Table of contents

Product-led growth

Founders care about product-led growth because it can change the unit economics of the whole company: lower CAC, faster payback, and a growth engine that scales without adding sales and support in lockstep.

Product-led growth (PLG) is a go-to-market motion where the product experience is the primary driver of acquisition, activation, conversion to paid, expansion, and retention—often through self-serve onboarding and in-app upgrade paths.

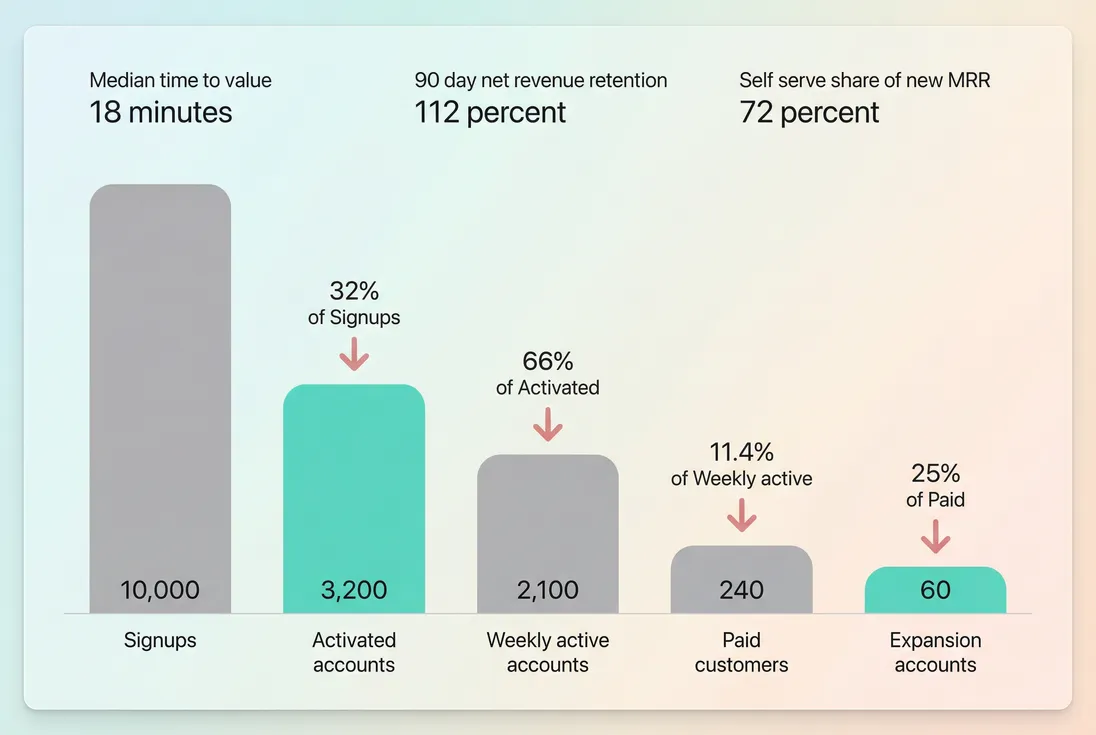

A PLG funnel that makes the business question obvious: where are users failing to reach value, and does value translate into paid conversion and expansion.

What PLG really means

PLG is not "we have a free plan" or "we run a trial." Those are packaging choices. PLG is about causality: product usage creates enough value and intent that it reliably drives the next revenue event.

A practical way to think about it:

- Acquisition: users arrive and can start without talking to anyone.

- Activation: users reach a defined "aha" moment (not vanity activity).

- Conversion: users upgrade because the product makes the limit or value obvious.

- Expansion: usage naturally increases scope (seats, workflows, volume).

- Retention: the product becomes part of a recurring workflow.

PLG also isn't binary. Many successful SaaS companies run hybrid motions:

- PLG for speed (self-serve onboarding, fast iteration)

- Sales for complexity (security review, multi-stakeholder rollout)

If you want the contrast, it helps to read Sales-Led Growth alongside this and decide where you want human effort to sit in the customer journey.

The Founder's perspective

PLG is a commitment to making "improve the product experience" a first-class growth lever. If your team can't connect product changes to conversion, retention, and expansion, you'll drift into a costly hybrid where you pay for acquisition and sales—but churn like a self-serve product.

