Cashflow

The Cashflow report provides a comprehensive view of all the money flowing through your subscription business. Unlike MRR which tracks recognized recurring revenue, the Cashflow report shows actual cash movements including one-time payments, refunds, fees, taxes, and currency exchange impacts.

This report is essential for CFOs and finance teams who need to understand the real financial position of the business, beyond just the recurring revenue metrics.

Overview

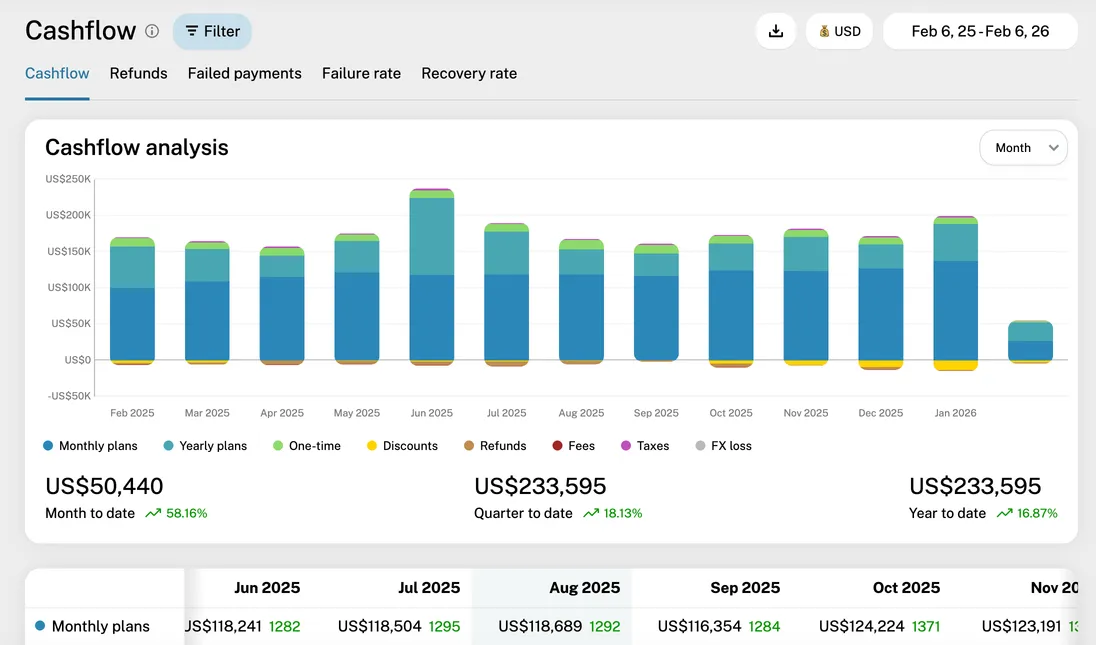

The Cashflow report includes a timeline chart showing your net cashflow over time, and a detailed breakdown table showing all cash components.

Timeline chart

The timeline chart displays your net cashflow over the selected period. Positive cashflow is shown in green, while negative cashflow (more money going out than coming in) is shown in red.

Hover over any point to see the detailed breakdown of cash components for that period.

Breakdown table

The breakdown table shows all cash movement categories:

| Category | Description |

|---|---|

| Recurring Revenue | Cash received from subscription payments |

| One-time Payments | Non-recurring charges like setup fees or add-ons |

| Refunds | Money returned to customers |

| Discounts | Revenue reduction from applied discounts |

| Processing Fees | Payment processor fees (Stripe, etc.) |

| Taxes | VAT, sales tax, and other taxes collected |

| FX Adjustments | Gains or losses from currency exchange |

| Net Cashflow | Total cash position after all adjustments |

Click any row to see the individual transactions that make up that category.

Filters

The Cashflow report supports comprehensive filtering:

- Date range - Select custom ranges or preset periods

- Interval - View by day, week, month, quarter, or year

- Currency - Choose your reporting currency. FX adjustments are calculated automatically using daily exchange rates.

- Additional filters - Filter by plan, region, customer segment, etc. (see all filters)

Exporting the data

Export the cashflow data as CSV for use in accounting software or financial models by clicking the "Export" icon.

Practical tips

- Reconciliation: Use the Cashflow report to reconcile your subscription revenue with your bank statements and accounting records.

- FX Impact: If you operate in multiple currencies, pay close attention to the FX Adjustments line to understand how currency fluctuations affect your bottom line.

- Fee Analysis: Monitor Processing Fees as a percentage of revenue. If fees are growing faster than revenue, it may be time to negotiate better rates with your payment processor.