Table of contents

Reactivation MRR

Reactivation MRR is one of the fastest ways to "manufacture" growth without increasing acquisition spend—but it only works when you treat it as a repeatable operating lever, not a one-off winback campaign.

Definition (plain English): Reactivation MRR is the amount of monthly recurring revenue added in a period from customers who had previously churned (their MRR was zero) and then came back as paying subscribers.

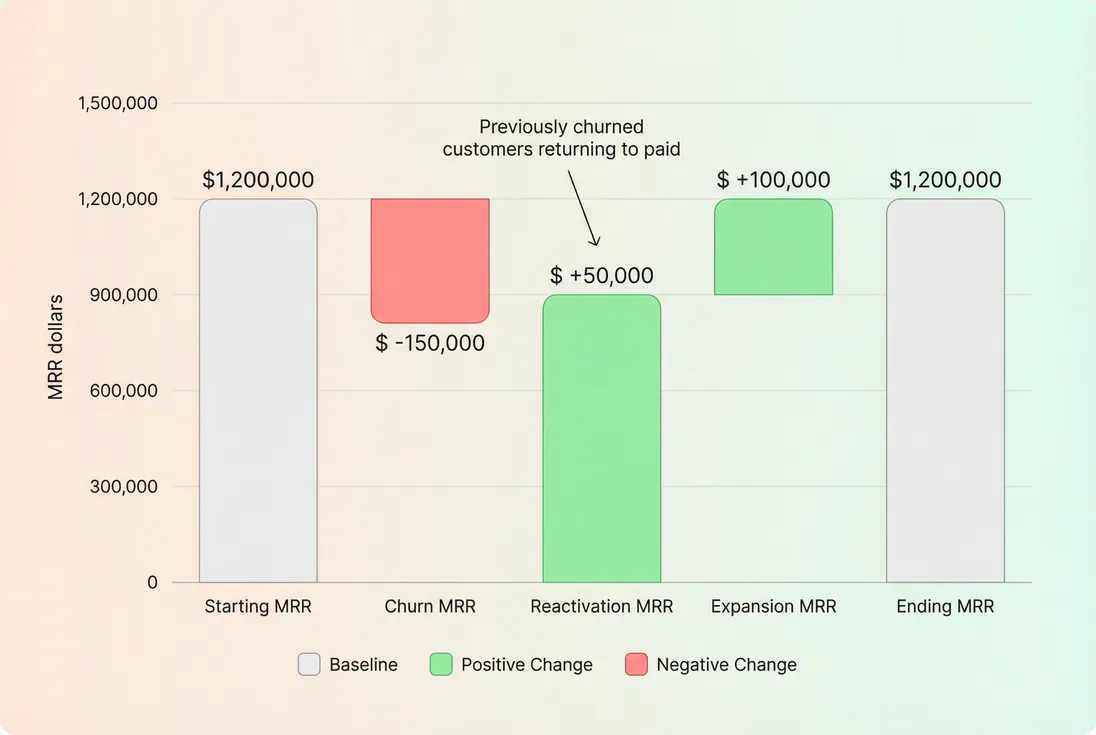

Reactivation MRR is a "positive movement" that directly offsets churn and can materially change your ending MRR even when new sales are flat.

What this metric reveals

Reactivation MRR answers a specific founder question: Are we losing customers permanently, or temporarily?

Two companies can have the same MRR churn and very different futures:

- Company A loses $50k MRR and only wins back $2k over the next few months. That churn is mostly permanent.

- Company B loses $50k MRR and wins back $20k through a strong winback motion and product fixes. That churn is partly reversible.

Reactivation MRR is especially valuable because it changes how you should think about:

- Churn economics: If meaningful churn comes back, your "true" long-term loss is smaller than the churn event suggests.

- Growth planning: If reactivation is reliable, it can fund headcount without assuming aggressive new acquisition.

- Retention work prioritization: High reactivation can mean customers are leaving for solvable reasons (timing, onboarding gaps, temporary budget freezes) rather than a broken product-market fit.

The Founder's perspective: Reactivation MRR tells you whether churn is a cliff or a detour. If it's a detour, you can invest in a disciplined winback system and reduce pressure on new pipeline. If it's a cliff, you need to fix why customers leave in the first place.

How reactivation MRR is calculated

At its core, reactivation MRR is a sum of MRR from accounts that were previously churned and became paying again during the period.

A practical operational definition:

- The customer's MRR was zero before the event (they had churned).

