Table of contents

DAU/MAU ratio (stickiness)

If you're growing signups but DAU/MAU is flat (or falling), you're often buying revenue that won't renew. Stickiness is one of the fastest ways to tell whether your product is becoming part of a customer's routine—or just something they tried.

DAU/MAU ratio (often called "stickiness") is the share of your monthly active users who are active on a typical day. In plain terms: of everyone who used you this month, how many show up today?

What stickiness reveals

Stickiness is not a revenue metric. It's a behavior metric that usually leads revenue outcomes—especially renewal probability, expansion potential, and support load.

Here's what DAU/MAU tends to reveal for founders:

- Habit strength: Are users returning frequently enough that your product is "default"?

- Product-market fit quality: High growth with low stickiness is often shallow adoption.

- Renewal risk: Falling stickiness often shows up weeks before churn conversations.

- Adoption depth vs breadth: Broad MAU with weak DAU can mean many casual users; strong DAU suggests deeper workflow embedding.

This connects naturally to metrics like Active Users (DAU/WAU/MAU) (to define the population), Cohort Analysis (to separate new vs mature users), and churn metrics like Customer Churn Rate and Logo Churn.

The Founder's perspective: If DAU/MAU is declining, I assume one of two things is happening: (1) we're acquiring the wrong customers/users, or (2) we're failing to convert "first value" into a repeatable workflow. Both require product and go-to-market changes—not just more top-of-funnel.

How to calculate it

At its core:

Where:

- DAU = distinct users who performed your "active" action on a given day

- MAU = distinct users who performed that action at least once in the last 30 days (or the calendar month, if you use calendar reporting)

The most important decision: what counts as "active"

Your definition should reflect value, not presence.

Good "active" definitions are usually a core value event, like:

- Created or resolved an item (ticket, task, incident)

- Shipped or deployed something

- Published content

- Ran a report that stakeholders actually use

- Completed a workflow step that correlates with retention

Bad definitions often include:

- Login

- Page view

- Opened an email notification

If you need help triangulating "value," pair stickiness with Feature Adoption Rate and Time to Value (TTV) to confirm that "active" users are actually reaching meaningful outcomes.

Use average DAU, not the best day

DAU bounces around (weekends, holidays, launches). Most teams use average DAU across the period:

Then:

A quick numeric example

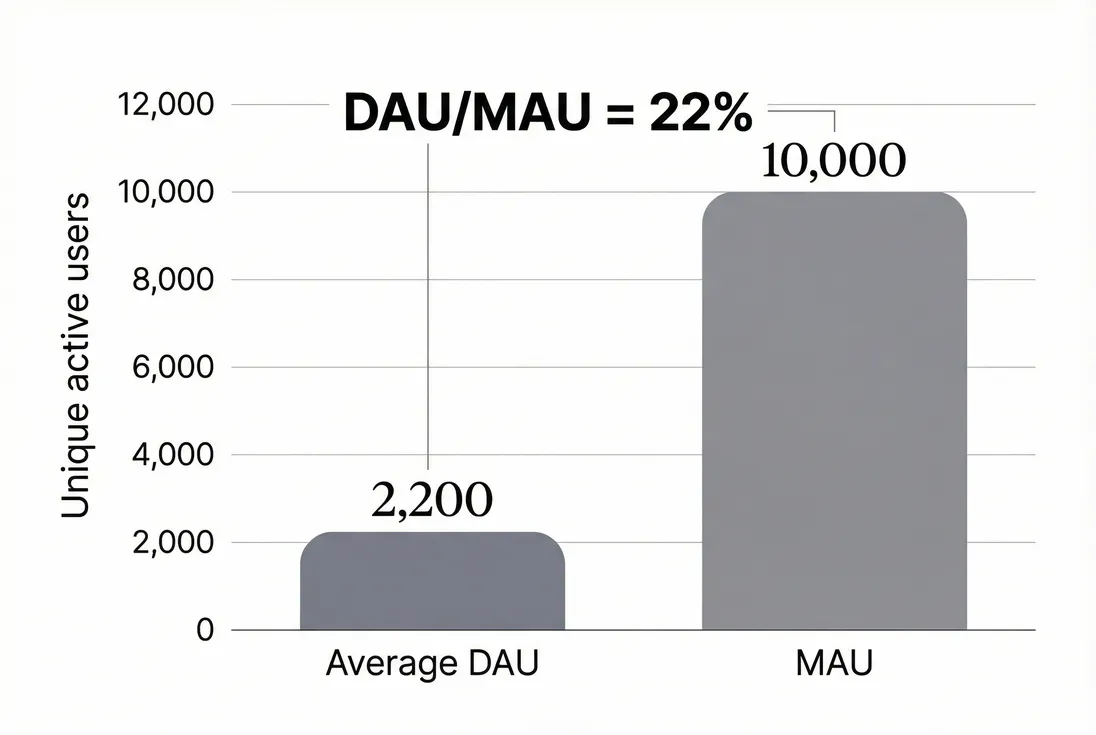

- MAU (unique active users in last 30 days): 10,000

- Average DAU across the month: 2,200

DAU/MAU = 2,200 / 10,000 = 22%

Interpretation: on a typical day, about 1 in 5 of your monthly active users is getting value.

