Table of contents

M&A readiness

Founders don't lose deals because they have one "bad" quarter. They lose deals because diligence reveals uncertainty—numbers that don't tie out, retention that can't be explained, or customer risk that was never quantified. That uncertainty becomes a price cut, harsher earnout terms, or a deal that drags on until it dies.

M&A readiness is how prepared your SaaS business is to survive diligence with minimal surprises—so a buyer can underwrite your revenue, retention, and cash flows with confidence. It's not a single KPI; it's a practical readiness level across metrics quality, customer risk, financial hygiene, and operational repeatability.

What buyers are really underwriting

A buyer is not just buying "ARR." They're buying future free cash flow with known risk. In diligence, almost every request maps back to four underwriting questions:

Is recurring revenue real and repeatable?

Clean definitions for MRR (Monthly Recurring Revenue), ARR (Annual Recurring Revenue), renewals, and expansions.Is retention explainable and durable?

Retention by segment, by cohort, and by customer size. Not just a blended number.Is growth efficient and forecastable?

Pipeline quality, sales cycle stability, pricing discipline, and believable expansion mechanics.Are there hidden risks that can blow up the model?

Customer concentration, refunds, discounting practices, churn reason patterns, technical debt, and collections risk.

The Founder's perspective: In an acquisition, your job is to eliminate "unknowns." If a buyer can't reconcile your ARR to your billing system in 30 minutes, they assume other things are also messy—and they price that risk in immediately.

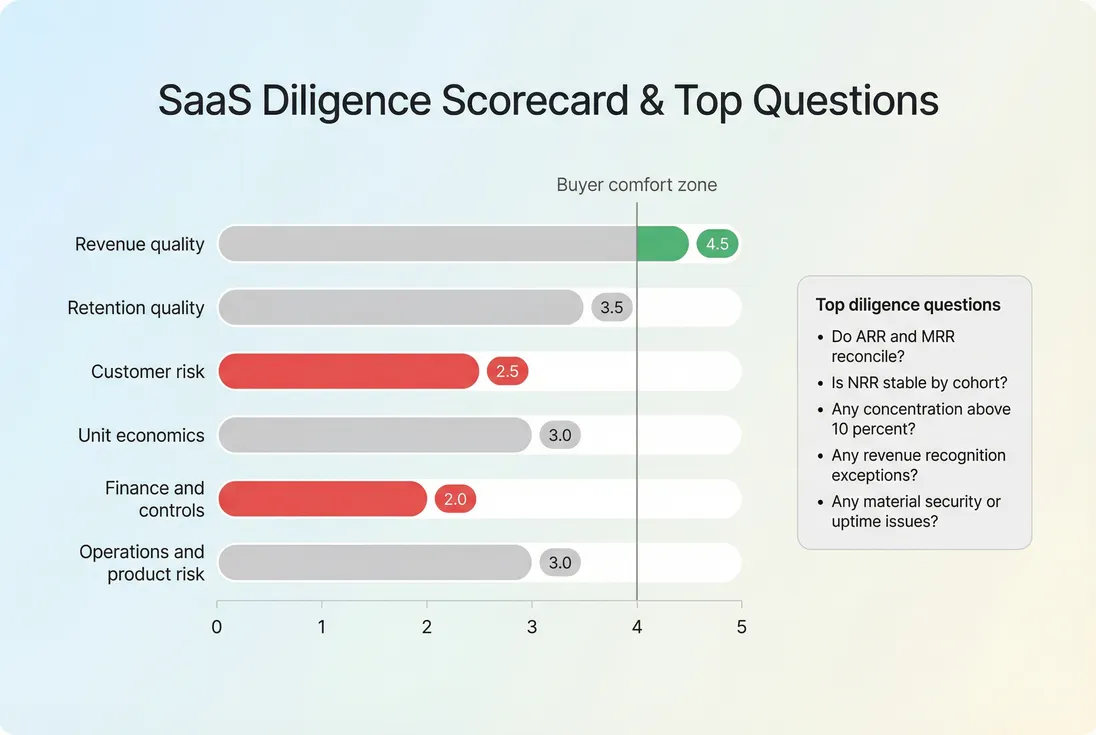

How to quantify M&A readiness

You can treat M&A readiness as a composite score so you can manage it like a project, not a vague goal. One simple model is a weighted score across the areas buyers consistently pressure-test:

- Revenue quality (definitions, movements, contracts)

- Retention quality (cohorts, churn drivers, expansion)

- Customer risk (concentration, AR exposure, segments)

- Unit economics (margins, payback, efficiency)

- Finance & controls (close process, reconciliations, audit trail)

- Operations & product risk (uptime, roadmap dependency, tech debt)

A lightweight way to calculate a readiness index:

ext{M&A readiness} = frac{sum , ext{weight} \cdot ext{area score}}{sum , ext{weight}}

Where each area score is typically 1–5, based on clear acceptance criteria (for example: "ARR ties to billing exports and general ledger every month" earns a 5).

