Table of contents

NTM (next twelve months) revenue

Founders care about NTM revenue because it turns "we're growing" into a 12-month financial plan: how much revenue you can realistically produce next year, and how fragile that plan is to churn, renewals, and sales execution.

NTM (next twelve months) revenue is the amount of revenue you expect to recognize over the next 12 months, based on your current revenue base plus your forecast for churn, expansion, renewals, and new bookings.

Why NTM changes decisions

NTM revenue sits at the intersection of operating plan and cash discipline. It's the metric that makes these questions answerable with numbers, not vibes:

- Can we hire 2 AEs now, or do we need another quarter of proof?

- If churn ticks up, how much does next year's revenue plan break?

- Are we actually on track for the board's growth target—or just having a good month?

- What valuation conversation will we have if we raise in 6–9 months (often framed around forward revenue, not trailing)?

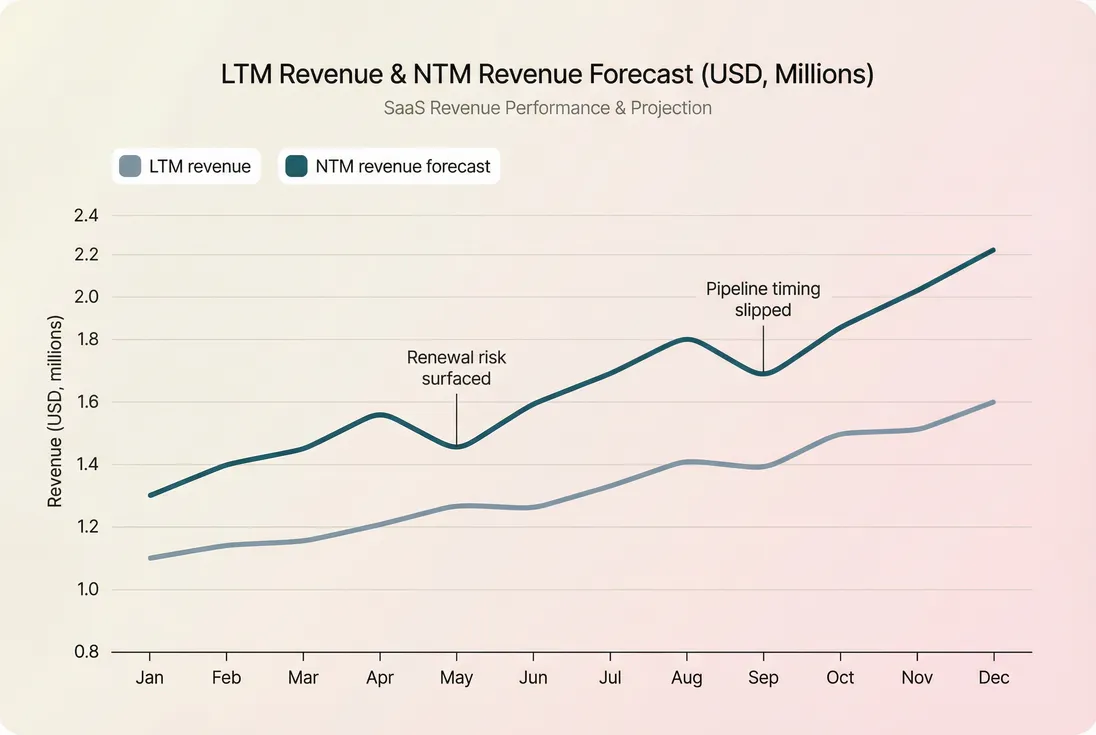

It's also the clean bridge between backward-looking performance like LTM (Last Twelve Months) Revenue and forward-looking goals.

The Founder's perspective

I don't need NTM revenue to be "perfect." I need it to be decision-grade: conservative enough to keep me from over-hiring, but detailed enough to tell me whether the plan fails because of churn, weak expansion, or insufficient new bookings.

What counts (and what doesn't)

The most common mistake with NTM revenue is mixing incompatible concepts. Before you calculate anything, decide which "version" you're using.

