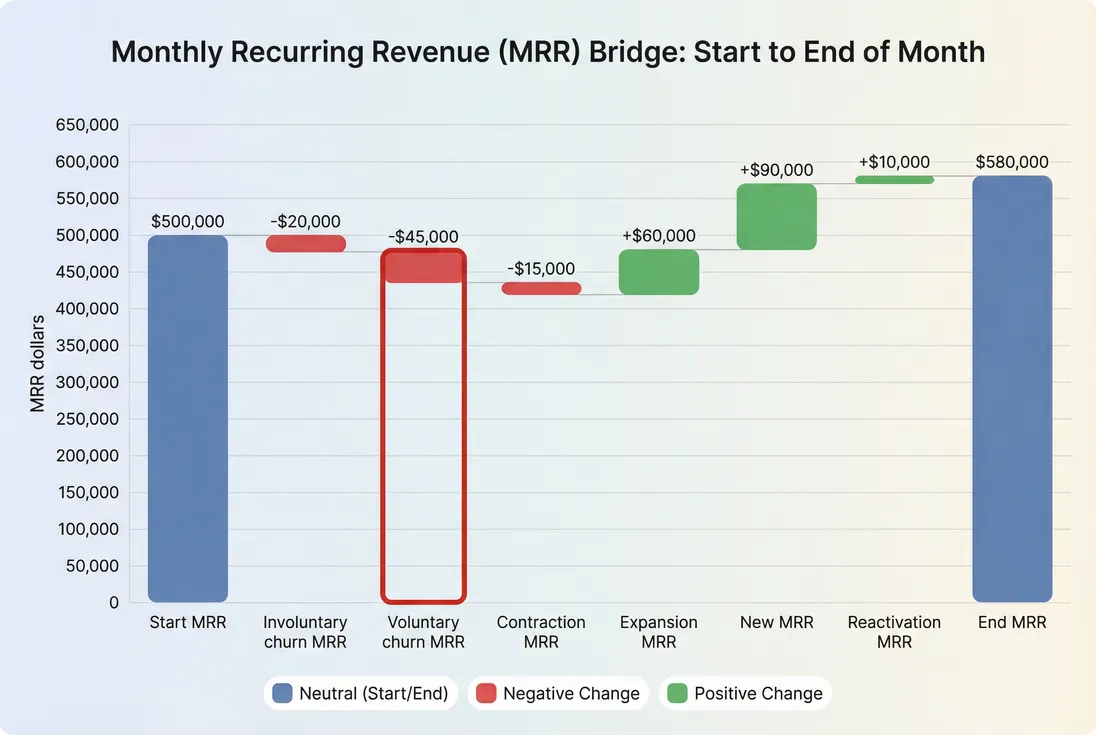

Step 1: quantify impact in dollars and logos

Start with both views:

- Voluntary logo churn rate (how widespread)

- Voluntary MRR churn rate (how costly)

Then connect it to retention rollups:

Step 2: localize by segment

Cut voluntary churn by:

- plan and pricing tier

- customer size / ARPA bucket (see ARPA (Average Revenue Per Account))

- acquisition channel

- contract length (monthly vs annual; see Average Contract Length (ACL))

- primary use case

- geography (sometimes driven by VAT or billing friction; see VAT handling for SaaS for context)

If you use GrowPanel, the practical workflow is to use churn and filters to isolate the segment, then confirm with customer list drill-down and MRR movements to see the exact cancellations and timing (see /docs/reports-and-metrics/churn/ and /docs/reports-and-metrics/filters/).

Step 3: validate with churn reasons

Don't guess. Categorize churn reasons consistently and keep the taxonomy stable long enough to see trends (see Churn Reason Analysis).

A simple founder-friendly churn taxonomy:

- No longer needed (use case ended)

- Missing key features / roadmap gap

- Too expensive / budget cut

- Switched to competitor

- Bad experience (bugs, performance, support)

- Security/compliance requirement

- Implementation failed / never launched

The goal isn't perfect truth; it's repeatable signal you can act on.

