Table of contents

Customer lifetime

Founders rarely fail because they can't acquire customers—they fail because customers don't stick around long enough to repay acquisition costs and fund the next round of growth. Customer lifetime is the simplest way to pressure-test whether your retention is "good enough" to support your pricing, CAC, and headcount plans.

Customer lifetime is the average amount of time a customer remains active and paying before they churn (cancel or non-renew), usually expressed in months or years.

What customer lifetime reveals

Customer lifetime is a retention quality metric disguised as a unit economics metric. It answers questions like:

- "If we acquire 100 new customers this month, how long will that revenue base last?"

- "Can we afford to scale paid acquisition, or will we just buy churn?"

- "Should we push annual contracts, invest in onboarding, or tighten qualification?"

It also helps you interpret other metrics correctly:

- ARPA (Average Revenue Per Account) tells you how much each customer pays while they're active.

- Logo Churn tells you how often customers leave.

- Customer lifetime turns churn into a time horizon: how long you can count on revenue from an average customer.

The Founder's perspective

Customer lifetime is the "runway" of your customer base. If it's short, every growth initiative becomes fragile: you must constantly replace revenue just to stay flat, CAC payback gets tight, and forecasts become noisy. If it's long, you can take smarter risks—pricing tests, new channels, bigger hires—because the base decays slowly.

How customer lifetime is calculated

There are two practical ways founders calculate lifetime:

- Quick estimate from churn (fast, rough)

- Cohort-based lifetime (slower, more accurate)

The quick churn-based estimate

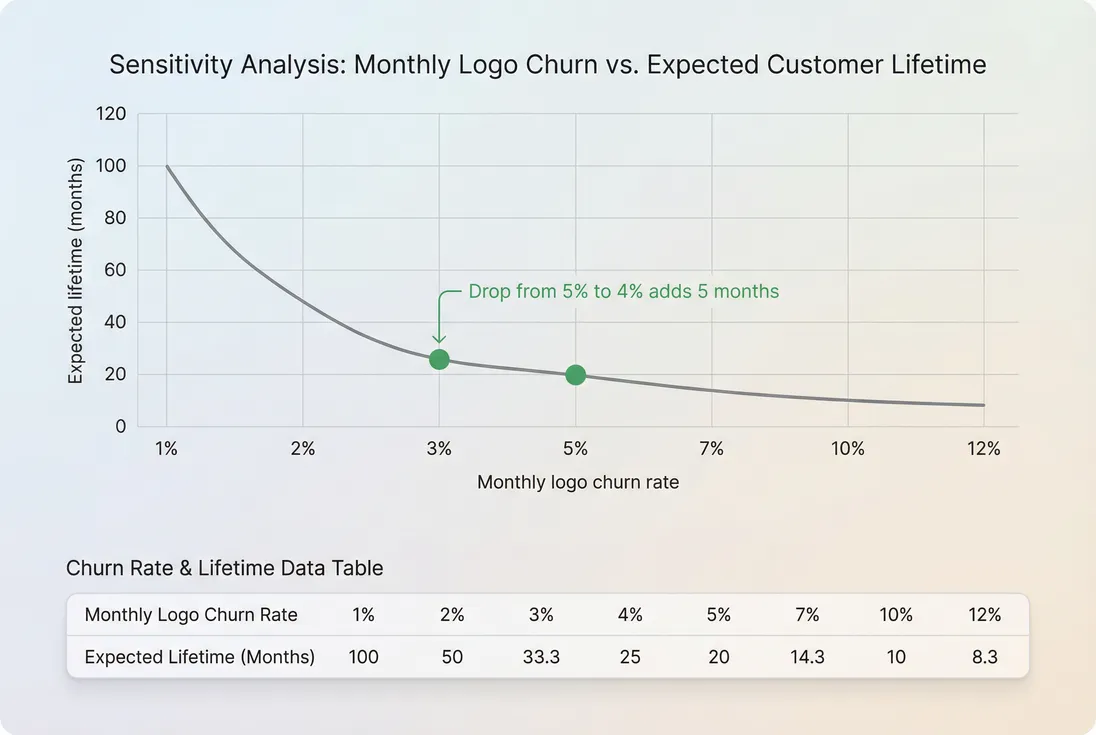

If churn is relatively stable, expected customer lifetime is the inverse of churn rate.