A simple scorecard turns "be ready for M&A" into measurable workstreams and shows where diligence will likely apply pressure.

Which metrics actually move price

Valuation frameworks vary, but the mechanics are consistent: higher quality revenue and lower risk increases the multiple; uncertainty lowers it. Here are the metrics that most reliably affect outcomes.

Revenue base: ARR, MRR, and CMRR

Buyers want "recurring" to mean contracted, collectible, and consistently defined.

- Use ARR (Annual Recurring Revenue) and MRR (Monthly Recurring Revenue) definitions that match your billing reality (including how you treat annual prepay, upgrades, downgrades, and cancellations).

- If you sell annual contracts or have delayed start dates, CMRR (Committed Monthly Recurring Revenue) can help explain contracted future revenue without overstating current run-rate.

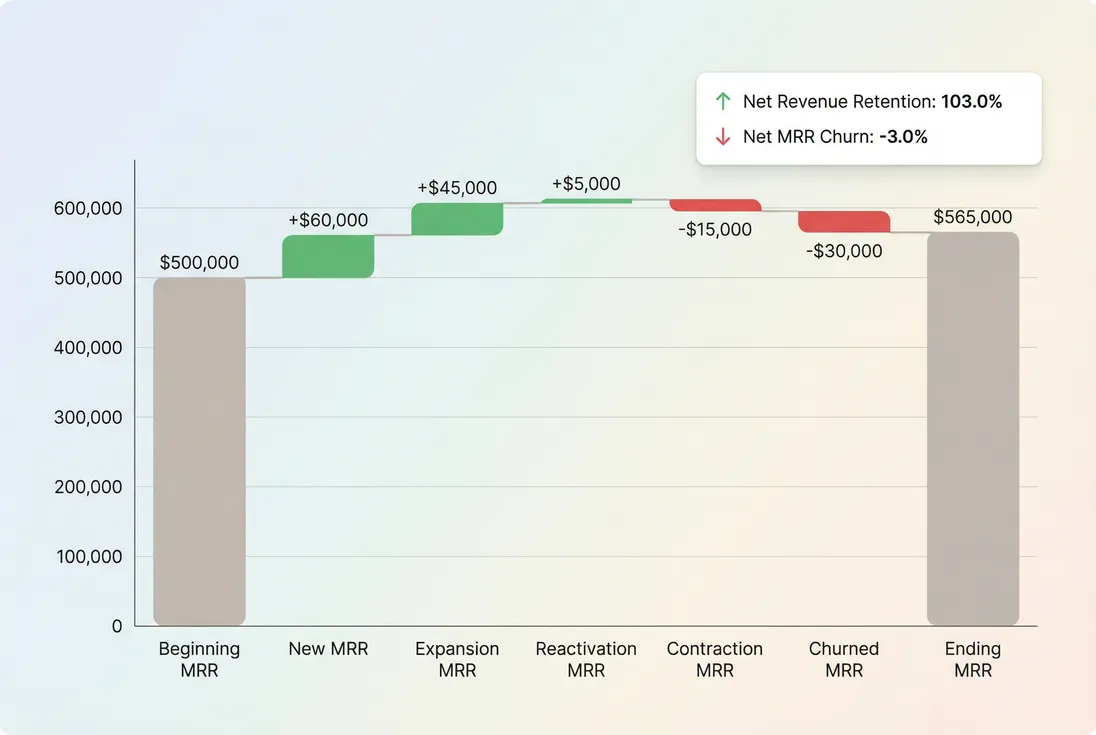

If you have frequent plan changes, the fastest diligence win is a clean monthly bridge of MRR movements—buyers love when they can trace "what changed" without a custom spreadsheet.

MRR movement bridges reduce diligence friction because buyers can verify growth quality (new vs expansion) and risk (contraction vs churn) in one view.

