Table of contents

Sales-led growth

Sales-led growth is expensive when it's working and brutal when it's not. The difference is whether you can reliably turn pipeline into cash fast enough to fund the next batch of deals—without burning out your team or discounting away your margins.

Sales-led growth (SLG) is a go-to-market motion where revenue growth is driven primarily by a sales team converting qualified opportunities into contracts, typically through demos, negotiation, and a guided onboarding. In SLG, your "product" still matters, but people are the scaling mechanism for acquisition and expansion.

When sales-led growth wins

SLG isn't "better" than product-led. It's a fit decision driven by deal size, complexity, and how buyers want to purchase. A strong SLG motion typically shows up when:

- The buyer needs help: security review, compliance, procurement, integrations, or change management.

- Value requires orchestration: onboarding is not instant; success depends on rollout planning.

- Deal sizes justify humans: selling time and sales engineering make economic sense.

- Your market rewards trust: credibility, references, and negotiation matter as much as features.

A practical way to think about SLG is that you're choosing to buy certainty with headcount. You accept higher costs (sales comp, tooling, enablement) to increase conversion, expand larger accounts, and handle complexity.

The Founder's perspective

If you can't explain why a human needs to be in the loop, SLG will feel like pushing a boulder uphill. The strongest reason is not "we want enterprise." It's "our customers need guided buying and guided adoption."

SLG vs PLG in one table

Use this as a quick diagnostic, not a taxonomy exercise.

| Dimension | SLG (typical) | PLG (typical) |

|---|---|---|

| Primary acquisition | Reps closing opportunities | Users adopting product and upgrading |

| Deal size | Higher ASP (Average Selling Price) and higher ARPA (Average Revenue Per Account) | Lower entry price, expands over time |

| Sales cycle | Longer, multi-stakeholder | Shorter, often self-serve |

| Key constraints | Pipeline quality, win rate, cycle time | Activation, retention, viral loops |

| Risk | Payback and cash timing | Churn, low expansion, commoditization |

If you're still evaluating your overall motion, pair this with Go To Market Strategy and contrast with Product-Led Growth.

How SLG is measured

SLG is a motion, not a single universal KPI. But you can measure how sales-led you are and whether the motion is scaling efficiently.

Sales-led share of new ARR

At minimum, quantify the percentage of new revenue that depends on a rep.

Interpretation:

- Rising sales-led share can be good (bigger customers, more complex deals) or bad (self-serve weakening).

- Falling sales-led share can mean PLG is working—or that reps are failing to close.

If you only track one "SLG-ness" number, track this by segment (SMB, mid-market, enterprise). It prevents you from accidentally building an expensive sales machine to sell a low-ACV product.

The four operating numbers that run SLG

Founders tend to over-focus on top-line growth and under-focus on the mechanics. SLG is governed by four numbers:

- Pipeline created (future revenue supply)

- Win Rate (conversion efficiency)

- Sales Cycle Length (cash timing)

- Deal size (usually tracked as ACV (Annual Contract Value) and ASP)

A helpful "capacity planning" relationship is:

And if you want to sanity-check bookings per rep:

Interpretation:

- If bookings per rep falls while pipeline rises, you likely have a qualification or value proposition problem.

- If bookings per rep is stable but growth stalls, you likely have a capacity (headcount) or pipeline generation problem.

The Founder's perspective

Your forecast is only as good as your cycle time and stage conversion rates. If you can't answer "where do deals die" and "where do deals stall," you're guessing—especially when you hire your second and third reps.

Revenue quality still matters

SLG teams can "win" bookings while losing the business. You still need revenue quality metrics:

- GRR (Gross Revenue Retention) to ensure churn and downgrades aren't erasing your sales work.

- Net Revenue Retention to validate expansion and pricing power.

- Logo Churn to understand whether you're selling the wrong customers.