Example:

- Monthly logo churn = 4%

- Estimated lifetime = 1 / 0.04 = 25 months

For annual churn:

Example:

- Annual logo churn = 20%

- Estimated lifetime = 1 / 0.20 = 5 years

When it's useful

- Early-stage planning

- A back-of-the-napkin CAC ceiling

- Sanity-checking whether churn improvements matter

When it misleads

- Churn is lumpy (renewal-driven, annual-heavy)

- Retention improves with tenure (common in B2B)

- You have meaningful reactivations

- You're mixing segments (SMB + enterprise in one number)

For the underlying churn metric, see Customer Churn Rate and Logo Churn.

Cohort-based lifetime (what you should trust)

A cohort-based approach measures how long customers actually stayed, based on cohorts that started at similar times (or similar plans).

A simple, operationally useful version:

How to interpret the components:

- Total customer months: count how many "active customer-months" you had in a period (e.g., 1 customer active for 10 months = 10 customer months).

- Customers churned: count how many customers ended during that same period.

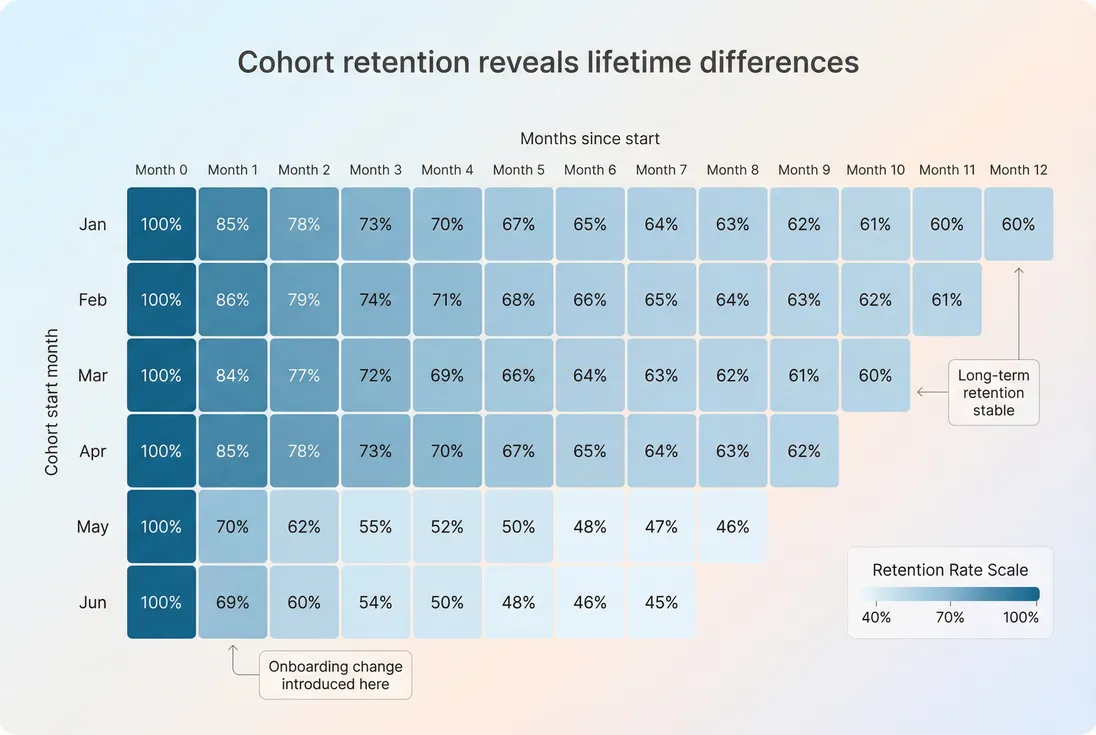

This approach becomes much better when you:

- compute it by cohort (start month, plan, channel)

- compute it for a mature window (e.g., cohorts that started 12–18 months ago)