- The customer's MRR becomes greater than zero due to a new or resumed subscription.

- The MRR you count is the customer's new MRR at reactivation (after discounts, plan changes, and quantities).

A concrete example

Assume it's April:

- A customer canceled in February and their MRR went from $200 to $0.

- In April they return on a $150 plan (downgraded).

- Your reactivation MRR in April includes $150, not $200.

If a different customer returns and immediately upgrades:

- Churned from $300 to $0 last month

- Comes back this month at $500 (new team, more seats)

- Reactivation MRR includes $500

This is why reactivation MRR should be reviewed alongside ARPA (Average Revenue Per Account) and plan mix. A "high reactivation count" can still be weak revenue if returning customers re-enter on lower tiers.

Reactivation MRR vs related movements

Founders get tripped up when teams label everything "reactivation." Use this table to keep definitions clean:

| Movement | Customer status before event | Customer status after event | Typical label |

|---|---|---|---|

| New MRR | Never paid | Paying | New |

| Expansion MRR | Paying | Paying at higher MRR | Expansion |

| Contraction MRR | Paying | Paying at lower MRR | Contraction MRR |

| Churn MRR | Paying | Not paying | Churn |

| Reactivation MRR | Not paying (previously paid) | Paying | Reactivation |

Where this matters: reactivation is not part of NRR (Net Revenue Retention) in most standard definitions because NRR tracks the starting cohort of active customers. Reactivations were not active at the start.

Common measurement pitfalls

Counting payment retries as reactivation

If you're dealing with Involuntary Churn, decide whether "failed payment then recovered" ever truly went to zero MRR. If not, it's not reactivation. Mixing these inflates winback performance and hides billing problems.Not defining a churn recognition rule

If you recognize churn at cancellation vs at period end, reactivation timing shifts. Your metric becomes noisy. Choose a consistent policy and stick with it.Confusing pauses with churn

If customers "pause" but you keep them as active with $0 MRR, you need an explicit policy: do you treat return-from-pause as reactivation? Many teams do—but then you must segment it separately from "true churn reactivation" or you will overestimate winbacks.

The Founder's perspective: Be strict with definitions. A metric that makes you feel better but doesn't match cash reality will cause you to overhire and under-invest in retention fixes.

What drives reactivation MRR

Reactivation is not random. It is driven by a few repeatable forces you can influence.

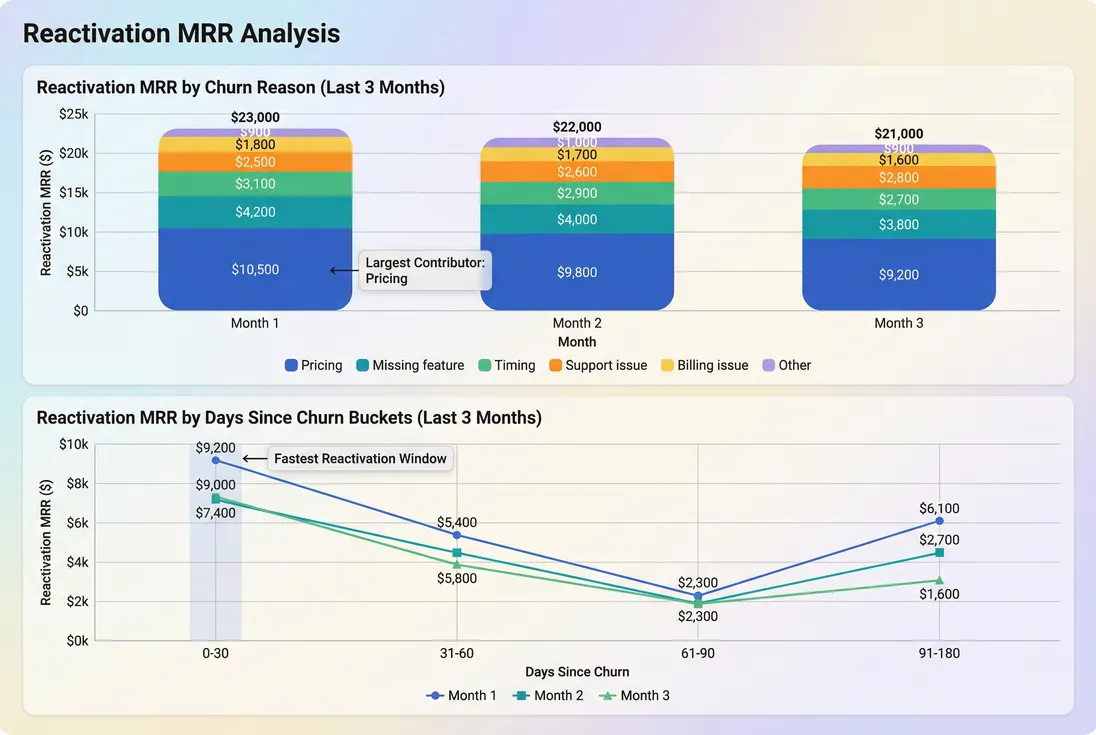

1) Reason for churn (reversible vs irreversible)

