Table of contents

Renewal rate

Renewal rate is one of the fastest ways to tell whether your growth is "real" or just a leaky bucket. If renewals are weak, every new dollar of MRR (Monthly Recurring Revenue) you add is partly replacing what you're about to lose—making forecasts unreliable, payback harder, and hiring riskier.

Renewal rate is the percentage of customers (or recurring revenue) that renew when their subscription or contract reaches its renewal date within a given period.

Which renewal rate should you track?

Most founders say "renewal rate" but mean one of two different things. Tracking the wrong one leads to wrong decisions.

Logo vs revenue renewal

Logo renewal rate answers: Did customers stay?

This is closest to "relationship retention" and is often owned by Customer Success.

Revenue renewal rate answers: Did the dollars stay?

This is what your model cares about when you're planning ARR (Annual Recurring Revenue), headcount, and runway.

A customer can renew (logo renewal) but at a lower price (revenue renewal declines). Or you can renew at a higher price (revenue renewal increases), often via seat growth, usage growth, or packaging changes.

The Founder's perspective: If I only look at logo renewal, I might celebrate "90 percent renewal" while my base is quietly shrinking from downgrades and discount-heavy saves. Revenue renewal tells me whether I can fund growth from my existing customers.

Contract renewals vs "always-on" subscriptions

Renewal rate is most meaningful when there is a clear renewal event:

- annual or multi-year contracts

- committed terms (even if billed monthly)

- enterprise agreements with a renewal quote process

For pure month-to-month self-serve subscriptions, "renewal" is effectively the same as ongoing retention and churn (see Customer Churn Rate and MRR Churn Rate). You can still define a "monthly renewal rate," but it's basically the inverse of monthly logo churn.

Gross vs net at renewal

Founders often benefit from reporting two revenue views at renewal:

- Gross revenue renewal rate: revenue kept from the renewing base after downgrades, excluding any expansion.

- Net revenue renewal rate at renewal: revenue after renewal including expansion that happens as part of the renewal event.

These ideas map closely to GRR (Gross Revenue Retention) and NRR (Net Revenue Retention), but renewal rate is event-scoped (only customers with a renewal date in the period), while GRR and NRR are usually time-scoped (a starting base over a month/quarter/year).

How do you calculate it?

Renewal rate gets messy in real life because contracts renew early, renew late, change plans, or consolidate accounts. The cure is being explicit about the population and dates.

Step 1: define "up for renewal"

Your denominator is not "all customers." It's customers whose term ends in the period.

Examples:

- "All annual contracts with an end date in March"

- "All enterprise contracts ending this quarter"

- "All customers with a renewal due in the next 60 days" (for a pipeline view)

Be consistent: if you run the metric monthly, use the contract end date to assign contracts to a month.

Step 2: define what counts as "renewed"

Most teams count a contract as renewed if:

- a new term starts within an allowed window around the end date (for example, 30 days before to 30 days after), and

- the customer is active and paying (watch out for payment failures; see Involuntary Churn)

The exact window depends on how your sales and procurement work. What matters is consistency and documenting it.

Step 3: choose logo and revenue views

Here's a concrete example for a March renewal cohort.