What "good" looks like in practice

There's no universal benchmark because stickiness is driven by natural usage cadence. A payroll product shouldn't be "daily." A customer support tool probably should.

A practical benchmark table founders can use:

| Product usage pattern | Examples | Typical healthy DAU/MAU |

|---|---|---|

| Daily workflow | support, messaging, monitoring, developer tooling | 25% to 50% |

| Several times per week | collaboration, project execution, sales engagement | 15% to 35% |

| Weekly workflow | analytics reviews, planning, finance ops | 10% to 25% |

| Monthly or periodic | compliance, audits, invoicing cycles | 3% to 15% |

How to use this table correctly:

- First, decide what cadence should be true for retained customers.

- Then benchmark stickiness only among customers who have reached "mature usage" (often 60–90+ days old).

- Compare segments (SMB vs mid-market, self-serve vs sales-led) separately.

The Founder's perspective: I only call stickiness "bad" if it's bad for the customer's expected cadence. If the product is supposed to be weekly and DAU/MAU is 8%, that might be fine—if WAU/MAU is strong and renewals are healthy.

What moves the ratio

DAU/MAU changes when either the numerator (DAU) or denominator (MAU) changes. That sounds obvious, but it's where founders misread the signal.

Three common scenarios (and what they mean)

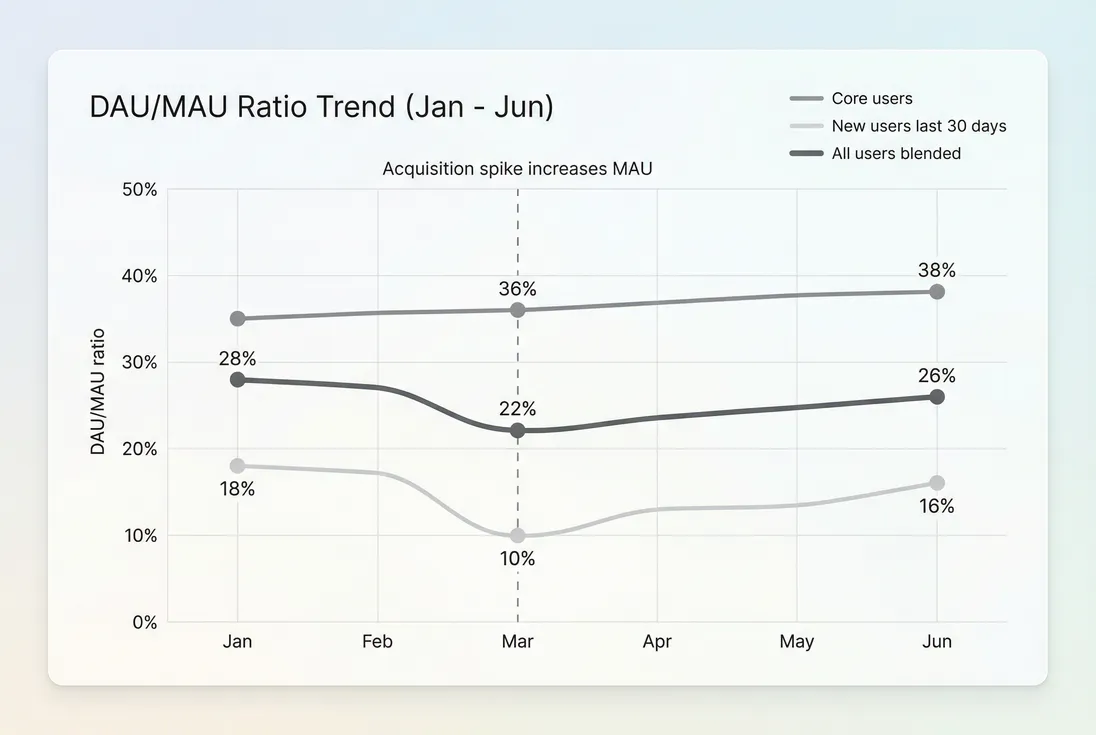

1) MAU grows faster than DAU (stickiness falls)

This often happens after:

- A successful acquisition push

- A free trial or freemium expansion

- A new integration that drives one-time activation

Interpretation: you expanded the top of the "active" base, but new users haven't formed a repeat habit yet. This is not automatically bad—but it becomes bad if cohorts don't catch up.

