Table of contents

Revenue growth rate

A SaaS can look healthy in a single snapshot (MRR is up, pipeline exists, churn feels manageable) and still be quietly decelerating. Revenue growth rate is the metric that exposes that drift early—before you hire ahead of demand, miss a cash plan, or realize your retention is doing more damage than your acquisition can offset.

Revenue growth rate is the percent change in revenue over a defined period (most commonly MRR or ARR), comparing the end of the period to the start.

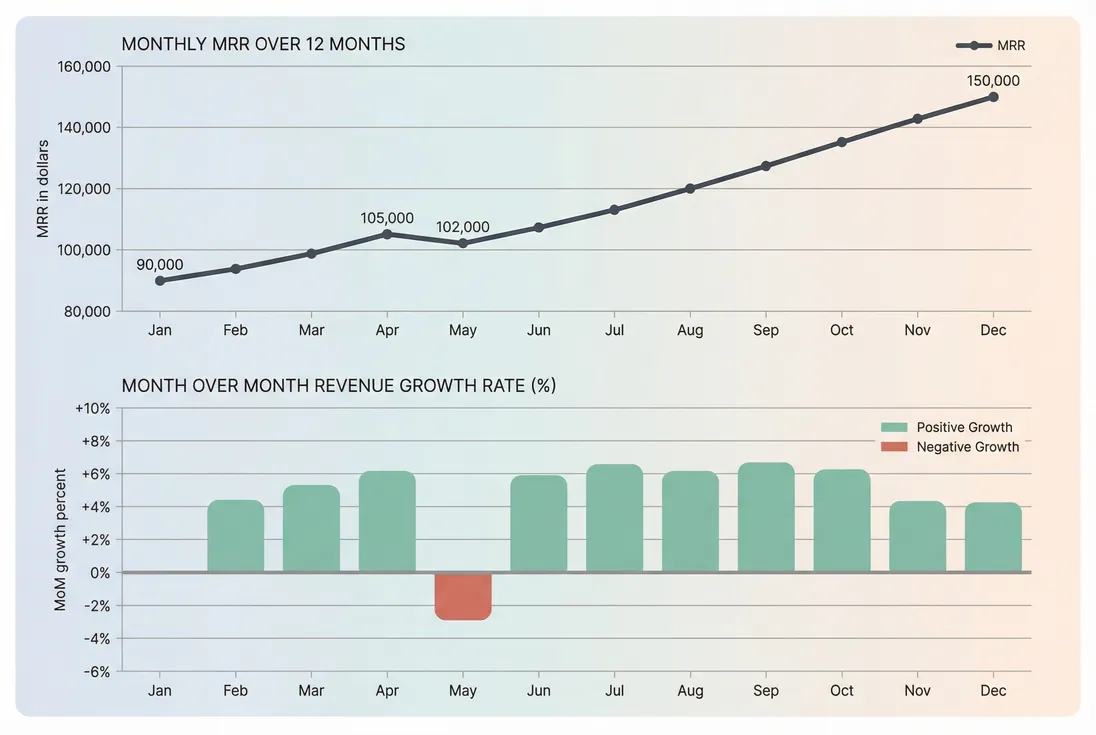

Seeing MRR and growth rate together prevents a common trap: celebrating a higher MRR level while missing a clear deceleration trend.

Which revenue should you use

"Revenue" is overloaded in SaaS. Pick the version that matches the decision you're trying to make, then stay consistent.

MRR and ARR for operating reality

For most founders, revenue growth rate should be based on recurring run rate:

- MRR (Monthly Recurring Revenue) growth rate: best for weekly or monthly operating cadence.

- ARR (Annual Recurring Revenue) growth rate: best for board-level narrative and longer-range planning.

If you do any meaningful annual billing, resist the temptation to use cash collected as "revenue" for growth. Cash spikes create fake growth months and fake slowdowns later. If you need to reconcile billing timing, learn the difference between Recognized Revenue and Deferred Revenue.

Recognized revenue for finance, not steering

Recognized revenue growth is essential for accounting and audits. It is often the wrong steering wheel for product and go-to-market decisions because it lags what's happening in acquisition and churn.

