Table of contents

Qualified pipeline

Founders don't miss revenue targets because they "didn't sell hard enough." They miss because they ran out of real opportunities early, then spent the last month of the quarter negotiating with deals that were never going to close.

Qualified pipeline is the total value of sales opportunities that have passed your qualification bar (real buyer, real problem, real path to purchase) and are expected to close in a defined time window (usually this month or this quarter).

It's the bridge between "we're generating interest" and "we can reliably hit bookings," and it's one of the cleanest early-warning signals you have.

What counts as qualified

Most teams get into trouble because "qualified" becomes a vibe, not a definition. Qualified pipeline only works when it is a gate—a standard that is consistently applied.

A practical SaaS qualification bar usually includes:

- ICP fit: industry, size, tech stack, security needs, and pricing tolerance match your target customer.

- Problem clarity: a specific pain exists and your product is meaningfully differentiated.

- Buyer reality: you know who can say yes (or you know the buying committee and process).

- Mutual plan: there's a documented next step and a credible path to close.

- Time window: the close date is inside your reporting window (e.g., this quarter) and the customer's timeline supports it.

If you're debating whether something is qualified, you probably need one extra rule:

No next step scheduled = not qualified.

Opportunities without a calendar commitment belong in "nurture," not in pipeline you're counting on.

The Founder's perspective

Qualified pipeline is a trust metric. When it's strict, your forecast becomes boring—in a good way. When it's loose, you'll "feel good" right up until week 11 of the quarter, then scramble with discounts and desperation closes.

Qualified pipeline vs. SQLs and MQLs

Qualified pipeline is downstream of lead metrics like MQL (Marketing Qualified Lead) and SQL (Sales Qualified Lead). You can have rising SQL volume and falling qualified pipeline if:

- reps are talking to lower-intent accounts,

- discovery is weak,

- pricing is misaligned, or

- deals are stalling before mutual commitment.

That's why founders like it: it's closer to cash.

How to calculate qualified pipeline

There are two common versions. You should know which one you're looking at.

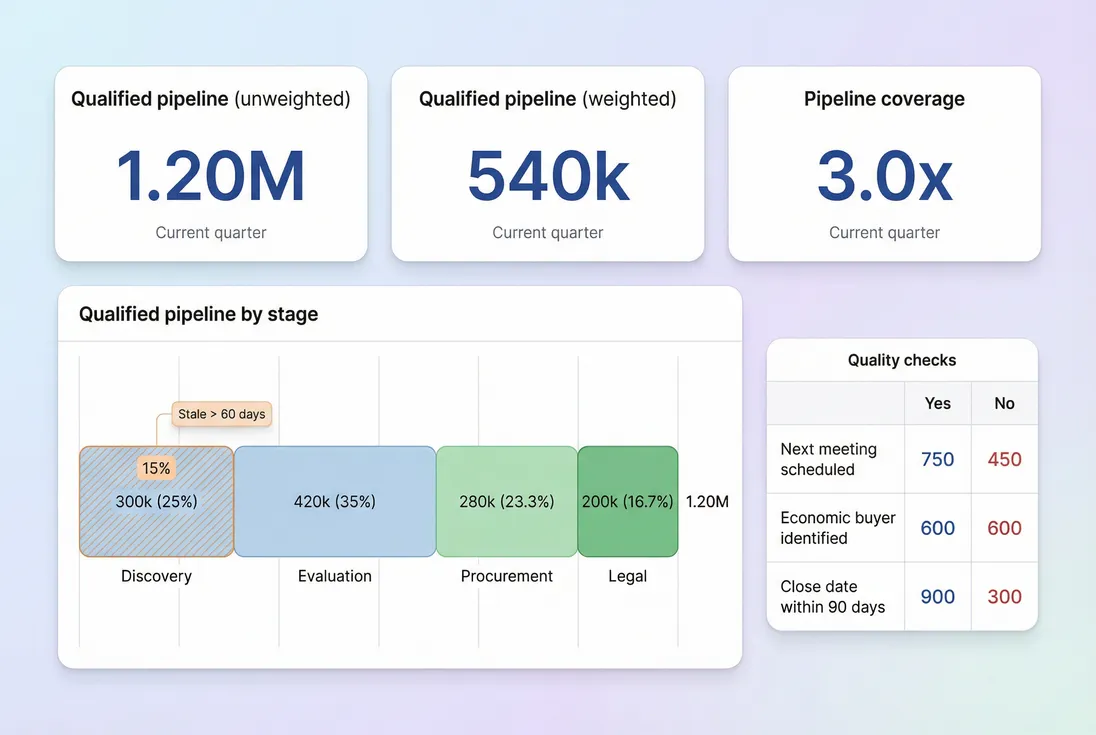

Unweighted qualified pipeline (simple and hard to fake)

Unweighted qualified pipeline is the total contract value (usually ACV) of all qualified opportunities expected to close in your time window.

