Table of contents

Per-seat pricing

Per-seat pricing can either create a compounding growth engine (every department rollout expands revenue) or a silent churn factory (customers buy seats, fail to activate them, then cut hard at renewal). The difference usually isn't your price—it's what you measure and how you operationalize seat growth.

Per-seat pricing is a subscription model where a customer's recurring charge is directly tied to the number of user "seats" they purchase (or are billed for). More seats typically means more revenue; fewer seats means contraction.

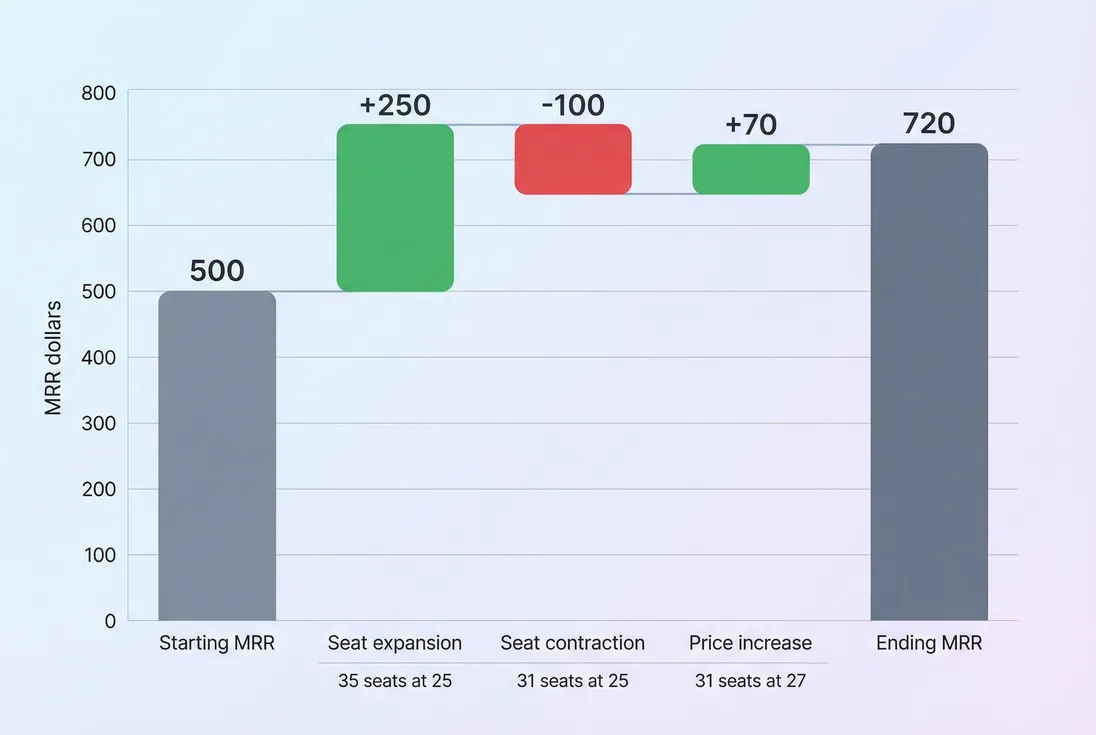

This waterfall makes seat-driven expansion and contraction legible, so you can separate product adoption wins from pricing changes and downsizing.

How per-seat pricing is calculated

At its simplest, per-seat pricing is just units times price.

Where founders get into trouble is assuming "seats" is a single, obvious number. In practice, you must define which seat count drives billing:

- Provisioned seats: how many seats the customer has assigned (often controlled by an admin).

- Licensed seats: how many seats the contract allows (often a committed minimum).

- Active seats: how many unique users are actually using the product in a defined window.

A common billing rule is:

The metric founders should track: effective price per seat

Even if you have a list price, discounts, seat bundles, and negotiated rates change what you actually realize.

This is the number you use to answer questions like:

- Are we quietly discounting more in the mid-market than we think?

- Is expansion coming from more seats, or from higher price per seat?

- Do larger accounts get lower effective price per seat (volume curve), and is that intentional?

For context, connect this back to MRR (Monthly Recurring Revenue) and ASP (Average Selling Price). Per-seat pricing changes how MRR grows (via seat count), and it changes what "average price" means (it's now a mix of seat counts and rates).

