Table of contents

Cohort analysis

Founders care about cohort analysis because it's the fastest way to answer a hard question: are we actually getting better, or are we just getting bigger? When topline MRR grows, averages can hide declining retention, weaker acquisition quality, or a "leaky bucket" that will eventually stall growth.

Cohort analysis groups customers (or revenue) by a shared start point—like the month they first subscribed—and then tracks their behavior over time (retention, revenue, usage, expansion). Instead of one blended churn rate, you see how each generation of customers performs.

What cohort analysis reveals

Averages answer "what is churn right now?" Cohorts answer "what changed?" That's why cohorts are the tool you use when you're making product, pricing, or go-to-market changes and need to validate whether they're working.

Cohort analysis is especially good at revealing:

- Onboarding effectiveness: If Month 1 retention improves after an onboarding change, you'll see the curve lift for newer cohorts.

- Acquisition quality: If a new channel brings customers who churn in Month 2–3, the early top-of-funnel looks great, but the cohort curve exposes the damage.

- Expansion motion health: Revenue cohorts can show whether accounts expand after adoption or stay flat.

- Hidden churn timing: Blended churn can look "fine" while cohorts reveal churn is simply being delayed (for example, contracts aren't renewing).

The Founder's perspective: If you can't tell which initiative improved retention, you will keep debating opinions. Cohorts turn retention into an experiment scoreboard: this onboarding flow, that pricing page, this sales segment—did it move the curve or not?

Cohorts also connect directly to unit economics. Improvements in retention lift LTV (Customer Lifetime Value), which changes what you can afford to spend on CAC (Customer Acquisition Cost) and how quickly you can recover it via CAC Payback Period.

Which cohorts matter most

"Cohort" just means "group with a shared start." The key is choosing a start that matches your decision.

Common cohort types

| Cohort start | Track over time | Best for | Watch-outs |

|---|---|---|---|

| First paid month (subscription start) | Logo retention, MRR retention | Core SaaS retention and churn | Annual plans can mask churn until renewal |

| Signup month (free/trial) | Activation, conversion, early usage | Product-led growth and onboarding | Define "active" consistently |

| First value event (activation) | Retention after value | Product improvements | Requires solid event instrumentation |

| Plan or price point at start | Revenue retention, upgrades | Pricing strategy | Plan migrations can distort comparisons |

| Acquisition channel | Retention, expansion | Budget allocation | Attribution often lies; keep it simple |

For subscription businesses, the default starting point is first paid month, then you track retention in future months. That pairs naturally with recurring revenue concepts like MRR (Monthly Recurring Revenue) and churn metrics like Logo Churn and MRR Churn Rate.

Pick the interval that matches your sales motion

- Monthly cohorts: Best for SMB/self-serve and fast iteration.

- Quarterly cohorts: Better for low-volume B2B or enterprise where monthly cohorts are too small and noisy.

- Weekly cohorts: Only if you have high volume and changes week-to-week (rare for B2B SaaS).

The Founder's perspective: If you only close 10 deals a month, a monthly cohort chart will tempt you into false conclusions. Go quarterly so you can make fewer, higher-confidence decisions.

How to calculate cohort retention

Cohort analysis isn't one formula; it's a way to align time and compare apples to apples. But two calculations show up constantly: logo retention (customers) and revenue retention (MRR).

Logo retention (customer retention) by cohort

Interpretation:

- If a cohort has 100 customers at Month 0 and 70 are still active at Month 3, Month 3 logo retention is 70%.

- This is the cleanest view of product stickiness and churn timing.

Revenue retention by cohort (MRR-based)

Interpretation:

- This can exceed 100% if expansion offsets churn and contraction.

- It's the cohort-level building block behind GRR (Gross Revenue Retention) and NRR (Net Revenue Retention).

A concrete example

Suppose your March cohort starts with 50 customers paying $200 MRR each:

- Month 0 cohort MRR = $10,000

- By Month 3:

- 5 customers churned (−$1,000)

- 10 customers upgraded (+$1,500)

- 3 customers downgraded (−$300)

Month 3 cohort MRR = $10,000 − $1,000 + $1,500 − $300 = $10,200

Revenue retention at Month 3 = 102%

That's why you should look at logo and revenue retention together:

- Logo retention tells you if customers are leaving.

- Revenue retention tells you whether the customers who stay are expanding enough to compensate.

