Table of contents

Product activation

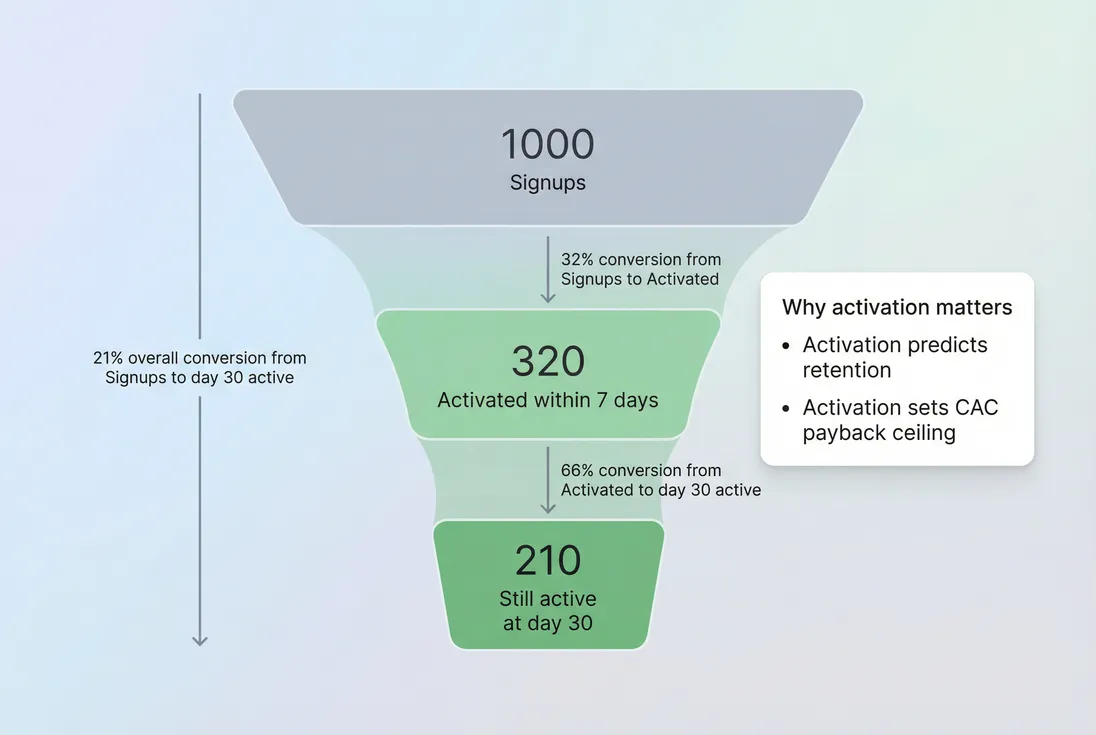

If activation is weak, everything downstream lies to you. Your signups look "fine," your pipeline feels "busy," and your revenue forecast keeps missing. The real issue is simpler: too many new customers never reach value, so they churn, never expand, and poison your CAC payback.

The practical payoff of measuring product activation is focus. You stop debating "top of funnel" and start fixing the first value moment that actually drives Retention and revenue.

Product activation is the share of new accounts (or users) that reach a defined value milestone (the "aha" moment) within a defined time window. It's your best early signal that someone will stick around.

Activation is the bridge between interest and durable usage. If the bridge is weak, your day-30 retention will collapse no matter how many signups you buy.

What activation really tells you

Activation is not "engagement." It's not "they logged in." It's evidence they got value.

If you pick the right activation definition, three things become easier:

- Forecasting gets less delusional. Activation is an early proxy for whether a cohort will retain.

- Growth spending becomes safer. Channels that drive high activation usually drive better unit economics (not always more signups).

- Product priorities become clearer. If activation is the bottleneck, you don't need another feature. You need faster time-to-value.

Activation is also the cleanest way to diagnose when a growth problem is actually a product problem.

- Low signup-to-activation conversion often means onboarding friction, confusing positioning, or the wrong ICP.

- High activation with later churn often means the activation event is too easy (or your product solves a "first week" problem, not a durable one).

- Activation that varies wildly by channel is usually a targeting/expectation mismatch, not an onboarding bug.