The Founder's perspective: If you can't explain last quarter's growth as "more customers," "more seats," or "higher price," you can't confidently set hiring plans, quotas, or a pricing roadmap. Per-seat businesses win when seat expansion is a repeatable motion—not a lucky outcome.

When per-seat pricing wins

Per-seat pricing tends to work when value scales with the number of people participating. The biggest green flags:

- Collaboration value: the product gets better when more teammates join (shared work, handoffs, visibility).

- Role-based usage: each user has their own workflow and is individually productive with the tool.

- Clear internal champion: someone benefits from rolling it out broadly (RevOps, IT, team lead).

- Low marginal cost per user: adding users doesn't explode support or infrastructure costs.

This is why per-seat is common in B2B collaboration, workflow, CRM, support tools, and internal productivity software.

When per-seat pricing is a bad fit

Per-seat pricing struggles when value is weakly correlated with headcount:

- Outcomes are driven by transactions (orders, API calls) or volume (data rows, messages).

- Only a few "power users" create most of the value while many users are occasional viewers.

- Procurement requires many stakeholders to have access, but actual usage is concentrated.

In these cases, per-seat can trigger predictable behaviors:

- seat sharing (one login)

- invite friction (teams avoid adding users)

- "shelfware" (paid seats that never activate)

- renegotiation pressure ("we want enterprise-wide access at a flat fee")

If you're seeing those patterns, compare alternatives like Usage-Based Pricing or hybrid packaging (base + seats + usage).

What per-seat pricing reveals in your business

Per-seat pricing is useful because it creates built-in expansion—but only if adoption is real. The most actionable lens is to split seat economics into three layers.

Layer 1: seat growth (the expansion engine)

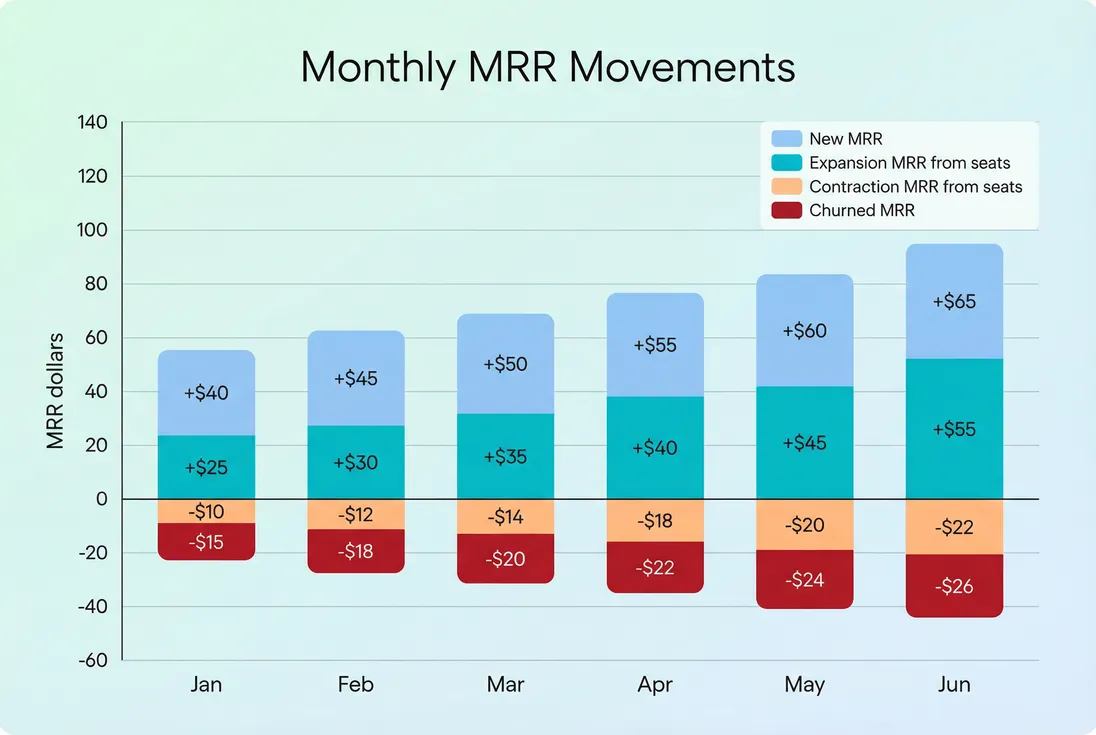

Seat growth is your best leading indicator of expansion MRR.