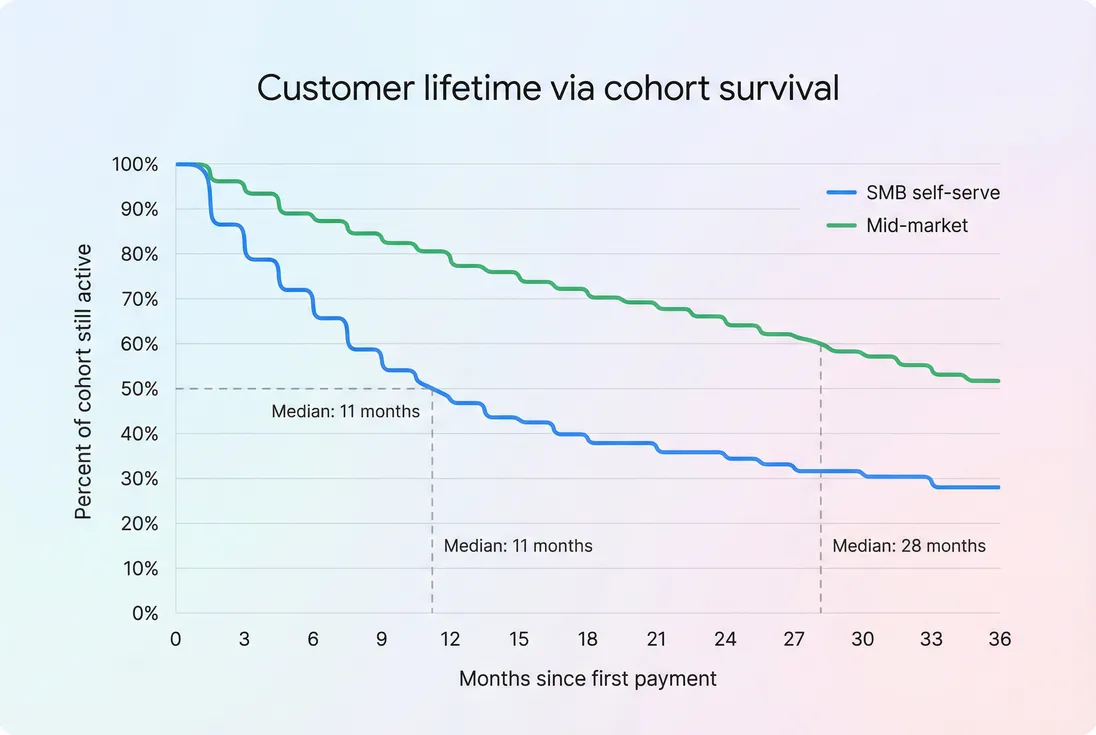

If you want to visualize retention by cohort (which is the clearest way to see lifetime differences), read Cohort Analysis.

The Founder's perspective

If you're deciding "do we scale a channel?" you want cohort-based lifetime by acquisition source, not a blended average. A blended lifetime can look fine while a new channel quietly brings in customers who churn in 60 days—burning cash and support time.

What drives customer lifetime (and what doesn't)

Customer lifetime moves for a handful of reasons. The founder job is to separate real retention improvements from measurement artifacts.

1) Customer-value fit and onboarding

The biggest driver is whether customers reach "aha" fast and repeatedly.

Signals that lifetime is primarily a value/onboarding issue:

- short time-to-churn (many cancel in month 1–3)

- lots of downgrades before cancelation (see Contraction MRR)

- churn reasons cluster around "didn't use" or "not worth it" (see Churn Reason Analysis)

This is where you connect lifetime to behavioral metrics like activation and usage, and to customer experience measures like CES (Customer Effort Score) and CSAT (Customer Satisfaction Score).

2) Pricing, packaging, and discounting

Pricing changes can increase churn (shorter lifetime) even when revenue rises.

Typical patterns:

- Price increase: lifetime may dip first (more marginal customers churn), then stabilize if value is strong.

- Aggressive discounting: can reduce lifetime by attracting low-intent buyers and setting renewal expectations. See Discounts in SaaS.

A practical check: if lifetime drops after discounting, you didn't "buy growth"—you bought churn and support load.

3) Contract length and renewal mechanics

Longer contracts can change when churn shows up.

- An annual contract can make lifetime look longer in-month, but you still face a cliff at renewal.