Three useful versions of NTM revenue

Contracted NTM revenue

Revenue you expect to recognize from already-signed contracts, including scheduled renewals that are contractually committed (and excluding anything not signed).Forecast NTM revenue (best estimate)

Contracted revenue plus probabilistic expectations for renewals and pipeline, based on your historical Renewal Rate, churn, and win rates.Upside NTM revenue (scenario)

The "if things go well" case. Useful for capacity planning, but dangerous if you treat it as the plan.

If you only track one number, use "forecast NTM revenue (best estimate)"—but keep a reconciliation to contracted revenue so everyone can see how much of the plan is assumed.

NTM revenue vs. related SaaS metrics

| Metric | What it represents | Best for | Common confusion |

|---|---|---|---|

| MRR (Monthly Recurring Revenue) | Current monthly recurring run-rate | Near-term performance | Treating one good month as a trend |

| ARR (Annual Recurring Revenue) | Annualized run-rate today | Scale/valuation shorthand | Not time-phased; ignores seasonality and timing |

| CMRR (Committed Monthly Recurring Revenue) | MRR adjusted for known committed changes | Conservative planning | Assumes only known changes, not pipeline |

| NTM revenue | Next 12 months of recognized revenue | Operating plan + hiring | Blending committed and speculative items |

| Deferred Revenue | Cash collected for future service | Cash flow + accounting | Not the same as "future revenue" in a forecast |

| Recognized Revenue | Revenue recorded under accounting rules | Financial statements | May differ from billing timing |

If you sell annual upfront plans, be especially careful: NTM revenue is about what gets recognized over time, not what you bill this month.

How to calculate NTM revenue

There are two practical approaches. The right one depends on your pricing model and how much data discipline you have today.

Approach A: bottom-up monthly forecast (most accurate)

Forecast revenue for each of the next 12 months, then sum it.

This method forces you to confront timing: renewals don't happen evenly, expansions lag onboarding, annual contracts recognize monthly, and pipeline closes cluster around quarter-end.

How to build it (practical version):

- Start with your current customer base and expected renewals by month.

- Apply expected churn and contraction assumptions (ideally by segment).

- Add expected expansion (again, segment-based if you can).

- Add new bookings by month, using capacity and Sales Cycle Length reality—not hope.

Approach B: run-rate bridge (fast, good enough)

If you need a simple, decision-grade number quickly, start from today's ARR and bridge to a 12-month expectation.

This won't capture timing (important for cash planning), but it's often sufficient for:

- hiring guardrails,

- board targets,

- investor updates,

- high-level scenario planning.

