Table of contents

Logo churn

Losing a few customers can feel "small" until you realize churn compounds: every month you're refilling a leaky bucket. Logo churn is the fastest way to see whether your customer base is stabilizing—or quietly eroding—regardless of revenue size.

Logo churn is the percentage of paying customers (logos) who cancel or fail to renew during a period. It's a customer-count metric: each account counts once, whether they pay $29/month or $29,000/month.

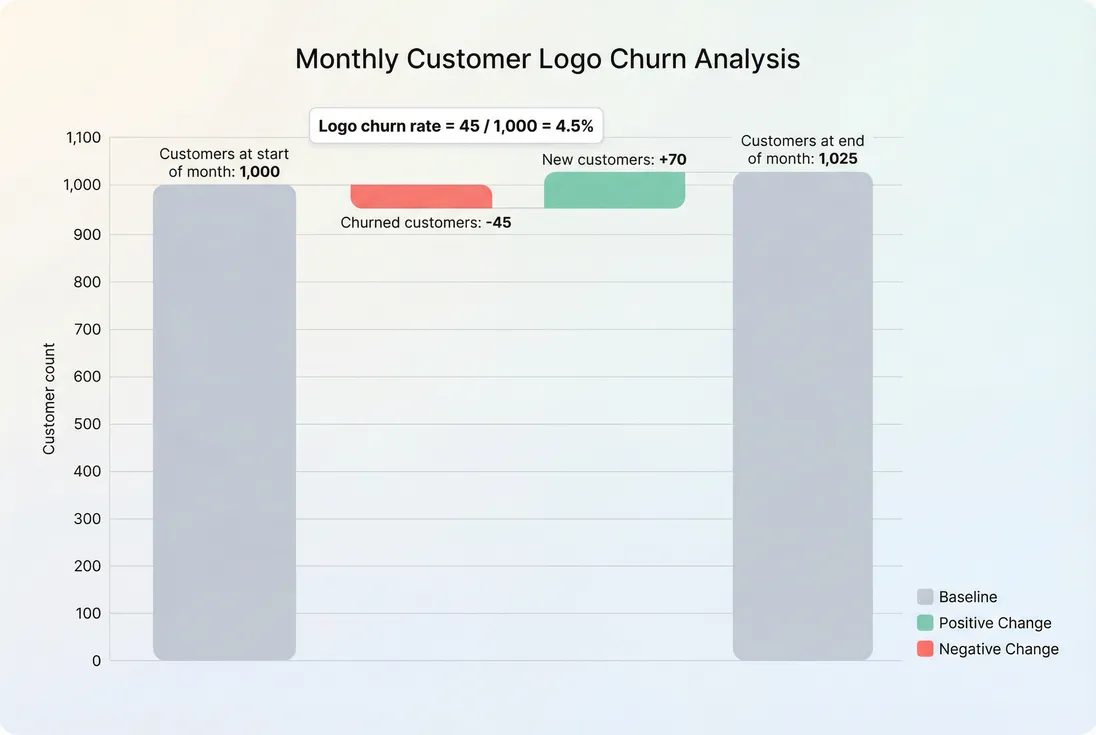

A simple customer-count bridge makes logo churn intuitive: it's the churned logos divided by the starting base, independent of new sales.

What logo churn reveals

Logo churn answers a founder-level question: are we keeping customers—yes or no? That sounds obvious, but it's uniquely useful because it strips away revenue weighting.

Here's what logo churn is especially good at detecting:

- Weak onboarding and time-to-value issues (customers leave quickly, often within the first 30–90 days)

- Bad-fit acquisition (you're acquiring customers who were never likely to succeed)

- Support and reliability problems (lots of smaller accounts churn after a rough month)

- Pricing or packaging friction (customers decide the product isn't worth it at renewal)

And here's what logo churn can hide if you look at it alone:

- Losing a single large customer may barely move logo churn, but can wreck revenue retention. That's why you pair logo churn with MRR Churn Rate and Net MRR Churn Rate.

- Healthy expansion can offset revenue churn even while many small logos leave. Your customer count can decline while revenue grows.

The Founder's perspective: Logo churn is my "customer truth serum." If it's rising, something about who we sell to, how we onboard, or what we deliver is breaking—even if revenue metrics look temporarily fine.