2) DAU grows faster than MAU (stickiness rises)

This usually means:

- More frequent usage among existing users

- Better workflow embedding

- A feature that creates repeatable value

Interpretation: your product is becoming more essential. This often precedes improvements in retention and expansion.

3) Both DAU and MAU fall, but stickiness holds

This can be:

- Seasonality (holidays)

- Outage impact

- Product/market shift affecting overall demand

Interpretation: stickiness alone won't save you; you're shrinking the active population.

Stickiness is sensitive to acquisition mix

If you suddenly start acquiring users who only need occasional value, stickiness drops even if retention is fine.

This is why segmenting matters:

- By acquisition channel (paid search vs partner vs organic)

- By plan

- By persona (operator vs executive viewer)

- By industry

Tie this back to Churn Reason Analysis when you see stickiness sliding: it helps validate whether the issue is product value, onboarding, pricing expectations, or "wrong customer" acquisition.

When stickiness lies to you

DAU/MAU is simple, which makes it easy to game accidentally—or misinterpret.

Pitfall 1: your "active" event is too shallow

If "active" = login, stickiness will rise when you add SSO, shorten sessions, or change auth flows—even if value delivery didn't improve.

Fix: tie "active" to a value event, and validate with Feature Adoption Rate and retention cohorts.

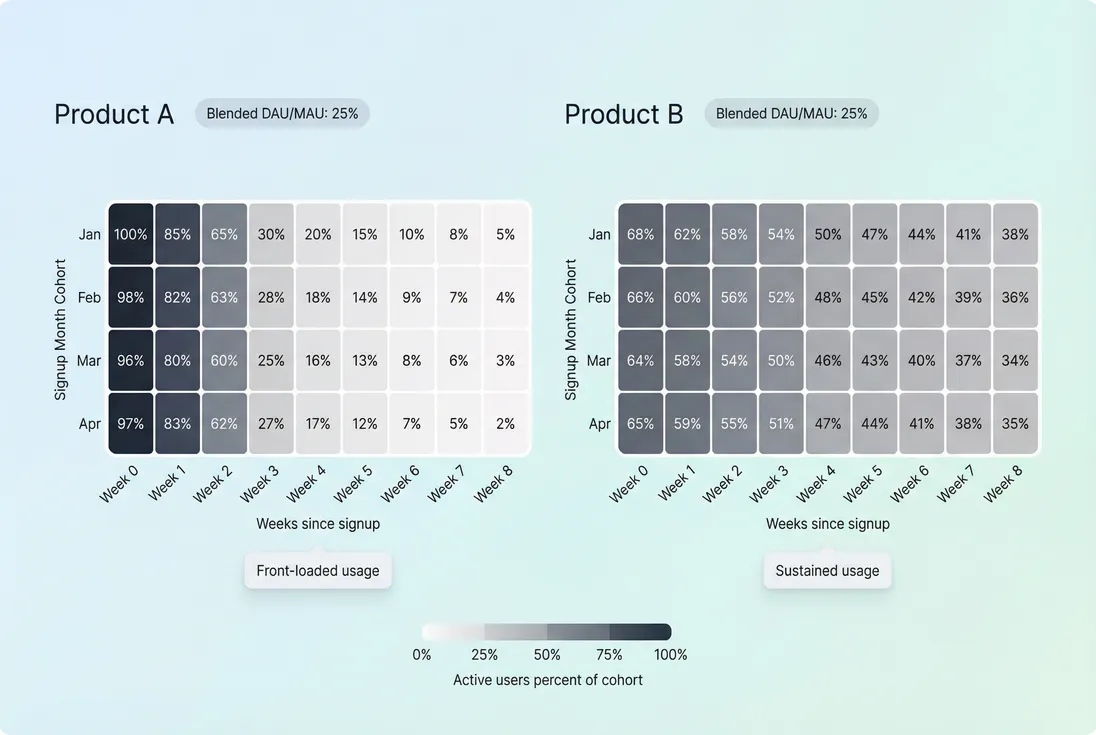

Pitfall 2: power users mask broad disengagement

A small group can generate high DAU while the median customer is drifting. This is common in:

- Sales-led SaaS where admins use the tool daily but end users don't

- Products with "operator" roles and "viewer" roles

Fix: compute stickiness:

- per account (accounts with at least one active user today / active accounts this month)

- per role/persona (admin vs contributor vs viewer)

- per plan and company size

Pitfall 3: calendar and timezone issues

If you report DAU in one timezone and MAU in another (or your customer base is global), your daily counts can be distorted.