How to measure PLG in practice

There isn't one universally accepted "PLG metric." What founders need is a PLG scorecard: a small set of measures that prove the product is creating revenue outcomes.

Start with a measurable activation

Activation is the first point where PLG becomes real. Define a single activation event that implies value, for a specific ICP. Examples:

- "Created first dashboard and invited a teammate"

- "Connected data source and ran first report"

- "Shipped first API call in production"

- "Published first project and got first external view"

Then measure it.

If activation rises, you should expect downstream improvements (conversion, retention). If activation rises but paid conversion does not, your activation definition is probably too shallow—or your pricing/packaging doesn't align with value.

Useful related metrics: Onboarding Completion Rate and Time to Value (TTV).

Track time to value like a growth constraint

PLG lives or dies on speed. "Time to value" is typically measured as the time between signup and activation (or first meaningful outcome).

Use the median, not the average, because a small number of stalled accounts will distort the mean.

Interpretation:

- Shorter TTV usually means your onboarding path is clearer, defaults are better, and the product is easier to adopt.

- Longer TTV often means setup is heavy, the ICP is wrong, or customers need services—even if they love the product later.

Measure self-serve conversion (and be honest)

Define "self-serve" operationally: upgraded to paid without a sales touch (no calls, no bespoke quotes). You can still support users with docs or chat; the point is that sales isn't the conversion engine.

Why denominator matters: dividing by signups can hide a broken activation step. PLG is about product-delivered value; activation is the closest proxy.

Tie PLG to revenue quality

PLG often increases volume (more customers) but can decrease ARPA if the product attracts smaller accounts. So track both:

- ARPA (Average Revenue Per Account) to understand account quality

- NRR (Net Revenue Retention) to see whether expansion offsets churn and downgrades

- Logo Churn or Customer Churn Rate to understand customer stability

A simple "is PLG driving revenue" indicator many founders use is product-led revenue share—the portion of net new revenue that comes from self-serve new customers plus expansion (because strong PLG usually creates both).

