Table of contents

Net negative churn

If you can grow revenue without relying on new customer acquisition every month, your company becomes dramatically easier to finance, forecast, and scale. Net negative churn is the clearest signal that your existing customers are becoming a growth engine instead of a maintenance burden.

Net negative churn means expansions from existing customers exceed the revenue you lost from churn and downgrades during the same period. In other words, your customer base "grows itself."

What net negative churn actually tells you

Net negative churn is not a vanity metric. It answers a specific founder question:

If we stopped acquiring new customers for a period, would our revenue base still grow?

When the answer is yes, a few things change operationally:

- You can scale more predictably because retention and expansion do more of the work.

- Your growth becomes less dependent on CAC and paid channels (see CAC (Customer Acquisition Cost) and CAC Payback Period).

- Sales and marketing can focus on higher quality acquisition instead of constantly backfilling churn.

The Founder's perspective

Net negative churn is what makes "efficiency" real. When expansion offsets churn, every incremental dollar you invest in acquisition stacks on top of a base that is already compounding. That's why this metric often correlates with easier fundraising and calmer cash planning.

The main nuance: net negative churn is about existing customers only. New customer revenue is a separate growth lever and should not be mixed into the churn calculation.

How it is calculated (and where founders mess it up)

Most teams compute net negative churn using net MRR churn (monthly) or net revenue churn (monthly or annually). The cleanest starting point is net MRR churn because it forces consistent treatment of upgrades, downgrades, and cancellations. If you want the deeper version, read Net MRR Churn Rate alongside this.

Here's the core formula:

- If the result is negative, you have net negative churn.

- If it's positive, your base is shrinking without new acquisition.

Many founders also think in NRR terms:

Net negative churn implies NRR above 100 percent (see NRR (Net Revenue Retention)).

A concrete example

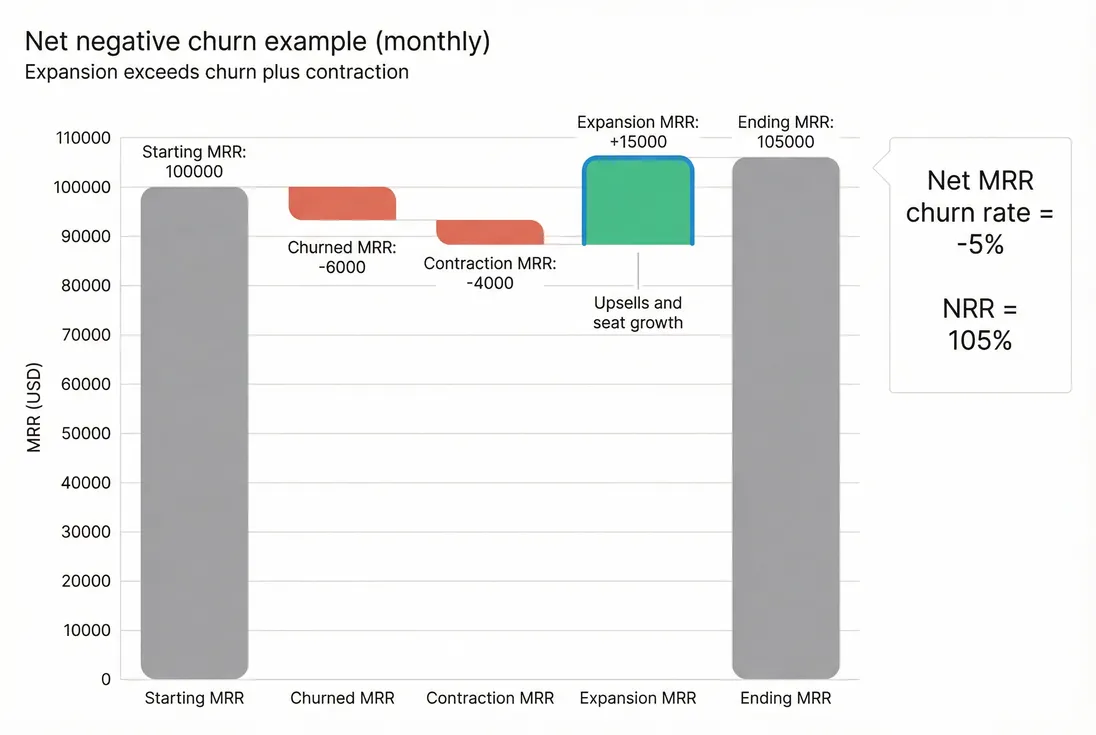

Assume you start the month with $100,000 in MRR:

- Churned MRR: $6,000

- Contraction MRR: $4,000

- Expansion MRR: $15,000

Net MRR churn rate:

That's -5% net MRR churn (net negative churn). Your ending MRR from the starting customer set is $105,000, even before counting any new customer MRR.

A waterfall view makes net negative churn intuitive: expansion must be larger than churn plus contraction, producing a higher ending MRR from the same customer base.

The three most common calculation mistakes

Including new customer MRR

Net negative churn is about what happened to customers you already had at the start of the period. New MRR belongs in growth analysis, not churn.Mixing bookings with MRR

Churn and expansion should be measured on normalized recurring revenue (see MRR (Monthly Recurring Revenue) and ARR (Annual Recurring Revenue)). If you're mixing annual prepayments or one-time fees, your churn signal will get noisy (also see One Time Payments).Not separating downgrades from churn

Contraction is often the early warning before churn. Track it explicitly (see Contraction MRR).

If you use GrowPanel, this decomposition is typically done through MRR movements and then segmented with filters (see /docs/reports-and-metrics/mrr-movements/ and /docs/reports-and-metrics/filters/).

What drives net negative churn in real SaaS businesses

Net negative churn is usually a product and pricing outcome, not a "reporting trick." Founders typically get there through one (or more) of these mechanisms.

Expansion mechanics that reliably work

Seat growth (classic B2B)

If your product is per-seat (see Per-Seat Pricing), expansion comes from org growth and deeper penetration. This is the most consistent engine because expansion is tied to customer success.

Usage growth (metered or hybrid)

Usage-based pricing (see Usage-Based Pricing) can produce strong expansion, but it can also introduce volatility. The key is ensuring usage correlates with value, not accidental overages.

Packaging upgrades Clear plan differentiation and lifecycle packaging (starter → team → business) can drive expansion without heavy sales effort. Watch that "upgrades" aren't just customers escaping limitations that should have been addressed earlier.

Price realization Sometimes expansion is actually price uplift: list price increases, discount roll-offs, moving legacy customers to current pricing (see Discounts in SaaS). This can improve net churn quickly, but it can also increase churn risk later if value isn't obvious.

The Founder's perspective

I trust net negative churn most when expansion comes from customer outcomes (more seats, more usage tied to value). I trust it least when it comes from pricing cleanup alone. Price realization is real, but it's not the same as customers choosing to grow with you.

What usually prevents it

Weak activation and adoption If customers don't reach Time to Value (see Time to Value (TTV)), they rarely expand—and they often downgrade before canceling.

Misaligned ICP A "leaky bucket" of customers who are too small, too price-sensitive, or not a fit will keep logo churn high, which forces expansion to do heroic work (see Logo Churn).

Expansion concentrated in a few whales You can get net negative churn through a handful of accounts. That's fragile and introduces Customer Concentration Risk.

How founders should interpret changes month to month

Net negative churn is powerful, but it's also easy to misread in the short term. Founders should interpret changes in two layers:

- Level: are we negative, zero-ish, or positive?

- Quality: what's driving the number (broad-based expansion vs concentrated spikes)?