| Metric | Value |

|---|---|

| Accounts up for renewal | 100 |

| Accounts renewed | 92 |

| Accounts churned | 8 |

| Revenue up for renewal | 200,000 |

| Renewed revenue after renewal | 186,000 |

- Logo renewal rate = 92 / 100 = 92 percent

- Revenue renewal rate = 186,000 / 200,000 = 93 percent

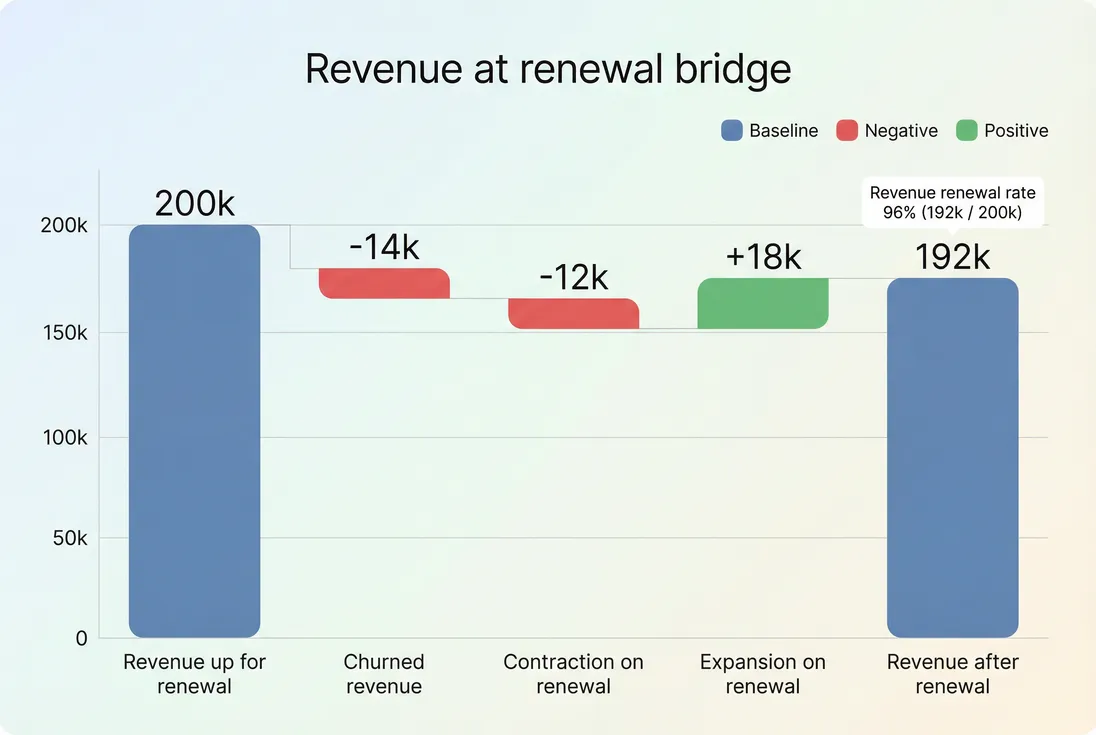

Now add the nuance founders actually need:

- Of the 92 renewed accounts:

- 20 renewed with a downgrade totaling -12,000

- 15 renewed with an upgrade totaling +18,000

That's why you should pair renewal rate with a movement breakdown like Expansion MRR and Contraction MRR, and review it like a bridge.

The Founder's perspective: I use the bridge to decide where to invest. If churn is the problem, I fund save plays and product fixes. If contraction is the problem, I revisit packaging, discounting, and whether we're selling customers more than they can adopt.

Practical calculation rules to document

Write these down and apply them the same way every period:

- Early renewals: Do you count them in the month signed or the month due? Most finance teams attribute to the due month to keep the denominator aligned.

- Late renewals: How long do you wait before labeling as churn? (Also see /blog/when-should-you-recognize-churn-in-saas/.)

- Mid-term upsells: If a customer expands mid-term, do you treat that as part of "revenue up for renewal" for the cohort? Usually yes, because it's the revenue at risk.

- Account merges and splits: If two accounts consolidate into one contract, make sure you can still trace the renewal cohort.

What drives renewals in practice?

Founders often assume renewals are mostly about "customer happiness." In reality, renewal outcomes are the result of a few controllable systems.

Value realization before the renewal window

By the time a customer enters procurement, their decision is mostly made. The renewal rate you see this quarter is heavily influenced by:

- onboarding effectiveness (see Onboarding Completion Rate)

- time to first value (see Time to Value (TTV))

- adoption of the core workflow, not just logins (see Feature Adoption Rate)

A useful pattern: segment renewal rate by customer age and first-use milestones. If customers who reach "Milestone A" renew at 95 percent and those who don't renew at 70 percent, your biggest renewal lever is not a "renewal campaign." It's getting more customers to Milestone A.

Pricing, discounting, and packaging pressure

A renewal can fail for product reasons, but it can also fail because the customer believes:

- the price increased faster than perceived value

- the contract is over-provisioned (common with seat-based tools)

- a competitor offers a "good enough" substitute at a lower price

This is where renewal rate connects directly to Discounts in SaaS and ASP (Average Selling Price). Heavy discounting can preserve logo renewal while damaging revenue renewal and training customers to negotiate every year.