How to calculate it

At its simplest, logo churn is churned customers divided by starting customers for the period (usually a month).

A few practical details matter more than the formula:

Define "churned customer" clearly

Most teams count a customer as churned when they:

- Cancel a subscription and it ends

- Fail to renew at contract end

- Stop paying and the account is not expected to resume (watch out for payment failures; see Involuntary Churn)

If you're not consistent about when churn is recognized (cancellation date vs. access end date vs. invoice failure), your logo churn trend will be noisy and untrustworthy. If you want deeper guidance, align recognition rules with finance and RevOps and keep them stable over time (see also the practical discussion in /blog/when-should-you-recognize-churn-in-saas/).

Use the right denominator

Most founders use customers at start of month because it's stable and comparable. Avoid dividing by "end of month customers" (it bakes in your new sales and makes churn look better during growth months).

If your customer base is growing extremely fast and churn is clustered, you can also calculate with average customers—but document it and don't mix methods in board decks.

Example (with interpretation)

- Customers at start of month: 800

- Churned customers in month: 32

Interpretation: about 1 in 25 customers left this month. If that persists, it will materially slow customer-base growth unless acquisition keeps up.

What drives logo churn up or down

Logo churn is an outcome metric. The fastest way to make it actionable is to connect it to drivers you can control.

1) Customer mix and go-to-market fit

If you move downmarket (more SMB), logo churn usually rises because:

- budgets are smaller and more volatile

- switching costs are lower

- "try and churn" behavior is common in PLG

If you move upmarket (mid-market/enterprise), logo churn often falls—but each churn event becomes more expensive in revenue and pipeline impact. Pair this with Customer Concentration Risk so you don't celebrate "low logo churn" while becoming dependent on a handful of whales.

2) Contract length and renewal dynamics

Logo churn behaves differently under:

- Monthly self-serve: churn can happen anytime; trends move quickly.

- Annual contracts: churn clusters at renewal months; monthly logo churn becomes "spiky."

For annual-heavy businesses, track:

- a monthly view (to see renewal months clearly)

- a trailing view (to understand the underlying rate across the year)

- renewal cohorts (logo retention by contract start month)