Exclude one-time and timing artifacts

If you're trying to understand the health of your recurring engine, keep these separate:

- One Time Payments (implementation, setup fees)

- Refunds in SaaS and Chargebacks in SaaS

- Short-term promotions and Discounts in SaaS

- Taxes and compliance handling like VAT handling for SaaS

The Founder's perspective: I use MRR growth rate to decide pace (hiring, spend, targets). I use recognized revenue growth to explain the story to finance and investors. Mixing them leads to over-hiring during cash spikes and panic-cutting during recognition lag.

How to calculate growth rate

At its simplest, revenue growth rate is just percent change over a period.

Common SaaS versions

Pick one primary view, then use secondary views to sanity-check:

- Month over month: sensitive, best for fast feedback

- Quarter over quarter: smoother, good for planning

- Year over year: controls for seasonality

If you track MRR:

Example: starting MRR is 100,000 and ending MRR is 110,000. Growth rate is 10%.

Annualizing monthly growth (use carefully)

Founders often want to translate a monthly growth rate into an annual headline. That's compounding, not multiplying.

Here's what that looks like:

| Monthly growth rate | Approx annualized growth |

|---|---|

| 2% | ~27% |

| 5% | ~80% |

| 8% | ~152% |

| 10% | ~214% |

Use annualized growth for intuition, not promises. Small monthly changes compound dramatically, and most SaaS businesses do not sustain a single monthly rate for 12 straight months.

Two practical measurement rules

- Use start-of-period as the denominator (the "base you had to grow from").

- If your starting revenue is tiny, growth rates will be huge and misleading. In very early days, pair growth rate with absolute net new dollars (for example, net new MRR).

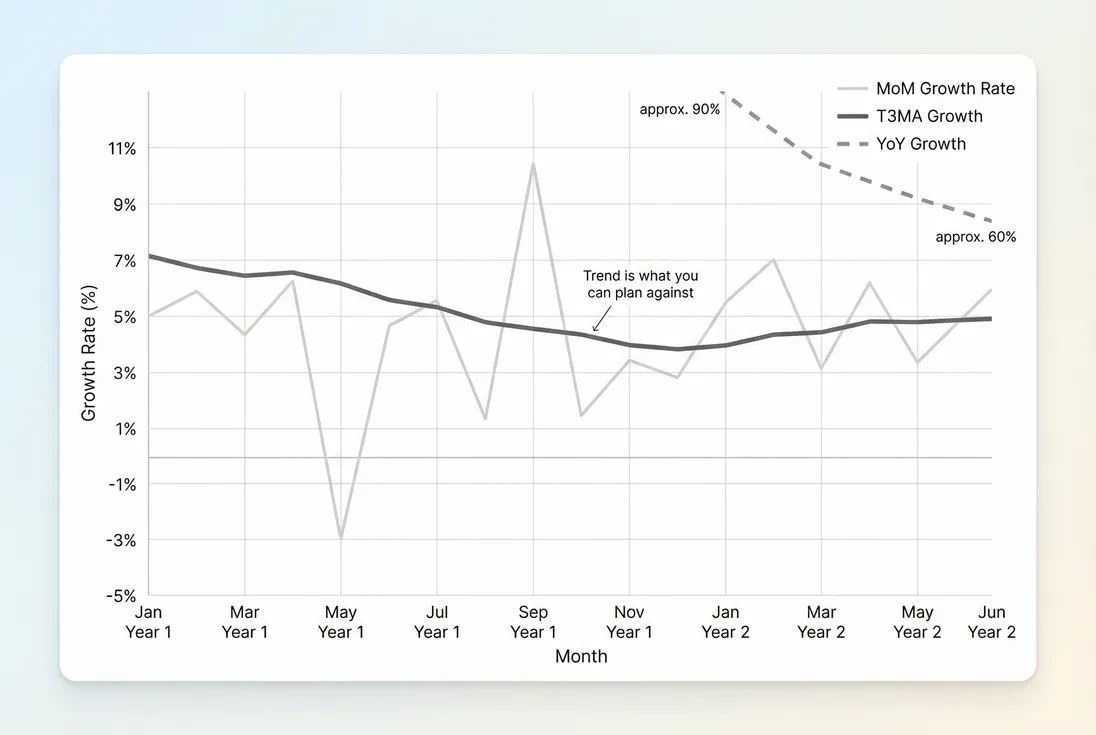

If you need smoothing, a T3MA (Trailing 3-Month Average) is usually the simplest fix: it reduces noise without hiding the direction.