What influences cohort curves

The curve shape is driven by a few practical levers:

- Time to value: If customers don't reach value quickly, Month 1–2 drops are steep (often an onboarding problem).

- Customer-fit and targeting: If you broaden targeting, early cohorts may look worse even if acquisition volume increases.

- Pricing and packaging: A new entry plan may increase signups but lower retention if it attracts low-intent customers. (Related: ASP (Average Selling Price) and Discounts in SaaS.)

- Product reliability and support: Outages and unresolved bugs show up as cohort deterioration after the event, not immediately in averages. (Related: Uptime and SLA.)

- Billing mechanics: Failed payments inflate churn if you don't manage Involuntary Churn. Refund policies also matter; see Refunds in SaaS.

How to interpret cohort patterns

Most cohort charts "feel obvious" after you learn what to look for. Here are the patterns that actually drive decisions.

1) The early cliff

If Month 1 retention is dramatically worse than later months, you likely have a time-to-value gap. Customers churn before they become embedded.

What to do:

- Identify the first value event and push customers there faster.

- Tighten ICP targeting so customers arrive with a real use case.

- Shorten setup steps, improve templates, or add guided onboarding.

This is where pairing cohorts with leading indicators (activation, feature adoption) matters. See Feature Adoption Rate and Time to Value (TTV).

2) The slow leak

If cohorts steadily decline month after month with no plateau, you may have:

- Weak ongoing engagement (product is not a habit)

- Limited switching costs

- A problem that isn't persistent (customers "graduate")

This is common in tools that solve a one-time project instead of a recurring workflow. It's not necessarily fatal, but it changes pricing, packaging, and sales strategy.

The Founder's perspective: If you can't get a retention plateau, your growth strategy can't rely on compounding expansion. You'll need either much lower CAC, stronger reactivation, or a shift to a more recurring problem.

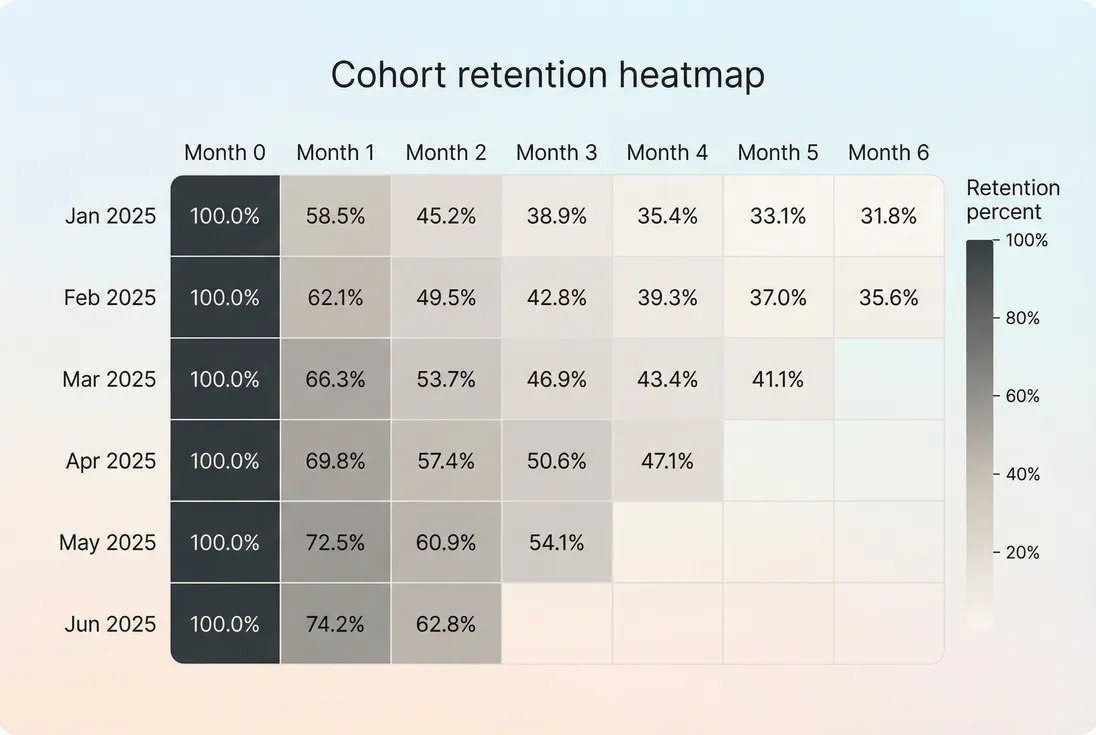

3) New cohorts shifting up (or down)

This is the most important signal: Are newer cohorts performing better than older ones at the same age?

