Table of contents

Net MRR churn rate

Net MRR churn rate is one of the fastest ways to answer a founder's uncomfortable question: if we stopped acquiring new customers today, would revenue still hold up—or shrink? It compresses retention, downgrades, and upsells into a single number that directly impacts your growth efficiency, valuation narrative, and how aggressive you can be with spending.

Plain-English definition: Net MRR churn rate is the percentage of starting monthly recurring revenue you lose after accounting for expansions (upsells), but excluding new customer MRR. If it's negative, your existing customers are growing faster than you're losing revenue from churn and downgrades.

What net MRR churn reveals

Net MRR churn rate tells you how much your existing revenue base is "leaking" (or compounding) each month.

- Positive net MRR churn: your installed base is shrinking. You must replace lost revenue with new sales before you can grow.

- Near-zero net MRR churn: your base is stable; growth comes mostly from net new MRR.

- Negative net MRR churn: existing customers expand enough to offset churn and downgrades (often called net negative churn; see Net Negative Churn).

The Founder's perspective: Net MRR churn is a planning metric. It determines whether your growth engine is "push" (you must constantly sell) or "pull" (the base expands). It changes how much pipeline you need, what you can afford to spend, and which customer segments deserve focus.

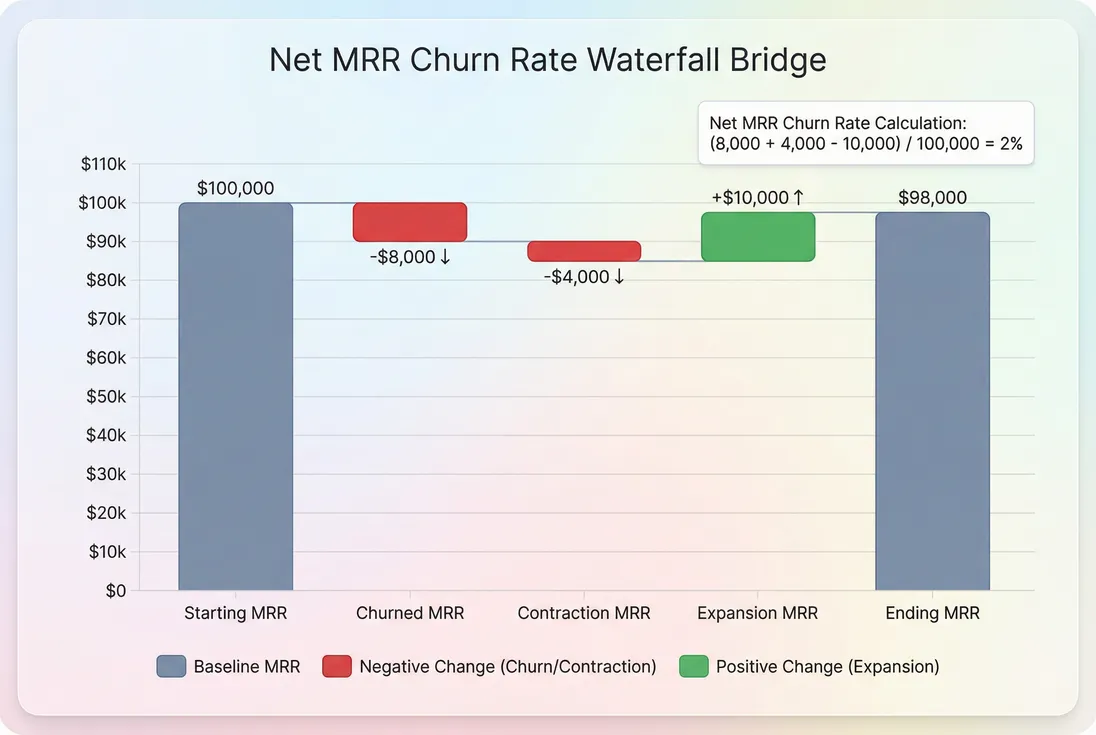

A waterfall view makes net MRR churn tangible: churn and downgrades pull MRR down; expansion pushes it back up. The net of these movements determines whether your base is compounding or leaking.