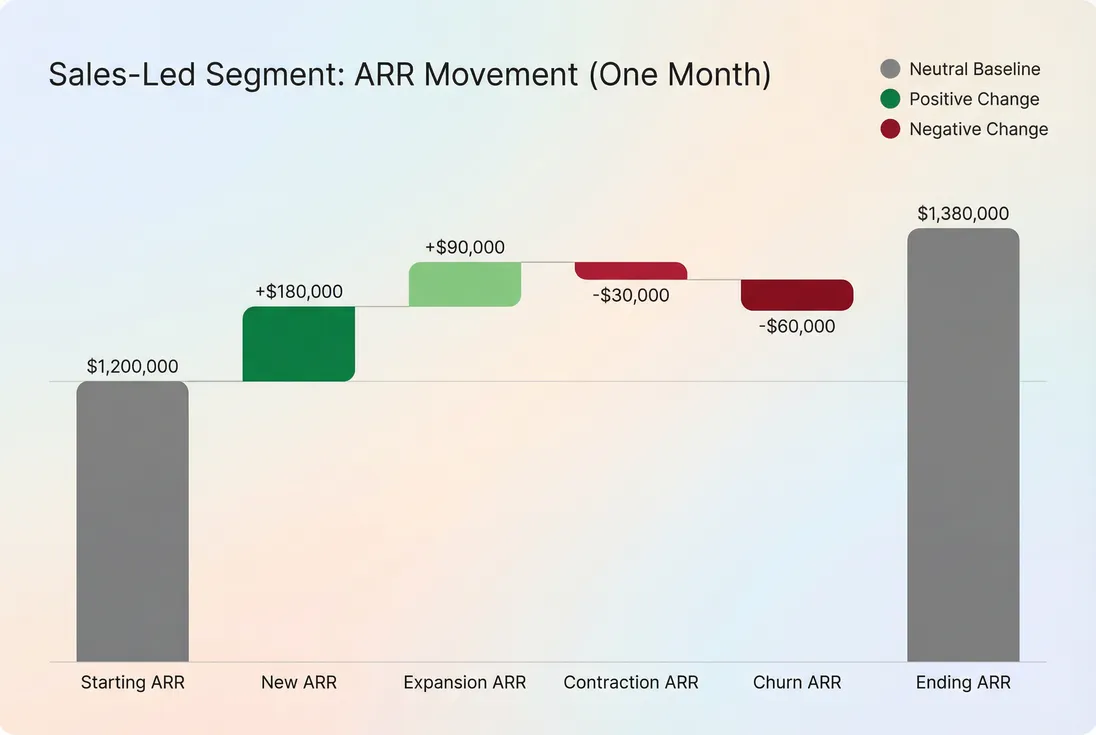

When you review growth, separate acquisition from retention and expansion. If you have access to an ARR bridge (new, expansion, contraction, churn), it becomes obvious whether sales is building a durable base or a leaky bucket.

For recurring revenue businesses, tie this back to ARR (Annual Recurring Revenue) and MRR (Monthly Recurring Revenue).