- If newer cohorts are higher at Month 2 and Month 3, your improvements are real.

- If only Month 1 moved but Month 3 didn't, you may have improved activation but not long-term value.

- If cohorts shift down after a GTM change, treat it as an acquisition quality issue until proven otherwise.

4) Revenue retention crossing 100%

When revenue retention rises above 100% over time, expansion is winning. This is the cohort-level story behind low or negative Net MRR Churn Rate.

But be careful:

- A single large account can distort revenue cohorts (especially early-stage).

- Expansion that comes from discounts expiring or billing changes can look like product-led growth when it isn't.

Practical benchmarks (use cautiously)

Benchmarks depend on ACV, implementation complexity, and whether you sell to consumers, SMB, or enterprise. Use this table as a sanity check, not a goal.

| Motion | What "healthy" often looks like | What's concerning |

|---|---|---|

| SMB self-serve | Big early drop, then plateau by Month 3–4 | No plateau; steady decline through Month 6+ |

| Mid-market SaaS | Smaller early drop; steady retention with gradual expansion | Sharp Month 1 cliff (often onboarding/fit) |

| Enterprise | Churn appears at renewals; revenue retention depends on expansion | False confidence between renewals |

If you're annual-contract heavy, supplement cohorts with renewal views like Renewal Rate and be explicit about when you "count" churn. (Related: /blog/when-should-you-recognize-churn-in-saas/)

How founders use cohorts to make decisions

Cohorts are only useful if they change what you do next. Here are the highest-leverage founder use cases.

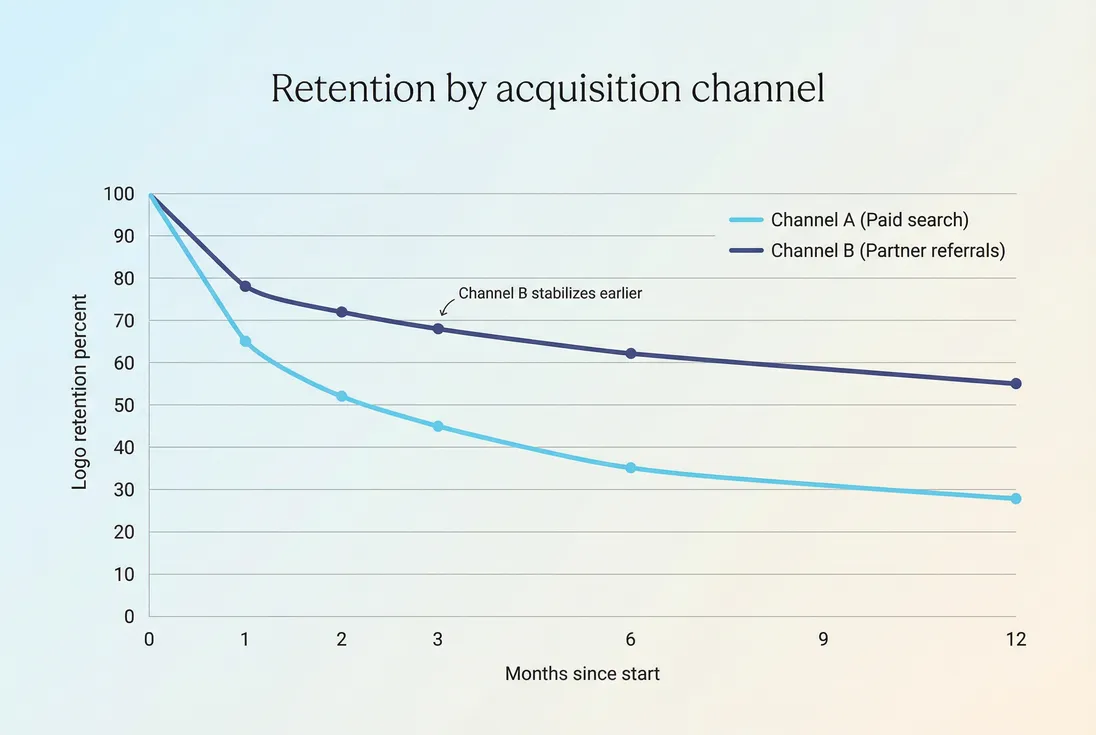

Reallocate acquisition spend based on payback reality

If one channel retains 15–20 points better by Month 3, that's not a "marketing insight." It changes how aggressively you can spend.

