Table of contents

LTM (Last Twelve Months) revenue

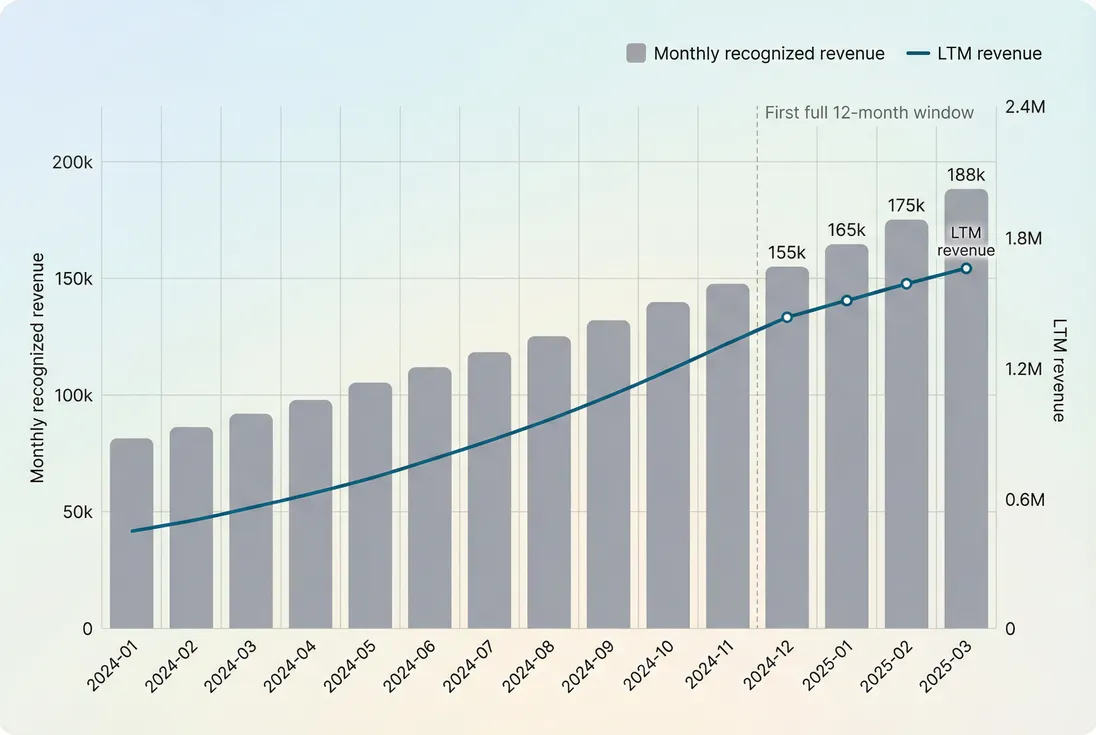

Founders like LTM revenue because it answers a brutally practical question: what did the business actually earn over the last year, in a way that smooths out monthly noise. That makes it a common anchor for budgeting, investor updates, valuation conversations, and sanity-checking your growth narrative.

LTM (Last Twelve Months) revenue is the total revenue recognized across the most recent 12 months. It's a trailing, rolling number: every new month you add the latest month and drop the month from 12 months ago.

What LTM revenue reveals

A reality check on scale

MRR and ARR are great for momentum, but they can mislead if your revenue is seasonal, spiky, or influenced by annual prepayments. LTM revenue answers: how much revenue was actually recognized in the last year (see Recognized Revenue).

This matters when you're making "scale" decisions:

- hiring ahead of growth

- increasing paid acquisition

- stepping up infrastructure spend

- deciding whether you're ready for an audit, a financing round, or M&A (see M&A Readiness)

The Founder's perspective: If you're about to add a sales pod or commit to a 12-month vendor contract, LTM revenue is a safer baseline than a single great month. It tells you what the business has proven it can sustain across a full year of churn, expansions, and seasonality.

Why investors ask for it

Many external conversations implicitly anchor on trailing performance:

- EV/Revenue discussions often reference a trailing base (see EV/Revenue Multiple)

- diligence questions like "what did you do in the last twelve months?" are trying to avoid cherry-picked months

How it differs from ARR and MRR

LTM revenue is trailing and inclusive. ARR/MRR are run-rate and usually recurring-focused.

| Metric | Time orientation | What it represents | Where it shines | Where it misleads |

|---|---|---|---|---|

| MRR (Monthly Recurring Revenue) | Current month | Recurring run-rate | Operating cadence, retention | Ignores non-recurring, volatile month |

| ARR (Annual Recurring Revenue) | Forward run-rate | Annualized recurring run-rate | Planning, valuation framing | Overstates if growth is recent or churn is rising |

| LTM revenue | Trailing 12 months | Recognized revenue total | Scale, trend, seasonality | Lags in fast growth; mix can hide issues |

A useful mental model:

- In fast growth, ARR tends to be higher than LTM revenue (LTM includes earlier, smaller months).