What drives SLG unit economics

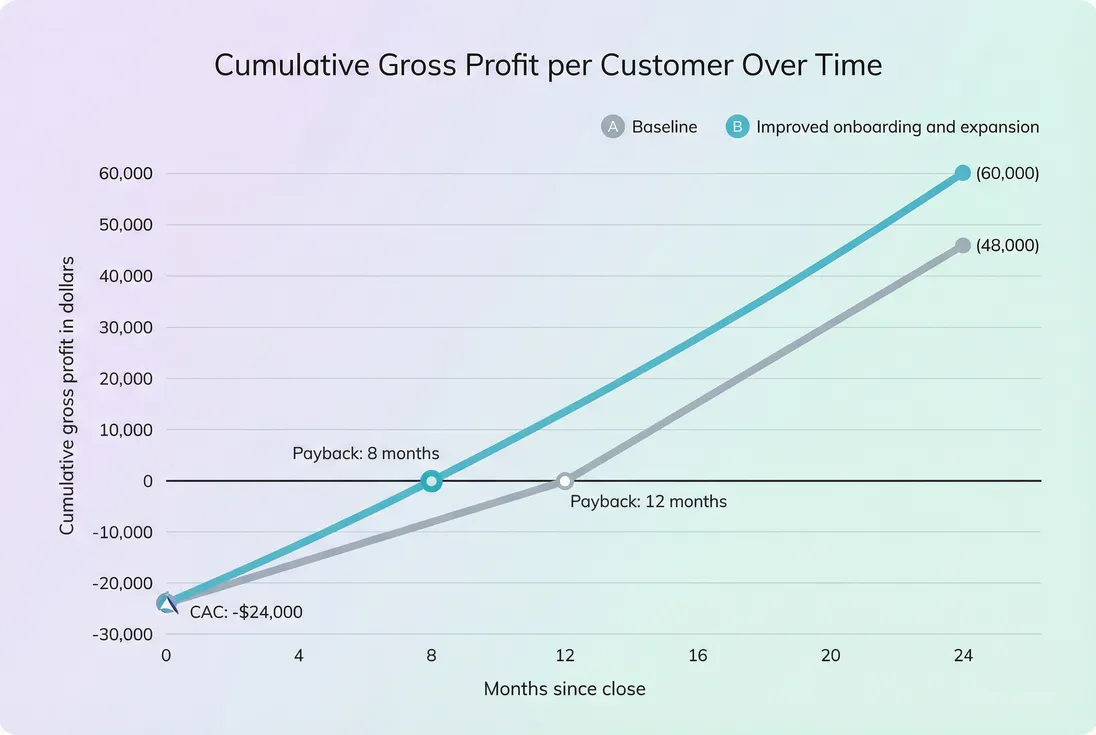

SLG is usually decided (and later punished) by unit economics—especially how long it takes to get your acquisition spend back.

CAC and payback

Two founders can have the same growth rate with very different outcomes. The difference is often CAC (Customer Acquisition Cost) and CAC Payback Period.

A practical payback approximation is:

Interpretation:

- Higher ARPA or higher gross margin shortens payback (SLG becomes fundable).

- Longer sales cycles and lower win rates inflate CAC (SLG becomes fragile).

- Heavy discounting "helps" bookings but hurts payback—often invisibly.

Discounting deserves its own discipline. If you discount, track it as a first-class variable, not a footnote. See Discounts in SaaS.

The payback curve (why time matters)

Payback isn't just a number; it's a cash timing profile. A sales-led business that bills annually upfront behaves very differently than one that bills monthly in arrears.

What founders often miss: you can improve payback without "cutting CAC" by improving the denominator:

- Packaging that increases initial land (higher ARPA/ASP)

- Faster time-to-value and onboarding (earlier retention and expansion)

- Better gross margin (lower delivery costs)

Tie operational initiatives back to Gross Margin and Time to Value (TTV).

Retention and expansion are part of SLG

In SLG, a rep can close a deal that the product and CS cannot sustain. That creates a dangerous illusion: bookings look great; net growth doesn't.

In practical terms:

- If GRR is weak, your qualification is wrong, your onboarding is weak, or your product cannot deliver on promises.

- If NRR is weak in a segment that should expand, your packaging is capped, seat growth isn't happening, or you're not driving deeper adoption.

To pressure-test expansion, look at Expansion MRR and Contraction MRR in addition to churn.

The Founder's perspective

If sales is the "growth engine," customer success is the "engine oil." You don't fix a retention problem by hiring more AEs. You fix it by selling what you can deliver, onboarding faster, and designing expansion paths customers actually want.