What drives the number

Revenue growth rate is an outcome metric. To improve it, you need to decompose it into levers you can pull.

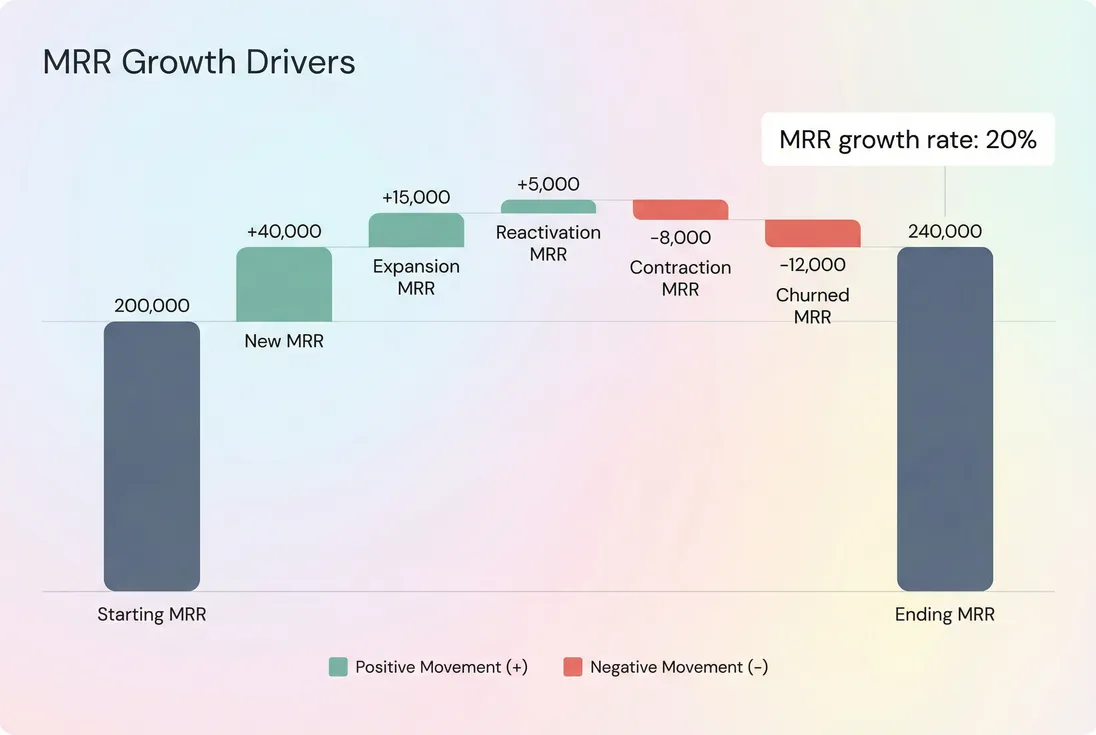

The MRR movement bridge

For recurring SaaS, the end minus start change in MRR is driven by five components:

And then:

This is why founders who only track "growth" get stuck. The same 6% monthly growth could be:

- great acquisition with scary churn, or

- mediocre acquisition with world-class expansion, or

- a temporary pricing bump masking slowing demand.

A bridge makes growth actionable: you can see whether you're winning because of new sales, expansion, reactivation, or despite churn and contraction.

What each driver usually implies

- New MRR: acquisition volume, conversion rate, win rate, sales capacity, pipeline quality.

- Expansion MRR: product adoption, pricing/packaging, seat growth, success motion. See Expansion MRR.