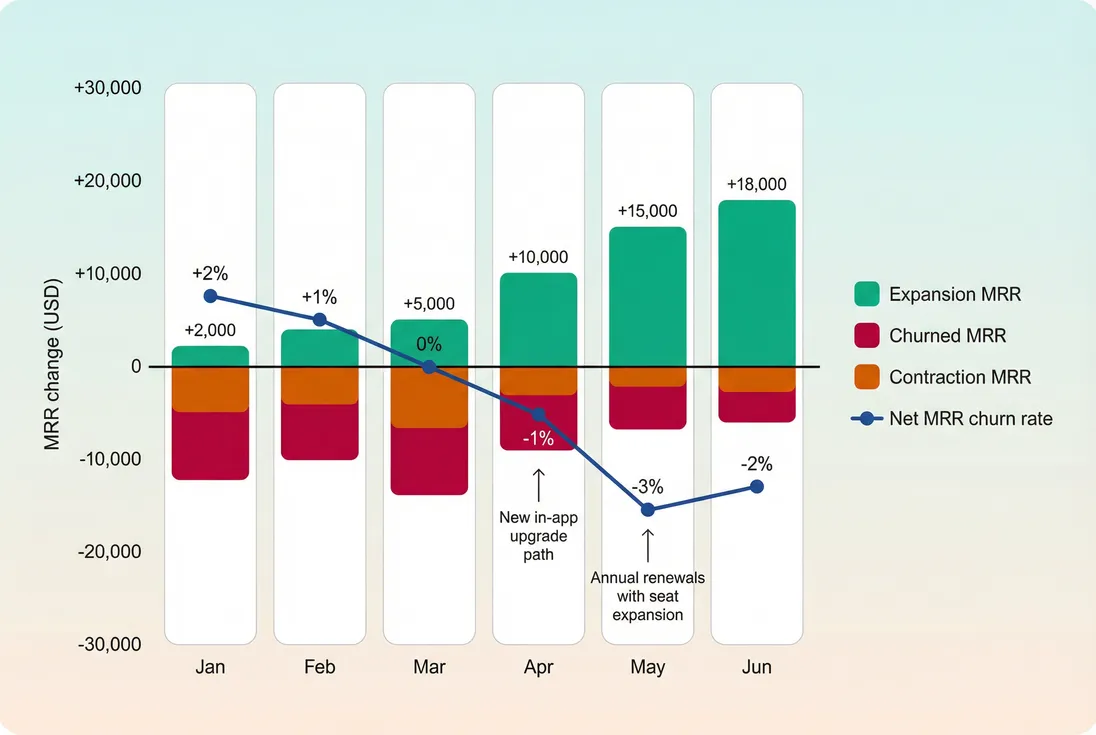

Use a trailing view, not a single month

A single enterprise upsell can swing a small base into "net negative churn" for a month. The decision-making mistake is treating that as a structural change.

A simple practice: track net MRR churn as both:

- Monthly value

- Trailing 3-month average (see T3MA (Trailing 3-Month Average))

Month-to-month net negative churn is often noisy; separating churn, contraction, and expansion shows whether the improvement is durable or just one big upsell.

Pair it with two "guardrail" metrics

Net negative churn is incomplete on its own. Pair it with:

- Gross retention: GRR (Gross Revenue Retention) tells you whether you're fixing the leak, not just outgrowing it.

- Logo churn: Logo Churn tells you whether you're losing too many customers even if revenue is holding up.

A common pattern in SMB-heavy PLG: net negative churn (revenue) looks great, but logo churn is high. That usually means expansions are coming from a minority of power users while the majority fail to adopt.

Benchmarks that are directionally useful

Benchmarks vary by pricing model, contract length, and customer size. Still, founders need a sanity check. Here's a practical reference (monthly net MRR churn):

| Segment / model | Typical range | Interpretation |

|---|---|---|

| Early-stage SMB PLG | +2% to +8% | Base shrinks without new acquisition; focus on activation and churn reasons. |

| Mature SMB with good expansion | -2% to +2% | Around zero is strong; negative usually requires clear expansion levers. |

| Mid-market B2B, seat-based | -1% to -5% | Sustainable net negative churn is common when adoption spreads in accounts. |

| Enterprise | -3% to -10% | Possible with expansions and renewals, but watch concentration and lumpy timing. |

Use benchmarks as a debugging tool, not a goal. The question is: is our number plausible given our pricing and customer behavior?

How founders use it to make decisions

Net negative churn becomes useful when it changes what you do next. Here are the founder-grade applications.