Involuntary churn and billing mechanics

In SMB and self-serve, a meaningful share of "non-renewals" are not intentional:

- card expired

- failed invoice payment

- billing contact changed

- tax or VAT handling issues for international customers (see VAT handling for SaaS)

If your renewal rate drops while product usage is stable, check billing failure rates and your dunning process (also review Accounts Receivable (AR) Aging for larger customers on invoicing).

Customer concentration and "whale" dynamics

If a handful of large customers represent a big fraction of the renewing revenue, a single churn can swing revenue renewal rate dramatically.

Use the lens from Customer Concentration Risk and Cohort Whale Risk:

- Track renewal rate separately for top revenue deciles.

- Don't let a great SMB renewal rate hide an enterprise renewal problem (or vice versa).

How should you interpret movement?

Renewal rate is easy to overreact to. The trick is separating "real change" from "math and timing."

Ask: did the renewal mix change?

A common false alarm: your renewal rate falls because this month included a lot of smaller, earlier cohorts with weaker fit.

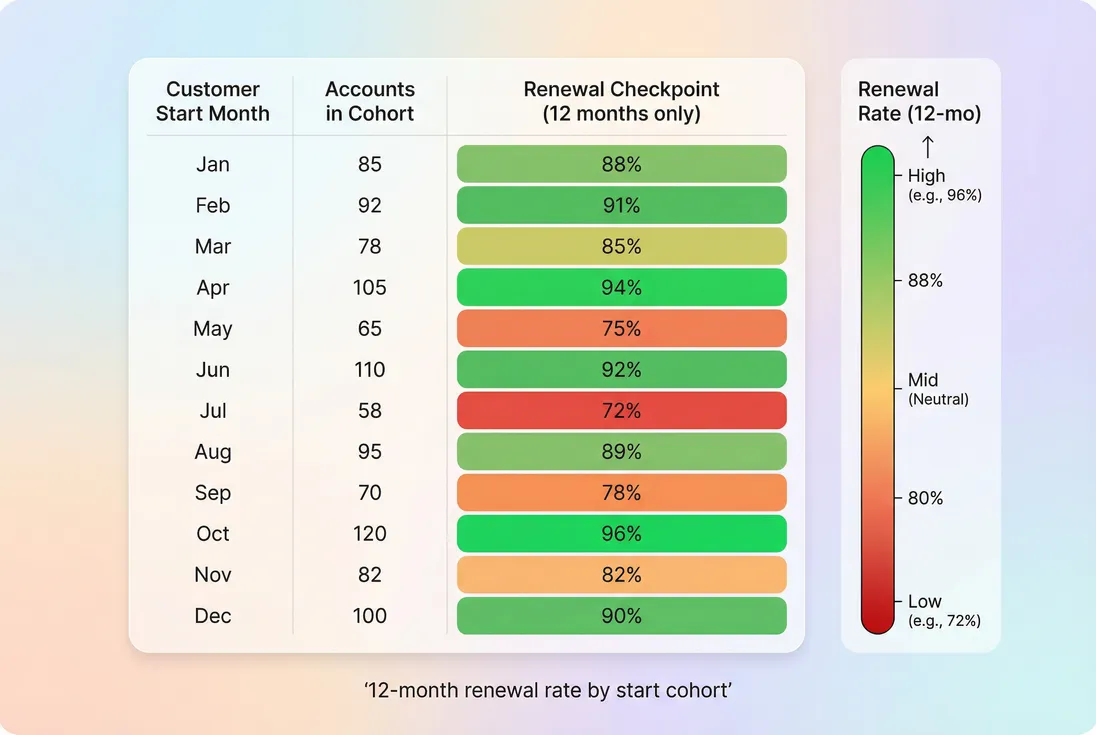

Before declaring an emergency, break renewal rate down by:

- plan or tier

- ACV bands (see ACV (Annual Contract Value))

- customer age at renewal

- acquisition channel (if you have it)

- industry and geography (often a hidden driver)

If you use GrowPanel, this is exactly where filters and cohorts help: isolate the renewal cohort you care about and compare like-for-like behavior (see /docs/reports-and-metrics/filters/ and /docs/reports-and-metrics/cohorts/).

