Table of contents

Unsubscription rate

If your emails are a meaningful part of onboarding, activation, and expansion, unsubscription rate is an early "trust meter." When it climbs, you're not just losing a marketing channel—you're often losing the ability to guide customers to value, which can show up later as weaker retention and higher churn.

Unsubscription rate is the percentage of email recipients who opt out of your emails over a specific send or time period.

What unsubscription rate reveals

Founders typically look at unsubscription rate for one of three reasons:

- Onboarding isn't sticking. New users who unsubscribe from onboarding sequences often never reach "aha," which can foreshadow poor Onboarding Completion Rate and weak early retention.

- You're over-emailing or mis-targeting. You may be sending too often, sending broad blasts instead of relevant segments, or emailing the wrong personas.

- You have a value gap. Sometimes the emails are fine—the product experience isn't. If people disengage from lifecycle messages at the same time usage drops, you may have a Time to Value (TTV) problem, not an email problem.

Unsubscription rate is not the same as "churn," but it's often an upstream indicator. If you want to understand actual cancellations, pair this with Customer Churn Rate and Logo Churn.

The Founder's perspective

I care about unsubscription rate because it tells me whether our messaging is compounding product value—or compensating for missing value. If new users unsubscribe early, we're losing our cheapest leverage to drive activation. If power users unsubscribe, we're probably wasting their time with irrelevant updates.

How to calculate it

There are a few valid definitions. The key is to pick one, document it, and use it consistently.

Campaign unsubscription rate (most common)

This is the cleanest version for day-to-day decisions on a specific email or sequence step.

Why "delivered" matters: if you divide by "sent," deliverability issues can make your rate look artificially low or high depending on how your ESP reports bounces. Delivered normalizes for that.

List unsubscription rate (period-based)

This is useful when you're reporting monthly and want a broader view of "list decay."

This version answers: "What percentage of our reachable list opted out this month?" It's less tied to a specific campaign and more tied to list health and overall messaging strategy.

Two practical nuances founders miss

1) Track counts and rate together.

A low rate can hide meaningful volume if you're sending at scale. Conversely, a high rate on a small experimental segment might not matter.

2) Define what "unsubscribe" means in your system.

Some stacks treat "unsubscribe from all" differently than "unsubscribe from marketing" (while still receiving receipts and critical notices). For SaaS, that distinction matters: you want users to keep receiving transactional and security communications, even if they opt out of marketing.

How to interpret changes

Unsubscription rate only becomes actionable when you interpret it in context: what you sent, to whom, and why.