Notes that matter in SaaS:

- Use ACV (Annual Contract Value) (or ARR equivalent) for comparability across monthly vs annual plans.

- Decide whether to include expansion opportunities separately from new business. Mixing them can hide new-logo weakness.

- If your company sells multi-year prepaid, track both ACV and total contract value for cash planning, but keep qualified pipeline primarily ACV-based for growth planning.

Weighted qualified pipeline (useful, but easy to "optimism drift")

Weighted qualified pipeline multiplies each opportunity's value by a probability of closing (often stage-based).

Weighted pipeline is helpful for forecasting, but it breaks when:

- stage definitions are inconsistent,

- probabilities are inflated,

- reps keep deals in later stages too long,

- close dates slip but remain inside the quarter.

A good operating rule: run the business on unweighted; forecast on weighted.

Pipeline coverage (the number founders actually need)

Coverage translates pipeline into whether you can plausibly hit a bookings goal.

If your quarterly new ARR bookings target is $200k and you have $600k qualified pipeline, you have 3.0x coverage.

Coverage becomes actionable when you tie it to your Win Rate:

- If win rate is 25%, "expected bookings" from $600k pipeline is about $150k.

- If you need $200k, you either need more pipeline, higher win rate, or higher deal size (see ASP (Average Selling Price) and ACV).

A quick "required pipeline" estimate:

(Use your real win rate on qualified opportunities, not overall lead-to-close.)

What drives qualified pipeline up or down

Qualified pipeline changes for only a few reasons. The trick is diagnosing which one you're seeing.

1) Volume of opportunities entering qualified

This is a throughput problem: not enough deals are becoming real.

Upstream drivers include:

- lead volume and conversion (see Lead Velocity Rate (LVR))

- SDR output and meeting show rates

- trial-to-sales handoff (if you're hybrid; see Free Trial)

- ICP targeting quality

If qualified pipeline is shrinking because fewer opportunities are entering, your "fix" is rarely inside sales calls. It's usually targeting, messaging, channel mix, or SDR capacity.

2) Average deal size of qualified deals

If your qualified pipeline is flat but bookings targets are rising, you're probably relying on deal size to bail you out.

Deal size moves due to:

- pricing and packaging changes

- seat counts or usage assumptions (see Per-Seat Pricing and Usage-Based Pricing)

- discounting behavior (see Discounts in SaaS)

- selling to larger or smaller segments

Founders should watch for a dangerous pattern: qualified pipeline up, ASP down. That often means demand is real, but you're drifting downmarket (and CAC payback may worsen).