Step 4: tie to leading indicators

Once localized, connect to:

- activation and onboarding completion

- usage and adoption (feature adoption drop is a common precursor; see Feature Adoption Rate)

- customer effort and satisfaction (see CES (Customer Effort Score) and CSAT (Customer Satisfaction Score))

- account health monitoring (see Customer Health Score)

The Founder's perspective

Treat voluntary churn like a product quality backlog with revenue attached. If you can name the top 3 churn drivers by dollars (not by count), you can prioritize roadmap, support, and pricing changes with far less debate.

How founders use voluntary churn in real decisions

Voluntary churn becomes most useful when it directly changes what you do next month.

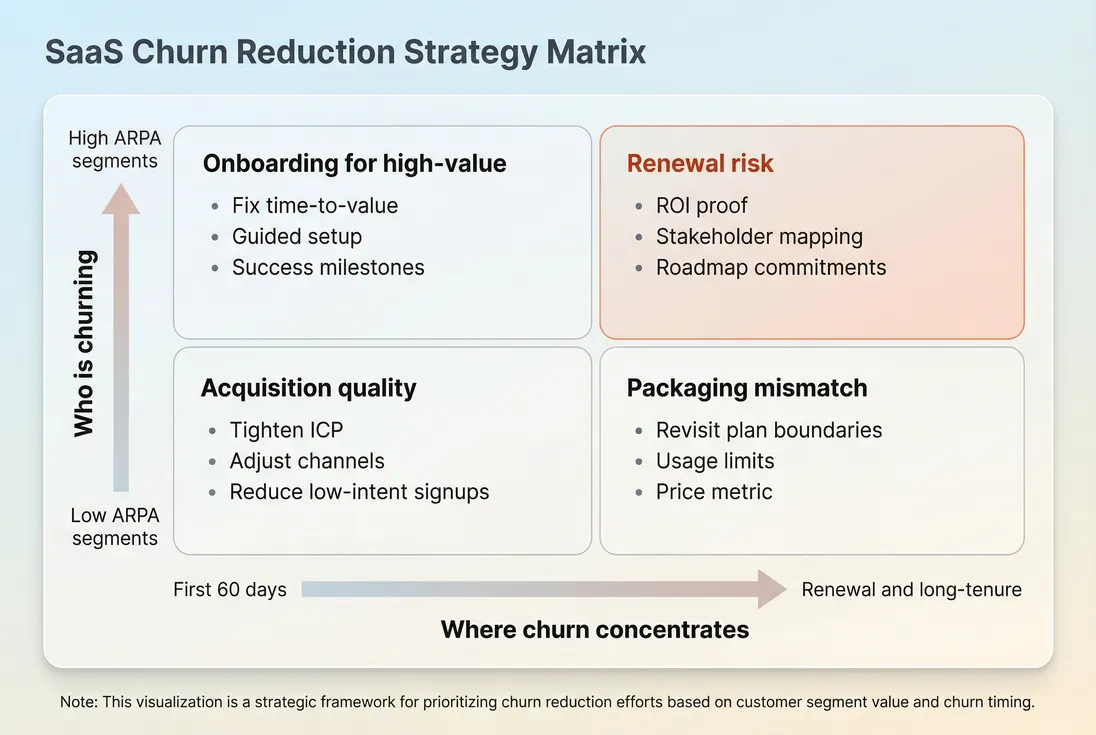

1) Decide where retention work belongs

- If churn is mostly involuntary, fix billing and recovery flows.

- If churn is voluntary and concentrated in month 1–2, fix onboarding and activation.

- If churn is voluntary and concentrated around renewal, improve value proof, stakeholder mapping, and ROI narratives.

2) Set growth expectations and spending limits

Voluntary churn directly impacts:

- LTV (Customer Lifetime Value)

- CAC Payback Period

- Burn Multiple and SaaS Magic Number through efficiency

A small voluntary churn improvement can unlock materially higher acquisition spend while keeping payback stable.