Reactivation MRR is highest when churn is caused by reversible triggers:

- Budget freeze or procurement delay

- Champion leaves, but account still needs the product

- Implementation stalled (they plan to "restart later")

- Short-term project completed (but similar project returns)

- Temporary dissatisfaction that can be fixed

It's lowest when churn is structural:

- You lost on product requirements

- Pricing is fundamentally misaligned with value

- A competitor is a clear better fit

- The customer segment is wrong

If you don't already do it, implement Churn Reason Analysis. Reactivation MRR becomes far more actionable when you can say, "We win back 25% of ‘timing' churn within 60 days, but only 3% of ‘missing feature' churn."

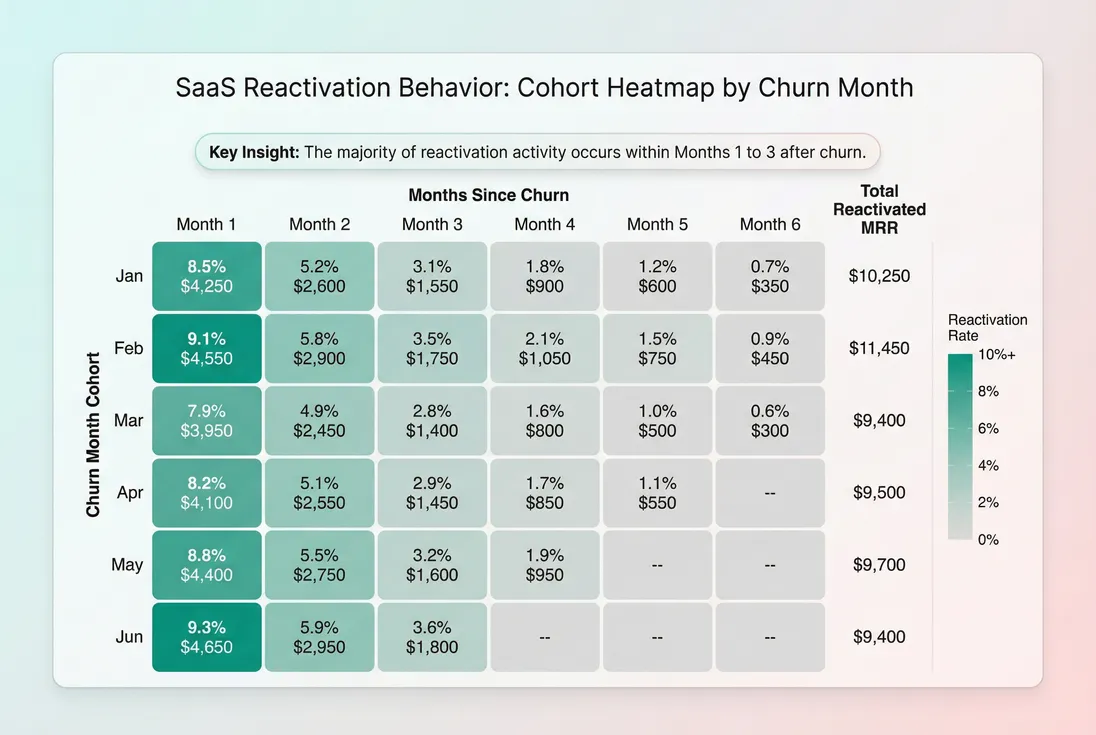

2) Time since churn

Most products see a steep decay curve: the longer a customer is gone, the less likely they return (and the more re-onboarding cost you'll incur).

That's why "months since churn" is a critical breakdown. A good winback motion often looks like:

- Strong reactivations in the first 30–90 days (fresh context, less switching cost)

- A long tail of occasional returns (new budget cycle, new champion)

Reactivation is usually time-sensitive. Cohort views help you see whether winbacks are happening quickly (good) or only after long gaps (harder to scale).