How to calculate it correctly

Most teams calculate net MRR churn rate monthly, using starting MRR as the denominator and only revenue movements from existing customers in the numerator.

A few practical notes:

- Starting MRR: MRR at the beginning of the period (often beginning of month). For MRR basics, see MRR (Monthly Recurring Revenue).

- Churned MRR: MRR lost from customers who cancel.

- Contraction MRR: downgrades, seat reductions, discounting down, usage dropping (if you treat it as recurring).

- Expansion MRR: upgrades, added seats, add-ons, price increases on renewal, usage increasing (if treated as recurring). See Expansion MRR and Contraction MRR.

Relationship to NRR

If you compute both over the same base and time window, net MRR churn is essentially the inverse of net revenue retention (NRR). This helps reconcile metrics across finance, RevOps, and investor reporting. See NRR (Net Revenue Retention).

So:

(When both are expressed as a decimal ratio for the same period.)

Where teams accidentally get it wrong

- Including new MRR in expansion. New logos are not "expansion." If you include them, net churn will look artificially good.

- Mixing billing and MRR logic. Invoicing timing (annual upfront, proration) can distort movement timing. If you sell annual contracts, consider CMRR (Committed Monthly Recurring Revenue) for planning consistency.

- Refunds and chargebacks treated inconsistently. Refunds and failed payments can look like churn if not categorized properly. See Refunds in SaaS and Chargebacks in SaaS.

- Discount changes mislabeled. A promo expiring is expansion; a new discount is contraction. Track discounting explicitly (see Discounts in SaaS).

The Founder's perspective: If your net MRR churn suddenly "improves" after you change billing terms, you may have changed accounting mechanics—not customer behavior. Don't celebrate until you confirm the movement categories match reality.

What moves the metric

Net MRR churn is not one behavior. It's three different revenue forces competing every month. Understanding which force is dominant is how you turn the metric into decisions.

Churned MRR (cancellations)

Common drivers:

- Poor activation and time-to-value (see Time to Value (TTV))

- Product gaps or reliability issues

- Budget cuts (often affects SMB first)

- Competitors bundling or undercutting pricing

Churned MRR is usually "hard loss." It's also the most damaging because once a customer cancels, expansion opportunity goes to zero.

Contraction MRR (downgrades)

Contraction is often leading indicator churn—especially for seat-based products or usage-based tiers.

Common drivers:

- Seat reductions after layoffs

- Customers consolidating tools

- Over-discounting at renewal

- Value not scaling with price as accounts grow

Contraction deserves special attention because it often signals you're not defending value at the point of renewal or you're overexposed to a volatile customer segment.

Expansion MRR (upsells and pricing power)

Expansion is the only component that can flip net churn negative. But it has different sources:

- Organic expansion: customers grow, adopt more, add seats

- Commercial expansion: packaging changes, add-ons, price increases

- Contract mechanics: annual true-ups, renewal uplifts

If your net churn is driven primarily by a small number of large accounts, you're exposed to concentration risk. Review Customer Concentration Risk and Cohort Whale Risk.

How to interpret changes

The biggest mistake founders make is interpreting net MRR churn as a single "retention score." It's more like a net of opposing motions—and that means you must look at the underlying movement mix.

A practical interpretation table

| Net MRR churn outcome | What it usually means | What to check next |

|---|---|---|

| Above 3% monthly | Base is shrinking fast; growth is expensive | Break down churn vs contraction; segment by plan and cohort |

| 1% to 3% monthly | Typical for many SMB motions; still a tax on growth | Improve onboarding, reduce involuntary churn, revisit pricing floors |

| Around 0% | Base is stable | Invest in acquisition efficiency; build predictable expansion motion |

| Negative | Expansion offsets losses | Ensure it's broad-based, not whale-dependent; watch logo churn |

Benchmarks vary a lot. A product-led SMB tool might be "fine" at +2% net churn monthly if CAC is low and margins are high. A sales-led mid-market product may be in trouble at +2% because CAC payback and sales capacity planning break down. Use CAC Payback Period and LTV (Customer Lifetime Value) to sanity-check what your churn implies financially.