- In decline, ARR tends to be lower than LTM revenue (LTM still includes better historical months).

How to calculate it correctly

The clean definition is simple: add up recognized revenue for the last 12 calendar months.

If you want to track momentum, calculate LTM growth versus the prior LTM period:

Recognized revenue vs billed vs cash

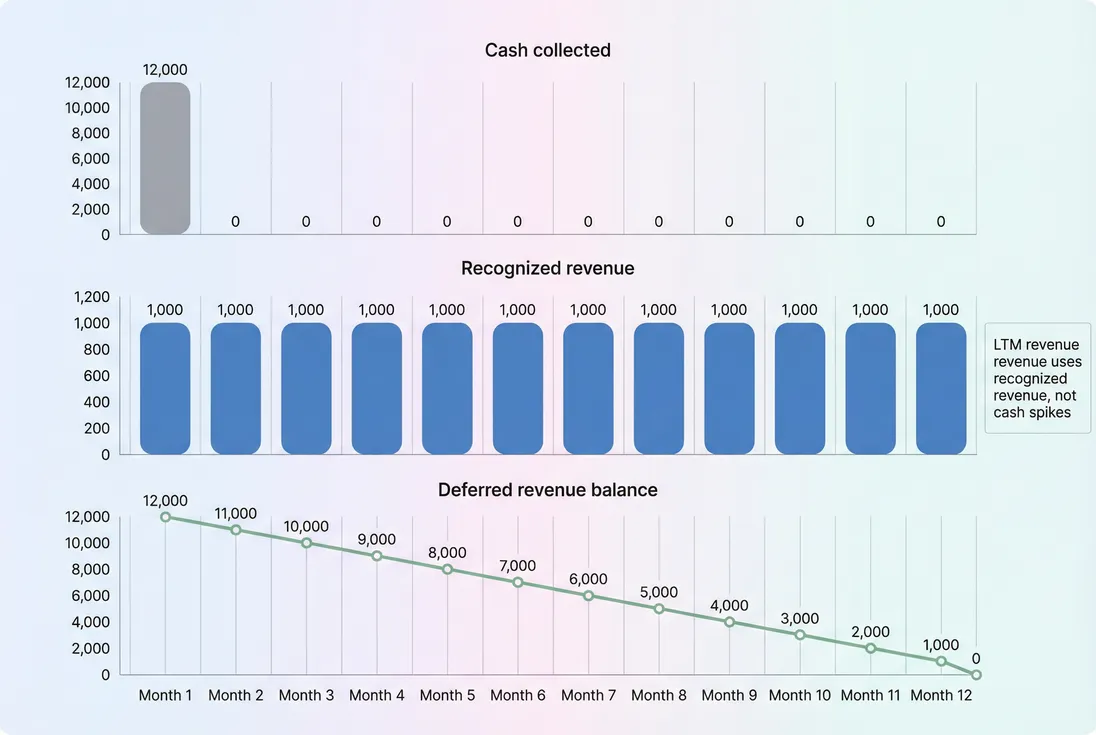

Most confusion comes from mixing three different "revenues":

- Cash collected (bank/Stripe payouts): affected by annual prepay timing, refunds, and chargebacks.

- Billed/invoiced: closer to commercial activity, but still timing-dependent.

- Recognized revenue: matches delivery of service over time (what financial statements typically use).

If your SaaS sells annual prepaid plans, cash collected will spike while recognized revenue smooths across the contract term. That's why LTM revenue is typically based on recognized revenue rather than cash.

What to include (and what to net out)

To keep LTM revenue decision-grade, define inclusions explicitly:

Include:

- subscription revenue recognized in the period

- usage-based revenue recognized in the period (see Usage-Based Pricing and Metered Revenue)

- one-time fees only if they are part of recognized revenue in the period (see One Time Payments)

Net out:

- refunds (see Refunds in SaaS)

- chargebacks (see Chargebacks in SaaS)

- discounts as they reduce revenue recognized (see Discounts in SaaS)

Be careful with taxes:

- VAT/GST is often collected on behalf of governments and typically shouldn't be counted as revenue (see VAT handling for SaaS).