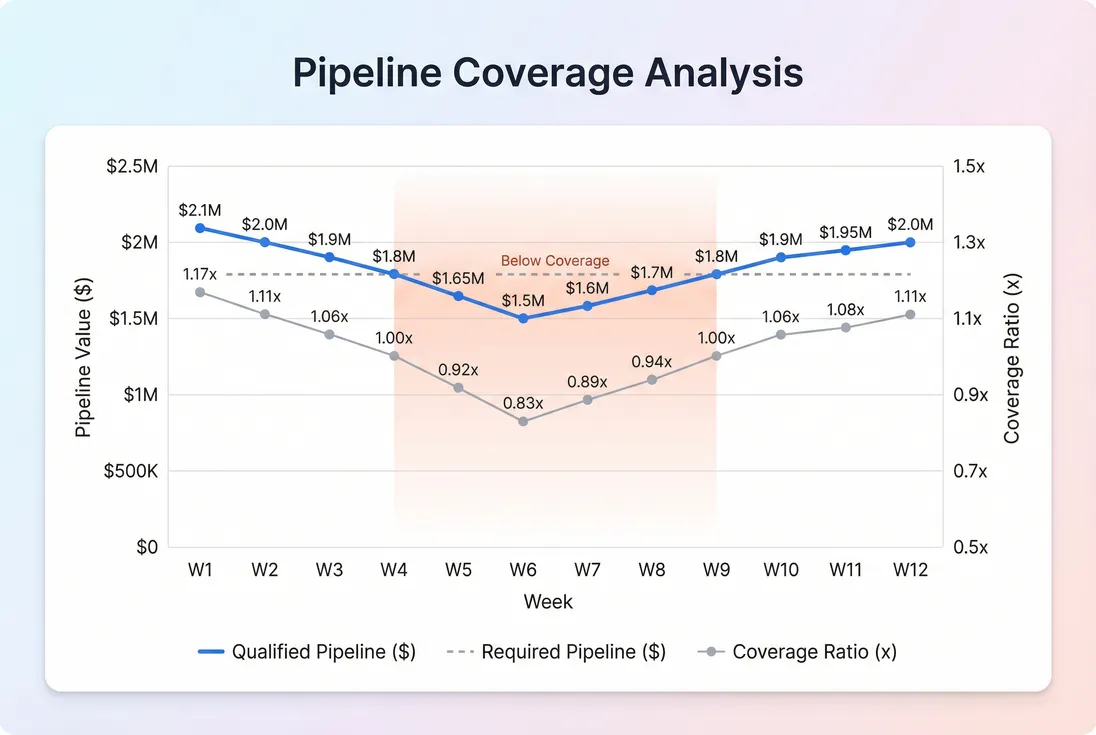

3) Sales cycle length and slippage

Pipeline is time-bound. A deal that slips out of the quarter effectively disappears from the metric, even if it's still alive.

If qualified pipeline drops late in the quarter, check:

- stage aging (time in stage)

- close date push-outs

- procurement/legal cycle realities

- whether deals are truly qualified or just "in stage 3"

Longer cycles also change your required coverage. If your Average Sales Cycle Length increases, you need more pipeline earlier to hit the same bookings.

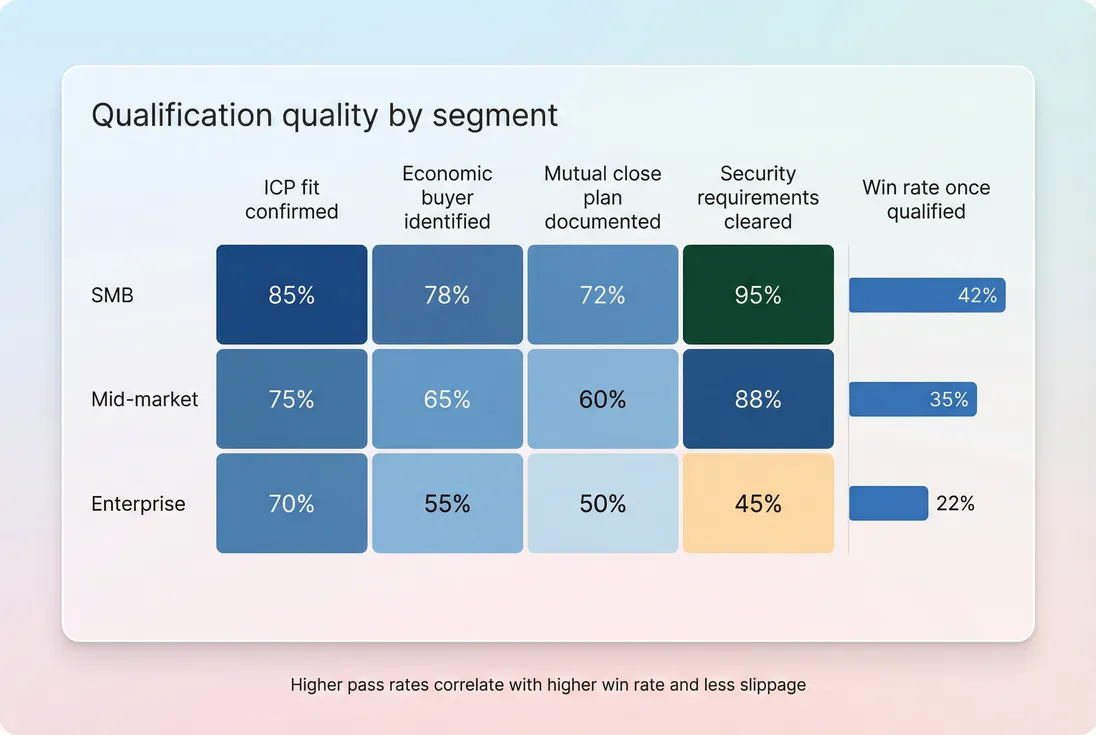

4) Qualification strictness (the silent killer)