- Multi-year deals reduce logo churn volatility, but can mask product issues until renewal cycles.

Related: Average Contract Length (ACL).

4) Involuntary churn (billing failures)

Billing issues shorten lifetime without reflecting product value:

- failed payments

- expired cards

- chargebacks and refunds

If you see lifetime falling while product engagement looks stable, investigate involuntary churn and leakage such as Refunds in SaaS and Chargebacks in SaaS.

5) What doesn't directly change lifetime: expansion

Expansion is critical, but it's a different lever.

- Expansion improves revenue retention metrics like NRR (Net Revenue Retention).

- It may correlate with longer lifetime (customers who expand often stay longer), but expansion itself doesn't define when a customer ends.

This matters because "lifetime from churn" is a logo metric; it won't capture value gained from expansion. That's one reason lifetime should be interpreted alongside LTV (Customer Lifetime Value) and retention metrics.

How to interpret changes in lifetime

Customer lifetime is easy to overreact to because it can move for reasons that aren't durable. Use this checklist before acting.

First, ask: is this a segment shift?

Blended lifetime often changes because your mix changed:

- more small customers vs fewer large customers

- a new channel (partners, paid search, marketplaces)

- a new plan tier

Action: segment lifetime by:

- plan / tier (see ASP (Average Selling Price) as a proxy for plan)

- acquisition source

- customer size or use case

If you're using GrowPanel, this is where filters, cohorts, and the customer list become operational: you want to isolate the "new behavior" cohort and see whether it's broad-based or localized.

Helpful references:

Second, ask: is churn timing shifting?

A change in billing terms can shift churn recognition timing:

- moving monthly to annual

- introducing annual-first with monthly fallback

- changing cancelation policy (end-of-term vs immediate)

If churn is now "chunkier," you'll see lifetime fluctuate. Pair lifetime with:

- renewal rate (see Renewal Rate)

- cash collection patterns (see Accounts Receivable (AR) Aging for invoiced motions)

Third, ask: is it early churn or late churn?

Same average lifetime, very different business.

- Early churn (0–3 months): acquisition targeting, onboarding, expectation setting, trial-to-paid motion

- Late churn (12+ months): product roadmap gaps, competition, budgeting cycles, executive sponsorship loss

This distinction changes what you do next.

The Founder's perspective

If churn happens early, fix your funnel and onboarding before you hire more sales or buy more traffic. If churn happens late, fix renewal risk: exec alignment, usage depth, and ROI narratives. "Improve retention" is not a strategy—knowing when customers leave is.

How founders use customer lifetime in real decisions

Set CAC ceilings and payback expectations

Lifetime is one of the three multipliers behind how much you can afford to spend to acquire a customer:

Then you translate LTV into acquisition constraints via:

A concrete scenario:

- ARPA = $200 per month

- Gross margin = 80%

- Lifetime = 20 months

Estimated LTV ≈ 200 × 0.8 × 20 = $3,200

If your CAC is $2,500, the ratio is tight, payback may be long, and you'll feel it in cash. If lifetime improves from 20 to 25 months (same ARPA, margin), LTV rises 25%—often the difference between "scale" and "stall."

Decide whether annual-first is worth it

Annual contracts can:

- reduce churn frequency

- increase cash collected up front (affecting runway)

- improve forecasting

But they can also:

- hide product issues until renewal

- increase refund and dispute risk if expectations aren't set

Use lifetime to validate whether annual is creating durable retention or just delaying churn. Pair it with:

- GRR (Gross Revenue Retention) and NRR (Net Revenue Retention)

- churn reason analysis

Prioritize retention work versus new acquisition

If lifetime is short, your growth engine leaks. A good rule of thumb for founders:

- If logo churn is high and early churn dominates: prioritize onboarding, activation, qualification.

- If logo churn is moderate but expansion is weak: prioritize adoption and monetization.

- If both look healthy: invest more confidently in acquisition.

This connects directly to capital efficiency metrics like Burn Multiple and Capital Efficiency.