3) Choose contract strategy and packaging

If monthly customers churn voluntarily at high rates but annual customers retain well, that suggests:

- value is real, but not immediate, or

- onboarding needs to be stronger, or

- the monthly plan attracts low-intent buyers.

This is where you revisit:

- trial structure (see Free Trial and Product-Led Growth)

- packaging and minimum commitment

- price metric fit (see Per-Seat Pricing and Usage-Based Pricing)

4) Build a save motion that doesn't distort data

Save offers can reduce churn, but they can also hide the real problem if overused. Two practical rules:

- Track "saved" accounts separately (so churn improvements aren't just discounting).

- Watch for churn deferral: if saves only delay churn by 1–2 months, you need product fixes, not better negotiation.

Discount-heavy saves also affect ARPA and can complicate your Discounts in SaaS analysis.

Common pitfalls (and how to avoid them)

Mixing voluntary and involuntary

If you don't split them, you'll often "fix churn" by improving dunning while customer intent keeps worsening. Always keep a voluntary view alongside total churn. Start with Involuntary Churn as the comparator.

Treating churn as one homogenous rate

Voluntary churn is rarely uniform. A single blended number hides:

- one bad channel,

- one broken plan,

- one mispriced segment,

- or one integration gap.

Make segmentation and cohorts a default, not a special project (see Cohort Analysis).

Overreacting to small numbers in enterprise

If you have 20 enterprise customers, one non-renewal can spike voluntary logo churn. In enterprise, pair the metric with:

- account narratives,

- renewal pipeline health,

- and concentration risk (see Customer Concentration Risk).

Letting expansion mask churn

NRR can stay strong while voluntary churn rises, especially if a few large accounts expand. Use voluntary churn to keep an honest view of customer intent, and pair it with GRR (Gross Revenue Retention) so you don't confuse "upsell strength" with "product satisfaction."

Putting it into an operating cadence

A lightweight cadence that works for many founders:

- Weekly (tactical): review voluntary cancels and top churn reasons; scan for product incidents or onboarding failures.

- Monthly (operational): review voluntary churn by segment, plus cohort curves; decide 1–2 retention experiments.

- Quarterly (strategic): evaluate whether churn is telling you to change ICP, packaging, or GTM motion (see Go To Market Strategy).

If you can consistently answer these four questions, you're using voluntary churn well:

- Who is leaving on purpose?

- Why are they leaving (top drivers by dollars)?

- When in the lifecycle does it happen?

- What will we change next based on that?

Voluntary churn doesn't just measure retention—it measures whether your business is compounding or constantly restarting.

Frequently asked questions

Voluntary churn is a customer decision to leave, usually driven by value, fit, pricing, or competition. Involuntary churn is billing failure, card expiration, or payment friction. Separating them tells you whether to invest in product and customer success (voluntary) or dunning and billing ops (involuntary).

It depends on segment and contract length. For SMB monthly plans, 2 to 5 percent monthly logo churn may be normal early, but mature products target lower. For B2B annual contracts, voluntary churn shows up as renewals and should be low single digits annually in healthy segments.

Start with segmentation: which plan, cohort, acquisition channel, and use case is churning. Then check time-to-value and activation drops, product reliability issues, and pricing changes. Validate with churn reasons, support tickets, and product usage. Don't treat it as one number until you localize it.

Track both. Logo voluntary churn tells you if customers are leaving; voluntary MRR churn tells you how much revenue is leaving. In many SaaS companies, logos churn but revenue holds due to larger customers staying, or the opposite. Using both prevents overreacting to noise in either metric.

Voluntary churn is a core driver of both. Higher voluntary churn reduces GRR directly by removing revenue. NRR can still look acceptable if expansion offsets it, which can hide customer dissatisfaction. Use voluntary churn alongside GRR and NRR to understand whether growth comes from retention or constant replacement.