When teams miss a quarter, they often "solve" it by loosening qualification so the pipeline number looks healthy. That's how you end up with:

- high pipeline coverage,

- low win rate,

- end-of-quarter discounting,

- and forecast misses.

The metric didn't fail—you changed what it means.

How much qualified pipeline you need

There's no universal benchmark, but there are reliable ranges once you account for win rate and sales cycle.

A practical coverage table

| Motion | Typical sales cycle | Typical win rate on qualified opps | Common coverage range |

|---|---|---|---|

| SMB transactional | 2–4 weeks | 25–40% | 1.5x–3x |

| Mid-market | 4–10 weeks | 15–30% | 3x–5x |

| Enterprise | 10–26+ weeks | 10–20% | 4x–6x+ |

Use this table as a starting hypothesis, then calibrate using your own history.

The founder-grade way to set a target

- Start with a bookings target (new ARR or ACV) tied to your ARR plan (see ARR (Annual Recurring Revenue)).

- Use your actual win rate on qualified opportunities.

- Inflate for slippage risk if deals routinely push.

Example:

- Quarterly bookings target: $300k new ARR

- Win rate: 20%

- Slippage adjustment: 1.2 (because a chunk will slip)

Required qualified pipeline:

So: $300k / 0.20 × 1.2 = $1.8M qualified pipeline needed.

That's the number you can manage to weekly.

How to interpret changes (without fooling yourself)

Qualified pipeline is a signal, but only if you interpret it with context.

When it rises

A rise is good when it comes from:

- more opportunities entering qualified,

- higher ACV deals entering qualified,

- healthier stage progression (more late-stage mix),

- improved quality checks (next steps, buyer identified).

A rise is suspicious when it comes from:

- close dates pulled forward without new information,

- stage "upgrades" without mutual commitment,

- inflated probabilities (weighted pipeline jumps, unweighted does not),

- old deals resurrected without a real trigger.

When it falls

A fall can be good if it reflects cleanup:

- removing stale deals,

- tightening qualification,

- pushing out unrealistic close dates.

A fall is dangerous when:

- qualified inflow is down for multiple weeks,

- stage aging is up,

- win rate is declining at the same time.

That combo usually means demand quality is deteriorating (channel drift, ICP mismatch, competitive pressure, or pricing friction).

Where qualified pipeline breaks

Most SaaS teams don't have a pipeline problem; they have a definition and hygiene problem. Here are the common breakpoints and what to do about them.

Close-date fantasy

Symptom: big pipeline number, but deals keep slipping.

Checks: percent of qualified pipeline with close date changes in the last 14 days; stage age distribution.

Fix: enforce "close date requires customer-confirmed milestone." No milestone, no date.

Late-stage parking lot

Symptom: procurement/legal stages are bloated; weighted pipeline looks great; bookings miss anyway.

Checks: median days in late stages; number of "no next step" deals.

Fix: create an explicit "blocked" status and exclude blocked deals from qualified pipeline until the customer re-engages with a dated action.

Qualification inflation

Symptom: qualified pipeline rises, but win rate falls.

Fix: tighten the gate. If your qualified-to-won conversion drops, your definition is too permissive or your ICP drifted.

Tie this back to unit economics: if you're paying to acquire low-quality opportunities, you'll see it in CAC (Customer Acquisition Cost) and later in CAC Payback Period.

Deal size mirage

Symptom: qualified pipeline is "fine," but it's made of many tiny deals or a few unrealistic whales.

Checks: distribution of ACV in qualified (median and percent in top 5 deals).

Fix: split reporting: "core segment qualified pipeline" vs "outlier qualified pipeline." Outliers should never be the plan.

This also connects to concentration risk when you do land whales (see Customer Concentration Risk).

How founders use it in real decisions

Qualified pipeline is operationally useful because it tells you what to do this week.