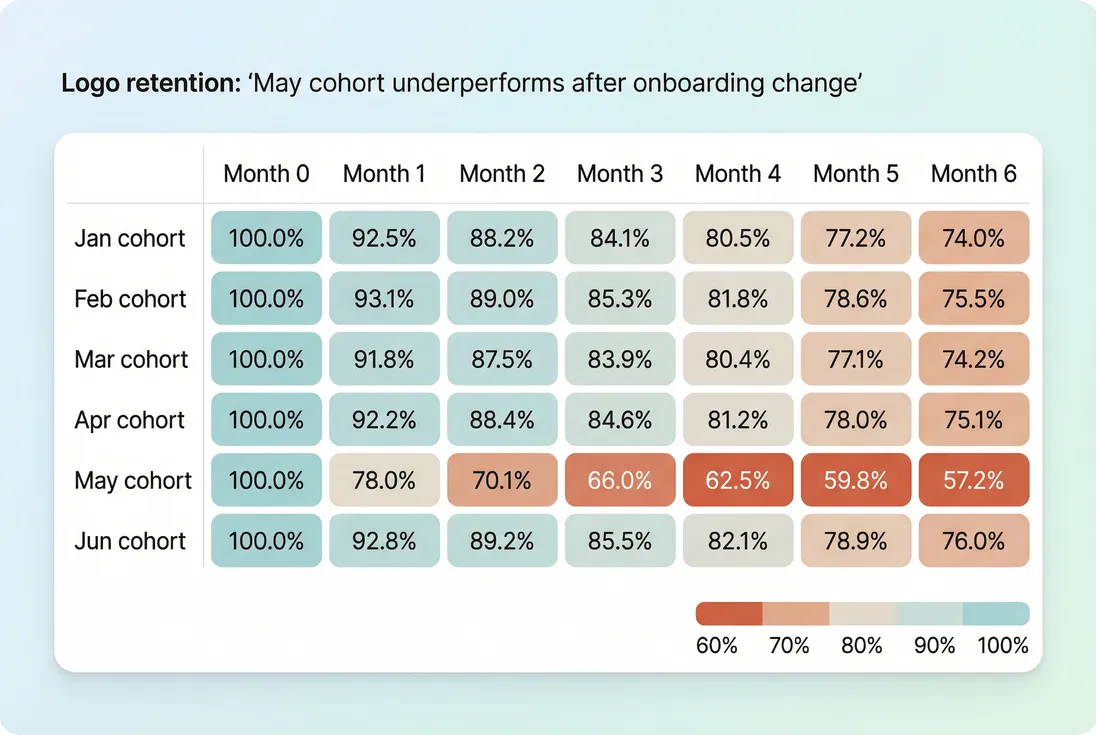

This is where Cohort Analysis stops being "nice to have" and becomes operationally necessary.

3) Time-to-value and early-life churn

Most SaaS businesses have a "danger zone" where churn is highest—often the first 30–90 days.

If logo churn rises while new acquisition is steady, it's frequently one of:

- onboarding got worse (new flow, missing emails, fewer success calls)

- product complexity increased (more setup required)

- your ideal customer profile drifted (marketing widened targeting)

If you're tracking onboarding, connect churn back to leading indicators like Onboarding Completion Rate and time-to-value in your own product instrumentation.

4) Involuntary churn and billing friction

Payment failures can create "churn" that isn't about product value. If logo churn spikes alongside more failed payments, you may have a dunning/retry issue or card expiration wave rather than a product problem.

Founders often misread this and overreact with product changes. Segment churn into voluntary vs. involuntary whenever possible (see Voluntary Churn and Involuntary Churn).

5) Pricing, discounts, and packaging changes

A price increase can raise logo churn even if it improves revenue efficiency. Two common patterns:

- Price increase without improved packaging: more small customers leave, logo churn rises; revenue retention may still improve.

- Discount cleanup: removing legacy discounts can increase churn in older cohorts.

If you're changing pricing, look at churn by plan and legacy discount status (see Discounts in SaaS and ASP (Average Selling Price)).

The Founder's perspective: When logo churn jumps after a pricing change, I don't immediately roll it back. I first check whether the churn is concentrated in low-ARPA accounts and whether support load dropped. Sometimes higher logo churn is a rational trade for a healthier business.

Benchmarks that actually help

There is no universal "good" logo churn number. Benchmarks only help when they match your segment and contract structure.

Here are directional monthly ranges many founders use as a starting point:

| Segment (typical motion) | Monthly logo churn (rough) | What it usually implies |

|---|---|---|

| Enterprise (sales-led, annual) | 0.2%–1.0% | Renewals are the battleground; churn is lumpy |

| Mid-market (sales-led, mixed terms) | 1%–2.5% | Watch implementation success and champion turnover |

| SMB (self-serve, monthly) | 3%–7% | Fast churn loops; onboarding and ICP matter most |

| PLG at very low price points | 5%–10%+ | Expect higher churn; win with activation and expansion |

Use benchmarks as context, not a target. The better question is:

- Is logo churn improving for the cohorts you're proud of?

- Is it worsening for specific channels, plans, or geographies?

If you need a single "board-friendly" view, smooth the volatility using a trailing average (see T3MA (Trailing 3-Month Average))—but keep the raw monthly view internally so you don't miss sudden issues.