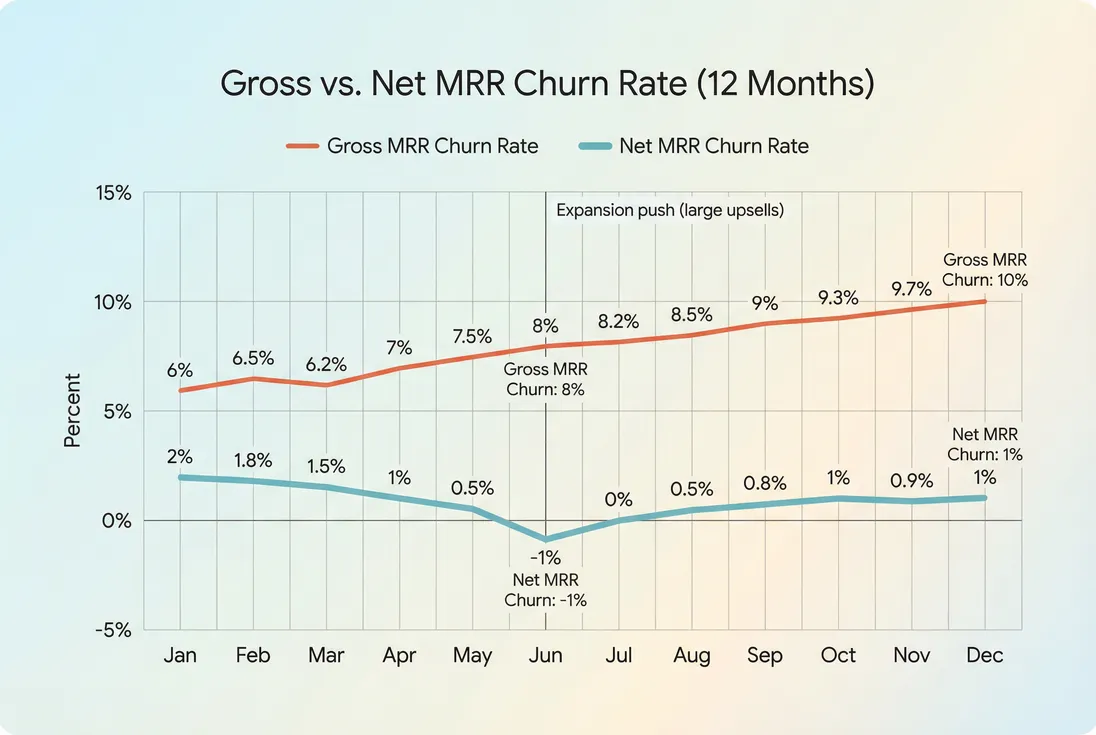

Why net can improve while the business worsens

A classic pattern:

- You lose many small customers (high Logo Churn)

- A few large customers expand a lot

- Net MRR churn improves or goes negative

- But support load, reputation, and pipeline quality deteriorate

That's why net MRR churn should be paired with:

- MRR Churn Rate (gross revenue loss)

- Logo churn (customer count loss)

- Retention by cohort (who is sticking around)

Net MRR churn can look healthy during an upsell wave even as gross churn worsens. Always inspect churn, contraction, and expansion separately before drawing conclusions.

Smoothing: avoid overreacting to one month

Net MRR churn is noisy in early-stage or low-MRR businesses. A single expansion can swing the rate meaningfully.

Two tactics that help:

- Track a trailing average alongside the monthly point (see T3MA (Trailing 3-Month Average)).

- Segment the metric by customer size. One enterprise account should not dominate your interpretation of the entire company.

The Founder's perspective: Don't let one great upsell month convince you retention is "solved." When hiring and budgeting, assume expansions normalize—then see if the business still works.

Where the metric breaks

Net MRR churn is powerful, but it can mislead if your revenue model or data hygiene isn't aligned.

Annual contracts and true-ups

If customers pay annually and expand mid-term:

- Billing may show a large invoice at one point in time.