Forecasting and growth planning

If your net MRR churn is negative, your existing base contributes positive organic growth. That affects:

- Hiring pace and burn planning (see Burn Rate and Burn Multiple)

- How aggressive you need to be on top-of-funnel to hit growth targets

- How you model cash runway (see Runway)

A practical forecasting approach:

- Forecast existing base using net MRR churn (by segment if possible).

- Forecast new MRR from pipeline or conversion metrics.

- Combine into a scenario model (base case, downside, upside).

The Founder's perspective

When net churn is negative, I can take smarter acquisition bets. If paid acquisition underperforms for a quarter, I'm not immediately in a hole because the base is still compounding. If net churn is positive, every acquisition miss is magnified.

Pricing and packaging validation

Net negative churn is one of the cleanest validations that your pricing model captures increasing customer value over time.

- If you launch a new tier and net churn improves because expansion rises, the tier is doing real work.

- If you raise prices and net churn improves but logo churn worsens the next cycle, you may have overreached on value communication or grandfathering strategy (see Price Elasticity).

Tie pricing changes to expansion behavior, not just immediate MRR lift.

Customer success coverage and playbooks

CS teams should treat the churn formula like an operating dashboard:

- Rising contraction often means adoption issues, not "lost accounts."

- Falling expansion can mean your upgrade path is unclear, or value milestones aren't being reached.

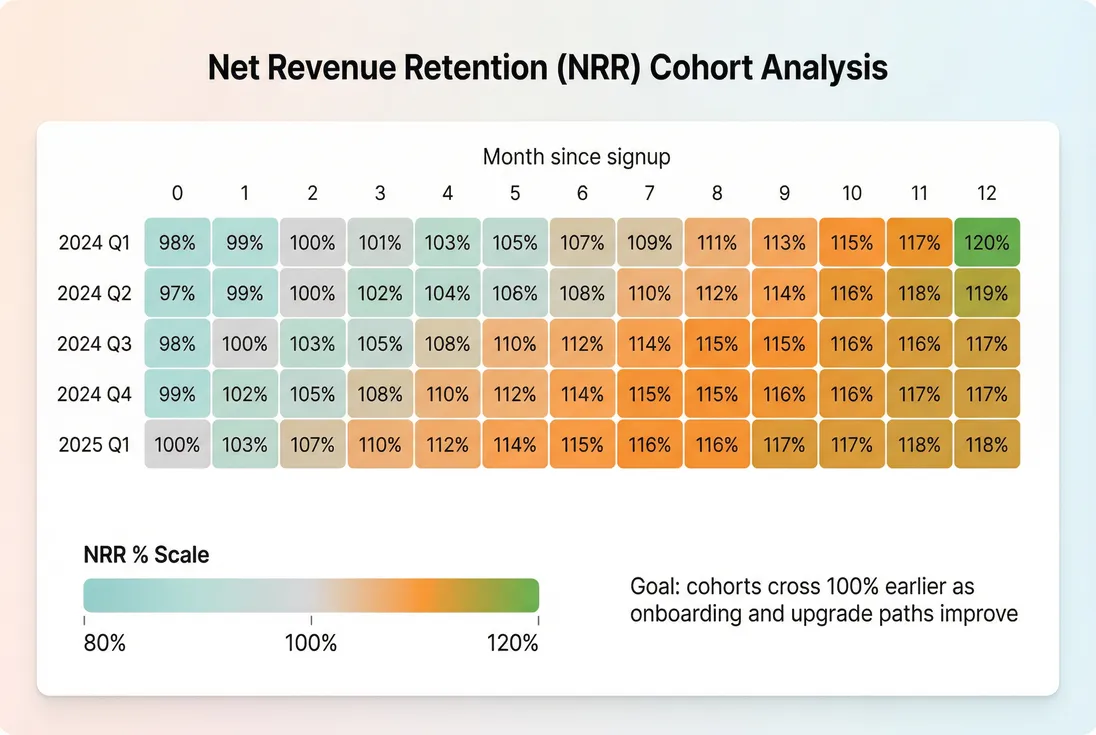

This is where cohorting matters. Use Cohort Analysis to answer: Do customers expand after they hit a certain age or adoption milestone? If yes, your CS and onboarding should be engineered to accelerate that moment.

