Net Revenue Retention (NRR)

The Net Revenue Retention (NRR) report (also known as Net Dollar Retention or NDR) is the most comprehensive measure of customer value. It tracks the percentage of recurring revenue retained from an existing customer cohort, factoring in all revenue changes: Expansion, Reactivation, Contraction, and Churn.

NRR is considered the single most important metric for demonstrating built-in revenue growth. The primary goal is to achieve an NRR above 100%.

NRR is calculated by taking the Starting MRR of the cohort, adding all gains (Expansion + Reactivation), subtracting all losses (Contraction + Churned MRR), and dividing the result by the Starting MRR.

For an in-depth explanation of NRR as a metric, see the NRR guide in the SaaS Metrics Academy.

Overview

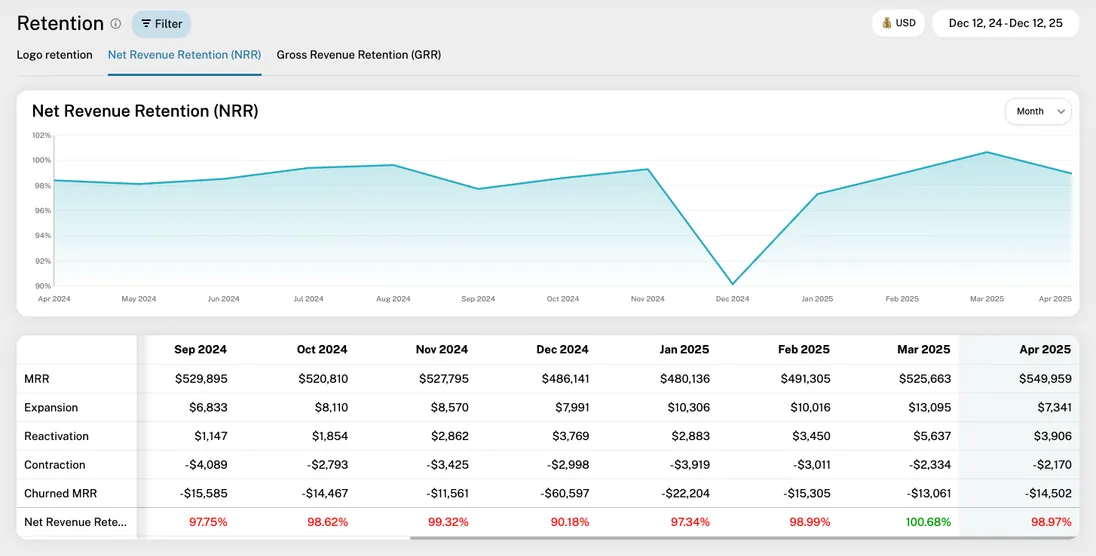

The Net Revenue Retention (NRR) report includes a timeline chart and a breakdown table. This report is critical because it demonstrates the financial growth you achieve from your existing customer base, without needing to acquire new logos. The breakdown table cells are not clickable and there is no detail table.

Timeline chart

The timeline chart displays the NRR rate over time, typically alongside an average line (e.g., 6 months).

The NRR line will often change color based on the 100% threshold:

- Green: When the rate is above 100%. This indicates Negative Churn (Expansion and Reactivation revenue outweighs all losses). This is the hallmark of a growth-stage SaaS company.

- Red: When the rate is below 100%. This indicates that the revenue lost from Contraction and Churn is greater than the revenue gained from Expansion and Reactivation.

The report employs the same month-to-month calculation convention as other MRR reports to ensure consistent data over time.

Breakdown table

The table underneath the chart displays the core data points for each period.

| Metric | Description |

|---|---|

| MRR | The total MRR at the end of the period (Closing MRR). |

| Expansion | The MRR gained from existing customers upgrading or adding more seats/products during the period. |

| Reactivation | The MRR gained from former, churned customers who started a new paid subscription during the period. |

| Contraction | The MRR lost from existing customers downgrading their subscriptions during the period. |

| Churned MRR | The MRR lost from customers who canceled all paid subscriptions during the period. |

| NRR Rate | The final calculated Net Revenue Retention Rate, displayed as a percentage. This value should ideally be above 100%. |

Filters

The report supports a wide range of filters to help you analyze where revenue growth or loss is concentrated. These include:

- Date range

- Interval (Daily, weekly, monthly, quarterly, or yearly)

- Additional filters – plan, region/country, billing frequency, etc. (see all filters)

Filters are applied to both the chart and the table simultaneously.

Exporting the data

You can export the table as a CSV file for offline analysis or reporting by clicking the "Export" icon next to the date picker.

Practical tips

- The 100% Benchmark: NRR is most valuable when it is above 100%. This means your revenue grows even if you acquire zero new customers. Venture Capitalists often look for NRR benchmarks of 120%+ for the most successful SaaS models.

- Identify Expansion Success: Use filters to segment NRR by plan or feature usage to see which customer segments and pricing tiers are most effective at driving Expansion MRR.

- NRR vs. GRR: Compare NRR against your Gross Revenue Retention (GRR). The difference between the two rates represents the percentage of your Starting MRR generated purely by your expansion and upsell strategies.