To actually operationalize this, you need reactivation broken down by:

- Months since churn (or days)

- Churn reason

- Segment (SMB vs mid-market vs enterprise)

- Original plan vs return plan

This is where cohort thinking matters; review it alongside Cohort Analysis so you don't treat reactivation as a single blended number.

3) Pricing and packaging changes

Pricing changes often create both churn and reactivation:

- Some customers cancel at the announcement.

- A subset comes back after negotiating, choosing a lower tier, or realizing the ROI.

This can make reactivation MRR look "healthy" while your customer experience is degraded. If you are running price tests, also track:

- Reactivation MRR (wins back)

- Logo churn (how many accounts you lost)

- Plan mix and discounting behavior (see Discounts in SaaS)

4) Sales and lifecycle motion

Reactivation MRR can come from either:

- Self-serve winback: automated sequences, in-app nudges, limited-time offers

- Sales-led winback: rep-driven outreach, procurement navigation, contract restructuring

The driver here is not "more emails." It's having a clear owner and SLA for churned accounts, especially those with high historical LTV (Customer Lifetime Value) or high expansion potential.

How to interpret changes

Reactivation MRR is one of those metrics where "up is good" can still hide problems. Interpret it in context.

When higher reactivation is genuinely good

Higher reactivation MRR is usually good when:

- Churn is stable or falling, and reactivation is rising

- Reactivated customers return at similar or higher ARPA

- Time-to-reactivation is shrinking (faster winbacks)

- Reactivation is driven by "timing" or "temporary" churn reasons

In those cases, reactivation is acting like a compounding asset: you're building a reliable winback engine.

When higher reactivation is a warning

Higher reactivation MRR can be a red flag when:

- Churn is rising and reactivation is rising too

This can mean customers are repeatedly canceling and returning—often caused by pricing confusion, weak value realization, or seasonal use cases. - Reactivations come back heavily discounted

You might be "renting" revenue with concessions and creating a future churn problem. - Reactivation is concentrated in a few large accounts

You may be exposed to Customer Concentration Risk and reading too much into a lumpy month.

A simple sanity check founders use: compare reactivation to churn in the same period.

Interpretation:

- 0.10 means you won back $1 for every $10 churned that month.

- 0.30 means you won back $3 for every $10 churned.

This ratio is not a substitute for retention metrics like GRR (Gross Revenue Retention) or Net MRR Churn Rate, but it is a practical "how reversible is churn?" indicator.

The Founder's perspective: I like reactivation when it reduces my dependence on new acquisition. I don't like reactivation when it's caused by customers gaming our billing cycle or repeatedly failing to see value. The same number can signal either story—segment it.

Reactivation MRR vs new sales

Founders often over-credit reactivation because it feels like "found money." Treat it with the same discipline as new sales:

- What channel generated it?

- What was the sales effort?

- What concessions were required?

- How long do reactivated customers stick around?

If reactivated customers churn again quickly, you are not creating durable revenue—you are creating noise. This is why you should pair reactivation MRR with retention-by-reactivation cohort tracking.

How founders use reactivation MRR

This metric becomes powerful when it drives specific decisions and operating rhythms.

1) Build a winback pipeline

Treat churned accounts as a pipeline with stages:

- Churned (day 0)

- Qualified for winback (right segment, right reason)

- Contacted

- Re-engaged (demo scheduled, trial restarted)

- Reactivated (paid again)

- Retained after reactivation (still active after 60–90 days)

This is not just "CRM hygiene." It lets you forecast reactivation MRR like you forecast new MRR.

If you want a simple starting point, track:

- Number of Reactivations

- Reactivation MRR

- Median days to reactivation

- Reactivation to churn ratio

2) Prioritize the right churned accounts

Not every churned customer deserves equal attention. A practical prioritization model:

- High historical MRR + reversible reason: fastest payback for sales-led winback

- Low historical MRR + reversible reason: automate (email + in-app prompts)

- Structural churn reasons: feed product strategy, don't burn sales cycles

Use ARPA (Average Revenue Per Account) to set tiers (for example, "rep touch required above $500 MRR").

3) Decide what to fix vs market around

Reactivation MRR is diagnostic when you align it with churn reasons:

- If "missing feature" churn rarely reactivates, you likely need a roadmap change or segment change.

- If "timing" churn reactivates often, you likely need better lifecycle messaging, onboarding, and reactivation triggers.

- If "price too high" churn reactivates only with discounts, you likely have packaging issues (or your value messaging is weak).