Ask: is this a logo issue or a revenue issue?

Use a simple interpretation grid:

| What changed | Likely reality | Common fixes |

|---|---|---|

| Logo down, revenue down | True churn spike | product gaps, CS coverage, positioning, save plays |

| Logo flat, revenue down | Downgrades, discounting | packaging, success plans, adoption, pricing discipline |

| Logo up, revenue flat | More small renewals | improve expansion motions, revisit ICP |

| Logo flat, revenue up | Expansion at renewal | double down on expansion path and value proof |

Also pair renewal rate with Logo Churn and Net MRR Churn Rate to understand the overall retention system outside the renewal event.

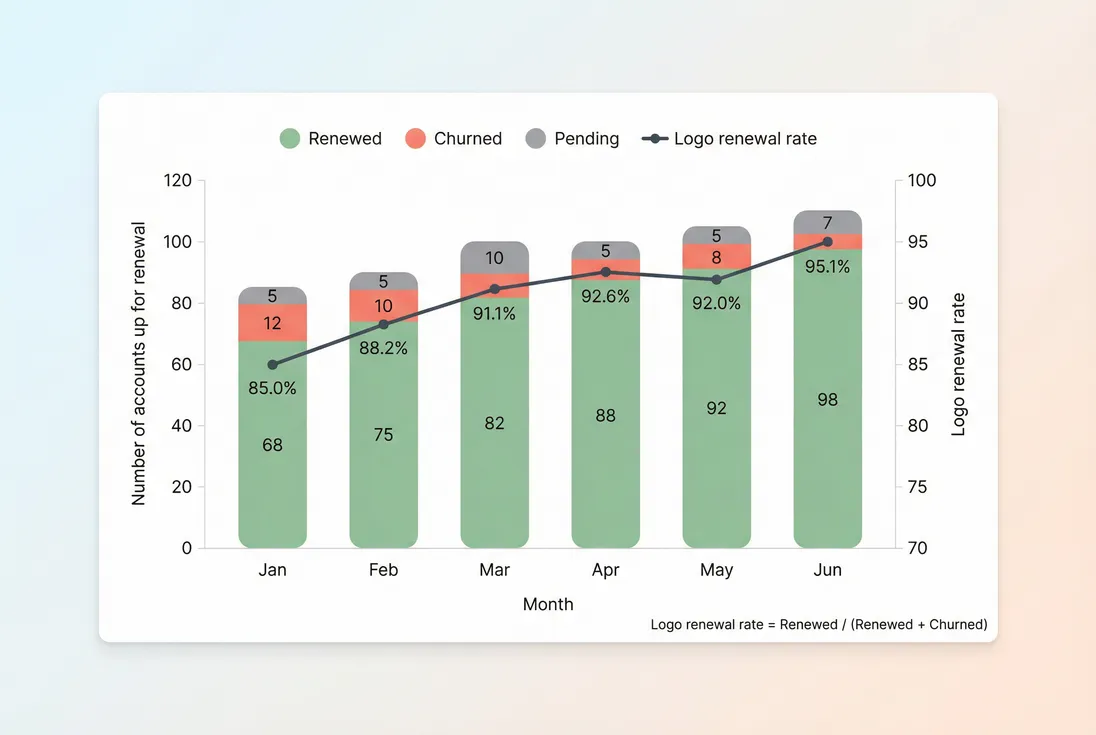

Ask: are you counting "pending" correctly?

If you measure renewals by calendar month, you will always have customers in a gray zone:

- procurement delays

- legal redlines

- budget approvals

- internal champion changes

If your "renewal rate" includes pending contracts in the denominator but not the numerator, it will look worse mid-month and improve at month-end. The fix is to report:

- renewal rate for contracts resolved (renewed or churned)

- a separate pending renewal pipeline count/value

Ask: did contract length change?

If you push multi-year deals, you can "improve" renewal rate mechanically (fewer renewal events) while increasing concentration risk. Use Average Contract Length (ACL) alongside renewal rate so you understand what's driving stability.