If you need one formula to align the team and the buyer, use net retention based on MRR movement components:

And its "risk lens" cousin:

For deeper operational visibility, buyers often ask to see the same movements by segment (SMB vs mid-market, monthly vs annual, self-serve vs sales-led). If you're using GrowPanel, this is typically where MRR movements and filters become your "show, don't tell" layer (see /docs/reports-and-metrics/mrr-movements/ and /docs/reports-and-metrics/filters/).

Retention: stability matters more than peaks

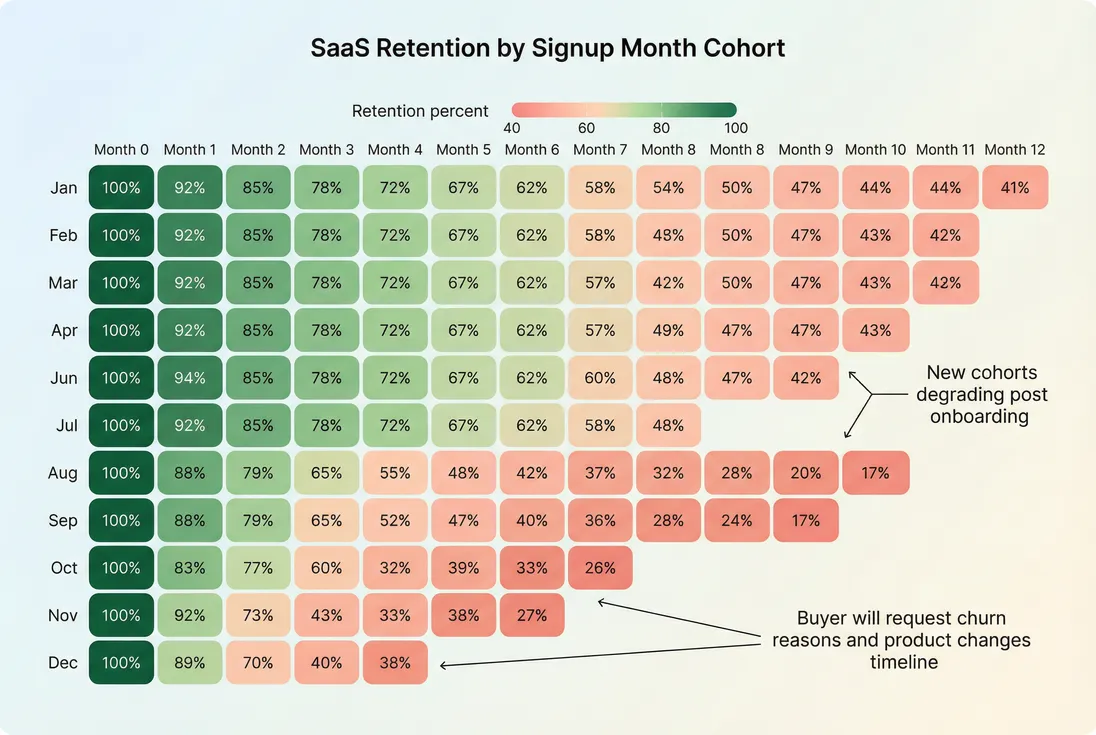

A single high NRR month doesn't impress anyone if cohorts are deteriorating or one expansion whale is masking churn. Diligence tends to focus on:

- Cohort stability (use Cohort Analysis)

- Logo churn and revenue churn side-by-side (see Logo Churn and MRR Churn Rate)

- Churn drivers (use Churn Reason Analysis)

Practical expectations (varies by segment, but useful as "buyer comfort" heuristics):

| Area | Often comfortable | Raises diligence pressure |

|---|---|---|

| GRR | ~85–95% | <80% or volatile |

| NRR | ~100–130% | <95% without a clear fix |

| Logo churn | low and stable | spikes, seasonality unexplained |

| Cohort slope | similar across cohorts | newer cohorts worse than older |

The Founder's perspective: Buyers don't need perfection. They need a coherent retention narrative: "Here's where churn comes from, here's what we changed, and here's the cohort evidence that it's working."