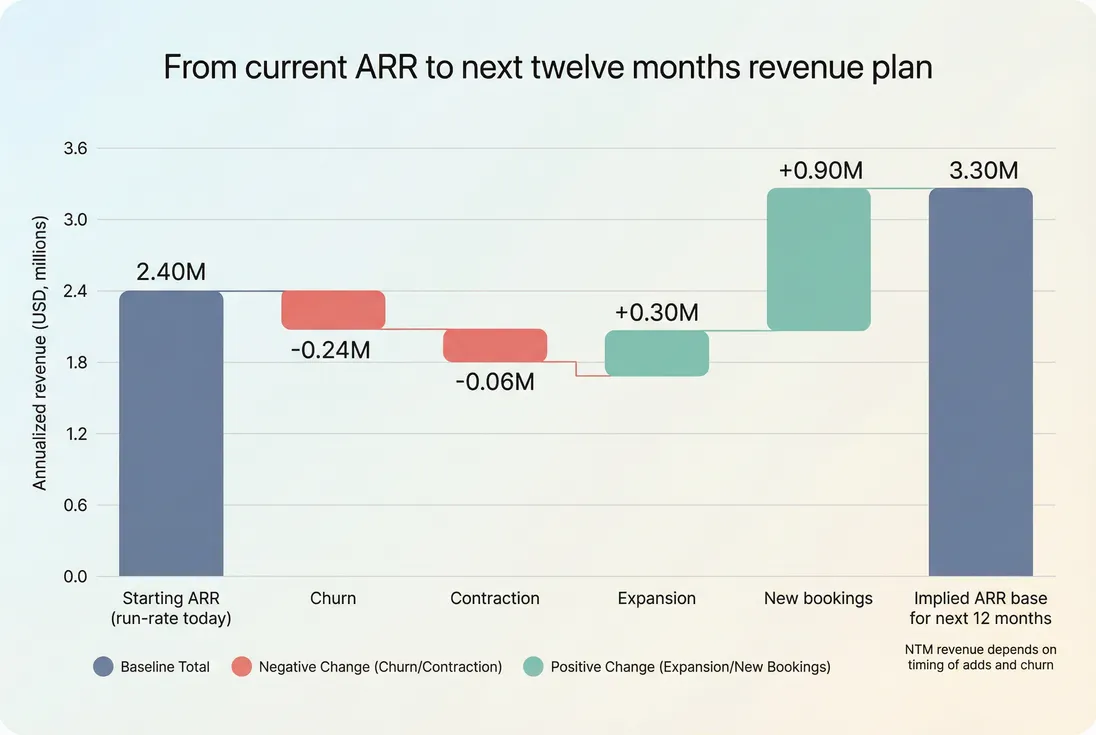

A concrete example (bridge method)

Assume:

- Starting MRR: $200k (so starting ARR ≈ $2.4M)

- Expected churn over next 12 months: $240k ARR

- Expected contraction over next 12 months: $60k ARR

- Expected expansion over next 12 months: $300k ARR

- Expected new ARR from new customers: $900k ARR

Net change: +$900k +$300k −$240k −$60k = +$900k ARR

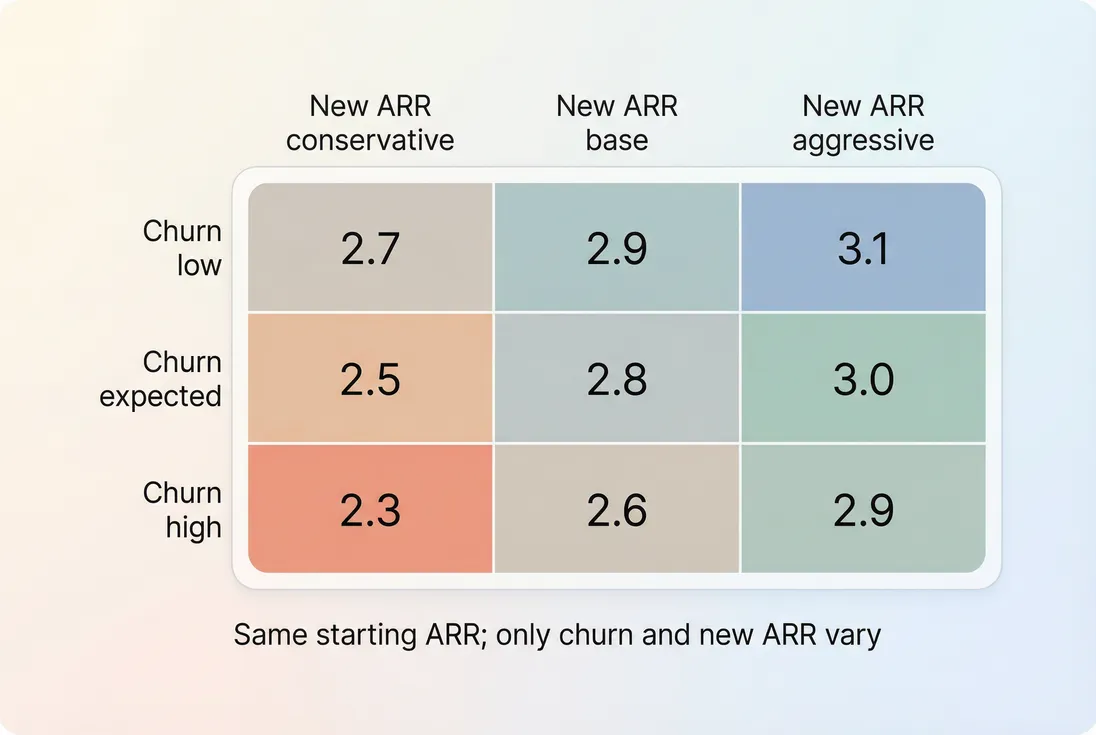

So forecast end-of-period ARR is about $3.3M, and your NTM revenue (recognized across the next year) will depend on timing, but will roughly sit between $2.7M–$3.1M in many real SaaS plans depending on when new ARR lands.

The key takeaway: the NTM number is less important than the bridge showing what must be true (churn, expansion, new bookings timing) for the number to happen.