How to find the bottleneck

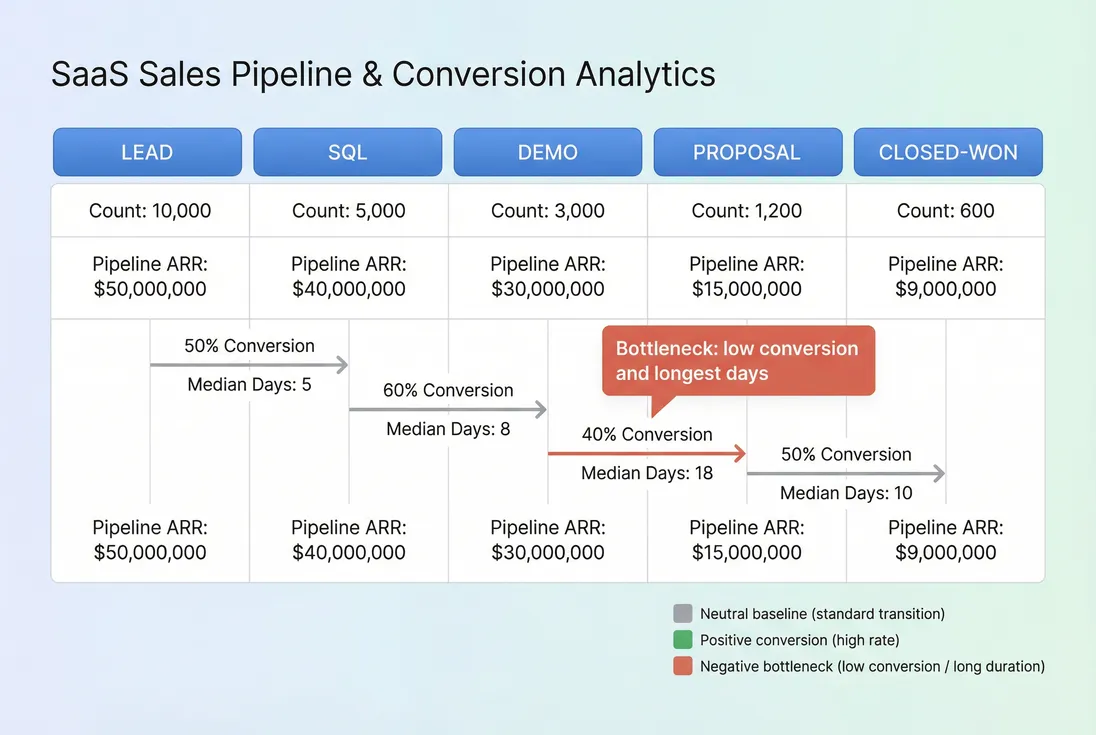

SLG problems are often misdiagnosed as "we need more leads" or "we need better reps." Most of the time, there's a specific bottleneck—and you can see it by measuring conversion and time at each stage.

Measure conversion and time by stage

A simple rule: a stage with low conversion and long duration is your constraint. That's where forecast accuracy dies, CAC inflates, and rep morale drops.

Track, by segment:

- Stage-to-stage conversion rates

- Median days in stage

- Drop reasons (at least: no decision, lost to competitor, pricing, security, missing feature)

Then connect funnel issues to the right fix:

| Bottleneck | What it usually means | What to change first |

|---|---|---|

| Lead → SQL weak | Wrong ICP or weak targeting | Tighten ICP, improve qualification |

| SQL → Demo weak | Bad outreach or messaging | Rewrite sequences, sharpen positioning |

| Demo → Proposal weak | No clear value case | Improve discovery, ROI narrative, technical proof |

| Proposal → Closed-won weak | Pricing/procurement friction | Packaging, legal terms, negotiation strategy |

| Closed-won → Live weak | Onboarding failure | Implementation playbook, reduce time-to-value |

If you're not already doing this, build a weekly "funnel ops" review: one page of stage conversion and stage aging, segmented by customer type.

Watch for fake growth

Common SLG failure pattern: you "grow" bookings by relaxing qualification and discounting. It looks good for one or two quarters and then shows up as churn, non-payment, and implementation backlog.

Three signals you're buying growth:

- Discount rate climbing quarter-over-quarter

- Sales cycle length increasing while win rate decreases

- Retention weakening in the newest cohorts

Retention cohorting is how you catch this early. See Cohort Analysis and Churn Reason Analysis.

Cash collection is part of the model

SLG often involves invoices, net terms, and procurement. If you're not collecting cash on time, your unit economics may be fine on paper but broken in reality.

If you sell annual invoices, add a basic receivables cadence:

- Invoice aging review

- Clear ownership for collections

- Standardized payment terms by segment

If this is becoming material, you'll want a simple Accounts Receivable (AR) Aging view.

How to scale without chaos

Scaling SLG is less about hiring and more about making performance repeatable. The founder's job is to turn tribal knowledge into a machine.