Workflow:

- Build cohorts by acquisition channel.

- Compare Month 3 and Month 6 logo retention (and revenue retention if applicable).

- Recompute LTV assumptions and CAC payback expectations.

- Shift budget toward the channels with better period-3+ retention, not just more signups.

This links directly to LTV:CAC Ratio and Sales Efficiency.

The Founder's perspective: If your paid channel closes fast but churns fast, you are renting growth. Cohorts let you see that early—before the churn wave hits your MRR.

Validate onboarding and activation changes

A good onboarding change should:

- Improve Month 1 retention (fewer "couldn't get value" churns)

- Often improve Month 2–3 retention as customers build habit

If only Month 1 moves, you may have improved setup completion without improving ongoing value. Pair with Onboarding Completion Rate and DAU/MAU Ratio (Stickiness).

Pressure-test pricing and packaging

Pricing changes often create mixed effects:

- Higher price can worsen logo retention but improve revenue retention (better-fit customers stay, expansion is easier).

- A cheaper entry plan can improve conversions but harm retention if it attracts low-intent accounts.

Use cohorts segmented by starting plan and track both logo and revenue retention. Combine with ARPA (Average Revenue Per Account) to see whether you're retaining higher-value customers or just more customers.

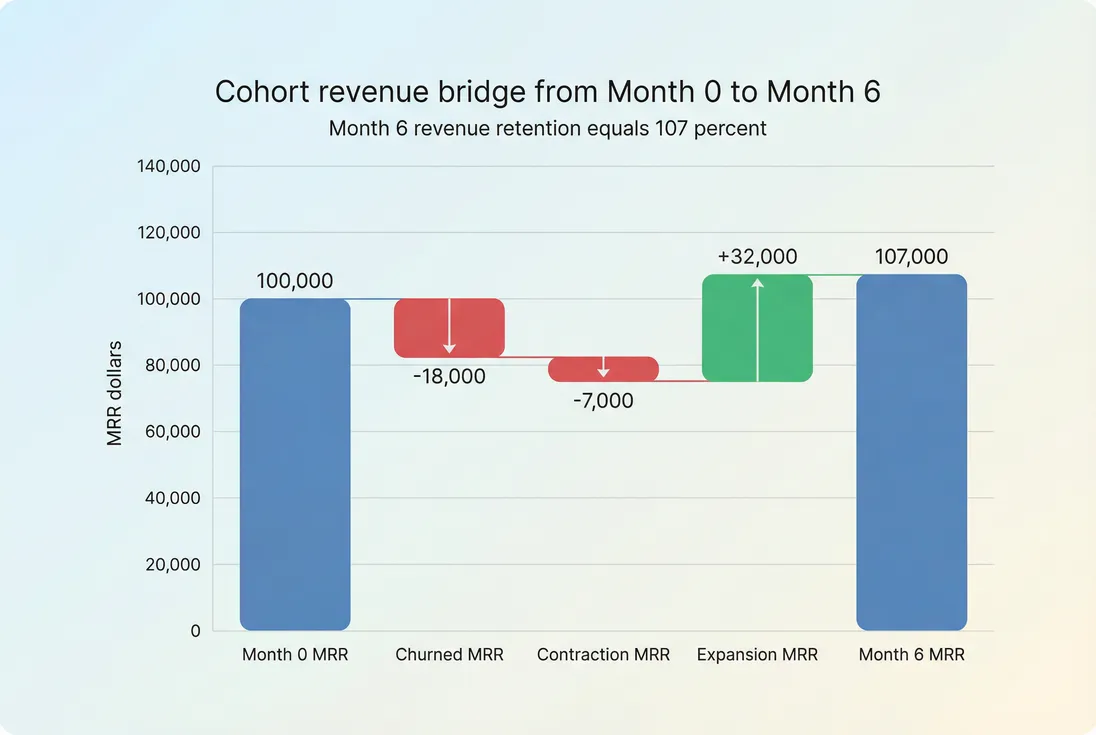

Understand why revenue retention moved

When revenue retention changes, you want to know whether it was:

- Less churn

- Less contraction

- More expansion

A simple cohort revenue bridge makes this obvious.