- If seat counts grow steadily inside retained customers, you should expect stronger Expansion MRR and healthier NRR (Net Revenue Retention).

- If seat counts spike early then flatten, you may be selling initial bundles but failing to land department rollouts.

A practical weekly view:

- New logos gained (drives new baseline seats)

- Seat adds in existing customers (true expansion)

- Seat removals (contraction / downsizing / failed adoption)

Tie these motions to Net MRR Churn Rate so you can see whether seat adds are offsetting seat removals.

Layer 2: seat realization (the shelfware detector)

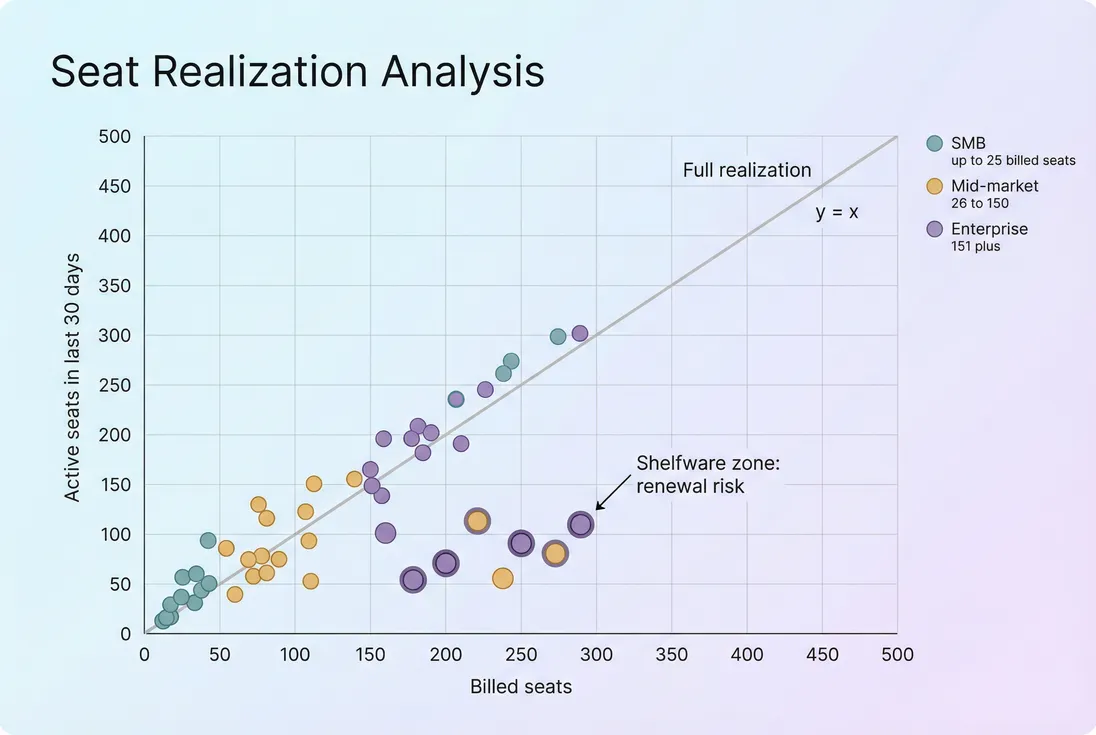

Seat realization is the simplest way to detect "paid but unused" risk.

Interpretation:

- High realization (for example, 80–100%): customers are actually using what they pay for.

- Low realization (for example, below 60%): the account is accumulating shelfware; renewal and contraction risk rises.

This is where per-seat businesses often get fooled: MRR looks healthy now, but usage is telling you next quarter's story.

Seat realization exposes shelfware: revenue that looks stable today but is likely to contract at renewal if activation doesn't catch up.

Operationally, low realization tells you where to intervene:

- improve onboarding and enablement

- simplify invites and provisioning

- create role-appropriate "light seats" so casual users aren't over-priced

- add usage alerts to customer success plays

Use Cohort Analysis to compare realization for customers acquired under different onboarding flows or pricing pages.