If you're using GrowPanel, segmenting net churn and expansion patterns through cohorts is typically the fastest way to spot whether newer cohorts are healthier (see /docs/reports-and-metrics/cohorts/).

Cohort views prevent false confidence: net negative churn is most valuable when many cohorts reliably expand past 100% NRR, not just one quarter of whale upgrades.

When net negative churn breaks (and what to do)

Net negative churn is not a permanent state. It breaks for predictable reasons—and founders should treat those breaks as diagnostics.

Break case 1: Expansion slows before churn rises

This is the most common early warning. Customers don't churn instantly; they first stop growing.

What to check:

- Is product usage flattening for key segments? (See Active Users (DAU/WAU/MAU) and Feature Adoption Rate.)

- Did a pricing/packaging change remove a natural upgrade path?

- Did you shift acquisition to a lower-quality segment that expands less?

What to do next:

- Build an expansion funnel: eligible accounts → engaged accounts → expanded accounts.

- Instrument the "upgrade moment" inside the product (or the sales motion) and remove friction.

Break case 2: Contraction spikes

Contraction spikes often signal one of these:

- Customers bought too big initially (over-seated, over-committed)

- Your value story didn't match the ongoing usage reality

- Budget pressure in a specific vertical

What to check:

- Segment contraction by plan, size, industry, and customer age.

- Run Churn Reason Analysis specifically on downgrades, not just cancellations.

What to do next:

- Adjust onboarding to land closer to "right-sized" and expand later.

- Introduce guardrails: usage alerts, adoption check-ins, renewal prep.

Break case 3: Net negative churn is whale-driven

If 2–3 accounts drive most expansion, you are exposed to renewal timing and negotiation power.

What to check:

- Expansion concentration: what percent of expansion comes from top 10 accounts?

- Account-level volatility: do big expansions come with big contractions later?

What to do next:

- Build a broader expansion base by improving the upgrade path for mid-tier accounts.

- Track Customer Concentration Risk and plan cash conservatively.

Practical checklist for busy founders

If you want net negative churn to be decision-grade (not just a nice chart), use this operating checklist:

- Define it cleanly: existing customers only; separate churn, contraction, expansion.

- Review monthly, manage weekly: monitor movements, but judge performance on trailing averages.

- Segment aggressively: by plan, size, and customer age; otherwise you'll miss the real driver.

- Pair with guardrails: GRR and logo churn prevent you from "winning" via a shrinking customer base.

- Tie it to a playbook: every swing in the metric should map to a concrete lever—onboarding, adoption, packaging, pricing, or CS coverage.

Net negative churn is one of the few SaaS metrics that directly reflects compounding value. If you can make it durable and broad-based, it changes the physics of your business.

Frequently asked questions

Net negative churn means your existing customers are growing their spend faster than you are losing revenue from cancellations and downgrades. Over the measured period, expansion revenue outweighs churned plus contraction revenue. Practically, your current customer base can grow even if you stop acquiring new customers.

Yes, conceptually they describe the same outcome from two angles. Net negative churn is a negative net revenue churn rate. NRR frames it as retention plus expansion, where values above 100 percent mean expansions exceed revenue lost. Use whichever is more intuitive for your team and reporting cadence.

It depends on segment and pricing. Enterprise and seat based products can sustain net negative churn more reliably. Many SMB focused products will hover near zero and occasionally go negative in strong months. Focus less on a single month and more on a trailing average by segment and cohort maturity.

Absolutely. You can have net negative churn while losing many small customers if a few larger accounts expand a lot. That can be fine, but it increases concentration risk and can mask onboarding or product value issues for smaller customers. Pair it with logo churn and cohort level retention.

Treat it like an early warning. First, decompose the change into churn, contraction, and expansion movements. Then segment by plan, size, and customer age to find where expansion slowed or churn spiked. Decide whether the fix is product adoption, pricing and packaging, customer success coverage, or billing hygiene.