Standardize the deal shape

Before you hire aggressively, standardize:

- ICP definition (what you accept and reject)

- Packaging and pricing logic (what gets quoted and why)

- Implementation scope (what's included vs paid services)

- A default contract length (often annual)

This reduces one-off negotiations and improves forecast accuracy. It also makes rep onboarding possible.

A practical metric to monitor here is your deal size distribution (ASP/ACV) by segment. If median deal size is drifting down, you may be hiring for a market that doesn't want to pay.

Build the quota model from math, not hope

Quotas should reflect your actual funnel math: win rate, cycle length, and realistic capacity.

A basic planning chain looks like:

- Decide bookings target

- Back into required pipeline using win rate

- Ensure pipeline creation capacity exists (SDR, marketing, outbound, partner)

- Ensure cycle time fits the quarter and cash needs

If you want a high-level efficiency lens, use Sales Efficiency and (for many SaaS teams) SaaS Magic Number, but don't let them replace funnel truth.

The Founder's perspective

Hiring the next rep before you can explain your conversion rates is how you turn "growth" into an expensive science experiment. Your job is to define what good looks like at each stage, then hire to that system.

Don't let sales outpace the product

In SLG, it's tempting to close "strategic" deals that stretch the roadmap. Occasionally that's correct, but it must be deliberate—and priced accordingly.

A simple governance rule:

- If a deal requires roadmap work, treat it like an investment.

- Ask whether the work benefits a broad segment or a one-off.

- Tie exceptions to longer contract length, higher ACV, or clear expansion.

This is also where churn recognition matters. If you're selling annuals and deals fail early, know how you treat churn timing and refunds. See Refunds in SaaS and When should you recognize churn in SaaS?.

Using recurring revenue analytics in SLG

SLG teams often live in the CRM and forget the subscription reality. Your CRM tells you what might happen; subscription analytics tells you what did happen.

For founders, the most useful recurring revenue lenses are:

- MRR and ARR trend to separate real growth from pipeline optimism: MRR (Monthly Recurring Revenue), ARR (Annual Recurring Revenue)

- Movement analysis to see whether growth is new vs expansion vs churn (especially critical in enterprise): MRR Movements

- Retention by cohort to catch overselling early: Retention, Cohorts

- Segmentation filters to ensure SLG is working in the segment you think it is: Filters

If you're operating SLG, make your weekly exec cadence include both:

- CRM funnel health (pipeline, stages, forecast)

- Subscription health (new revenue, churn, expansion, retention cohorts)

That dual view is how you avoid the classic trap: building a great sales org on top of a weak retention engine.

A simple SLG checklist for founders

If you want a fast self-assessment, answer these with real numbers:

- Do we know our sales-led share of new ARR by segment?

- Can we point to one funnel bottleneck we're actively fixing?

- Is CAC payback short enough to fund growth from cash, not hope?

- Are GRR and NRR stable (or improving) in the newest cohorts?

- Do we have a standardized deal shape and onboarding path?

If you can't answer at least three of these cleanly, treat "scale sales" as a red flag until you can.

Frequently asked questions

SLG usually makes sense when your ACV is high enough to support human selling and onboarding. As a rule of thumb, founders start seeing SLG work around 6k to 25k+ ARR per customer, or whenever deals require multiple stakeholders, security review, procurement, or a tailored rollout.

Track what percent of new ARR closes with a rep involved, and what percent closes self-serve. If most meaningful deals require a demo, pricing approval, or procurement handling, you are sales-led. If reps mainly help larger outliers while most revenue is self-serve, you are sales-assisted.

A common target is 12 months or less for efficient SLG, with many teams aiming for 6 to 9 months once the motion is mature. Early on, 12 to 18 months can be acceptable if retention is strong and expansion is predictable. Longer payback is risky without ample cash.

Confirm you have repeatable pipeline and a stable conversion path: clear ICP, consistent lead flow, win rate that holds by segment, and a sales cycle you can forecast. If new reps cannot hit first value milestones quickly, fix enablement, pricing, or qualification before scaling headcount.

Discounts can be a strategic lever, but they quietly damage payback and rep productivity if they become the default. Monitor discount rate by segment and rep, and tie approval to deal quality signals like annual prepay, longer contract length, or expansion potential. Avoid using discounting to mask weak positioning.