Customer risk: concentration and collections

Two risks routinely trigger price renegotiations late in process:

Customer concentration

Use Customer Concentration Risk to quantify dependency. Common pressure points:- Any single customer above ~10% of ARR

- Top 5 customers above ~25–35% of ARR

- A "whale cohort" whose renewals cluster in one quarter

Collections and AR health

Even "recurring" revenue is risky if you can't collect it. Buyers often ask for:- AR aging schedules (see Accounts Receivable (AR) Aging)

- Refund and chargeback patterns (see Refunds in SaaS and Chargebacks in SaaS)

- Disputes, write-offs, and payment failure rates (involuntary churn risk)

If you have meaningful invoicing, AR clean-up can be one of the highest ROI readiness projects because it directly improves cash conversion and reduces "quality of revenue" debates.

Profitability: margin and burn credibility

Even growth buyers typically diligence profitability drivers:

- Gross Margin and how it trends with scale

- Hosting and support cost structure (COGS logic, see COGS (Cost of Goods Sold))

- Burn and efficiency (see Burn Rate and Burn Multiple)

A common diligence failure: founders present "adjusted" margins that can't be tied to accounting exports, or they exclude real costs that a buyer will absolutely include post-close.

What this metric reveals in diligence

M&A readiness reveals how much of your valuation is supported by evidence vs belief. The best way to use it is to predict where the buyer will apply a risk discount.

Where buyers push hardest

If you're seeing heavy follow-up questions, it's usually because of one of these patterns:

- ARR does not reconcile across billing, CRM, spreadsheets, and bank deposits.

- Discounting is ad hoc, with no policy or clear renewal uplift plan (see Discounts in SaaS).

- Revenue timing is confusing, especially with annual prepay, implementation fees, or usage components (see Recognized Revenue and Deferred Revenue).

- Retention is blended, and when segmented it tells a different story (for example: SMB is deteriorating while enterprise expands).

- Cohorts are getting worse, but the team is only showing last month's NRR.

This is why readiness isn't "finance work" alone. It's cross-functional: RevOps (definitions), CS (renewal and churn reasons), Product (adoption and TTV), and Finance (reconciliation and controls).

Buyers trust retention when cohorts tell a consistent story; diverging newer cohorts trigger deeper diligence and often a valuation haircut.

When M&A readiness breaks

Readiness "breaks" when you can't answer buyer questions with fast, consistent evidence. These are the most common breakpoints.

1) Metric definitions shift mid-process

If your team can't state (and stick to) how you treat:

- upgrades/downgrades timing,

- cancellations vs non-payment,

- refunds and credits,

- annual prepay in MRR,

…you will relitigate numbers every week. Align definitions early using canonical pages like MRR (Monthly Recurring Revenue) and Net MRR Churn Rate.

2) "One-off" revenue is mixed into recurring

Implementation, onboarding, overages, and services can be legitimate revenue, but mixing them into ARR/MRR without a clear policy creates distrust. If you have a usage component, be explicit about how you treat it (see Usage-Based Pricing and Metered Revenue).

3) Customer list cannot be explained

Buyers often request a customer list with ARR by account, start date, renewal date, plan, and recent changes. If you can't produce this quickly, they assume poor controls. (If you use GrowPanel, the customer list and segment filters are typically your fastest way to show this cleanly.)

4) Forecast depends on hope

If the plan assumes expansion that historically hasn't happened, or assumes churn improvement without cohort evidence, it will be discounted. Tie growth assumptions to:

- historical expansion behavior (Expansion MRR),

- sales capacity realities (Sales Rep Productivity),

- and payback constraints (CAC Payback Period).

The Founder's perspective: If your forecast requires "we'll hire 5 reps and double close rate," that's not a forecast—it's a funding pitch. M&A buyers pay for proven motion, not potential motion.

How founders use M&A readiness in real decisions

M&A readiness is most valuable before you run a process. It helps you decide what to fix, what to disclose early, and what to ignore.

Decide whether to run a process now

Run a sale process when you can defend three things:

- Your run-rate is real (ARR/MRR reconciled, discounting policy stable).

- Retention is explainable (cohorts + churn reasons + corrective actions).

- Risk is bounded (concentration quantified, AR under control, no major unknown liabilities).

If any of those are weak, you may still sell—but expect one of:

- a lower multiple,

- heavier earnout,

- more escrow/holdback,

- or a longer exclusivity period.

Choose which improvements create the most value

Not all readiness work creates equal leverage. Highest ROI projects tend to be:

- Retention segmentation and cohorts: show where the business is actually strong (see Cohort Whale Risk).

- MRR movement discipline: reduce time spent debating numbers (buyers hate debates).

