Table of contents

Involuntary churn

Involuntary churn is the most frustrating kind of churn because it's "accidental": customers who likely still want your product disappear because the payment rails failed. For founders, it's a profit leak that quietly inflates churn, depresses GRR (Gross Revenue Retention), and makes your growth look worse than your product actually is.

Definition: Involuntary churn is revenue or customers lost because payment collection fails (card declines, expired cards, bank issues, failed renewals) and the account is eventually canceled or access is removed—without the customer intentionally choosing to leave.

A practical way to think about it: voluntary churn is a product/value problem; involuntary churn is a billing/collection problem. You need both separated to run the business correctly.

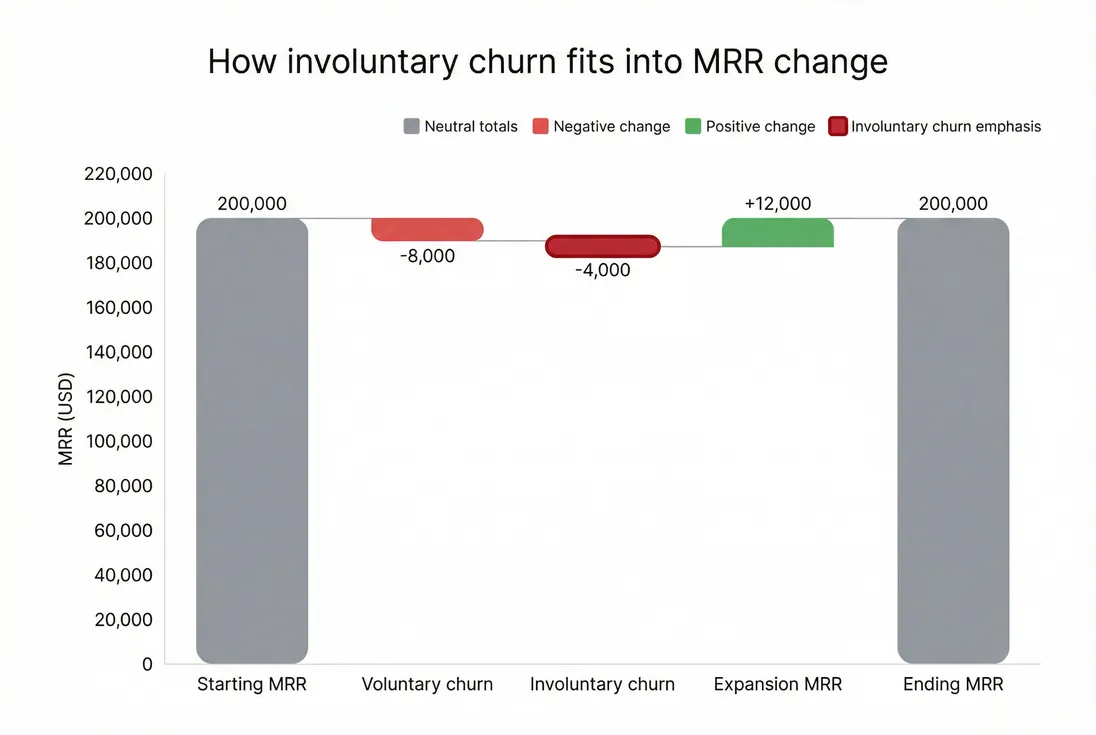

Involuntary churn is a specific slice of revenue loss inside overall MRR movement—separating it keeps you from blaming product or pricing for billing failures.

What this metric reveals

Involuntary churn answers one operational question: How much revenue are we losing due to payment collection failure, not customer intent?

That matters because it changes what you do next:

- If churn is mostly voluntary, you invest in onboarding, product, pricing, and customer success.

- If churn is materially involuntary, you invest in billing reliability: retries, payment method mix, notifications, and operational follow-up.

It also affects how you interpret your broader churn and retention metrics:

- MRR Churn Rate looks worse when involuntary churn rises, even if customers still love the product.

- Net MRR Churn Rate can mask involuntary churn if expansion is strong—meaning you can be "winning" on net while still leaking avoidable customers.

- Logo Churn can spike due to payment failures in low-ARPA segments even when higher-value customers retain.

The Founder's perspective: When investors (or you) ask "why did churn spike?", you want to answer with evidence. "We had a product issue" and "our dunning broke after a billing migration" lead to completely different fixes, timelines, and headcount decisions.