If contraction is the culprit, investigate packaging and value perception. If churn is the culprit, investigate onboarding, product reliability, and support responsiveness. If expansion is weak, examine seat growth, usage, and whether customers hit natural upgrade moments (see Per-Seat Pricing and Usage-Based Pricing).

Decide when you can scale

Cohorts answer a scaling question better than most "growth" metrics:

- If each new cohort retains as well or better than the last, growth investments compound.

- If new cohorts are worse, scaling spend can accelerate the problem.

This is closely related to your Natural Rate of Growth: without improving retention/expansion, new acquisition has diminishing returns.

When cohort analysis breaks (and how to fix it)

Cohorts are powerful, but they are easy to misuse. These issues are the usual culprits.

Small cohorts and whale distortion

A single large customer can make revenue retention look amazing (or terrible).

Fix:

- Segment cohorts by customer size or ACV band.

- Report both logo and revenue retention.

- Consider trimming outliers for diagnostic views (but keep them for financial truth).

Related reading: Customer Concentration Risk and Cohort Whale Risk.

Annual billing and renewal timing

With annual contracts, "monthly" retention can look flat until renewal month, then drop suddenly.

Fix:

- Use cohorts measured in quarters or by renewal periods.

- Pair with renewal rate reporting and churn recognition rules.

Plan migrations and messy definitions

If customers move between plans, "who belongs to which cohort" can get confusing.

Fix:

- Define cohorts based on the start event you care about (first paid date), not the current plan.

- Use segmentation to compare starting plan vs current plan outcomes.

Refunds, chargebacks, and billing noise

Refund policies or payment failures can make churn look like product churn when it's really billing churn.

Fix:

- Separate voluntary vs involuntary churn where possible (see Voluntary Churn and Involuntary Churn).

- Be consistent in how you treat Chargebacks in SaaS and refunds in retention calculations.

Confusing cohorts with snapshots

A cohort chart is not a "current state dashboard." It's a history of customer generations.

Fix:

- Use cohorts to evaluate change over time.

- Use current-period metrics (like churn rate) to manage the business week-to-week. See Customer Churn Rate.

How to operationalize cohorts in GrowPanel

If you want cohorts to drive decisions, make them easy to slice and revisit:

- Start with the Cohorts report and choose whether you're looking at customer retention or MRR-based retention: /docs/reports-and-metrics/cohorts/

- Cross-check results in Retention views (GRR/NRR perspectives): /docs/reports-and-metrics/retention/

- Use Filters to isolate segments (plan, geography, acquisition source if available in your data): /docs/reports-and-metrics/filters/

- When a cohort shifts, inspect the customer list behind the cells to see who churned, expanded, or contracted, then validate with MRR movements.

The Founder's perspective: A cohort chart tells you where to look. The customer list and MRR movements tell you what actually happened—and which playbook (onboarding, CS, pricing, billing) to run next.

Frequently asked questions

Start with the retention curve shape: how much drops after period 1, when it stabilizes, and whether later cohorts are shifting upward. Then segment by plan, channel, or persona. If only the average changes, you cannot tell whether acquisition quality improved or churn timing changed.

Benchmarks vary by segment and contract type. Instead of chasing a universal number, compare (1) new cohorts vs older cohorts, (2) SMB vs mid-market vs enterprise, and (3) channels. In B2B, you want fast stabilization and gradual improvement from cohort to cohort more than a single target.

Price increases can raise early churn because marginal customers self-select out, while improving long-term revenue retention from better-fit customers. Also check whether you changed plan mix or discounting. Pair logo retention with revenue retention to see if fewer customers stay, but those who stay are higher value.

Compare cohorts by acquisition channel using the same time window and the same definition of active. If a paid channel has weaker retention after month 2, your CAC payback will deteriorate even if signups look strong. Reallocate budget toward channels with higher period 3+ retention and expansion.

Small cohorts create noisy heatmaps. As a rule, avoid strong conclusions from cohorts under 30 to 50 customers unless the effect is large. If volume is low, widen the cohort period (quarterly instead of monthly) or focus on revenue cohorts, which can be more stable than counts in B2B.