Decide whether to hire sales

If qualified pipeline per rep is low, adding reps usually makes results worse (more people fighting over too few real deals).

A practical heuristic before hiring:

- Can each rep realistically carry enough qualified pipeline to hit quota with your win rate?

- Is qualified pipeline inflow growing fast enough to support more capacity?

If not, hire SDR/marketing capacity first, or fix ICP/messaging.

The Founder's perspective

I don't greenlight a sales hire because we want growth. I greenlight it because we have repeatable qualified pipeline creation per rep, and the bottleneck is capacity—not demand quality.

Decide where to spend (and what to cut)

When qualified pipeline is below required coverage, you can choose among three levers:

- Increase qualified inflow (channels, outbound, partnerships).

- Increase conversion (sales process, enablement, tighter ICP).

- Increase deal size (packaging, pricing, selling higher).

Tie spend decisions to efficiency metrics like Burn Multiple and Sales Efficiency. If you're burning cash but qualified pipeline isn't rising, the spend is not creating winnable demand.

Prevent discount spirals

Discounting often appears late in the quarter when qualified pipeline was weak six weeks earlier.

If coverage is low, your choices are:

- accept the miss and protect pricing power, or

- discount to pull deals in.

The right call depends on your cash constraints (see Burn Rate and Runway). But qualified pipeline gives you the warning early enough to choose—not panic.

Align product and GTM

A healthy qualified pipeline is not only sales execution; it reflects product-market clarity. If qualification fails for the same reasons repeatedly (no urgency, weak differentiation, missing integrations), that's product strategy feedback.

Use a simple "lost in qualification" reason tracking alongside Churn Reason Analysis so you're learning on both acquisition and retention.

A simple operating cadence

Qualified pipeline becomes powerful when you review it consistently and force decisions.

Weekly (founder + sales lead)

- Qualified pipeline vs required (coverage)

- Inflow into qualified this week (count and ACV)

- Stage aging and "no next step" count

- Top 10 deals: next step, buyer, close plan, and a single key risk

Monthly (GTM planning)

- Win rate on qualified opps (by segment, channel, rep)

- Slippage rate (percent that moved out of month/quarter)

- ASP/ACV trend in qualified (see ASP (Average Selling Price))

- Leading indicators: SQL volume and qualification rate (see Lead-to-Customer Rate)

Quarterly (strategy)

- Is the qualification bar correct for your motion?

- Are you drifting upmarket or downmarket?

- Are you under-investing in demand gen or over-hiring sales?

- Does pipeline reality support your ARR plan (see ARR (Annual Recurring Revenue))?

Practical takeaways

- Qualified pipeline is not "pipeline in the CRM." It's pipeline you'd bet payroll on.

- Track unweighted for truth and weighted for forecasting.

- Manage to a required pipeline line using win rate and slippage.

- When the metric moves, diagnose: inflow, deal size, cycle time, or qualification strictness.

- Tight definitions and hygiene beat heroic end-of-quarter closing every time.

Frequently asked questions

Most SaaS teams operate with 2x to 5x coverage depending on deal size and cycle length. SMB with fast cycles can run closer to 1.5x to 3x. Mid-market and enterprise often need 3x to 6x because win rates are lower and deals slip. Use your own win rate and sales cycle as the anchor.

Track both. Unweighted shows raw "at-bat" dollars and whether top-of-funnel volume is sufficient. Weighted is better for near-term forecasting but is easy to game with overly optimistic probabilities. If weighted looks good while unweighted is thin, you likely have forecasting optimism rather than real demand.

Define qualified as a consistent gate: clear ICP fit, confirmed problem, identified buying process, realistic close window, and a commercial path to your typical deal size. If you are sales-led, tie it to a completed discovery. If you are product-led, require usage evidence plus buyer identification before calling it qualified.

A spike can be real progress, but it is often reclassification. Common causes: old opportunities were moved into a "qualified" stage without new discovery, close dates were pulled forward, or duplicates were merged. Validate by checking stage age, next steps scheduled, and whether new opportunities entered qualified in the last two weeks.

Qualified pipeline is an input to bookings, and bookings drive future ARR. Convert pipeline to expected bookings using win rate and expected timing, then translate bookings into ARR using contract terms and start dates. Use this alongside metrics like ACV and win rate to test whether your ARR goal is achievable with current demand.