- The economic reality is expansion over future months.

Using MRR normalization or CMRR (Committed Monthly Recurring Revenue) keeps the churn math consistent month-to-month.

Usage-based pricing edge cases

With usage-based pricing, "expansion" may simply be usage variability. Decide whether usage is truly recurring enough to treat as MRR (see Usage-Based Pricing and /blog/can-usage-based-pricing-be-counted-as-mrr/).

A practical rule: if customers can drop to near-zero without canceling, net churn may reflect consumption volatility, not retention.

Involuntary churn hiding in plain sight

Failed payments can show up as churn or contraction depending on your system rules. If involuntary churn is meaningful, treat it explicitly and fix it operationally (see Involuntary Churn).

Discounts and price changes

Discounting policies can swing net churn without any change in product value:

- New discounts at renewal = contraction

- Discounts expiring = expansion

If you're running frequent promos, net churn becomes partly a pricing policy metric. Track discount cohorts separately (see Discounts in SaaS).

How founders use it to decide

Net MRR churn is most useful when it drives concrete actions: segment focus, CS resourcing, pricing changes, and growth planning.

1) Plan how much new MRR you really need

If you start the month at $200k MRR and net churn is +2%, you're losing $4k of MRR base-equivalent that month. Your sales team must first earn back $4k just to stay flat.

This is why net churn impacts efficiency metrics like Burn Multiple and SaaS Magic Number: higher leakage means more spend is required to produce the same growth.

2) Decide whether to invest in expansion or retention

Decompose net churn into its parts and pick the highest-leverage lever:

- If churned MRR is the problem: prioritize onboarding, activation, reliability, and churn reasons (see Churn Reason Analysis).

- If contraction is the problem: fix packaging, seat minimums, discount discipline, and value measurement.

- If expansion is weak: build systematic upgrade paths (feature gates, add-ons, usage tiers) and a CS motion to drive adoption.

This is also where ARPA matters: improving revenue per account can offset churn if it's healthy and repeatable. See ARPA (Average Revenue Per Account).