How to calculate it cleanly

You can measure involuntary churn in revenue terms (MRR), logo terms (customers), or both. Revenue-based is usually the decision driver because it ties directly to growth, runway, and valuation.

Revenue-based involuntary churn rate

At a high level:

Involuntary churned MRR should include only MRR that ended because the account became unpaid and then was canceled/locked after your standard recovery window.

Starting MRR is typically MRR at the beginning of the month (or quarter). Keep it consistent with how you calculate MRR (Monthly Recurring Revenue).

Logo-based involuntary churn rate

Useful when you're diagnosing workflow breakdowns (e.g., a specific payment method failing):

Involuntary churn as a share of churn

Founders often want a quick "how much of our churn is avoidable?" view:

This ratio is directionally powerful. If it rises, your churn problem is becoming more "ops and billing" than "product and value."

Two rules that prevent self-deception

Don't count the first decline as churn.

A card decline is a collection event, not churn. Only count churn once service stops or the subscription is terminated, aligned with your policy.Be consistent about gray areas.

Chargebacks and refunds complicate classification. A chargeback can be fraud, bank error, or buyer's remorse. Decide a policy and apply it consistently; if you can't confidently label it, keep an "unknown" bucket and use Churn Reason Analysis discipline rather than guessing. (Related: Chargebacks in SaaS and Refunds in SaaS.)

What actually drives involuntary churn

Involuntary churn usually comes from a handful of predictable failure modes. The fastest way to improve it is to stop treating it like a mystery and start treating it like a pipeline with drop-offs.

Common causes (and what they look like)

| Driver | What you see in metrics | Typical fix direction |

|---|---|---|

| Expired cards / replaced cards | Higher declines on older cohorts | Card updater support, proactive reminders |

| Bank declines / insufficient funds | Higher declines near month-end, in SMB plans | Retry timing, alternate payment methods, invoice options |

| Authentication failures (SCA, 3DS) | Higher failures in certain regions | Better checkout flows, retries requiring customer action |

| Billing implementation bugs | Sudden step-change spike across segments | Rollback, processor logs, invoice/charge reconciliation |

| Pricing changes / plan migrations | Declines correlate with price increase date | Improve comms, proration clarity, "confirm payment" prompts |

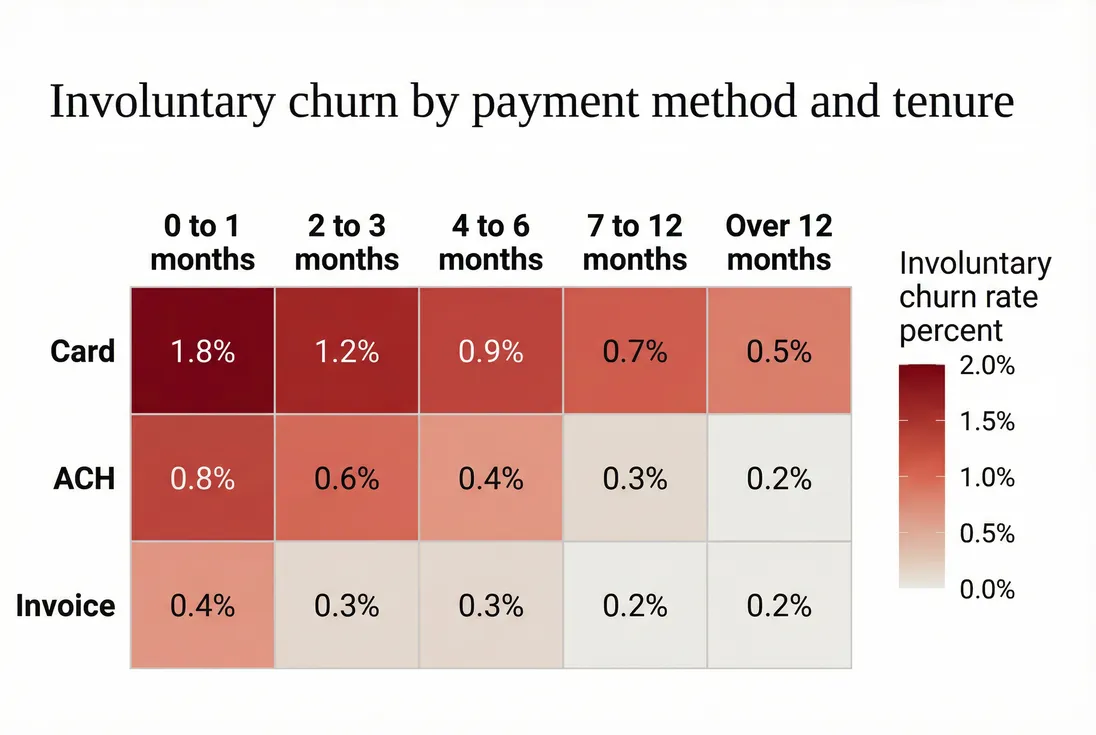

| Payment method mix (cards only) | Higher churn in geos where cards are weak | Add ACH/SEPA/wire, local methods |