What actually moves NTM revenue

NTM revenue doesn't "go up" for one reason. It changes when assumptions change—or when reality forces you to update your assumptions.

1) Starting base: current MRR and ARR

Your starting point is usually MRR (Monthly Recurring Revenue) and its annualized form, ARR (Annual Recurring Revenue). If your MRR is noisy (seasonal usage, large annual deals, one-off payments), your NTM forecast will inherit that noise.

Practical moves:

- Separate true recurring from one-time charges (see One Time Payments).

- Treat usage-based components carefully (see Usage-Based Pricing and Metered Revenue)—you may need ranges, not a single number.

2) Churn and contraction assumptions

Churn hits NTM revenue twice:

- It removes future revenue from customers who leave.

- It can reduce expansion potential (the customer can't expand if they're gone).

Track both logo churn and revenue churn. For definitions and interpretation, use:

If you only adjust NTM based on average churn, you'll miss concentration risk. A few large renewals can dominate the year (see Customer Concentration Risk).

The Founder's perspective

If NTM revenue dropped, I want to know whether it's because we lost customers (product problem), shrank them (value problem), or simply delayed new sales (execution problem). The action plan is completely different.

3) Expansion (the silent lever)

Expansion is the easiest lever to overestimate, because it feels "in your control." In practice, expansion depends on:

- time-to-value and adoption,

- account maturity,

- pricing model (seat-based expands differently than flat-rate).

Expansion is why two companies with identical new bookings can have very different forward revenue. Tie your expansion assumption to actual history and segment behavior (see Expansion MRR and Expansion MRR).

4) New bookings and sales capacity

New bookings are where NTM becomes a real operating plan:

- How many reps?

- What quota?

- What ramp?

- What win rate and sales cycle?

If your NTM assumes "pipeline will close," you don't have an NTM forecast—you have a wish.

Useful supporting metrics:

- Win Rate

- Qualified Pipeline

- CAC (Customer Acquisition Cost) and CAC Payback Period (to sanity-check growth affordability)

5) Pricing and discounting policy

Pricing changes often show up as "growth" in NTM, but the quality of that growth depends on retention response.

Two common traps:

- Discounting to hit a bookings target can inflate NTM while weakening future renewal performance (see Discounts in SaaS).

- Raising prices without tracking churn sensitivity can lift NTM in the plan and then disappoint in reality (see Price Elasticity).

How founders interpret NTM changes

A good NTM practice isn't "we updated the forecast." It's "we learned something."

When NTM rises

NTM revenue typically rises for one of four reasons. Each implies a different operational reality:

More new bookings than expected

Good sign, but validate whether it's timing (pulled forward deals) or true demand.Better retention or renewal expectations

Strong signal. Confirm with retention cohorts (see Cohort Analysis).More expansion

Often means improved activation/adoption, or a pricing model that scales with customer success.Pricing uplift

Can be high-quality or fragile depending on churn response.

When NTM falls

Treat an NTM decline as an early warning system. Your job is to categorize it fast:

Base erosion: churn or contraction assumptions worsened

Action: churn reason analysis, product fixes, better onboarding (see Churn Reason Analysis and Onboarding Completion Rate).Execution delay: pipeline pushed out 1–2 quarters

Action: diagnose stage conversion, sales cycle, rep productivity.Forecast hygiene: you removed optimistic assumptions

Action: good. Now re-plan hiring and spend.

How founders use NTM in real planning

NTM is only valuable if it changes what you do next.

Hiring and burn guardrails

Hiring is a forward-commitment decision. NTM revenue is one of the cleanest ways to define a "safe hiring envelope," especially when paired with:

A practical workflow:

- Plan headcount off your base case NTM.

- Allow discretionary hires only if the committed or high-confidence portion of NTM supports them.

- Define trigger points: "If NTM drops by X, we pause hiring."

Setting quotas and targets that don't backfire

If you only manage to bookings, you can create future churn. NTM revenue forces alignment:

- Sales can't hit bookings by over-discounting without lowering next year's plan.

- CS can't focus only on renewals while ignoring expansion if expansion is required to hit NTM.