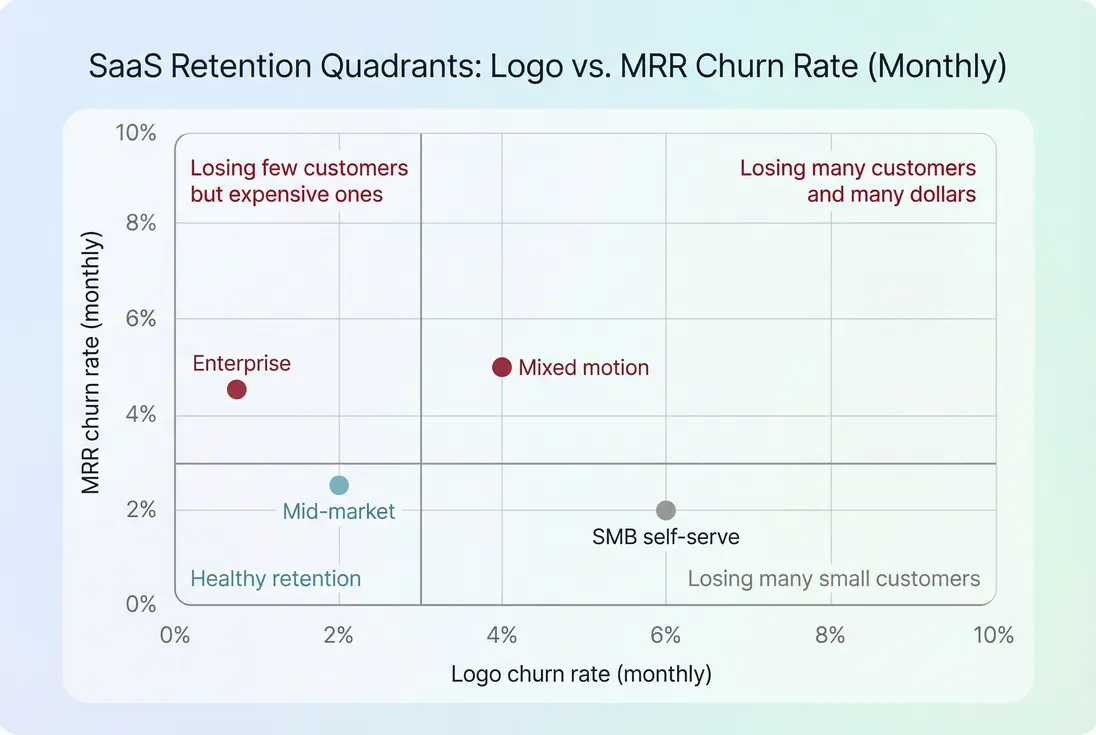

How to interpret logo churn with revenue

Logo churn becomes far more powerful when you compare it to revenue-weighted retention. This is where founders often unlock the "so what."

Logo churn and MRR churn tell different stories; the combination reveals whether you are losing small customers, large customers, or both.

A practical read of the four patterns:

High logo churn + low MRR churn

You're mostly losing smaller accounts. This may be acceptable in PLG/SMB if acquisition is efficient and expansion is strong. But it can also signal bad-fit acquisition or poor onboarding.Low logo churn + high MRR churn

You're losing few customers, but they're large or heavily contracted. This is a "whale problem": account-level success, renewals, and de-risking concentration matter more than funnel tweaks.High logo churn + high MRR churn

This is a core retention emergency. Expect second-order impacts: slower growth, worse CAC Payback Period, and pressure on Burn Multiple.Low logo churn + low MRR churn

Healthy baseline. Now your growth rate is more determined by acquisition and expansion than leakage (see Expansion MRR).

If you want a single revenue retention headline metric to pair with logo churn, use GRR (Gross Revenue Retention) for "how much revenue we kept from existing customers" and NRR (Net Revenue Retention) for "did expansion offset contraction and churn."

Where logo churn analysis breaks

Founders get misled by logo churn when definitions and data hygiene aren't tight.

Multiple subscriptions per customer

If one company can have multiple subscriptions, you need a clear rule for "logo." Otherwise, cancellations can be double-counted.

Operational fix: define a unique account identifier and ensure churn is counted once per account, not once per subscription.

Reactivations and win-backs

If churned customers return later, logo churn still counts the churn event (correct), but you also need a way to track win-backs separately (see Reactivation MRR for the revenue view).

If you're seeing lots of churn + reactivation cycles, it often indicates:

- seasonal use cases

- budget timing

- pricing not aligned to usage value

Free-to-paid confusion

Logo churn should be about paying logos unless you explicitly define otherwise. Mixing active free users into the denominator will distort retention and make paid churn look better or worse depending on conversion timing.

Annual renewals treated like monthly churn

If you report monthly logo churn for annual contracts without context, you'll get false alarms and false confidence. For annual-heavy motions, create a renewal calendar and treat renewal months as operational events, not noise.

The Founder's perspective: I don't want a single churn number. I want a churn system: clear definitions, segmented views, and a weekly habit of reviewing the biggest churn cohorts by count and the biggest churn events by dollars.