Why retries and grace periods matter

Involuntary churn is often determined by process design more than by customer willingness:

- How many retries do you run?

- Over how many days?

- Do you notify the customer immediately?

- Can they fix it in one click?

- Do you suspend access, reduce features, or allow a grace period?

A small change (like moving retries from 3 days to 10 days) can materially reduce involuntary churn—but it can also increase delinquency risk if you keep delivering service with no payment. That's why you should pair involuntary churn tracking with something like Accounts Receivable (AR) Aging if you invoice customers.

The Founder's perspective: If you're optimizing runway, involuntary churn is "found money," but only if you don't create a new problem: unpaid service delivery. Your policy should balance recovery and risk, and your metric definitions should match that policy.

How to interpret changes

The biggest mistake founders make is reacting to the level without looking at the composition.

A rising involuntary churn rate usually means one of three things

More payments are failing (collection reliability worsened)

Examples: processor issues, new decline rules, checkout/auth changes, card updater disabled.Your recovery process weakened (fewer failures recovered)

Examples: retries reduced, notifications broken, emails going to spam, dunning not localized.Your customer mix changed (same process, riskier inputs)

Examples: more low-ARPA customers, different geographies, more month-to-month plans, more debit cards.

A falling involuntary churn rate can be misleading

It can mean improvement—but it can also mean you changed definitions or timing. Common "false improvements":

- You extended grace periods and now call customers "active" longer (churn delayed).

- You moved customers to annual invoicing and now the issue shows up as AR delinquency instead of churn.

- You tightened cancellation policy so people cancel voluntarily before failing payment (classification shift).

When this metric moves, sanity-check it against:

- MRR Churn Rate (did total churn move too?)

- Retention views by cohort (did newer cohorts behave differently?)

- Payment failure counts and recovery timing (even if you track these outside your main dashboard)

How to diagnose spikes fast

Treat involuntary churn like incident response: isolate, segment, then fix root cause.

Step 1: confirm it's truly involuntary

Pull a sample of churned accounts and verify:

- Was there a cancellation event initiated by the customer?

- Were there failed invoices/charges leading up to churn?

- Did access end due to non-payment?

If you have mixed signals, separate into:

- Voluntary

- Involuntary

- Unknown / needs review

This is where tooling that provides a customer list and MRR movements is practical: you want to click from the metric into the underlying customers and events, not debate it in aggregate. (See: MRR (Monthly Recurring Revenue) and the docs for MRR movements.)

Step 2: segment to find the "break"

Most spikes come from one segment. The highest-yield cuts:

- Payment method (card vs ACH, etc.)

- Geo (country/region)

- Plan / price point (especially after price changes)

- Tenure (new customers vs long-tenured)

- ARPA buckets (see ARPA (Average Revenue Per Account))

If you can apply filters to churn and retention views, you can usually isolate the culprit in minutes instead of days. (See: filters.)

