Table of contents

Usage-based pricing

Usage-based pricing can turn product adoption into automatic expansion revenue—without more sales headcount. It can also create revenue volatility, bill shock, and churn if your meter, unit price, or guardrails are wrong.

Usage-based pricing is a pricing model where what a customer pays scales with measured consumption of your product (for example API calls, events processed, gigabytes stored, minutes transcribed), typically billed in arrears or with a committed minimum plus overage.

When usage-based pricing is a fit

Usage-based pricing works when your product's value is tightly tied to a measurable unit of consumption and customers can influence that consumption.

The simplest fit test

You're a strong candidate when most of these are true:

- Value scales with usage. More consumption reliably means more outcome (or closer to outcome).

- Costs scale with usage. Your COGS (Cost of Goods Sold) rises as customers consume more (compute, third-party fees, bandwidth), so charging more for more usage protects margin.

- Customers want to start small. Lower initial commitment can improve conversion, especially in PLG.

- Usage is measurable and auditable. You can defend the invoice with a clean definition.

You're a weak candidate when these are true:

- Budget predictability dominates. Many finance teams prefer stable invoices over "fairness."

- Usage is spiky or seasonal in ways customers can't control (or can't forecast).

- The meter is easy to game (automation loops, retries, scraping, duplicate events).

- Support costs explode with heavy users but pricing doesn't capture it.

The Founder's perspective: Usage-based pricing is not primarily a monetization decision. It's a risk transfer decision. You're shifting forecasting risk from you to the customer. If customers feel that risk is unmanaged, they will demand caps, switch vendors, or block expansion.

Three common structures

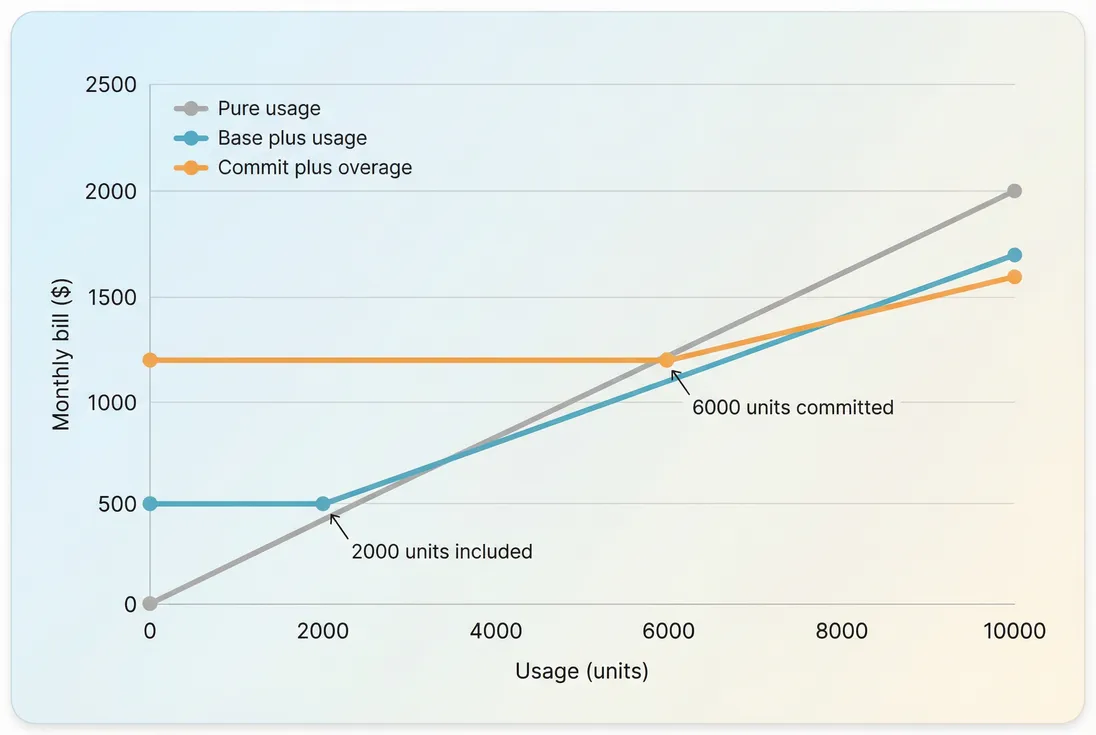

Most SaaS companies land in one of these:

- Pure usage: customer pays strictly for units consumed.