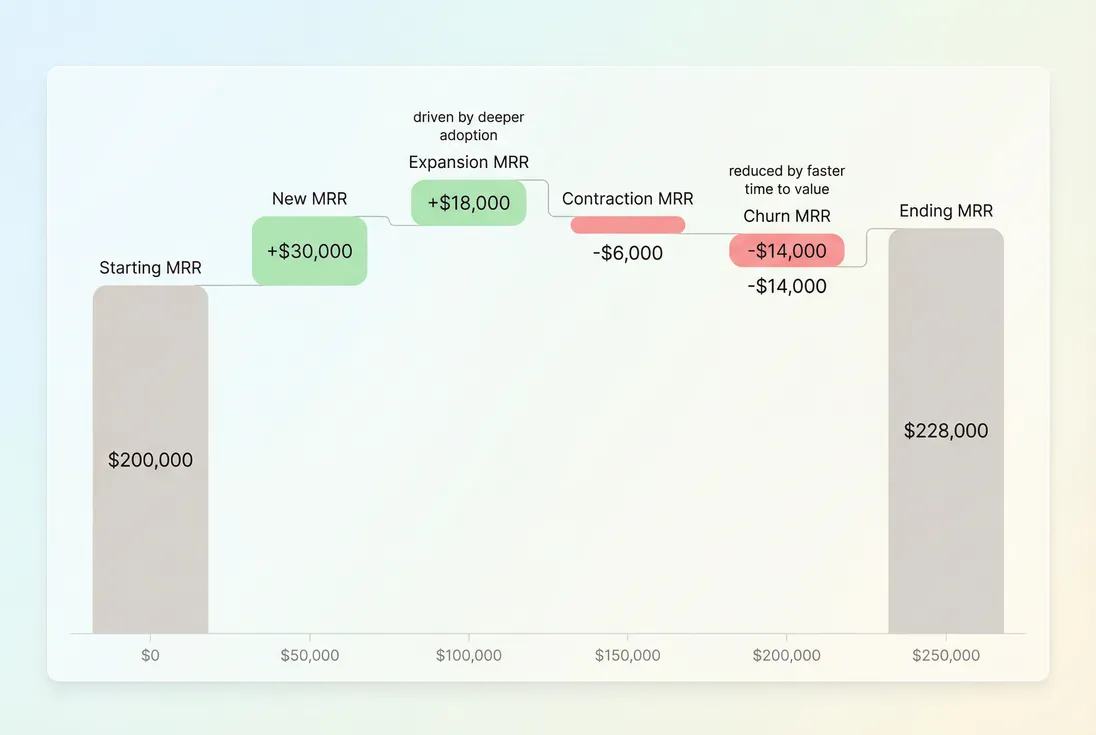

To ground this financially, connect it to MRR (Monthly Recurring Revenue) and retention metrics like Net MRR Churn Rate.

Benchmarks founders can use

Benchmarks depend heavily on category (developer tools vs HR SaaS), ICP (SMB vs mid-market), and onboarding complexity. Still, you need a starting point for "are we in the right zone."

| Metric | Early PLG (seed) | Healthy PLG (scale) | What you do if low |

|---|---|---|---|

| Activation rate | 15–25% | 25–45%+ | Tighten ICP, simplify setup, redefine activation |

| Median time to value | < 1 day | minutes–hours | Improve defaults, templates, guided onboarding |

| Trial-to-paid (self-serve) | 2–5% | 5–12% | Fix paywall, sharpen value metric, rework pricing |

| NRR | 90–105% | 110–130%+ | Improve adoption, expansion paths, reduce churn reasons |

| Logo churn (monthly SMB) | 3–7% | 1–3% | Fix onboarding fit, reduce involuntary churn, improve support |

Use these as directional, then calibrate with your margins, ACV, and support model.

What moves the numbers

PLG metrics respond to specific levers. When you see a change, you should be able to name the likely cause—and what to test next.

Activation levers

Activation improves when you reduce cognitive load and setup work.

Common drivers:

- A narrower "default" path for the primary use case

- Better templates and sample data

- Fewer required fields before value

- Better error handling and faster "first success"

If activation is flat, check segmentation. Often the average hides a split:

- ICP activates fine

- Everyone else churns or stalls

That's a go-to-market targeting problem as much as product. It should feed into your broader Go To Market Strategy.

Pricing and packaging levers

PLG conversion is tightly coupled to how you package value.

Good PLG packaging tends to:

- Put a clear cap on free usage that maps to value (seats, projects, volume)

- Make the "why upgrade" moment appear naturally during usage

- Avoid surprise costs that erode trust

If you're unsure what to cap:

- If value scales with team size, Per-Seat Pricing is often clean.

- If value scales with volume, Usage-Based Pricing can work, but requires strong in-product communication to avoid bill shock.

Also watch discounts. Over-discounting can inflate conversion but weaken retention and expansion. See Discounts in SaaS for how to think about downstream effects.

The Founder's perspective

If conversion is low, founders often "fix the top" with more acquisition. In PLG, the fastest path is usually the opposite: constrain acquisition to the ICP and fix activation-to-value. You're not trying to maximize signups—you're trying to maximize activated accounts that can expand.

Retention and expansion levers

PLG doesn't end at conversion. In many PLG businesses, expansion is the profit because initial plans are small.

Expansion improves when:

- The product supports multi-user collaboration and permissions

- New use cases unlock over time (reporting, automation, integrations)

- There are natural prompts to invite teammates or connect more data

- Billing aligns with value increase (seats, volume, features)