Fix: standardize reporting timezone and be consistent. If you operate globally, consider regional dashboards.

Pitfall 4: seasonality and weekly cycles

Many B2B products are "weekday products." Averages can hide the weekday pattern.

Fix: track:

- weekday-only DAU/MAU

- weekend DAU/MAU

- and optionally WAU/MAU if weekly cadence is what matters

Pitfall 5: stickiness isn't retention

Stickiness correlates with retention, but it's not the same thing. You can have:

- decent stickiness among remaining users

- while quietly losing accounts that never adopted deeply

That's why stickiness should be paired with Cohort Analysis and churn metrics like Customer Churn Rate.

How founders use it to make decisions

Stickiness becomes useful when you tie it to specific decisions and operating rhythms.

1) Diagnose whether you have a product problem or a GTM problem

A practical read:

- Low stickiness + high churn: product value is not sticking; focus on activation, workflow fit, and onboarding.

- Low stickiness + low churn (contracted revenue): usage may be role-specific or periodic; validate with customer interviews and cohort retention.

- High stickiness + high churn: often pricing/packaging mismatch, poor account-level value realization, or procurement-driven churn; investigate via Churn Reason Analysis.

- High stickiness + low churn: you're building an embedded workflow; invest in expansion and deeper adoption.

2) Set the right target (by segment)

Avoid a single company-wide target. Instead:

- pick one primary segment (for example, ICP self-serve teams)

- define the "active" event for that segment

- set a target for mature cohorts (for example, users older than 60 days)

Then monitor drift when you expand into new segments.

The Founder's perspective: I don't try to "optimize DAU/MAU" directly. I try to optimize one repeatable behavior that creates customer value. Stickiness is the scoreboard, not the playbook.

3) Prioritize roadmap work that creates repeat usage

Features that tend to raise stickiness are the ones that create:

- a reason to return (queue, inbox, review cycle, exception handling)

- a shared workflow (collaboration, approvals, assignments)

- ongoing data freshness (monitoring, alerts, scheduled runs)

- switching costs through integration (not lock-in—workflow continuity)

Features that often increase MAU but not DAU:

- one-time setup tools

- importers

- "nice to have" dashboards that get checked once

Raising stickiness is frequently about narrowing to the "core loop," not adding more surface area.

4) Use stickiness as an early-warning system

A useful operating habit:

- Review DAU/MAU weekly (blended and by key segments)

- Investigate any sustained move (up or down) lasting 2–3 weeks

- Always check cohorts before reacting

If the ratio drops, ask in this order:

- Did MAU spike from new acquisition?

- Did DAU drop (product issue, outage, seasonality)?

- Did the active definition change?

- Did a specific segment shift (channel, plan, persona)?

5) Pair with revenue metrics when it's time to scale

Stickiness helps you decide whether to scale acquisition efficiently. If you're evaluating payback and scaling spend, pair engagement with unit economics like CAC Payback Period and value metrics like LTV (Customer Lifetime Value). Low stickiness often means your modeled LTV is fragile.

A simple checklist to implement DAU/MAU well

- Define "active" as a value event, not login.

- Use average DAU and a consistent MAU window.

- Track stickiness by segment (plan, role, channel, cohort age).

- Pair it with cohort retention to avoid false confidence.

- Treat big changes as a prompt to investigate—not a KPI to manipulate.

Done right, DAU/MAU is a fast, founder-friendly signal of whether your product is becoming a habit—and whether your growth is compounding or leaking.

Frequently asked questions

It depends on usage frequency. Daily workflow products (support desks, chat, monitoring) often target 25 to 50 percent. Weekly workflow tools (analytics reviews, planning) might be healthy at 10 to 25 percent. Evaluate by segment and job-to-be-done, not as a single universal benchmark.

A growth push can increase MAU faster than DAU, especially if many new users activate once but do not form a habit yet. That temporarily lowers stickiness even if the business is improving. Check new-user cohorts separately, and track onboarding completion and time to value to see if habit formation is lagging.

Use DAU/MAU when your core value should be realized daily. Use WAU/MAU when weekly engagement is the real success pattern (for example, reporting, audits, planning). A good rule is to match the metric to the customer's natural cadence; otherwise you will push the product toward unnecessary daily usage.

Define activity as the smallest action that reliably indicates value, not just logging in. For example, created a ticket, shipped a build, sent an invoice, or completed a workflow step. Use the same definition for DAU and MAU. If you change the definition, expect a break in the trend line.

Yes. A small set of power users can drive high DAU while many accounts quietly disengage. Always segment stickiness by plan, persona, and cohort, and pair it with retention metrics and churn analysis. If stickiness is high but renewals are slipping, engagement may be concentrated in the wrong users.