- Concentration mitigation: land a few mid-sized customers to reduce dependency, or restructure contracts.

- Gross margin clarity: document COGS, remove "mystery" allocations, show scale economics.

Lower ROI (for M&A specifically) tends to be "polish" that doesn't change underwriting—like vanity dashboards that don't tie to source systems.

A 90-day M&A readiness plan

If you want a practical sprint, here's a sequence that matches how diligence actually unfolds.

Days 1–30: reconcile and define

- Lock metric definitions for ARR/MRR, churn, expansion, and reactivation.

- Produce a monthly reconciliation that ties billing exports to ARR/MRR totals.

- Build an MRR bridge for the last 12 months.

- Document treatment for discounts, refunds, chargebacks, and taxes (see VAT handling for SaaS if relevant).

Days 31–60: segment retention and risk

- Cohort retention by segment: plan, channel, customer size, geography if material.

- Churn reason analysis: top reasons, quantified, with "fix shipped" dates.

- Customer concentration table: top 10 accounts by ARR, renewal timing, and expansion history.

- AR aging and collections policy if invoicing (see Accounts Receivable (AR) Aging).

Days 61–90: package the evidence

- A simple data room structure with:

- ARR/MRR bridges and definitions

- cohorts and retention summaries

- customer list and concentration analysis

- margin and burn explanations

- contracts, pricing, and discount policy

- A "diligence narrative" memo: 2–3 pages explaining the business model, retention mechanics, and known risks (and what you're doing about them).

Benchmarks that buyers react to

Use these as "reaction thresholds," not universal truths:

| Topic | What tends to feel clean | What triggers discounting |

|---|---|---|

| Revenue reporting | ARR and MRR tie monthly | multiple versions of truth |

| Net retention | stable, explainable | volatile, whale-driven |

| Concentration | diversified customer base | renewals clustered in few accounts |

| AR and refunds | controlled, documented | rising disputes, unclear policies |

| Margin | consistent and defensible | COGS unclear, heavy adjustments |

| Efficiency | believable payback | growth requires step-change assumptions |

If you want to connect valuation to fundamentals, it can help to understand how buyers translate risk into multiples (see EV/Revenue Multiple and Enterprise Value (EV))—but the practical point is simpler: clarity raises price; ambiguity lowers it.

The simplest way to interpret changes

M&A readiness improves when your business becomes more legible:

- Higher readiness: fewer reconciliations needed, stable cohorts, predictable MRR movement, documented policies, lower concentration.

- Lower readiness: numbers change when someone "recalculates," retention is blended, churn reasons are anecdotal, or AR is messy.

Treat readiness like a risk backlog. Every ambiguity you remove is one less negotiation point later.

The Founder's perspective: Your goal isn't to impress a buyer with slides. It's to make it easy for them to say, "I understand this business, I trust the numbers, and I know what could go wrong."

If you want one concrete starting point: get your last 12 months of MRR movements and cohort retention into a form you'd be comfortable handing to a skeptical operator—and then build the rest of the diligence story around what those two views reveal.

Frequently asked questions

M&A readiness is your ability to pass buyer diligence quickly, defend your numbers, and avoid "risk discounts" to price. It's less about having perfect metrics and more about having consistent definitions, clean source-of-truth reporting, and a credible story for retention, growth, margins, and customer risk.

Buyers move fastest when ARR and MRR tie cleanly to billing systems, retention is stable, and customer concentration is controlled. Practically, the quickest "deal friction reducers" are clean MRR movements, stable net retention, clear deferred vs recognized revenue logic, and a short list of churn reasons with corrective actions.

Benchmarks depend on segment, but many buyers get comfortable when GRR is roughly 85–95 percent and NRR is roughly 100–130 percent, with low volatility. More important than the absolute number is consistency by cohort and segment, and a clear explanation of any step-changes.

Concentration increases perceived risk: one customer leaving can break the forecast. Many buyers start pushing harder when a single account is above ~10 percent of ARR or the top five exceed ~25–35 percent. If concentration is unavoidable, mitigate with longer contracts, strong expansion history, and diversification momentum.

For most SaaS companies, 60–120 days is enough to get materially "cleaner" for diligence: reconcile ARR/MRR, document metric definitions, normalize discounts and refunds treatment, tighten AR collections, and build segment-level retention cohorts. Deep fixes—like product stability or churn reversal—often take 6–12 months.