Layer 3: effective price per seat (the discount and packaging signal)

Track effective price per seat by:

- plan

- customer segment

- seat band (1–10, 11–25, 26–100, etc.)

- sales-led vs self-serve motion

If effective price per seat declines sharply in larger bands, that can be good (intentional volume pricing) or bad (uncontrolled discounting). Pair it with Discounts in SaaS to avoid confusing "growth" with "we gave it away."

The Founder's perspective: I don't mind offering volume discounts. I mind discovering that we're discounting randomly, which breaks forecasting, comp plans, and valuation narratives. Effective price per seat is how you catch that early.

How to interpret changes in per-seat revenue

Per-seat businesses often see MRR changes that look similar on a chart but mean very different things operationally. Use this table to avoid misreads.

| What changed | What it usually means | What to do next |

|---|---|---|

| Seats up, price flat | Real adoption and rollout | Double down on activation loops; identify expansion triggers |

| Seats flat, price up | Pricing power or repricing | Watch logo churn and downgrade behavior; validate with Price Elasticity |

| Seats down, logo retained | Downsizing or seat cleanup | Check seat realization; run re-activation plays; adjust packaging |

| Logo churn up | Product/segment mismatch or competitive loss | Use churn reason analysis and segment by seat band and ARPA |

| ARPA up but realization down | Shelfware accumulating | Expect renewal pushback; invest in adoption and admin reporting |

Bring in ARPA (Average Revenue Per Account) so you don't confuse "bigger accounts" with "healthier accounts." High ARPA driven by unused seats is fragile ARPA.

Where per-seat pricing breaks

Per-seat pricing "breaks" when the customer's internal logic shifts from "more users equals more value" to "more users equals more cost." You'll see it in a few recurring failure modes.

Invite friction becomes a growth tax

If admins or champions hesitate to add a user because each seat is expensive, you reduce collaboration—often hurting the very value you're selling.

Symptoms:

- Champions ask for "viewer" roles immediately

- Teams delay inviting other departments

- Usage concentrates in a small set of users

Fixes:

- introduce low-cost or free viewer seats

- bundle a base number of seats

- offer team packs (for example, 10 seats) instead of strict per-seat at small scale

Seat sharing and security workarounds

When pricing feels punitive, teams share credentials. That creates:

- inaccurate seat metrics

- security/compliance risks

- weaker product signals for adoption

Fix: make the per-seat price feel fair relative to the value of an individual login, and ensure onboarding makes it easy to provision/disable seats.

Shelfware turns into renewal contraction

Shelfware is not neutral. Customers notice unused seats during budgeting cycles.

A typical pattern:

- Customer buys 50 seats to "roll out soon"

- Only 20 become active

- They renew at 25 seats, often with a price demand

That shows up as Contraction MRR even if your product didn't get worse. It's a packaging and enablement issue as much as a success issue.

Procurement pushes for enterprise-wide pricing

Once you hit larger organizations, procurement often prefers predictability:

- annual commitments

- true-ups

- caps or enterprise licenses

This doesn't mean per-seat is wrong—it means you should be explicit about the rule set (committed seats, overage policy, and timing).

If you do annuals, be careful with billing edge cases (credits, partial refunds, disputes). It's not "per-seat specific," but it hits you more because seat counts change. If finance is asking questions, it's worth understanding Refunds in SaaS and Chargebacks in SaaS.

How founders use per-seat analytics to make decisions

Per-seat pricing is only as good as your ability to answer three operational questions quickly.

1) Are expansions coming from the right customers?

You want expansion to come from customers who:

- activate seats quickly

- retain logos

- expand in a stable, repeatable pattern

If expansion is concentrated in a few "whales," you increase concentration and forecasting risk (see Customer Concentration Risk).

A practical view is to split net change into new, expansion, contraction, churn.

Separating seat-driven expansion from seat-driven contraction keeps you honest about whether per-seat pricing is compounding or leaking value.

If you use GrowPanel, this is exactly the type of breakdown you can review via MRR movements and segment using filters (for example by plan or customer size). See MRR (Monthly Recurring Revenue) and MRR movements.

2) Are you pricing for adoption or for extraction?

A per-seat model should encourage rollout. If "adding a seat" feels painful, you may be over-extracting.

Two common "good" shapes:

- Low entry price + clear expansion path: easy to start, customers expand as they prove value.