- Base + usage (hybrid): a predictable platform fee plus variable usage.

- Commit + true-up: customer commits to a minimum spend/volume, then pays overages.

This chart is the decision in plain sight: you're choosing a bill curve. The "right" model is the one that matches how customers buy, budget, and expand.

What to meter as the value metric

Your meter is the foundation. If it's wrong, every downstream metric (retention, expansion, forecast accuracy, margin) gets noisy.

A good meter has five properties

A strong usage metric is:

- Customer-controllable: the customer can intentionally drive it up/down.

- Value-aligned: more units usually means more value realized.

- Cost-aware: it correlates with your variable costs so margin holds.

- Hard to manipulate: retries, bots, and internal loops won't inflate it.

- Easy to explain: customers can predict it without reading your code.

Examples that often work:

- Data, infrastructure, and developer tools: API calls, compute time, GB stored, seats plus API, environments.

- Communication products: messages delivered, minutes, contacts engaged.

- Analytics products: events ingested, queries run, dashboards served.

Examples that often fail:

- "Active users" when definitions vary.

- "Events" without deduping rules.

- "Credits" that are opaque and feel like casino chips unless transparently mapped back to usage.

If you're not sure, look at what customers already talk about when they describe value. Your value metric should sound like their language, not yours.

Define the meter like a contract

Ambiguity creates disputes, refunds, and churn. Be explicit about:

- When an event counts (attempted vs completed, delivered vs opened).

- Time window (UTC day vs customer timezone, billing period boundaries).

- Rounding rules (per 1,000 events, per GB-hour).

- Excluded activity (internal testing, retries, duplicates, bots).

- Data availability (customer-facing usage logs and export).

If you can't make the meter auditable, expect more billing friction and higher Involuntary Churn from failed collections and disputed invoices.

How to structure tiers and commits

Once the meter is right, pricing design becomes a set of practical tradeoffs: predictability vs fairness, simplicity vs segmentation, expansion vs margin protection.

The basic bill formula

A common hybrid model is "base fee + included usage + overage":

In business terms:

- BaseFee buys predictability (for you and the customer).

- IncludedUnits prevents nickel-and-diming at low usage.

- UnitPrice drives expansion and pays for variable costs.

Price the unit from unit economics

Usage-based pricing is only healthy if gross margin stays healthy as usage grows. Start with per-unit cost:

- Infrastructure per unit (compute, storage, bandwidth)

- Third-party fees per unit

- Support and operations that scale with heavy usage (often overlooked)

Then sanity-check the spread:

If that margin is thin, customers will outgrow your profitability before they outgrow your product.

The Founder's perspective: The mistake is setting unit price from competitors or gut feel. Set it from gross margin math first, then adjust packaging for willingness to pay. If the margin math doesn't work, the model doesn't work—no amount of clever tiers fixes it.

Tiers, volume discounts, and the bill curve

Most companies add tiers for two reasons:

- Match willingness to pay (big customers expect a better effective rate).

- Control bill shock (stepwise changes feel more predictable than pure linear).

A practical way to monitor what customers actually pay is effective unit price:

If effective price falls too fast as customers scale, you may be discounting expansion more than you realize. If it rises unexpectedly, you may be creating bill shock.

For discounting and promotional credits, treat them intentionally—especially with usage. A "free first 1M events" promo is effectively a discount with a very specific incentive structure. See Discounts in SaaS for how to think about it.

Commits stabilize revenue and reduce friction

Many founders start with pure usage, then later introduce commits because of:

- Customer budget requirements

- Your need for predictable cash and planning

- Investor preference for committed revenue

Commits can map more cleanly to recurring metrics like CMRR (Committed Monthly Recurring Revenue), while variable usage is treated as true-up/overage.

If you also sell annual terms, align commit structures with Average Contract Length (ACL) and how you manage Deferred Revenue and Recognized Revenue. Usage-based billing frequently creates timing differences between cash collection and revenue recognition.

This is why many "usage-based" companies are actually hybrid: founders want the expansion benefits of usage while keeping planning and cash flow manageable.