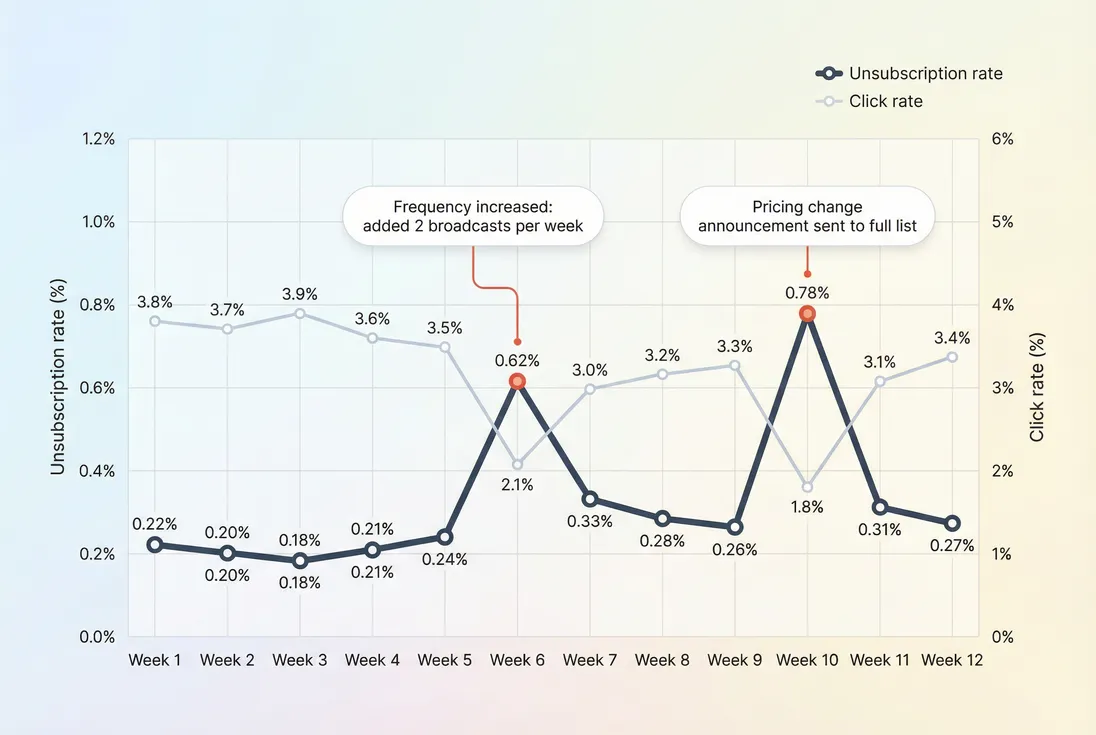

A weekly trend makes spikes explainable: tie changes in unsubscription rate to specific messaging and audience decisions, and confirm impact with engagement (click rate).

What a spike usually means

In SaaS, spikes typically come from one of these situations:

- Frequency jump without added value. The fastest way to create unsubscribes is increasing cadence while keeping content generic.

- Segment mismatch. You sent a message intended for a subset (new users, admins, a specific plan) to your whole list.

- Trust shock. Pricing/packaging changes, policy updates, or aggressive upsell messaging can trigger opt-outs—especially when customers feel surprised. (If you're using promotions, review how Discounts in SaaS can train expectations.)

- Lifecycle timing errors. The user isn't far enough along to care. A "power feature" email sent before they complete setup will feel like noise.

What a gradual increase means

A slow climb over weeks usually points to structural problems:

- You're steadily adding lower-intent subscribers (list quality drift)

- Your product value proposition has shifted, but your messaging hasn't

- Your list is aging and you're not refreshing relevance (topics, segmentation, triggered sends)

What a decrease can mean (and when it's misleading)

A lower unsubscription rate is good only if engagement and outcomes are stable or improving. Otherwise, you may have:

- Reduced sending volume so recipients had fewer chances to unsubscribe

- Stopped emailing marginal segments (rate drops, but pipeline or activation might also drop)

- A deliverability issue reducing delivered volume (rate becomes noisier)

If unsubscription rate drops while conversions drop, you didn't improve messaging—you just reduced reach.

What drives unsubscriptions in SaaS

Unsubscribes are rarely about one "bad email." They're typically the result of repeated misalignment between what users expected and what they got.

Expectation mismatch at signup

If users don't know what they're signing up to receive, every message feels like an interruption. Fixes are simple:

- Tell users what you'll send ("Product tips twice a week for the first 14 days")

- Explain why it matters ("to help you launch your first dashboard")

- Let them choose topics or cadence early (even a basic preference option helps)

Poor segmentation and relevance

Relevance is the biggest controllable lever. If your emails aren't segmented, you're forcing the average user to tolerate content designed for someone else.

High-value segmentation dimensions in SaaS:

- Lifecycle stage: trial, newly paid, long-tenured

- Role: admin vs end user

- Use case / industry: different workflows, different "aha"

- Plan tier: feature availability changes what's actionable

- Product behavior: activated vs not activated, feature adoption milestones

This connects directly to Feature Adoption Rate. If adoption is low and unsubscribes are high, your emails may be pushing features before users are ready—or the product is too hard to adopt.

Frequency and "attention tax"

More emails can work if each additional email is clearly valuable. Otherwise, you're taxing attention. A practical rule: if you can't articulate why an email helps the recipient succeed in the product, it's probably a broadcast you should not send.

Product experience leaks into email metrics

If users are frustrated, they stop wanting to hear from you. That can show up as:

- Lower clicks and higher unsubscribes

- Rising support volume

- Lower CES (Customer Effort Score) or NPS (Net Promoter Score)

If unsubscription rate worsens at the same time that product engagement (e.g., DAU/MAU Ratio (Stickiness)) declines, treat it as a product signal.

How founders use unsubscription rate

Unsubscription rate becomes powerful when you use it to decide what to change (targeting, content, cadence, or product).

A simple diagnostic workflow

When unsubscription rate rises, walk through this in order:

- Localize the increase

- Which campaign(s) or sequence step(s)?

- Which segment(s): trial vs paid, plan tier, lifecycle stage?

- Check whether engagement fell

- Did click rate drop at the same time?

- Are you seeing fewer key actions in-product (activation events)?

- Look for a trigger

- Frequency change?

- Major announcement (pricing, limits, compliance)?

- New acquisition channel adding low-fit users?