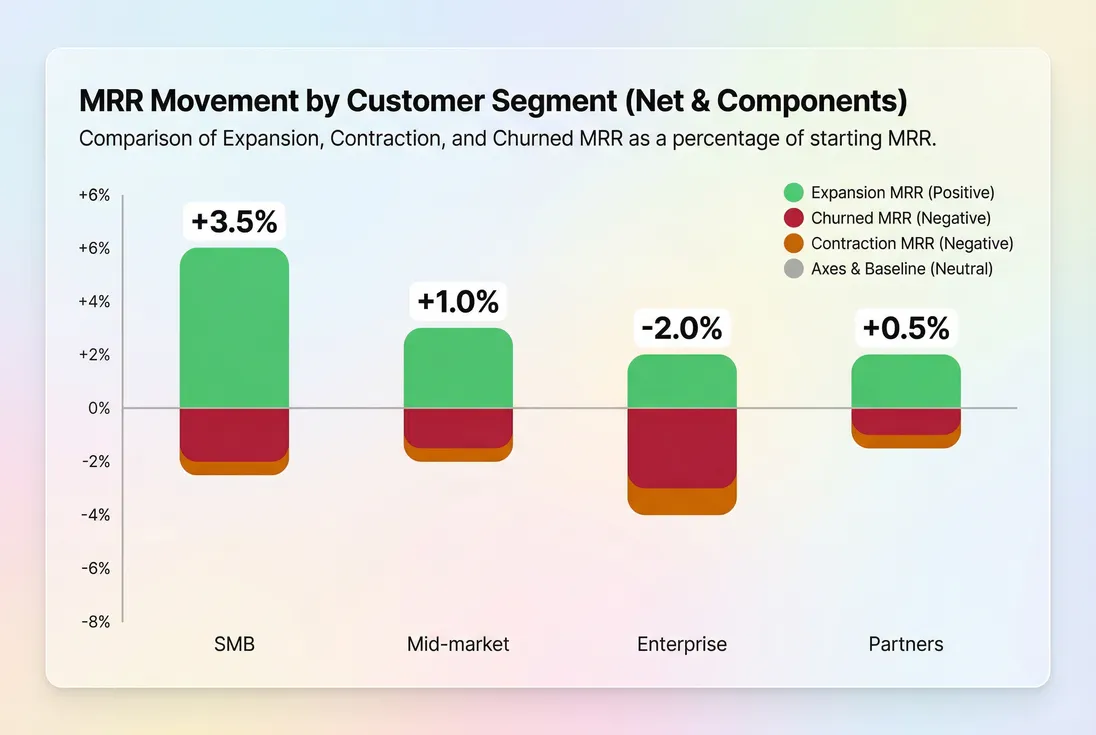

3) Find the real source by segment

Company-wide net churn averages away the truth. Segment it by:

- Plan / tier

- Customer size (SMB vs mid-market vs enterprise)

- Acquisition motion (product-led vs sales-led)

- Cohort month (see Cohort Analysis)

A practical exercise: build a table by segment and include the three components (churn, contraction, expansion). The goal is to find segments where expansion is structurally unlikely (so you must win on retention) versus segments where expansion is reliable (so you can invest in upsell motions).

Segmenting net MRR churn exposes where your business model is structurally strong (enterprise expansion) versus where it leaks (SMB churn). This is the fastest path from metric to action.

4) Spot "whale dependence" early

If one cohort or a few large customers drive most expansion, net churn can flip negative—until one renewal goes badly. Watch for:

- A single account contributing an outsized share of expansion

- Net churn volatility month-to-month

- High concentration in top customers

Then review Customer Concentration Risk and Cohort Whale Risk. The fix is often to broaden expansion across many accounts (product-driven expansion, clearer upgrade paths) rather than relying on bespoke upsells.

5) Operationalize it with movement tracking

Net churn becomes actionable when you can click into what changed:

- Which customers churned

- Which contracted (and why)

- Which expanded (and what triggered it)

If you're using GrowPanel, the most practical workflow is to review net MRR churn alongside MRR movements, then slice by filters and inspect the customer list to see the specific accounts behind the swings. Relevant docs: Net MRR churn, MRR movements, and Filters.

The Founder's perspective: Your job isn't to "improve net churn" in the abstract. It's to identify which customer motion is breaking (churn, contraction, or weak expansion) and then assign an owner, a timeline, and a measurable intervention.

A simple monthly review cadence

For most founders, a lightweight process beats a perfect model.

- Start with net MRR churn rate (trend and trailing average).

- Decompose it into churned MRR, contraction MRR, expansion MRR.

- Segment it (at least by customer size or plan).

- Investigate the top drivers (largest churns, largest contractions, largest expansions).

- Decide one action per driver (pricing, packaging, onboarding, CS outreach, product fixes).

- Track whether the component moved next month (not just the net).

If you keep this cadence, net MRR churn becomes a decision tool—not a vanity metric that looks good until it doesn't.

Frequently asked questions

It depends on segment and pricing model. Many SMB self-serve SaaS teams aim for roughly 0 to 2 percent net MRR churn per month. Mid-market and enterprise teams often push for 0 percent or negative net churn through expansion. Track it by segment, not just company-wide.

Not automatically. Negative net MRR churn can hide serious customer loss if expansion from a few accounts offsets churn elsewhere. Always pair it with gross measures like MRR churn and logo churn. If logos are falling while net looks great, you may be over-dependent on upsells.

Some teams include reactivation MRR, others don't. The key is consistency. If reactivations are common (paused accounts, seasonal usage), including them can better reflect real revenue recovery. If reactivations are rare, you can track them separately to avoid noise and gaming.

Net MRR churn tells you how much new sales must "run just to stand still." High net churn increases the sales and marketing capacity you need just to keep revenue flat. Improving net churn can be equivalent to adding new pipeline, which can change when you hire AEs versus CS.

Expansion can improve net churn even if the product experience is worsening—especially with seat-based pricing or annual true-ups. That's why you should look at contraction and churn separately and review churn reasons. A temporary expansion spike can mask an underlying retention problem for months.