How founders use logo churn to decide

Logo churn is only valuable if it changes what you do next week. Here are high-leverage decision loops founders actually run.

1) Diagnose: where is churn concentrated?

Start with segmentation that maps to decisions:

- Tenure: 0–30 days, 31–90, 91–365, 1+ years

- Plan / packaging tier (especially if you have a "starter" tier)

- Acquisition channel: outbound, paid search, integrations, partners

- Use case / industry (even if coarse)

Then validate with a cohort view. A classic pattern: a product change in May causes the May cohort to churn faster than April and June. That's a direct lead to investigate onboarding, activation, and product quality.

This is the moment to use Churn Reason Analysis to move from "who churned" to "why."

2) Prioritize: fix churn with the highest count

Because logo churn is count-based, it's great for prioritizing operational fixes that touch many customers:

- onboarding steps that block activation

- a confusing configuration workflow

- a missing integration that causes drop-off

- support backlog leading to unresolved tickets

Revenue-weighted metrics sometimes push you toward "save the whales" (which may be right), but logo churn helps you avoid death by a thousand cuts.

3) Decide: pricing and packaging tradeoffs

If you're considering a price increase, logo churn gives you an honest read on customer sensitivity—especially when you segment by plan.

A practical approach:

- model expected customer loss on lower tiers

- compare it to expected ASP lift (see ASP (Average Selling Price)) and changes in ARPA (Average Revenue Per Account)

- track whether churn is concentrated among chronically low-engagement accounts (a "good churn" argument) or among successful users (a "bad churn" signal)

4) Forecast: how much growth is "just refilling"?

A high logo churn rate forces more acquisition just to keep customer count flat. Even without complex modeling, you can sanity-check your growth engine:

- If you have 1,000 customers and 5% monthly logo churn, you lose ~50 customers/month.

- If you add 60 new customers/month, your net customer growth is only ~10/month.

That's why churn reduction often outperforms acquisition spending: it improves growth and efficiency.

5) Operationalize: a weekly churn review

A simple weekly agenda founders can run:

- Review trailing logo churn trend (smoothed) and last 7–14 days (raw).

- Identify the top churn segments by count (tenure, plan, channel).

- Pull the customer list for churned logos and scan common traits.

- Assign one owner to a single churn reduction experiment for the largest segment.

If you use GrowPanel, this workflow maps cleanly to the Logo Churn report plus filters and the customer list, then validating movement patterns in MRR movements (especially helpful when "churn" is actually a downgrade or billing issue).

Cohort retention makes churn actionable: you can see exactly which signup months broke and when the drop-off started.

A practical takeaway

If you remember one thing: logo churn is your clearest signal of customer-base health, but it only becomes actionable when segmented. Track it consistently, pair it with revenue-weighted retention metrics, and use cohorts to pinpoint when and where the customer experience fails.

For related metrics that complete the retention picture, connect logo churn to Customer Churn Rate, MRR (Monthly Recurring Revenue), and NRR (Net Revenue Retention).

Frequently asked questions

It depends on segment, contract length, and pricing model. SMB and PLG products often see higher monthly logo churn than enterprise due to lower switching costs and shorter commitments. Treat benchmarks as directional: compare against your own cohorts, track trends over time, and segment by plan and tenure before making decisions.

Logo churn is customer-count based, not revenue-weighted. You can retain more small accounts while still losing meaningful revenue through downgrades or a few larger cancellations. Pair logo churn with MRR-based metrics like MRR churn and Net MRR churn to understand whether the business is losing customers, losing dollars, or both.

Most SaaS teams use starting customers because it is simple and comparable month to month. Average customers can be useful when growth is very fast and churn is uneven through the month, but it changes interpretation. Pick one method, document it, and keep it consistent across reports and board updates.

Annual billing compresses churn into renewal months. Monthly logo churn can look artificially low, then spike when renewals cluster. For annual-heavy businesses, track logo churn on a trailing twelve-month basis and separately monitor renewal cohorts. Also be explicit about when you recognize churn so finance and operations stay aligned.

Start with segmentation, not company-wide averages. Break churn by customer tenure, plan, acquisition channel, and use case. Then identify whether the spike is voluntary or involuntary, and whether it correlates with a product change, pricing change, or support backlog. Prioritize fixes that address the largest churn cohort by count.