How to measure success over time

Usage-based pricing changes what "good" looks like. Traditional subscription metrics still matter, but you need a few usage-specific lenses to avoid false conclusions.

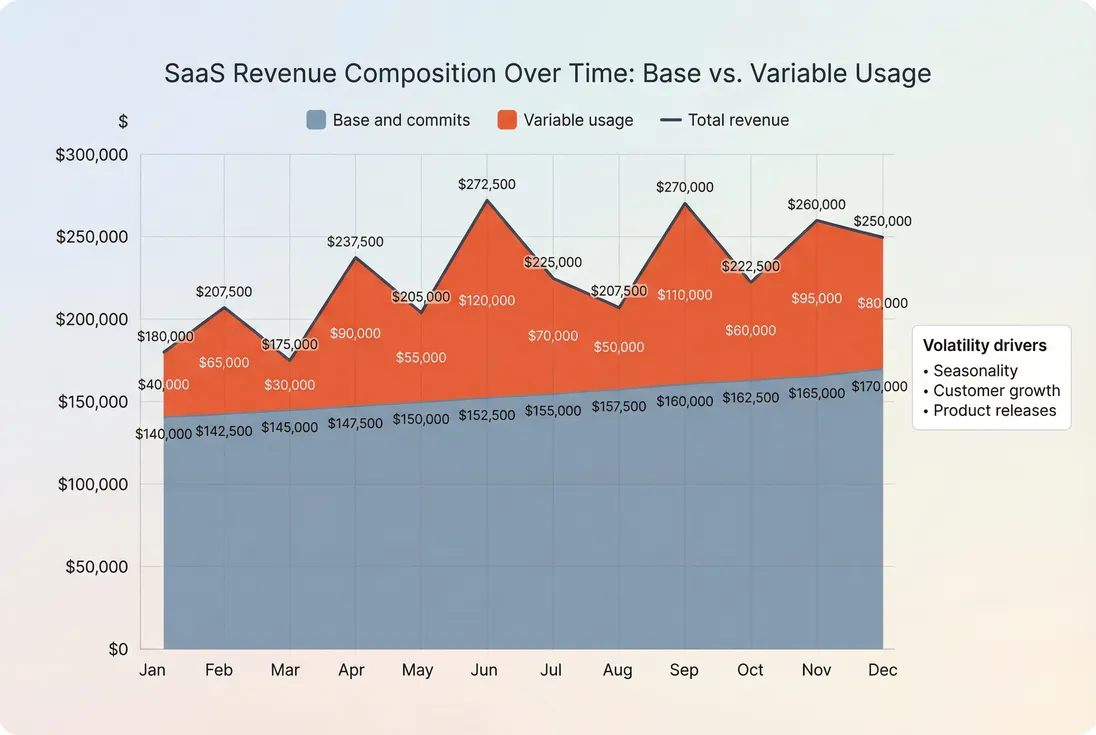

Start with revenue mix

Track how much of your revenue is truly variable:

Interpretation:

- Rising usage share can mean deeper adoption (good) or customers being surprised by bills (bad).

- Falling usage share can mean customers are stagnating (bad) or you successfully moved them to commits (possibly good).

Don't look at this globally only. Segment by customer size and acquisition channel. A few whales can distort the headline number—see Customer Concentration Risk.

Use retention metrics, but segment wisely

Usage pricing can improve expansion even if logo churn is unchanged. You'll want to monitor:

- Logo Churn to understand customer loss.

- GRR (Gross Revenue Retention) to see if customers shrink when they stay.

- NRR (Net Revenue Retention) to see whether expansion offsets churn and contraction.

Hybrid usage models often show a distinctive pattern:

- GRR might look "worse" because customers actively downshift usage in slow months.

- NRR can still be excellent if expansion cohorts grow over time.

This is where cohorting matters. Use Cohort Analysis to separate "new cohorts expanding" from "older cohorts stabilizing."

If you're analyzing these inside GrowPanel, use cohort segmentation and filters to isolate plans, segments, or regions before you change pricing. You're looking for whether the pricing change improved behavior (expansion, retention) or just shifted revenue timing.