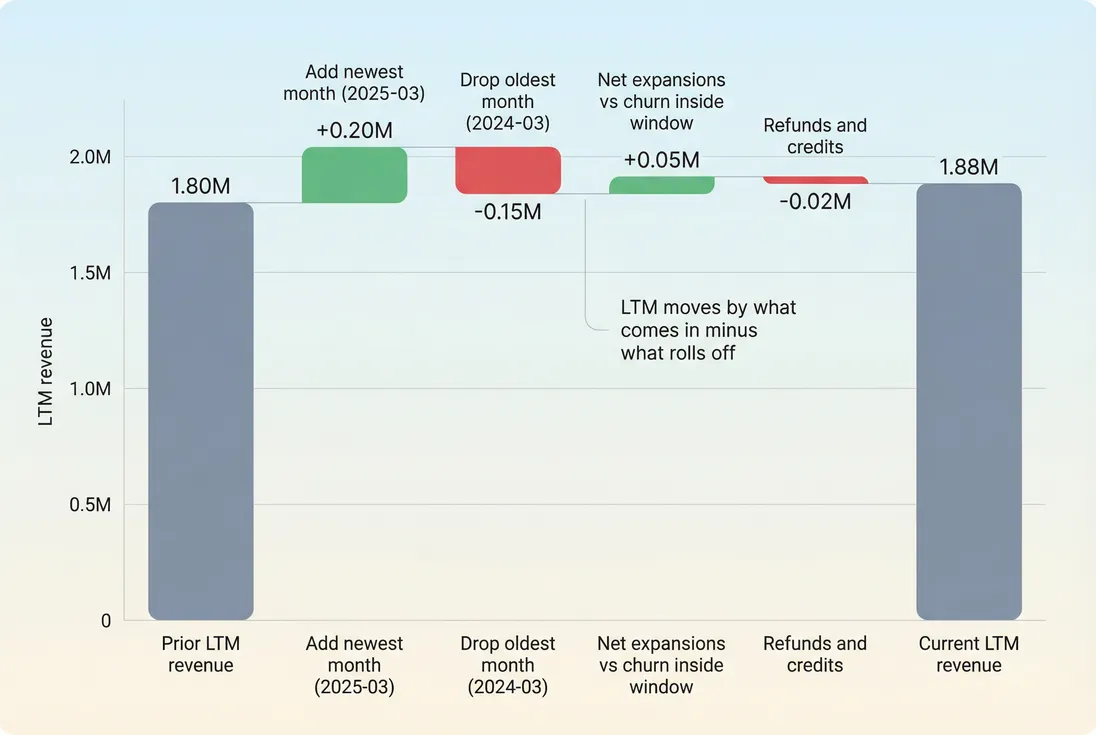

Why it moves month to month

Founders often expect LTM revenue to behave like a "scoreboard." It's not. It's a rolling window, so two forces are always at work:

- The newest month gets added.

- The month from 12 months ago drops off.

So the net change is:

That's why you can have a strong month and still see LTM barely move—if last year's same month was also strong.

A concrete example

- December last year recognized: $180k

- December this year recognized: $190k

Even if $190k feels like a win operationally, LTM only increases by $10k from this swap, before considering other months already in the window.

The "mix" problem: growth can hide churn

LTM revenue can rise while the business gets less healthy, because LTM is a total, not a diagnostic. Two common patterns:

- Discounting to grow: total LTM rises, but ASP and margins erode (see ASP (Average Selling Price) and Gross Margin).

- New sales masking retention issues: LTM rises, but NRR (Net Revenue Retention) or GRR (Gross Revenue Retention) deteriorates.

This is where you pair LTM revenue with the drivers:

The Founder's perspective: When LTM looks "fine," the temptation is to keep doing what you're doing. Don't. Use LTM as the headline, then immediately ask: did it come from new logos, expansion, price, or one-time items? If the answer is mostly new logos while retention slips, your growth is getting more expensive.

Where it misleads founders

Fast growth and "lag"

In fast growth, LTM revenue will understate your current run-rate because it averages in older, smaller months. If you recently doubled MRR, LTM will take time to reflect it.

Practical fix:

- report LTM revenue alongside ARR (Annual Recurring Revenue) or MRR (Monthly Recurring Revenue)

- show both the level and the trajectory (LTM growth rate and MRR trend)

Annual contracts and billing changes

LTM revenue based on recognized revenue is robust to annual prepay timing, but it's still sensitive to:

- changes in revenue recognition policy (less common for small SaaS, but it happens)

- shifting contract start dates (e.g., many renewals in January creates seasonality)

- implementation milestones if you recognize some revenue on delivery

If you're using billed revenue instead, billing policy changes can create false swings:

- moving from monthly to annual invoicing

- changing invoice timing (start-of-month vs mid-month)

- introducing upfront setup fees

One-time revenue distorts the story

If you include one-time items (implementation, overages, backfill invoices, true-ups), LTM revenue becomes a blend of recurring and non-recurring.