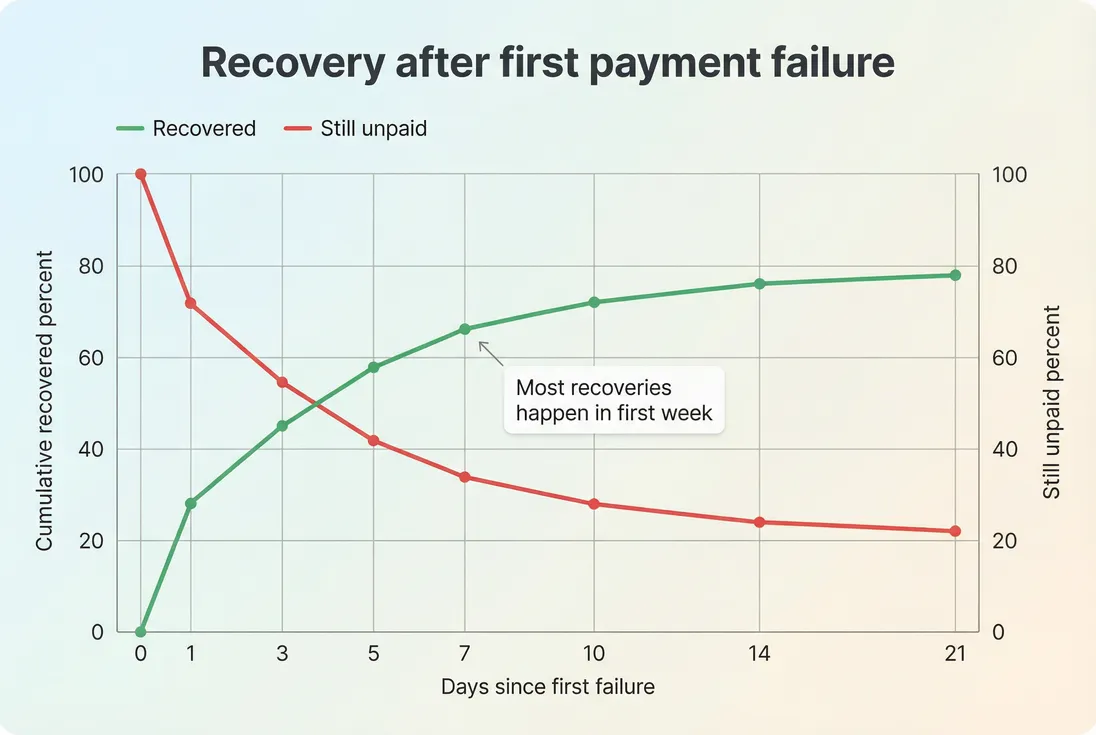

Step 3: look at the recovery curve

Involuntary churn is the end state. The leading indicator is how quickly failed payments get recovered.

The recovery curve shows whether you have a dunning/process issue (recoveries drop) versus a customer mix issue (recoveries stable but failures increase).

If your curve used to reach ~80% recovery by day 10 and now stalls at ~60%, the problem is likely in messaging, retries, or authentication—not in product value.

When the metric breaks

Involuntary churn is conceptually simple, but real billing setups create edge cases. If you don't define them, your metric will be noisy and you'll argue about it every month.

Annual and prepaid contracts

If you bill annually upfront, you'll see less month-to-month involuntary churn because there's no monthly collection event. But involuntary churn can still appear when:

- Renewal fails at the annual boundary

- Card details are outdated at renewal

- Procurement changes disrupt payment

Practical approach:

- Track involuntary churn at renewal months separately

- Use cohort views to compare annual renewal performance (see Cohort Analysis)

Invoicing and net terms

For invoice-based enterprise SaaS, "involuntary churn" often shows up as delinquency first, then eventually service termination or write-off.

If you only track cancellations, you'll miss the operational signal until it's too late. Pair your churn view with AR discipline (see Accounts Receivable (AR) Aging)).

Pauses, downgrades, and partial access

If you allow customers to pause, downgrade automatically, or go into a "read-only" mode when unpaid, decide what churn means:

- Is "paused but recoverable" churn? Usually no.

- Is "read-only" still an active customer? Depends on whether you consider it retained revenue or retained relationship.

The metric should reflect your business reality: if you're not recognizing revenue and not providing value, treat it as churn even if the account object still exists.

How founders use it to decide

Involuntary churn is most useful when it drives specific, near-term decisions. Here are the common ones.

Prioritizing retention work correctly

If involuntary churn is a meaningful share of total churn, it's often the fastest retention win because it doesn't require product changes—just better collection.

This is especially impactful if your CAC Payback Period is tight. Saving "accidental" churned customers increases realized LTV without additional acquisition spend (see LTV (Customer Lifetime Value)).

Planning pricing and packaging changes

Price increases and plan migrations often trigger involuntary churn via:

- Customers hitting card limits

- New authentication flows

- Confusion about proration leading to disputes

Before and after any pricing move, watch involuntary churn segmented by plan and ASP (Average Selling Price) band. A pricing win that creates a billing loss can net out poorly.

Managing risk by segment

If involuntary churn concentrates in a segment (e.g., low-ARPA monthly customers in certain countries), you have strategic options:

- Require stronger payment methods for that segment

- Offer annual discounts to reduce collection events (see Discounts in SaaS)

- Adjust qualification standards (especially if you're sales-led and seeing low-quality wins)

The Founder's perspective: A spike in involuntary churn is often a "hidden tax" on growth. If you don't fix it, you'll compensate by hiring more sales or spending more on marketing—when the cheaper move was to stop revenue from falling through the cracks.