- Reactivation MRR: win-back motion and product relevance. See Reactivation MRR.

- Contraction MRR: customers downgrading due to value gaps, over-selling, or packaging mismatch. See Contraction MRR.

- Churned MRR: customer failures, poor onboarding, weak ROI, competitive displacement. See MRR Churn Rate and Customer Churn Rate.

If you want a compact "quality of growth" check, pair growth rate with retention:

- NRR (Net Revenue Retention) tells you whether your installed base expands or shrinks.

- GRR (Gross Revenue Retention) tells you whether you're leaking revenue through churn and downgrades.

- Logo Churn helps you see whether you're losing customers even when dollars look stable.

The Founder's perspective: I treat growth rate as the scoreboard, but I run the team on the drivers. If growth slips, I do not ask for a bigger number. I ask which bar in the bridge moved and why.

How founders use it

Revenue growth rate is useful because it connects directly to three high-stakes decisions: hiring, spend, and expectations.

1) Setting a realistic hiring pace

Hiring is a commitment to future burn. If your growth rate is trending down, you can still hire—but only if you have evidence the slowdown is temporary (for example, a short-term pipeline dip) rather than structural (for example, retention decay).

A practical rule: avoid building a cost base that requires a growth rate you have not proven for multiple periods.

This is where pairing growth with efficiency matters:

- Burn Rate tells you how quickly you spend cash.

- Burn Multiple tells you how much burn you need for each dollar of net new ARR.

- CAC Payback Period tells you how long growth takes to pay for itself.

If growth slows and payback lengthens at the same time, hiring ahead usually makes the problem worse.

2) Forecasting and target-setting

Growth rate is a convenient input for forecasts, but only if it's grounded in drivers:

- For sales-led: pipeline coverage, Win Rate, Sales Cycle Length, ACV.

- For product-led: signup-to-paid Conversion Rate, activation, expansion, churn.

A clean way to set targets is:

- Start with a target growth rate.

- Translate into required net new MRR dollars.

- Translate into required new MRR, given expected churn and expansion.

This forces you to acknowledge retention reality instead of assuming it away.

3) Communicating momentum without cherry-picking

Boards and investors care about direction and durability. A single great month is not a trend. Show:

- MoM (fast feedback)

- YoY (seasonality control)

- a trailing average (signal over noise)

If you have to pick just one to avoid surprises, use the trailing average plus the bridge.

Practical benchmarks (use as guardrails)

Benchmarks vary by market, ACV, and motion, but founders need a starting point. As a rough operating guardrail for recurring SaaS:

| Stage (very approximate) | Typical MoM growth range | What matters most |

|---|---|---|

| Early (finding repeatability) | 10% to 20% | Proving a channel, initial retention |

| Post-PMF (building engine) | 5% to 10% | NRR, CAC payback, sales capacity |

| Scaling (efficiency focus) | 3% to 6% | Retention + efficiency, expansion |

Use these ranges to ask better questions, not to grade yourself. A high-ACV enterprise motion can look "slow" MoM while still being healthy due to lumpy deal timing.

If you want a sanity check on what growth is required just to offset churn drag, see Natural Rate of Growth.

When it misleads you

Revenue growth rate is simple, which makes it easy to misuse. Most "confusing growth" problems come from mixing definitions, timing artifacts, or concentration effects.

Timing artifacts that distort growth

- Annual upfront billing: cash spikes without real run-rate change (use MRR/ARR, not cash).

- Refunds and chargebacks: can create negative months that are operationally different from churn. See Refunds in SaaS.

- Usage-based and metered components: can be real growth, but volatile. See Usage-Based Pricing and Metered Revenue.

- Discounts and ramp deals: growth may be delayed or front-loaded. See Discounts in SaaS.

Mix effects: growth can change with no demand shift

If you move upmarket, growth rate might slow even as the business improves (higher ACV, longer cycles). If you move downmarket, growth rate might rise while churn gets worse.

To disentangle this, pair growth with:

- ARPA (Average Revenue Per Account) (is revenue per account rising?)

- Active customer count (are you growing logos?)