This is not "wrong," but you should be explicit:

- "LTM recognized revenue, total"

- plus a split: recurring vs non-recurring

Rolling-window optics can confuse teams

LTM can decline even when your most recent months are improving, if the months rolling off were unusually strong (for example, a big enterprise go-live last year).

This is why you should visualize the "roll-off" effect.

How founders use it in decisions

1) Budgeting and hiring

LTM revenue is a strong input for annual planning because it approximates what the business sustained across a full year.

A practical approach:

- Use LTM revenue as your "base capacity."

- Layer on a conservative growth assumption informed by current Revenue Growth Rate and retention metrics (NRR/GRR).

- Stress test with churn scenarios (see Customer Churn Rate).

Tie this into cost discipline:

- Compare LTM growth to burn (see Burn Rate and Burn Multiple) to avoid scaling spend faster than durable revenue.

The Founder's perspective: If you're using one exceptional quarter to justify a permanent cost increase, you're taking timing risk. LTM revenue helps you hire to the business you actually have, not the business you hope you have.

2) Investor updates and board reporting

LTM revenue is a stable headline number for monthly board packs because it doesn't whipsaw with billing timing.

What to include next to it (so it's not a vanity total):

- LTM revenue growth rate (YoY)

- current ARR or MRR run-rate

- NRR (Net Revenue Retention) and Logo Churn

- ARPA trend (see ARPA (Average Revenue Per Account))

3) Pricing and packaging validation

After a pricing change, founders often stare at MRR and wonder if it "worked." LTM revenue gives you a longer lens:

- a healthy pricing move should lift trailing revenue without requiring discounting to maintain volume

- if LTM rises but ARPA falls, you may be buying growth with discounts

Related reading that typically pairs well:

4) Segment-level strategy (where your LTM really comes from)

Company-wide LTM can hide dependency and risk. The operationally useful view is LTM revenue by segment, such as:

- self-serve vs sales-led (see Product-Led Growth and Sales-Led Growth)

- SMB vs mid-market vs enterprise

- geography (especially if taxes/refunds differ)

- plan tier

If you're using GrowPanel, this is where filters and the customer list become practical: segment your base, then cross-check LTM movement drivers using MRR (Monthly Recurring Revenue) and mrr movements (new, expansion, contraction, churn) to see whether LTM growth is durable or just acquisition-heavy.

(Reference: Filters, MRR (Monthly Recurring Revenue), MRR movements, Customer list)

5) Cash planning and collections (don't confuse it)

LTM revenue is not cash. For cash predictability, pair it with:

- Accounts Receivable (AR) Aging to see if revenue is collectible

- Deferred Revenue to understand how much cash you've already collected for future delivery

- refunds and chargebacks rates to estimate leakage

Practical interpretation rules

Use these rules of thumb to avoid common mistakes:

- If LTM is rising but ARR is flat, you may be seeing one-time revenue or timing effects—inspect mix.

- If ARR is rising fast but LTM is slow, you're likely in acceleration; validate retention so it's not a leaky bucket.

- If LTM is flat for months, it often means your newest months are only modestly better than the months rolling off—focus on improving the monthly engine (acquisition, expansion, churn).

- If LTM drops unexpectedly, check for refunds, credits, churn recognition timing, or an unusually strong month rolling off.

A simple reporting template

For most SaaS founders, this compact set is enough for monthly leadership review:

- LTM revenue (total recognized)

- LTM revenue growth rate (YoY)

- Current MRR and ARR run-rate

- NRR and GRR

- Net MRR churn rate

- ARPA trend

This keeps LTM as the stable headline, while the recurring metrics explain why it moved and whether it's sustainable.

Frequently asked questions

LTM revenue is the total revenue recognized over the last 12 months. ARR is a forward-looking run-rate based on recurring revenue today. In fast growth, ARR usually looks higher than LTM because LTM includes earlier, smaller months. In decline, LTM can look higher than ARR.

Include them if you are measuring total recognized revenue, which is what most investors mean by LTM revenue. If you want a recurring-only view, break out recurring versus non-recurring alongside LTM. The key is consistency: define it once, and report both the total and the mix.

Because LTM is a rolling 12-month window. A strong new month gets added, but the month from 12 months ago drops off. If the new month is only slightly better than the month that rolled off, LTM won't move much. This is normal and is why LTM smooths volatility.

Benchmarks depend on stage and base size. Early-stage companies often target triple-digit year-over-year growth, while later-stage firms may target 30 to 60 percent. Use LTM growth to judge whether your go-to-market is accelerating or decelerating, then validate with retention and sales efficiency metrics.

Not reliably. Cash receipts are impacted by annual prepayments, refunds, chargebacks, and timing. LTM revenue is typically recognized revenue, which follows delivery of service over time. If you only have cash data, report "LTM cash collected" separately and avoid mixing it with recognized revenue in investor updates.