- Pick the right fix

- If it's segment mismatch: tighten targeting

- If it's frequency: reduce broadcasts, keep triggered

- If it's value gap: fix onboarding/product, not copy

Segment-level view (where action usually is)

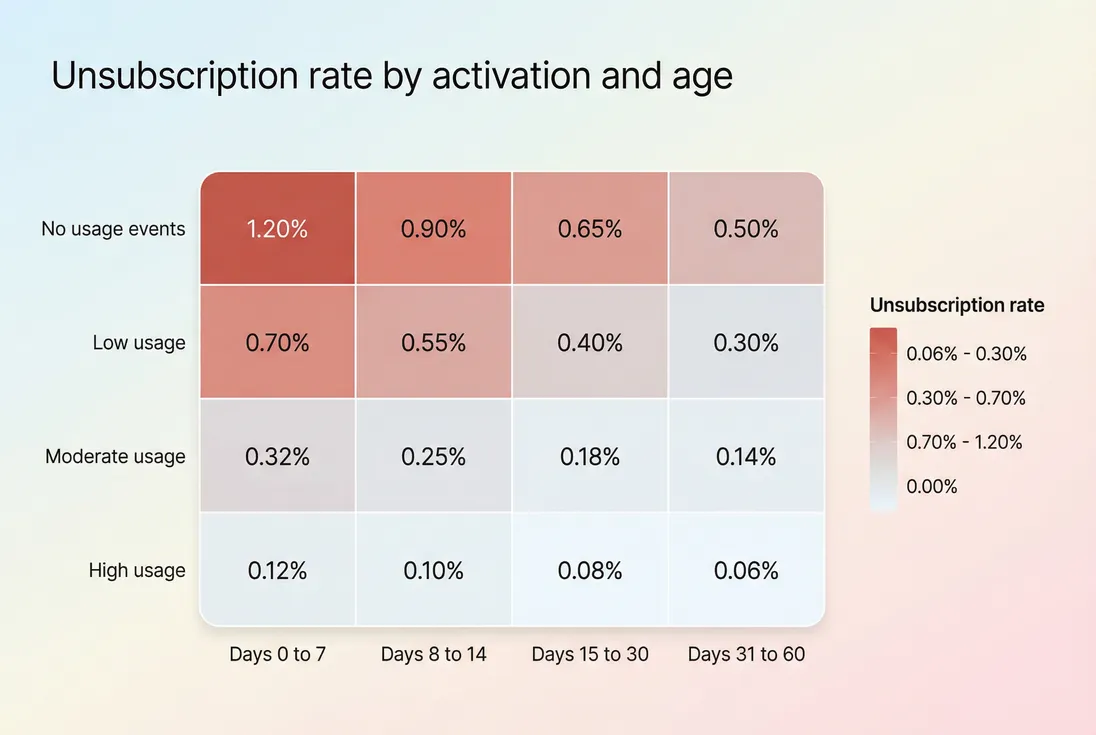

Unsubscription rate is usually highest in early lifecycle segments; that's where relevance and timing matter most, and where improvements can lift activation.

This chart is the kind of snapshot that drives decisions quickly:

- If new trials unsubscribe at 0.75% while established customers are at 0.12%, your onboarding emails likely don't match the user's first-week reality. Re-check setup steps, shorten time-to-first-value, and tighten onboarding content to the user's chosen use case.

- If activated users unsubscribe more than new trials, you may be prematurely pushing upgrades or sending too many generic "tips" instead of behavior-based messages.

Preference center is a founder-level lever

A preference center is not "nice to have." It's how you reduce unsubscribes without reducing communication.

What to offer at minimum:

- Email types (product updates, tips, webinars, newsletter)

- Frequency options (weekly digest vs real-time)

- Role-based streams (admin vs member)

This keeps users reachable even if they don't want everything.

Benchmarks and practical guardrails

Benchmarks vary by audience, but founders need thresholds for action. Use these as directional ranges for per-campaign unsubscription rate (unsubscribes divided by delivered emails).

| Email type | Typical range | "Investigate now" |

|---|---|---|

| Onboarding / activation sequence | 0.2%–0.8% | > 1.0% |

| Product newsletter / digest | 0.1%–0.4% | > 0.6% |

| Feature announcement (to relevant segment) | 0.1%–0.5% | > 0.7% |

| Pricing / packaging change | 0.3%–1.2% | > 1.5% |

| Sales/upsell blast to broad list | 0.4%–1.5% | > 2.0% |

How to use this table correctly:

- Compare like with like. Don't benchmark onboarding emails against a monthly digest.

- Watch the direction, not the exact number. A move from 0.2% to 0.5% can matter more than whether you're "above average."

- Pair with outcomes. If unsubs rise but trial-to-paid improves and spam complaints stay low, it may be an acceptable trade.