The founder's perspective

If activation doesn't move, don't scale acquisition. You're just pre-paying churn. Fix activation first, then revisit CAC (Customer Acquisition Cost) and CAC Payback Period.

How to define activation

Most teams fail here. They either define activation as something trivial (log in, visit a page), or something so strict it becomes useless (a full implementation, a long-term habit).

A good activation event has four properties:

- It's close to value. It represents the "aha" moment, not setup work.

- It's observable. You can track it reliably without manual judgment.

- It's fast. A new customer can realistically reach it in days, not months.

- It predicts retention. Activated cohorts should retain materially better than non-activated cohorts.

Activation event patterns that work

Here are practical, founder-friendly ways to define activation without overcomplicating it:

1) Key action completed (single event)

Best for simple products with one dominant workflow.

- Example: "Created first dashboard"

- Example: "Sent first invoice"

- Risk: can be gamed if the action is easy and not value-bearing

2) Key workflow completed (sequence)

Best when value requires two or three steps.

- Example: "Imported data + invited teammate + created first report"

- Risk: can become too strict; drop-off might reflect busywork, not value

3) Usage threshold (repeat behavior)

Best when value comes from habit or volume.

- Example: "Ran 3 analyses in 7 days"

- Example: "Completed 5 tickets with SLA met"

- Risk: slower to measure; might hide onboarding issues

4) Team-based activation (multi-user)

Best for collaborative B2B tools.

- Example: "At least 2 users performed the key action"

- Risk: smaller teams get penalized; segment by company size

Put your activation definition in writing

Use a one-liner you can argue about:

- "An account is activated when ______ happens within ______ days of signup/trial start."

Then list what it is not:

- "Logging in is not activation."

- "Finishing onboarding screens is not activation (unless it's the value moment)."

- "Payment is not activation (it's monetization)."

If you need onboarding metrics, track them separately. See Onboarding completion rate for that lens.

Concrete examples by motion

| Motion | Activation definition that usually works | Typical window |

|---|---|---|

| Self-serve PLG | Complete one value workflow + see output | 1–7 days |

| Free trial (B2B) | Value workflow + repeat usage threshold | 7–14 days |

| Sales-led mid-market | Implementation milestone + first real usage | 14–30 days |

| Usage-based product | First meaningful consumption above a threshold | 7–30 days |

Your window should reflect how fast customers can win. If your "typical" customer needs 21 days to activate, you don't just have a measurement problem. You likely have a Time to Value (TTV) problem.

The founder's perspective

Your activation definition is your strategy in metric form. If you define it as ‘created project,' you are prioritizing easy onboarding. If you define it as ‘project created and delivered outcome,' you are prioritizing customer results. Pick intentionally.