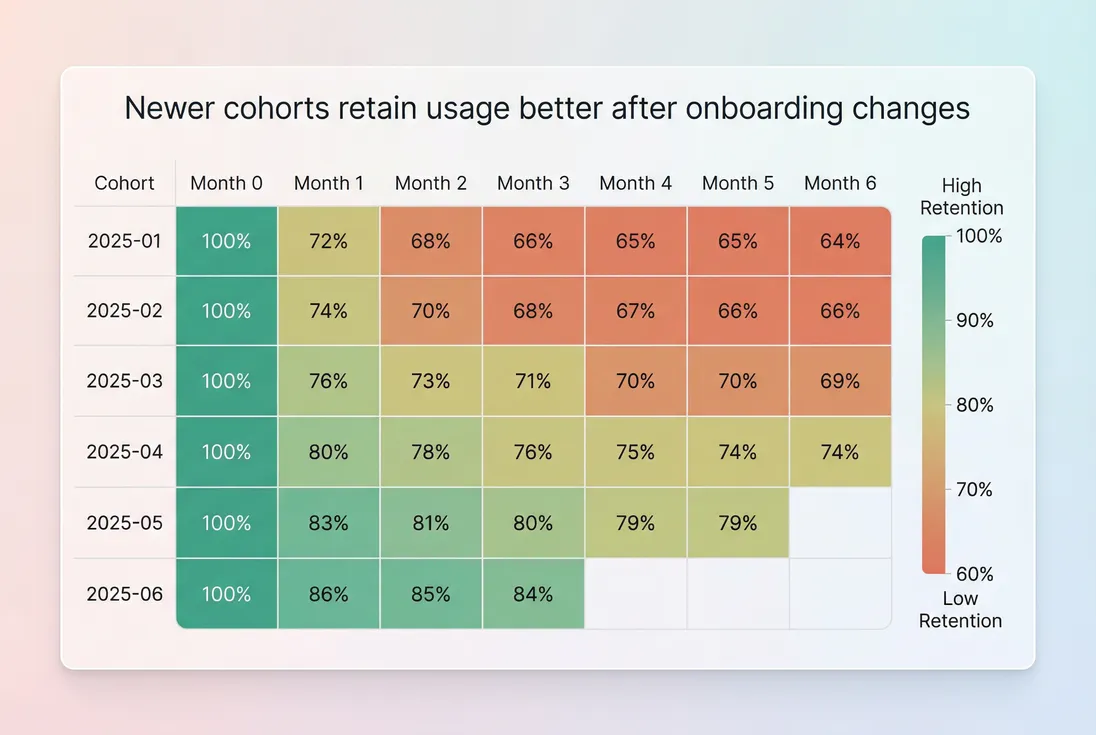

Watch usage retention, not just revenue retention

Revenue retention can be masked by price changes. Usage retention tells you if customers keep consuming the product.

A practical approach is:

- Define a cohort (by signup month or first paid month).

- Track median usage per account over subsequent months.

- Compare that trend to revenue per account (which might move due to price changes).

If usage retention improves after an onboarding or packaging change, that's a strong signal your pricing model is aligned with delivered value. Tie this back to Onboarding Completion Rate and Time to Value (TTV) to find the operational lever.

Forecasting: accept variability, then control it

Founders often ask, "How do I forecast revenue if it's usage-driven?"

Use a two-layer forecast:

- Committed base forecast (stable): base fees, commits, contracted minimums.

- Variable usage forecast (probabilistic): use trailing averages and segment assumptions.

A simple starting point is a trailing average for usage revenue per account (or per cohort). If your business is seasonal, compare against the same month last year.

For smoothing techniques, T3MA (Trailing 3-Month Average) is a practical way to reduce noise without lying to yourself.

Reporting: be consistent about MRR

If you report MRR (Monthly Recurring Revenue), decide and document what happens to variable usage:

- Conservative approach: only base fees and commits count as MRR; variable usage is usage revenue.

- Blended approach: include a standardized, smoothed "usage MRR" using a defined trailing window.

What matters is consistency. Investors and operators can handle either approach; they can't handle changing definitions quarter to quarter.

If you have a hybrid model, the subscription part will typically show up in recurring movements (new, expansion, contraction) like Expansion MRR and Contraction MRR. Use a movements view (for example, GrowPanel's MRR movements) to separate "growth from new logos" from "growth from customers consuming more."