Tie the operating plan to a bridge:

- Starting base

- Gross churn

- Net retention expectations (NRR (Net Revenue Retention) is a good anchor)

- New ARR required by month/quarter

Valuation and fundraising narratives

Investors frequently anchor on forward-looking revenue, especially in growth rounds. NTM revenue often appears implicitly in:

- EV/Revenue Multiple discussions

- Enterprise Value (EV) framing

The credibility test is straightforward: can you explain NTM as a set of measurable drivers (retention, expansion, pipeline conversion), and do you revise it quickly when inputs change?

Finance hygiene: revenue is not cash

NTM revenue is not a cash forecast. If you're cash constrained, pair it with:

- Accounts Receivable (AR) Aging (for collections risk)

- Billing Fees and Refunds in SaaS (for leakage)

- Deferred Revenue (for cash collected vs delivered)

This matters most with annual prepay, multi-year contracts, or high refund/chargeback exposure.

When NTM breaks (and how to fix it)

NTM is most dangerous when it looks precise but isn't.

Heavy usage-based revenue

If a meaningful share of revenue is metered, "next 12 months" depends on customer behavior, not contracts. Fix:

- forecast with ranges (base/upside/downside),

- tie assumptions to usage cohorts and expansion behavior,

- don't annualize a seasonal month into a confident NTM.

Annual upfront billing confusion

Annual prepay can make cash look great while NTM revenue stays stable (recognized monthly). Fix:

- keep revenue and cash separate,

- use deferred revenue to understand the gap between billing and recognition.

Pipeline optimism

If your NTM relies on "we'll close these big deals," you're building a plan on the least reliable input. Fix:

- weight by stage and historical win rates,

- enforce close-date hygiene,

- track forecast accuracy and adjust quickly.

Concentration and renewal cliffs

A few renewals can dominate the year. Fix:

- map top accounts by renewal month,

- run downside scenarios (lose top 1, top 3),

- align CS coverage to renewal risk, not account count.

How to operationalize NTM weekly

For busy founders, NTM should be a weekly instrument panel, not a quarterly spreadsheet ritual.

A lightweight cadence:

- Weekly: update pipeline timing and renewal risk; note any NTM delta and why.

- Monthly: reconcile forecast to actuals; re-baseline churn and expansion assumptions using retention and revenue movements.

- Quarterly: reset the operating plan, hiring guardrails, and spend envelope based on the new NTM base case.

If you use GrowPanel for the building blocks, you'll typically rely on:

- MRR (Monthly Recurring Revenue) and ARR (Annual Recurring Revenue) as the starting base

- MRR movements to understand what changed (see /docs/reports-and-metrics/mrr-movements/)

- churn and retention views to keep assumptions grounded (see /docs/reports-and-metrics/retention/ and /docs/reports-and-metrics/churn/)

- filters to separate segments with different churn and expansion behavior (see /docs/reports-and-metrics/filters/)

Quick takeaway

NTM revenue is a 12-month reality check. It's not just "ARR times twelve," and it's not just pipeline hope. Build it as a bridge from your current base to next year's outcome, keep a committed-vs-forecast split, and use changes in NTM to force specific decisions about churn, expansion, and sales execution.

Frequently asked questions

Use NTM revenue as the best estimate of revenue you will recognize over the next 12 months, based on current recurring revenue plus expected changes from churn, expansion, and new bookings. Keep a second view for committed revenue only, so you can separate contracts from assumptions.

ARR is a snapshot run-rate today, usually MRR times twelve. CMRR is a more conservative version that accounts for known downgrades and cancellations. NTM revenue is forward-looking and time-based, reflecting what you expect to recognize over the next year, not just your current run-rate.

It can, but only if you weight pipeline by win probability and timing, and you track it separately from contracted revenue. Many founders get in trouble by blending uncommitted pipeline into a single NTM number. A clear split between committed, forecast, and upside makes planning safer.

Early-stage SaaS commonly sees wide error bands because churn and pipeline timing are volatile. A practical benchmark is to aim for tight accuracy on the next 90 days, reasonable accuracy for the next two quarters, and to treat months 7 to 12 as scenario planning, not a promise.

NTM revenue often drives valuation conversations, especially alongside metrics like EV and revenue multiples. Internally, it guides hiring and budget guardrails. The key is credibility: investors want to see the bridge from current ARR to NTM revenue with explicit churn, expansion, and bookings assumptions.