- retention metrics (are you keeping what you win?)

Whale risk and concentration

One large customer expansion can inflate growth; one churn can crater it. If that's your reality, treat growth rate as fragile until proven otherwise.

Use:

- Customer Concentration Risk

- Cohort Whale Risk

- Cohort Analysis to see whether newer cohorts behave like older ones

Fixing volatility: show the smoothed truth

If your MoM growth swings, don't argue about which month "counts." Plot the raw series, then overlay a trailing average and a YoY line.

Smoothed and YoY views reduce false alarms while still surfacing real deceleration early enough to act.

Turning "growth is down" into actions

Use the bridge as your decision tree.

If new MRR is the problem

Focus on the front door:

- Tighten ICP and messaging (fewer low-fit logos that churn fast).

- Improve pipeline quality and speed: Lead Velocity Rate (LVR), Win Rate, Sales Cycle Length.

- Re-check pricing and packaging: ASP (Average Selling Price), Per-Seat Pricing, Price Elasticity.

- If you're trial-driven, fix activation and time-to-value: Free Trial, Time to Value (TTV), Onboarding Completion Rate.

If churn or contraction is the problem

Stop the leak before you pour more into acquisition:

- Quantify what's happening: Churn Reason Analysis.

- Split involuntary and voluntary churn: Involuntary Churn and Voluntary Churn.

- Improve early retention with onboarding and value realization.

- Watch for downgrade patterns that signal packaging mismatch or weak adoption.

This is also where cohort thinking matters: retention improvements should show up first in newer cohorts. Use Cohort Analysis to confirm.

If expansion is the problem

Expansion is rarely "a sales problem" alone. It's usually:

- unclear value ladder,

- missing product limits that justify upgrade,

- low adoption of sticky features, or

- weak success motion.

Track adoption and health alongside expansion outcomes: Feature Adoption Rate and Customer Health Score.

The Founder's perspective: When growth slows, my first move is not "push sales harder." It is to find the driver that changed, then decide whether the fix is product (activation and value), success (renewal and expansion), or go-to-market (pipeline and positioning).

A practical workflow (monthly)

- Compute MRR growth rate (MoM and trailing average).

- Build the bridge: new, expansion, reactivation, contraction, churn.

- Segment the bridge by plan, acquisition channel, or customer size to find mix shifts.

- Decide one primary bet for next month (not five).

If you use GrowPanel, the MRR movements view is the fastest way to operationalize this decomposition, and filters help you isolate where growth is actually coming from.

Revenue growth rate is a simple percent, but it's one of the highest-leverage metrics in SaaS because it connects directly to cash, hiring, and valuation expectations. Use it as a headline, but run the business on what creates it: new, expansion, reactivation, contraction, and churn.

Frequently asked questions

It depends on stage and go to market. Early stage can target 10 to 20 percent month over month because the base is small. Post product market fit often settles to 5 to 10 percent month over month. Later stage leaders may run 3 to 5 percent month over month with stronger retention and efficiency.

Use MRR or ARR for operating decisions because they reflect the recurring run rate. Use recognized revenue for accounting and financial statements. If you sell annual upfront, cash collected will spike, but MRR should stay smooth. Pick one primary definition and keep it consistent in board updates and internal targets.

Separate volume from price. Track customer count growth alongside ARPA (Average Revenue Per Account). If growth rises while customer count is flat, you likely changed pricing, packaging, or expansion behavior. Also break out new MRR versus expansion MRR and compare cohorts before and after the change to confirm durability.

Use a trailing average and a year over year view. A T3MA (Trailing 3-Month Average) reduces noise from timing, large deals, or annual renewals. Pair it with year over year growth to control for seasonality. Then diagnose volatility with an MRR movement bridge that shows new, expansion, contraction, and churn.

Growth rate is the input to your cash plan. If growth slows, your burn multiple and CAC (Customer Acquisition Cost) payback usually worsen unless you reduce spend or improve retention. Before hiring, confirm growth is driven by repeatable new acquisition and stable NRR (Net Revenue Retention), not one off deals or temporary discounts.