Where usage-based pricing breaks

Most failures come from one of four breakpoints. Fixing them usually means adding structure, not abandoning usage pricing.

Breakpoint 1: bill shock drives churn

Symptoms:

- Support tickets spike at invoice time

- Higher refunds and disputes (see Refunds in SaaS and Chargebacks in SaaS)

- Customers downshift usage aggressively, then cancel

Fixes:

- Add alerts at thresholds (80%, 100%, 120% of included units).

- Introduce included usage so early growth doesn't punish customers.

- Offer commits with true-ups for customers that need predictability.

- Consider rate limits or soft caps on runaway usage (especially for API products).

Breakpoint 2: the meter is not trusted

Symptoms:

- Customers ask for raw logs and you can't provide them

- Usage numbers don't reconcile with customer systems

- Sales cycles lengthen due to contract redlines

Fixes:

- Publish a clear meter spec (what counts, when it counts).

- Provide customer-accessible usage exports.

- Build internal audit tooling so finance can defend invoices.

- Tighten instrumentation and deduping.

If you're seeing churn tied to billing confusion, run Churn Reason Analysis specifically on usage-billed accounts.

Breakpoint 3: gross margin degrades with scale

Symptoms:

- Biggest customers are least profitable

- Infrastructure or third-party costs rise faster than usage revenue

- Sales discounts are stacked on top of already-decreasing effective unit prices

Fixes:

- Re-price the unit or adjust tier slopes.

- Add a base platform fee that better covers fixed costs.

- Revisit your Contribution Margin by segment.

- Engineer cost controls (caching, batching, limits) before pricing becomes punitive.

Breakpoint 4: cash collection friction increases

Usage billing often happens in arrears, which can increase accounts receivable and collections work—especially for larger invoices.

Fixes:

- Tighten invoicing cadence (monthly vs quarterly).

- Encourage prepay or commit structures for larger customers.

- Monitor Accounts Receivable (AR) Aging as you scale usage billing.

- Understand the impact of Billing Fees if you generate more invoices or line items.

The Founder's perspective: If enterprise buyers are asking for annual prepaid commits, that's not a rejection of usage-based pricing. It's a request to convert uncertainty into a contract. You can keep the usage value metric while moving cash flow and renewals toward predictability.

Practical checklist before you switch

Before rolling usage-based pricing to your whole base, validate these points with a small segment:

- Meter reliability: can you reproduce usage numbers for any customer and period?

- Unit economics: does gross margin hold at the 90th percentile of usage?

- Customer predictability: can customers estimate next month within a reasonable range?

- Guardrails: do customers get warnings before big overages?

- Retention impact: do cohorts retain usage better, not just revenue?

If you can't answer these confidently, start with a hybrid model (base plus usage) rather than pure usage. It preserves the expansion upside while reducing volatility and billing risk.

Related GrowPanel Academy concepts

If you want to connect usage-based pricing to your broader SaaS model, these are the most relevant:

- Metered Revenue

- MRR (Monthly Recurring Revenue)

- CMRR (Committed Monthly Recurring Revenue)

- NRR (Net Revenue Retention)

- Customer Concentration Risk

Frequently asked questions

Choose usage-based pricing when customer value clearly scales with consumption and customers want to start small and expand naturally. It works best when your variable costs scale with usage, and you can meter usage accurately. Avoid it when budgets are fixed, usage is unpredictable, or procurement requires price certainty.

A practical benchmark is whether customers can predict their bill within about 10 to 20 percent month to month. If variance is higher, expect more disputes, failed renewals, and demand for caps or commits. Segment by customer type because a few seasonal customers can distort overall volatility.

Use guardrails rather than blunt caps: included usage tiers, proactive alerts at thresholds, a soft cap that pauses non-critical usage, and a predictable commit plus overage. Also align onboarding to reach first value quickly so early usage growth feels like progress, not surprise fees.

The committed base fee usually maps cleanly to recurring revenue, while pure variable usage is better treated as usage revenue unless you standardize a smoothing method. If you do include variable usage in a recurring metric, document the rule and keep it consistent so trend lines are comparable over time.

Track gross margin per unit, effective unit price, usage retention by cohort, and net revenue retention. Also monitor customer concentration risk because a few heavy users can dominate revenue and support load. Pair this with churn reason analysis to catch pricing-driven churn early.