Tactics that reliably reduce involuntary churn

You don't need 20 initiatives. Most of the gains come from doing a few basics consistently.

Fix the recovery pipeline

High-impact levers:

- Smart retry schedule: more retries early (first 3–7 days), then taper.

- Clear notifications: immediate notice on failure, then reminders before access changes.

- One-click payment update: minimize friction; your customer should fix it in under a minute.

- Grace period policy: long enough to recover good customers, short enough to avoid excess unpaid service.

Reduce failure frequency

- Support payment methods that fit your customers (cards aren't universal).

- Encourage annual prepay where it makes sense (fewer collection events per year).

- Watch authentication and compliance issues in specific regions (SCA/3DS dynamics).

Don't confuse "saving churn" with "creating bad debt"

If you extend grace periods or keep service on while unpaid, track downstream effects:

- rising delinquent balances

- higher write-offs

- more chargebacks

For invoice-heavy models, this is exactly why pairing churn views with AR processes matters.

Practical benchmarks and targets

Benchmarks vary widely by market, payment method, and price point, but these ranges are useful for calibration:

- Card-first SMB SaaS: involuntary churn often ~10–30% of total churned MRR.

- High-velocity self-serve: involuntary logo churn can be noticeable even if MRR impact is smaller (many low-ARPA accounts).

- Enterprise invoicing: cancellation-based involuntary churn may look low; risk shows up in AR aging and write-offs instead.

A good internal target is not a universal number—it's continuous improvement against your baseline, validated by stable definitions. If you make a billing change and involuntary churn drops without a rise in delinquency or disputes, that's a real win.

How to operationalize it monthly

A lightweight cadence that works for busy teams:

- Report the split: voluntary vs involuntary vs unknown, in both MRR and logos.

- Review top segments: by plan, ARPA, geo, and tenure.

- Inspect the outliers: sample 10–20 involuntary churned accounts and confirm root cause.

- Track one leading indicator: recovery by day (or recovery rate within 7 days).

- Ship one fix per month: retry logic, email deliverability, payment update UX, or payment method expansion.

If you already track churn and retention in a dashboard, the key is making this metric actionable: the best view is one that lets you move from "involuntary churn is up" to "it's concentrated in these customers and this payment path" quickly. (Related reading: Retention and Cohort Analysis.)

A tenure-by-payment-method heatmap quickly reveals whether involuntary churn is a universal billing issue or concentrated in specific collection rails and early lifecycle moments.

The bottom line

Involuntary churn is avoidable revenue loss caused by collection failure—not a verdict on product value. Separate it from voluntary churn, define exactly when you recognize it, and monitor it by segment. When it rises, treat it like an operational incident: isolate the break, inspect recovery behavior, and fix the collection pipeline before you spend more on acquisition to replace preventable losses.

Frequently asked questions

For card-heavy SMB SaaS, involuntary churn often lands around 0.3 to 1.0 percent of starting MRR per month, or roughly 10 to 30 percent of total churn. Enterprise invoice businesses may show lower cancellation-based involuntary churn but higher delinquency and write-offs. Track your own baseline by plan and payment method.

Use the customer action as the divider: voluntary churn includes explicit cancellation, downgrade, or non-renewal decisions. Involuntary churn is loss caused by payment failure and enforced access removal after retries and grace periods. Chargebacks are ambiguous; define a policy and apply it consistently. Keep a third bucket for unknown to avoid mislabeling.

Count it when you stop providing service and no longer expect payment under your standard recovery process, not at the first failed charge. Most teams recognize churn after the final retry or dunning step plus a defined grace period. For invoicing, count when you write off the receivable or formally terminate service, aligned with AR policy.

Start with the basics: payment processor health, changes in retry logic, authentication failures, and whether card updater features are enabled. Then segment by payment method, geography, bank/card type, and plan price. Look for step-changes that correlate with a billing change, pricing change, or new checkout flow. Finally, confirm you are not misclassifying voluntary churn.

It is usually one of the highest ROI retention levers because you are saving customers you already paid to acquire. Quantify it as recovered MRR times gross margin, then compare to the cost of tooling, support time, and potential fraud risk. Also model impact on LTV (Customer Lifetime Value) and CAC Payback Period when involuntary churn falls sustainably.