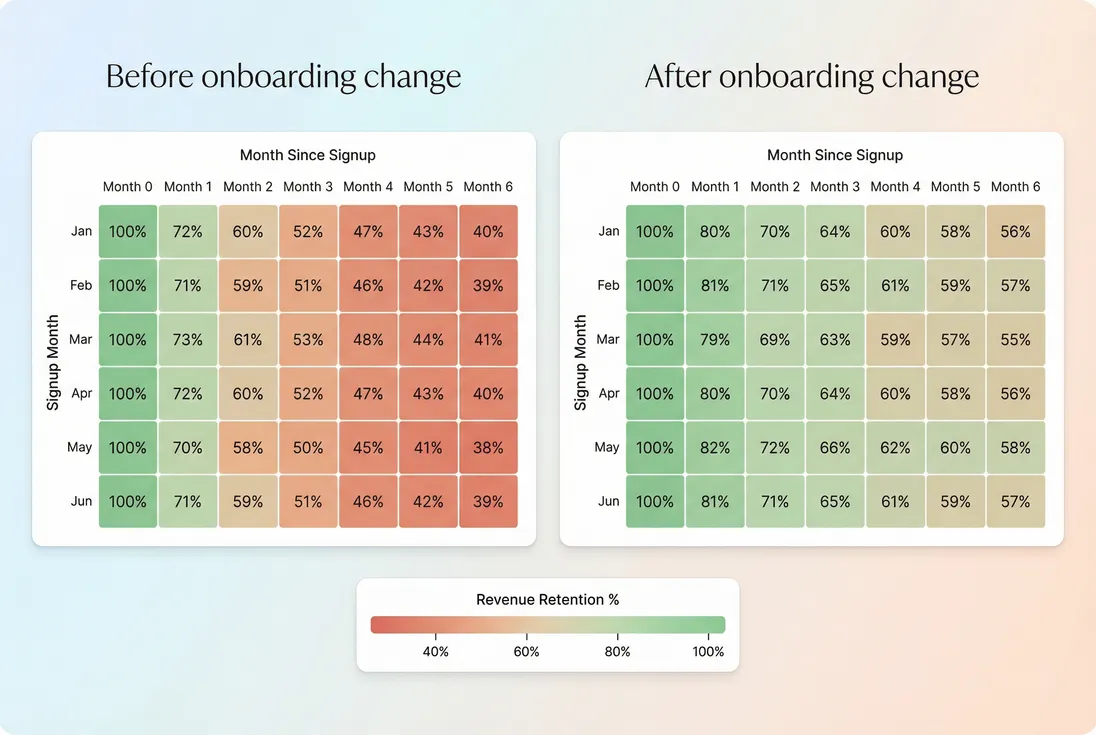

To manage this, founders should routinely inspect:

- Cohort Analysis (retention by signup month)

- GRR (Gross Revenue Retention) vs NRR (Net Revenue Retention) (are you "buying" growth with discounts or expansions?)

Cohort retention makes PLG improvements measurable: onboarding changes should shift retention curves, not just increase early activity.

If you track this inside GrowPanel, use Cohorts and segment by plan, acquisition source, and signup month using Filters to avoid averaging across very different customer types.

Where PLG breaks down

PLG failures are usually diagnosable. They show up as a mismatch between what the product makes easy and what the business needs.

Symptom: lots of signups, weak activation

Typical causes:

- You're attracting the wrong ICP (content or ads are too broad)

- Your activation requires data or setup users don't have

- You're measuring the wrong activation event

Fix pattern:

- Narrow targeting (channels, messaging, integrations)

- Reduce setup steps before value

- Redefine activation to an "outcome," not an action

Symptom: strong activation, weak paid conversion

Typical causes:

- The free experience is "good enough" for too long

- Pricing isn't tied to value, so upgrades feel arbitrary

- The upgrade moment doesn't occur at the peak of intent

Fix pattern:

- Add a value-based limit (not a random feature gate)

- Put upgrade prompts in the workflow at the moment of constraint

- Clarify the ROI: what does paid unlock that matters tomorrow?

This is where ASP (Average Selling Price) and ARPA (Average Revenue Per Account) help you avoid "converting" into low-quality revenue.

Symptom: conversion is fine, churn is high

This is the most expensive PLG failure mode because it creates the illusion of growth while your base erodes.

Diagnose with:

- Churn Reason Analysis (why they leave)

- Involuntary Churn (payment failures)

- DAU/MAU Ratio (Stickiness) (habit formation)

Fix pattern:

- Improve onboarding to the right use case (reduce "false positive" conversions)

- Make recurring workflows obvious (saved views, alerts, automation)

- Address involuntary churn with dunning and payment UX

If you're looking at revenue impact, separate churn into components and watch your MRR Churn Rate and Net MRR Churn Rate.