Sanity-check forecasts and hiring plans

Longer lifetime means your customer base decays slowly, making revenue forecasts more stable. Short lifetime means:

- you need more new bookings just to replace churn

- pipeline requirements rise

- support load becomes unpredictable (more new customers = more onboarding)

If you're planning headcount, pair lifetime with MRR (Monthly Recurring Revenue) trend and churn metrics like MRR Churn Rate.

Common traps (and how to avoid them)

Trap 1: Treating lifetime as precise early on

With small customer counts, a few churn events swing the metric. Use it as a directional input, and lean more on:

- cohort charts

- qualitative churn reasons

- leading indicators (activation, adoption)

Trap 2: Mixing segments that behave differently

Enterprise-like customers and SMB self-serve customers should not share one lifetime. Segment by:

- plan tier

- ACV band (see ACV (Annual Contract Value))

- acquisition channel

- region (use a geo view like map if available)

Trap 3: Confusing contract length with lifetime

A 12-month contract is not a 12-month lifetime. Customers can be "locked in" and still be unhappy. Watch renewal behavior and product engagement, not just billing duration. If you're tracking contract mechanics, pair with Average Contract Length (ACL).

Trap 4: Using 1 divided by churn during a transition

If you changed:

- pricing

- onboarding

- ICP targeting

- billing terms

…then churn is not stable. The inverse-churn lifetime estimate can be wrong by a lot. In transitions, cohort-based analysis is the safer decision tool.

Trap 5: Ignoring reactivations and pauses

Some products have meaningful "pause and return" behavior. If you count every pause as churn, lifetime will look shorter than the lived customer relationship. Track reactivations separately (see Reactivation MRR) and decide on a consistent churn recognition policy.

Practical benchmarks (use with caution)

Benchmarks vary widely by category, pricing, and go-to-market motion. Still, it helps to sanity-check your numbers.

A common way is to benchmark monthly logo churn and translate to expected lifetime:

| Segment (typical) | Monthly logo churn (rough) | Expected lifetime (rough) |

|---|---|---|

| SMB self-serve | 3% to 7% | ~14 to 33 months |

| Mid-market | 1% to 3% | ~33 to 100 months |

| Enterprise | 0.3% to 1% | ~100 to 333 months |

Use this table as a starting point, then validate with cohorts and renewal behavior.

The operating cadence that works

If you want customer lifetime to drive better decisions (not just be a dashboard number), run it on a cadence:

- Monthly: watch churn and early-life retention (0–3 months)

- Quarterly: cohort lifetime by plan, channel, and onboarding version

- Before scaling spend: lifetime and payback by acquisition source, not blended

Connect the outputs to actions:

- tighten qualification if early churn rises

- invest in onboarding if cohorts break

- revisit packaging if churn clusters in a specific tier

- revisit billing recovery if lifetime falls without product signals

Customer lifetime won't tell you why customers leave, but it tells you how much time you have to earn back CAC, deliver value, and build a compounding growth loop. That's why founders should treat it as a core operating metric—not a vanity average.

Frequently asked questions

Compare lifetime to your sales motion and contract structure, not to a universal benchmark. A self-serve SMB product might be healthy at 12 to 24 months, while mid-market often targets 24 to 60 months, and enterprise can be 5 plus years. The key is whether lifetime supports CAC payback and expansion plans.

Use 1 divided by monthly logo churn as a quick directional estimate, especially for early planning. But it breaks when churn is not steady, when annual contracts dominate, or when retention improves materially over time. For decisions like pricing or channel spend, cohort based lifetime is usually more reliable.

Annual contracts typically reduce observed churn frequency, but they do not automatically create more product value. Measure lifetime in renewal cycles and track what happens at renewal events. Also separate true retention from billing mechanics: annual prepay can hide short term dissatisfaction until renewal, so watch product usage and renewal risk.

NRR can rise from expansion among surviving customers while more customers churn earlier. That combination increases revenue retention but shortens average customer lifetime. This often happens when you push aggressive price increases, introduce add-ons that expand power users, or shift acquisition toward lower intent segments. Segment lifetime by plan and channel.

Lifetime determines how many months you have to recoup CAC and generate margin. If lifetime is short, you need fast payback and disciplined CAC caps, or you risk cash strain. If lifetime is long and predictable, you can invest more upfront. Always connect lifetime to gross margin and retention by cohort.