Also watch spam complaint rate if you have it. High unsubscribes are bad; high complaints are worse (they can damage deliverability and reduce delivered volume across the board).

Pair it with retention and revenue

Unsubscription rate becomes much more valuable when paired with product and revenue metrics—because the real question is whether unsubscribes predict weaker retention or expansion.

The two common patterns

Pattern A: Unsubscribes rise, retention falls

This often indicates a product value problem or a broken onboarding path. Confirm with:

- Cohort Analysis (do newer cohorts retain worse?)

- Customer Health Score (does health drop before unsubscribing?)

- Churn Reason Analysis (do reasons reference missing value or confusion?)

Pattern B: Unsubscribes rise, retention stable

This is more likely a messaging/targeting issue. You're annoying users without necessarily losing them—yet. Fix relevance and cadence before it turns into churn.

To tie it to revenue impact, monitor churn metrics like MRR Churn Rate and Net MRR Churn Rate. Unsubscribes won't directly change MRR, but they can reduce expansion opportunities and weaken reactivation when accounts go idle.

Cohort view: where unsubscribes concentrate

Unsubscribes cluster where value is missing: low-usage users in the first two weeks. That's a product and onboarding problem as much as a messaging problem.

This is the highest-leverage way to use the metric: unsubscription rate by activation and age. If the "no usage" cohort unsubscribes at 1.20% in the first week, your onboarding messages are either overwhelming, irrelevant, or arriving before the user can act on them.

Practical fixes that work

If you want lower unsubscription rate and better business outcomes, prioritize changes that increase relevance and speed customers to value.

1) Replace broadcasts with triggers

Instead of "Here are 5 things you can do," use behavior:

- "You invited your first teammate—here's how to set permissions"

- "You hit your usage limit—here's how to avoid disruption"

- "You completed setup—here's the next milestone"

These feel helpful, not promotional.

2) Tighten onboarding around one job

Many onboarding sequences fail because they try to teach the whole product. If you're PLG, users typically came for a specific job. Align onboarding to that job until the first success moment, then expand.

Use Time to Value (TTV) thinking: every email should reduce the time to the first real win.

3) Add "off-ramps" before opt-out

Before "unsubscribe," give users options:

- weekly digest

- only product updates

- only admin alerts (if relevant)

This is how you preserve the channel while respecting attention.

4) Fix acquisition quality if needed

If unsubscription rate is high across all campaigns and segments, your top-of-funnel may be pulling in low-fit users. Pair this investigation with:

- Conversion Rate (are you over-optimizing signups?)

- CAC (Customer Acquisition Cost) and CAC Payback Period (are you paying for low-intent leads?)

- Lead-to-Customer Rate (is the lead quality slipping?)

Sometimes the email team isn't the problem—the targeting is.

A weekly founder checklist

If you only have 10 minutes a week, review unsubscription rate like this:

- Top 5 campaigns by unsubscribes (count): what created the most opt-outs?

- Top 5 campaigns by unsubscription rate: what was most misaligned per recipient?

- New trials segment: is onboarding unsubscribing rising week over week?

- Compare against engagement: did click rate drop too?

- Pick one fix: segmentation, cadence, or a product/onboarding improvement

Unsubscription rate is a small metric with outsized leverage: it tells you whether your lifecycle communication is earning attention. Treat it as a signal of relevance and value—not just an email KPI.

Frequently asked questions

For most SaaS lifecycle and newsletter sends, a common healthy range is roughly 0.1% to 0.5% unsubscribes per delivered email. The right target depends on list quality, email type, and frequency. Judge it alongside click rate and spam complaints, not in isolation.

Spikes usually mean expectation mismatch: you emailed the wrong segment, changed frequency, or announced something that reduced perceived value (pricing, limits, positioning). Validate whether the spike is concentrated in a cohort or plan tier. Then check product engagement around the same period to confirm it is not a product-value issue.

No. A slightly higher unsubscription rate can be acceptable if your remaining audience is more engaged and conversions improve. The goal is not zero unsubscribes; it is sending relevant messages to the right people. The red line is when unsubscribes rise while clicks, activation, or retention fall.

No. Unsubscription rate measures opting out of emails, not canceling the product. But it can be an early warning signal: if new users unsubscribe from onboarding emails, they often fail to reach value and later churn. Track it by lifecycle stage and compare against retention metrics to see whether it predicts cancellations.

Improve relevance before reducing volume. Segment by lifecycle stage, role, and use case; send fewer generic broadcasts; and use triggered messages tied to real behavior. Add a preference center so users can choose topics and cadence. Also fix "surprise" emails by setting expectations at signup.