Symptom: PLG works, but revenue growth is slow

You may have PLG, but with a low ceiling due to:

- Low ARPA with limited expansion paths

- A small reachable market at self-serve price points

- High support burden that kills margin

At this stage, founders often add:

- A higher tier for larger teams (with clearer permissioning, security, admin)

- A sales-assist motion for accounts already showing usage intent

The key is not to "bolt on sales" randomly. Use product usage to decide who deserves human time.

The Founder's perspective

The moment you can predict expansion from usage, sales becomes an efficiency tool, not a growth crutch. Your job is to create a reliable rule like: accounts that hit activation plus sustained weekly usage are worth a human follow-up.

How founders operationalize PLG

PLG becomes powerful when it's run as a system: instrumentation, weekly review, and clear ownership of each funnel stage.

Build a weekly PLG operating rhythm

A simple weekly review (30–45 minutes) should answer:

- Did activation rate change? Why?

- Did time to value change? What broke?

- Did self-serve conversion change by segment?

- Did retention/expansion change by cohort?

- Which product changes shipped, and what metric should they move?

Tie these to financial outcomes:

- If activation improves, you should eventually see better CAC Payback Period.

- If retention improves, you should see better LTV (Customer Lifetime Value) and Rule of 40 dynamics.

- If self-serve share rises, your sales efficiency should improve (often visible in SaaS Magic Number).

Use revenue movements to validate PLG impact

PLG should show up in your MRR movements: more new self-serve MRR, more expansion, and lower churn after the product matures.

A revenue bridge keeps PLG honest: product improvements must show up as more expansion and less churn, not just more signups.

If you use GrowPanel for this, MRR movements and Retention help you connect product changes to revenue outcomes, while Customer list helps you inspect the specific accounts driving expansion or churn.

Decide when to add (or reduce) sales

A PLG business still benefits from sales when:

- The customer's buying process is heavy (security, legal, procurement)

- Multi-team rollout is required for value

- The product's value increases with implementation guidance

But add sales based on evidence, not hope. Signs you're ready:

- Activated accounts cluster in specific segments that expand well

- Retention is solid (otherwise sales just accelerates churn)

- There are clear usage thresholds that predict willingness to pay more

If you don't have those signals, sales will often mask product issues—and raise your burn. Keep an eye on Burn Rate and Burn Multiple as you change the motion.

Common PLG experiments that actually move metrics

If you need a practical starting backlog, these tend to produce measurable movement:

- Shorten setup: remove non-essential steps before first value (moves TTV and activation)

- Improve default success: templates, sample data, preconfigured flows (moves activation)

- Instrument friction: where users drop in onboarding (moves activation and TTV)

- Value-based limits: align free caps to value, not features (moves conversion)

- Expansion hooks: collaboration, permissions, multi-project support (moves NRR)

- Fix involuntary churn: better billing retries and card updates (moves retention)

Use one "north star" per experiment (activation, TTV, conversion, retention), and avoid shipping changes that you can't evaluate.

PLG is ultimately a test of whether your product can repeatedly deliver value fast enough that users choose to pay—and keep paying—without needing a human to persuade them. If you can measure activation, time to value, self-serve conversion, and retention by cohort, you can run PLG as an operating system instead of a slogan.

Frequently asked questions

Product-led growth is a go-to-market approach where the product experience drives acquisition, activation, conversion, expansion, and retention with minimal human touch. Practically, it means your fastest growth lever is improving onboarding, in-app value delivery, and upgrade paths, not adding more sales headcount.

Look for evidence that users reach meaningful value quickly and upgrade without high-touch sales. Track activation rate, time to value, self-serve conversion, and expansion versus churn. If growth slows whenever you pause sales or paid acquisition, you may have a product-assisted motion, not true PLG.

Benchmarks vary by category, but founders should expect fast time to value (minutes to a day), activation above 20 to 40 percent for a well-defined ICP, and improving retention by cohort. Self-serve conversion from trial often lands in the low single digits to high single digits.

Yes, but usually as hybrid PLG plus sales. The product creates educated demand and qualifies accounts through usage, then sales helps with security, procurement, and multi-team rollout. The measurement still starts with activation and retention, but you also track the share of pipeline influenced by product usage.

Optimizing signups instead of value. A PLG motion fails when the product cannot deliver a clear outcome quickly for the right user, or when pricing and packaging do not match how value scales. The result is high activity, low conversion, and churn that erases growth.