How to calculate activation

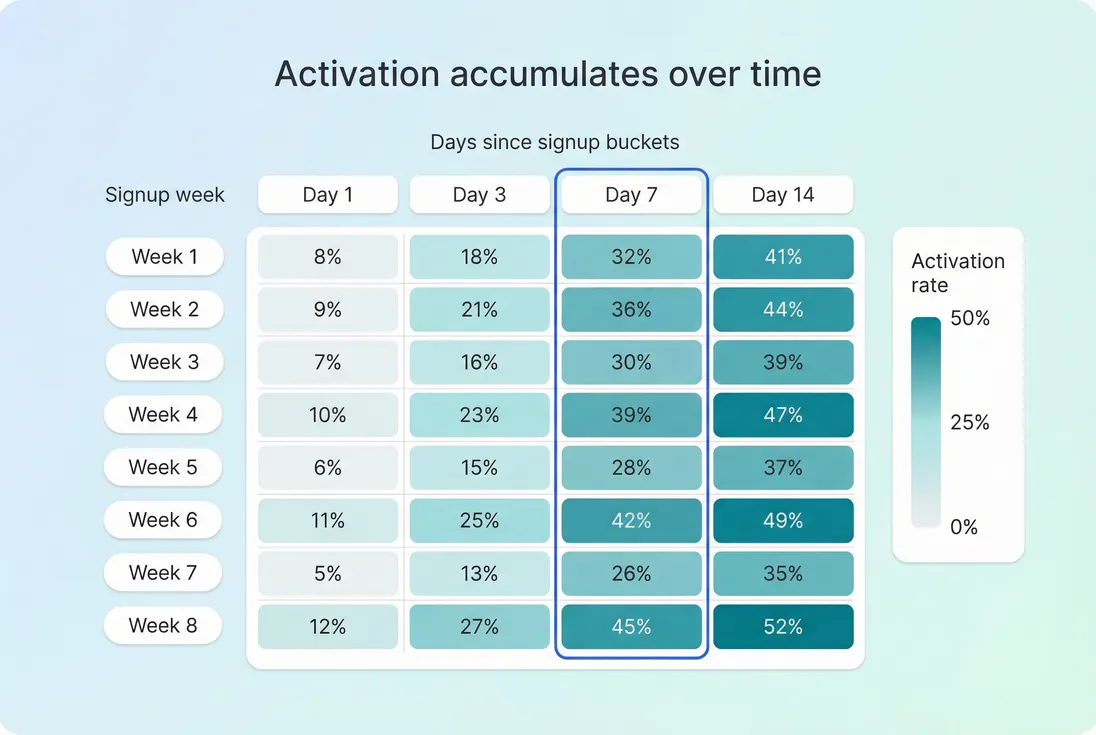

Activation is a cohort metric. You measure it on a group of new signups/trials that started in the same period, and you ask whether they activated within the window.

At its simplest:

Key choices you must make (and document):

- Cohort definition: signups, trial starts, or new customers

- Activation window: 1/7/14/30 days

- Entity: account-level or user-level

- Eligibility rules: exclude spam, internal accounts, demos, partners, etc.

Also track time to activation

Activation rate alone can hide pain. Two products can both have 30% activation, but one activates in 1 day and the other in 12 days. The first will usually retain better and support growth better.

If you're PLG, you want this number aggressively low. Every extra day is more drop-off and more support cost. See also Time To Value

Avoid these common calculation traps

Trap 1: Counting accounts that didn't have time

If you run a 14-day activation window, don't include signups from last week in your denominator. You'll artificially depress activation.

Trap 2: Mixing channels and ICP

Activation is extremely sensitive to customer intent. Segment by channel, use case, company size, and plan. Otherwise you'll "fix onboarding" when the real issue is targeting.

Trap 3: Letting the definition drift

If the activation event changes, your trend line becomes fiction. Change it deliberately, and annotate the timeline.

A cohort view shows whether activation is improving because you're onboarding better, or just because older cohorts had more time.

When activation breaks down

Activation is only useful if it behaves like a leading indicator. If it doesn't, treat that as a signal that your definition is wrong or your product has a deeper retention issue.

Here are the failure modes you'll see in real companies:

Activation is high, but retention is low

This is the classic "fake activation" problem.

Common causes:

- Your activation event is a setup step, not value

- Customers can "try" the product quickly but don't need it repeatedly

- You're attracting the wrong jobs-to-be-done with your marketing message

Fix:

- Add a "value proof" requirement (output generated, result achieved)

- Add a repeat behavior element (second usage within a week)

- Segment retention by activated vs not activated; the gap should be obvious

Use Cohort Analysis to validate the correlation.

Activation is low, but customers who activate retain well

This means your product works, but too few customers reach the win.

Common causes:

- Too many steps before value

- Confusing onboarding (or blank-state problem)

- Users don't know what "good" looks like

Fix:

- Remove steps, pre-fill data, offer templates

- Make the first workflow unavoidable and obvious

- Instrument where the drop-off happens and fix the top 1–2 blockers

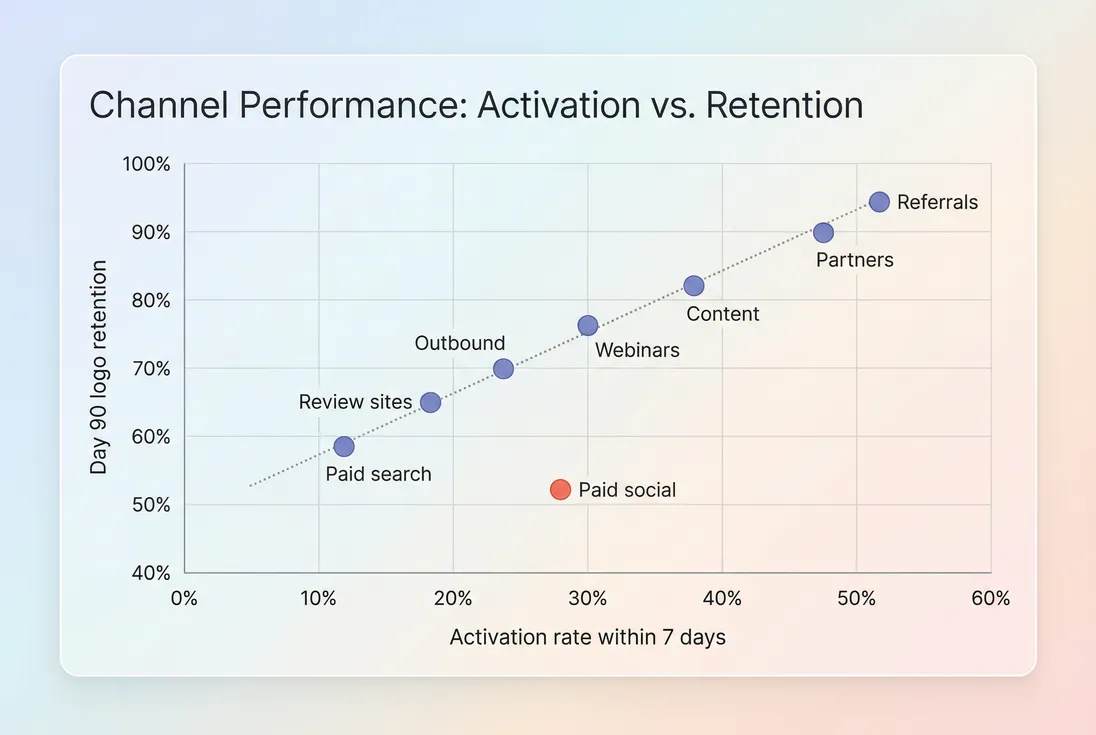

Activation varies wildly by channel

This is usually a targeting problem.

Example: Paid search drives lots of signups with low activation; referrals drive fewer signups with high activation. Your instinct will be "improve onboarding." The correct move is often "stop buying garbage intent."

Fix:

- Compare activation by channel alongside Conversion Rate and later retention

- Rewrite landing pages to set expectations

- Tighten targeting and qualification

The founder's perspective

A channel that "converts" but doesn't activate is not a growth channel. It's a distraction that inflates your support load and makes your churn look like a product flaw.

What changes activation

Activation moves when you change one of three things: who shows up, how fast they get to value, or how clear value is.

Lever 1: ICP and expectations

You can boost activation without touching product by getting the right people in the door.

- Narrow your promise (stronger positioning)

- Qualify harder (even in PLG, your website copy qualifies)

- Align the first-run experience to the most common use case

Tradeoff: narrower ICP can reduce top-of-funnel volume. That's fine if it improves retention and LTV (Customer Lifetime Value).

Lever 2: Onboarding and product guidance

This is the obvious lever, and most teams still do it poorly.

High-impact moves:

- Shorten the path to the first output

- Default users into a template that matches their role

- Reduce blank states; show examples immediately

- Instrument each step and remove the biggest drop-off

Tradeoff: too much guidance can feel restrictive to power users. Solve that with "skip for now" and role-based paths, not by removing guidance.

Lever 3: Trial and packaging choices

Trial structure changes activation behavior. A short trial forces focus; a long trial increases procrastination.

If you run a trial, activation is inseparable from your trial design. See Free Trial for the mechanics.

Tradeoffs to make explicit:

- Shorter trial: higher urgency, lower evaluation depth

- Longer trial: more time for complex onboarding, more dead trials

Packaging can also change activation:

- If the activation event requires a paid feature, your activation rate will drop—but customer quality may rise.

- If you include too much for free, you can inflate activation with low-intent users who never monetize.

That's why you should monitor activation alongside revenue quality metrics like ARPA (Average Revenue Per Account) and retention.

Activation should predict retention. If a channel activates but doesn't retain, you're probably acquiring the wrong customers or measuring the wrong activation event.

How founders use activation in decisions

Activation is only valuable if it changes what you do on Monday.