This is where your retention work connects back to Go To Market Strategy: reactivation tells you whether your product is a "nice-to-have" customers can pause, or a "need-to-have" they return to quickly.

4) Make retention investments pencil out

Retention and winback work is a cost center until you tie it to dollars. A founder-friendly way to quantify the benefit:

- If your churn is $100k MRR per month

- And you can reliably reactivate $20k MRR within 60 days

- Then your "effective" long-term loss is meaningfully lower than churn alone suggests

That can justify:

- A dedicated CS role

- Better lifecycle automation

- Fixing onboarding bottlenecks (see Onboarding Completion Rate)

- Improving time-to-value (see Time to Value (TTV))

5) Review it in your MRR movements

Reactivation MRR is easiest to manage when it's part of a consistent movement review cadence: new, expansion, contraction, churn, reactivation.

If you use GrowPanel, you'll typically review this in MRR movements with filters to isolate segments and plans (see MRR (Monthly Recurring Revenue) and /docs/reports-and-metrics/mrr-movements/ plus /docs/reports-and-metrics/filters/).

Segmentation turns reactivation from a single number into a playbook: which reasons win back, and how quickly.

Practical benchmarks and targets

Benchmarks vary widely, but here are useful operating ranges that founders can apply without fooling themselves:

Reactivation to churn ratio (monthly):

- Early SMB SaaS with self-serve motion: often 0.05 to 0.20

- Strong lifecycle + sales assist winbacks: 0.15 to 0.35

- Enterprise: can be near zero most months, then spike (lumpy)

Time to reactivate:

- Healthy winback engines often win most reactivation within 30 to 90 days

- If most reactivation happens after 6+ months, it's usually less predictable and harder to scale

Quality of reactivation:

- Watch whether reactivated accounts retain past 60–90 days

- If they churn again quickly, treat reactivation as a symptom, not a cure

If you want one founder-friendly target: make reactivation MRR predictable enough that you can forecast it, even if the absolute number is not huge.

When the metric "breaks"

Reactivation MRR becomes misleading when the underlying subscription events are messy. Watch for these failure modes:

- Annual plans treated inconsistently: If a customer churns at renewal and returns later, ensure you're not double-counting movements across months.

- Refunds and chargebacks: Returns can look like churn and reactivation if you process late Refunds in SaaS or Chargebacks in SaaS.

- Plan migrations: If customers "cancel then repurchase" during plan transitions, your system may record reactivation when it's really a migration artifact.

- Discount-driven cycling: Customers cancel to get a better deal, then return. Reactivation rises, but you're training bad behavior (and damaging ASP; see ASP (Average Selling Price)).

The fix is not complicated: tighten your event taxonomy, and always review reactivation alongside churn, discounting, and retention cohorts.

The operating takeaway

Reactivation MRR is not just a reporting line item. It's a measure of how reversible churn is—and whether you can turn yesterday's losses into next quarter's growth.

Use it like a founder:

- Track it as a consistent MRR movement (not a vanity metric)

- Segment it by reason, time since churn, and customer tier

- Push on speed (time to reactivate) and quality (post-reactivation retention)

- Treat spikes skeptically until you can explain them

If you can make reactivation MRR reliable, you reduce your dependence on ever-increasing acquisition—and you earn the right to scale with more confidence.

Frequently asked questions

Reactivation MRR comes from customers who were fully churned with MRR at zero and later return as paying customers. Expansion MRR comes from customers who were continuously active and increase spend. Mixing them hides whether you are winning back lost accounts or simply growing healthy accounts.

There is no universal benchmark because reactivation depends on customer segment, churn reasons, and contract cadence. As a practical target, many SMB SaaS teams aim to win back 10 to 30 percent of churned MRR over the following 90 days. Enterprise tends to be lumpier and slower.

Only if the customer actually churned to zero MRR and later returned. If a payment fails but the subscription never truly cancels, that is usually better tracked as involuntary churn reduction or payment recovery, not reactivation. Be consistent or you will overstate the impact of winback work.

Spikes usually come from lumpy cohorts: annual customers returning at renewal, a pricing change that triggered cancel and return behavior, or a specific winback campaign. Break it down by plan, cancellation reason, and months since churn. A spike can be great, but it can also mask rising churn.

Net Revenue Retention is typically calculated on the starting cohort of active customers, so reactivations are excluded because those customers were not active at the start of the period. Reactivation MRR still matters operationally because it reduces the long term impact of churn and improves payback.