- Base platform fee + seats: you get paid for the platform, then seats scale with usage.

Two risky shapes:

- High per-seat from day one: slows internal virality.

- Aggressive minimums without adoption support: creates shelfware and renewal fights.

Tie this back to Net Negative Churn—per-seat pricing often aims for it, but only achieved when expansion is durable.

3) Can you forecast revenue from org growth?

Per-seat pricing is attractive because it can align with customer headcount. But you need to validate that in your data:

- Do customers add seats as their org grows, or do they cap usage?

- Does seat growth lag hiring by a quarter (common), or does it lead (rare but great)?

- Do customers cut seats immediately in downturns?

Use simple segmentation:

- by industry (some industries are more cyclical)

- by seat band (small teams behave differently than 200+ seat deployments)

- by go-to-market motion (self-serve vs sales-led)

On the reporting side, the missing ingredient is usually consistent seat quantity tracking. If you track seat quantities in billing, you can analyze them cleanly (see Quantities).

The Founder's perspective: I'm not looking for perfect forecasts. I'm looking for early warning. If seat realization drops in my 50–200 seat accounts, I should assume contraction is coming and shift CS capacity before renewals hit.

Practical benchmarks and guardrails

Benchmarks vary widely, but these guardrails are broadly useful:

- Seat realization: aim to keep most retained accounts above ~70% once they've had time to onboard. If many accounts sit below ~50% for months, expect contraction.

- Discount discipline: define a volume curve intentionally. If effective price per seat varies wildly inside the same segment, your pricing is not controlled.

- Expansion concentration: avoid a situation where a handful of accounts drive most seat expansion. Diversify expansion across the mid-market if you can.

Also watch how per-seat interacts with CAC Payback Period. Per-seat can improve payback if accounts expand quickly after purchase, but it can hurt payback if customers start small and expand too slowly.

Rolling out per-seat changes safely

Changing seat definitions or price per seat is one of the easiest ways to create accidental churn. A safe rollout usually looks like this:

- Clarify the seat definition (active vs provisioned vs licensed) and document it in customer language.

- Model the impact on current customers: who pays more, who pays less, who is unchanged.

- Grandfather intelligently: keep existing customers on old rates, or offer a transition discount tied to adoption milestones.

- Instrument adoption: ensure you can measure active seats and seat realization by account.

- Review renewals by seat band: seat-based contraction is often concentrated in specific account sizes.

If you sell annual contracts, consider policy details (true-ups, timing, partial periods) and how they show up in revenue metrics like ARR (Annual Recurring Revenue) and CMRR (Committed Monthly Recurring Revenue).

The simplest way to get per-seat right

Per-seat pricing is not "set it and forget it." The healthiest per-seat businesses do three things consistently:

- Make adding a user feel obviously worth it (product and packaging).

- Track seat realization as a leading indicator (reduce shelfware before renewal).

- Separate seat expansion from price changes (so you know what's actually working).

When you do that, per-seat pricing becomes a durable expansion mechanism—not just a billing scheme that customers negotiate down over time.

Frequently asked questions

Per-seat pricing works best when value scales with people using the product and collaboration increases outcomes. If outcomes scale with transactions, data volume, or automation, per-seat can feel like a tax. Test by mapping customer value to added users and watching if growth creates expansion without added support burden.

There is no universal benchmark, but many SMB tools land around 5 to 25 per seat per month, mid-market often 20 to 75, and enterprise can exceed 100 depending on compliance and workflow criticality. Validate with win-loss notes, discount pressure, and retention by seat band, not competitor pages.

Bill by provisioned seats when customers want predictable invoices and admins control access; bill by active seats when you want lower friction to invite and you can measure activity reliably. Many founders use provisioned seats with an annual commit and true-ups, plus alerts on unused seats to reduce shelfware.

You cannot prevent downsizing, but you can reduce avoidable contraction by improving seat adoption and aligning packaging to real usage. Track seat realization, time-to-value, and admin workflows. Add role-based tiers, minimums, or bundles so customers remove low-value seats first without collapsing total revenue.

Monitor ARPA, expansion MRR, contraction MRR, logo churn, and NRR to understand whether seats are driving durable growth or just short-term expansion. Also watch seat realization and the distribution of account sizes. A rising ARPA with falling realization often signals shelfware and renewal risk.