1) Decide when to scale acquisition

A practical rule:

- If activation is trending up and activated cohorts retain better, you can scale spend cautiously.

- If activation is flat or falling, scaling acquisition will usually worsen your churn story and cash burn.

Tie this to unit economics. Improving activation increases downstream retention, which improves LTV and shortens payback. That's why activation work is often a higher ROI growth lever than "more campaigns."

2) Prioritize product work with real impact

Use activation drop-offs to decide what to build.

Do this:

- Map the steps from signup to activation

- Measure step-to-step conversion

- Fix the biggest drop-off first

Don't do this:

- Add "nice to have" features because someone churned

- Redesign onboarding because it "feels old" without evidence

If you want a brutally effective workflow, run a weekly activation review:

- Last week's activation rate by segment

- Top 2 drop-off steps and their change week-over-week

- 1 experiment you'll run next week, with a clear expected impact

3) Set guardrails for experimentation

Activation is easy to game. Your team will unintentionally optimize for the metric if you don't set guardrails.

Guardrails I recommend:

- Activation must correlate with 30/60/90-day retention

- Activation improvements must not reduce revenue quality (watch ARPA)

- Track support load or time-to-onboard if you're sales-assisted

If you run pricing or packaging tests, measure activation as a second-order effect. A price increase can lower activation (fewer low-intent signups) while improving retention and expansion. That can be a win.

4) Know what to ignore

Ignore:

- Daily activation rate fluctuations (too noisy)

- "Activation" definitions that are just clicks

- Cross-segment comparisons without controlling for intent and complexity

Watch:

- Activation rate by cohort (weekly is usually enough)

- Median time to activation

- Activation-to-retention gap (activated vs not activated retention)

The founder's perspective

If you can't explain why your activation event predicts retention in one sentence, you don't have an activation metric. You have a dashboard decoration.

Benchmarks (use carefully)

Benchmarks are only useful as a smell test. Your goal isn't to match a number; it's to build a reliable bridge from "showed up" to "gets value."

Here's a practical framing:

| If your activation is… | It usually means… | What to do next |

|---|---|---|

| < 15% | You have serious friction or mismatch | Re-check ICP, simplify first-run, remove steps |

| 15–30% | You're in the normal messy zone | Instrument drop-offs, improve time-to-value, segment |

| 30–50% | You likely have a clear value path | Scale acquisition cautiously, improve depth and expansion |

| > 50% | Either you're excellent or your definition is too easy | Validate correlation to retention and revenue |

If you want one hard rule: activation is "good" when activated cohorts retain materially better than non-activated cohorts. That gap is more important than the headline percentage.

What to do next (a simple playbook)

- Write your activation definition. One sentence. One window.

- Validate it against retention. Use cohort retention and compare activated vs not activated.

- Break activation into steps. Identify the largest drop-off.

- Run one experiment per week. Reduce steps, add templates, improve guidance, or tighten targeting.

- Revisit the definition quarterly. Your product changes; your value moment changes.

If you want to connect activation work to financial reality, do it through retention and unit economics. Activation is upstream of almost every metric you care about: churn, expansion, LTV, and payback. Measure it like you mean it.

Frequently asked questions

There is no universal good number because activation depends on your definition, your ICP, and your onboarding complexity. As a sanity check: self-serve B2B tools often land in the 20–40% range within 7 days; sales-assisted products may be lower but higher quality. Track activation plus retention.

Probably not. That usually means your activation event is too shallow, or you are activating the wrong customers. Activation should predict retention and expansion. If it does not, tighten the definition to include a value moment and a usage pattern, not just an onboarding step.

Use whatever matches how value is realized and how churn happens. If customers churn at the account level, measure account activation. If adoption requires multiple seats, include a team-based threshold like two users completing a key workflow. Keep it simple, and segment later.

Pick the smallest window that still reflects reality. PLG and trials often use 1–7 days. Mid-market onboarding might need 14–30 days. The window is a management tool: if your window is too long, you will tolerate slow time-to-value and misread channel quality.

Yes, if activation is a leading cause of churn. Poor activation creates early churn and kills LTV, which makes CAC and payback math ugly. But do not optimize activation in isolation. Your activation event must correlate with retention and revenue, or you will game the metric.