The Founder's perspective: A sudden renewal rate improvement can be a warning sign if it came from longer contracts plus bigger discounts. That can buy time, but it also pulls negotiation leverage forward and can inflate future renewal cliffs.

What actions improve renewal rate?

Renewal rate improves when you treat renewals as an operating system, not a quarter-end scramble.

Build a renewal operating cadence

For annual contracts, a practical cadence looks like this:

- 120 to 90 days out: confirm success criteria, baseline usage, stakeholder map

- 90 to 60 days out: present value recap, propose renewal path (same, down, up)

- 60 to 30 days out: commercial negotiation, legal, procurement

- 0 to 30 days after end: last-chance saves, win-back, clean churn reasons

Track renewal rate by "days to renewal" buckets. If deals are slipping later, you may not have a churn problem—you may have a process problem.

Use cohorts to find where it breaks

Renewal is often cohort-driven: something about onboarding, the product at the time, or the market you targeted created a weak set of customers.

This ties directly to Cohort Analysis: if the March–May cohorts are weak, ask what was true then:

- different acquisition channel?

- different ICP messaging?

- product reliability issues?

- pricing or packaging changes?

Fix the biggest renewal killers first

In most SaaS businesses, renewal improvements come from a short list:

Customers never reach a stable workflow

Fix onboarding, implementation, and habit formation. Measure adoption and time-to-value, not just NPS.You sold the wrong customers

Renewal rate is an ICP metric in disguise. If small agencies churn and mid-market teams renew, stop scaling acquisition into the churny segment.Expansion path is unclear

If customers renew but don't grow, your long-term LTV (Customer Lifetime Value) suffers. Make the "next step" obvious: more seats, higher tier, or usage-based growth (see Usage-Based Pricing).Discounting becomes the default

Use discounting intentionally. If saves always require a discount, you may be overpricing for realized value—or underserving post-sale.Billing and collections friction

For invoiced customers, prevent accidental churn and delayed renewals by monitoring receivables and disputes (see Chargebacks in SaaS and Refunds in SaaS).

Make renewal rate decision-relevant

A renewal rate number is only useful if it changes what you do. A simple, effective approach:

- Set a renewal rate target by segment (SMB vs mid-market vs enterprise).

- Review the renewal bridge monthly with the team.

- Pick one top driver to improve each quarter (onboarding milestone, pricing guardrails, dunning, save plays).

- Validate progress by cohorts, not just the latest month.

If you're already tracking retention in GrowPanel, combine the retention views with MRR movements to see whether renewals are failing due to churn, contraction, or weak expansion (see /docs/reports-and-metrics/retention/ and /docs/reports-and-metrics/mrr-movements/).

Renewal rate is not just a Customer Success KPI. It's a core input to forecasting, pricing strategy, and product prioritization. Track it in the right form (logo and revenue), define the denominator carefully (up for renewal), and interpret changes through segmentation and cohorts—then you'll know whether you're building durable growth or just running faster on a treadmill.

Frequently asked questions

A good renewal rate depends on segment and contract type. For annual B2B SaaS, many healthy businesses target roughly 85 to 95 percent logo renewal, with enterprise often higher and SMB often lower. Track it by segment and cohort; the aggregate can hide mix shifts and concentration risk.

Track both. Logo renewal rate tells you whether customers keep choosing you. Revenue renewal rate tells you whether the dollars stayed, which matters for planning headcount and cash. If logo renewals look stable but revenue renewals drop, downgrades and discounting are eroding your base.

Renewal rate is event based: it measures outcomes specifically for contracts reaching an end date in a period. Churn rate is usually time based, measuring loss over a month or quarter. GRR and NRR summarize retention over time for a starting revenue base, including expansions and contractions.

Downgrades usually count as a renewal for logo renewal, but reduce revenue renewal. Upsells at renewal increase revenue renewal and can even offset churn elsewhere. To avoid confusion, report renewals with a breakdown: renewed flat, renewed with contraction, renewed with expansion, and churned.

First validate measurement: the renewal population, dates, and late renewals. Then segment the drop by plan, ACV band, industry, and customer age to find where it is concentrated. Pull recent churn reasons, look for product changes or pricing changes, and run a focused save playbook for the next renewal window.