Table of contents

Customer churn rate

Churn is the silent tax on SaaS growth. If you're losing customers faster than you're improving retention, you can show "new bookings" every month and still feel like you're running in place—because you are.

Customer churn rate is the percentage of customers who cancel (or otherwise stop being active paying customers) during a period.

What churn rate reveals

Customer churn rate answers one founder-critical question: Are you building a business that keeps customers, or one that constantly replaces them?

It's tempting to focus on top-line growth, but churn is what determines:

- How durable revenue is (and how much your pipeline must refill every month).

- How high you can profitably spend on acquisition, because churn compresses lifetime value.

- Whether product-market fit is improving, especially when viewed by cohort and segment.

Churn rate is a customer-count metric. That makes it especially useful when you want to separate "we lost a few huge accounts" (revenue problem) from "we're losing lots of accounts" (product/market fit or onboarding problem).

If you want the revenue version, pair this with MRR Churn Rate and Net MRR Churn Rate. If you want a retention framing, connect it to Logo Churn, GRR (Gross Revenue Retention), and NRR (Net Revenue Retention).

The Founder's perspective: Customer churn rate is the fastest way to tell whether "growth" is real. If churn rises for two consecutive months, I assume our acquisition is masking retention weakness until proven otherwise.

How to calculate churn rate

At its simplest, customer churn rate is:

What counts as a "customer"

Define "customer" consistently. Common pitfalls:

- Multiple subscriptions per account: decide whether churn is per account (typical) or per subscription (less common).

- Paused / delinquent states: decide when you recognize churn (see your internal policy; many teams align with revenue recognition and billing status). For guidance on timing, see When should you recognize churn in SaaS?

- Free plans: exclude free users from customer churn unless you run a freemium model where "customer" includes free accounts by design.

If you're unsure, keep it simple: a customer is an account paying you recurring revenue at the start of the period.

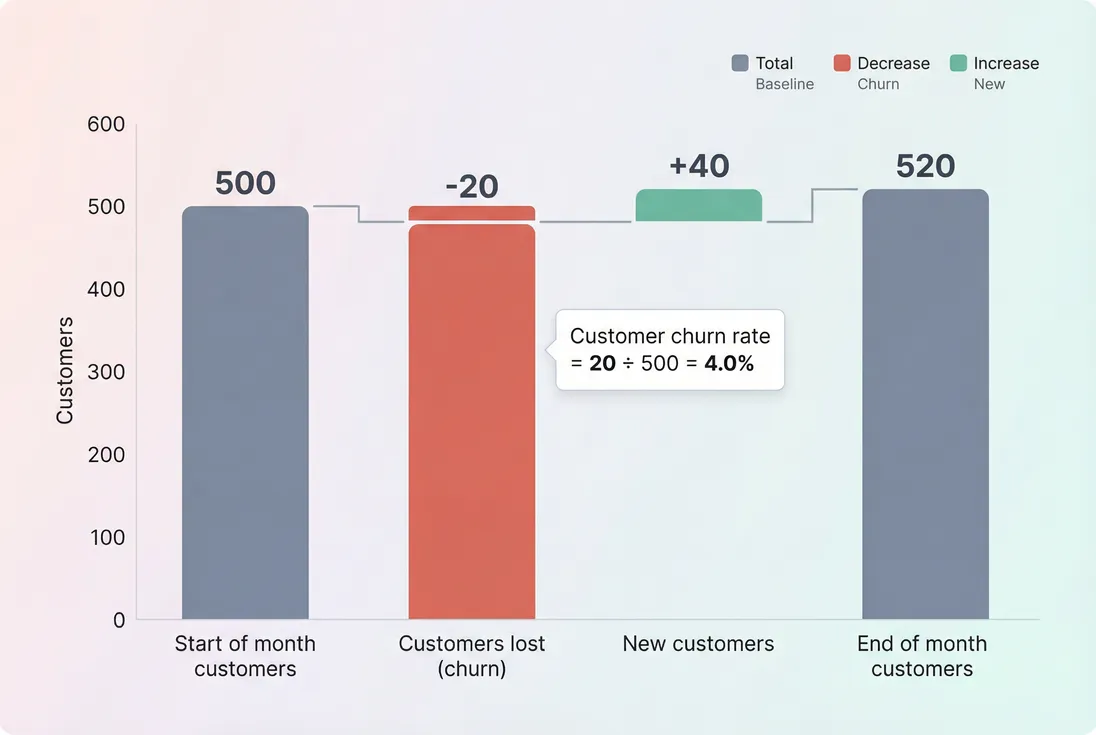

A concrete monthly example

- Customers at start of month: 500

- Customers who churned during month: 20

Customer churn rate = 20 / 500 = 4%

Notice what's not in the denominator: new customers acquired during the month. That's intentional. Churn measures loss on the starting base.

Want to run the numbers for your own business? Try the free churn rate calculator to see monthly and annualized churn rates instantly.

Monthly vs annual churn

For many SaaS businesses (especially SMB), churn is tracked monthly. For enterprise, annual churn can be more aligned with renewal cycles. Don't mix them without translating.

If you have a monthly churn rate and want an annualized view:

This translation matters because small monthly differences compound. For example, 3% monthly churn is not 36% annual churn; it's closer to ~30% annual churn when compounded.

When customer churn is the wrong lens

Customer churn can look "fine" while the business is unhealthy if:

- You're losing high-value customers (customer churn low, revenue churn high).

- You have meaningful contraction before churn (accounts downgrade, then cancel later). Track Contraction MRR alongside churn.

- You're using usage-based pricing where customers stay but spend drops. Pair with retention and revenue movement metrics (see Usage-Based Pricing).

If you want a customer-count retention view that's easier to compare across time, you can also track logo retention (the inverse of churn) in your retention reporting (see /docs/reports-and-metrics/retention/).

What moves churn up or down

Churn is an outcome. To manage it, you need to know which system is causing it to change.

Three common churn regimes

1) Early-life churn (onboarding failure)

Customers churn quickly because they never reach value.

Typical signals:

- Low Onboarding Completion Rate

- Slow Time to Value (TTV)

- Weak initial activation and low Feature Adoption Rate

Fix levers:

- Narrow the "first success" path

- Shorten setup steps

- Improve templates, defaults, and guided onboarding

2) Mid-life churn (product value gap)

Customers used the product, but stop because the value isn't durable.

Signals:

- Support volume rises

- CSAT/NPS softens (see CSAT (Customer Satisfaction Score) and NPS (Net Promoter Score))

- Engagement drops (see DAU/MAU Ratio (Stickiness))

Fix levers:

- Improve core workflows

- Invest in reliability and performance (see Uptime and SLA)

- Align roadmap to the segment that retains

3) Renewal churn (commercial / procurement churn)

Customers get value but leave due to budget, pricing, or procurement friction.

Signals:

- Churn clusters around renewal dates

- Downgrades precede churn

- Deal desk patterns: discounts, concessions, or price objections (see Discounts in SaaS)

Fix levers:

- Packaging and value metrics

- Success plans and ROI narratives

- Contract structure (see Average Contract Length (ACL))

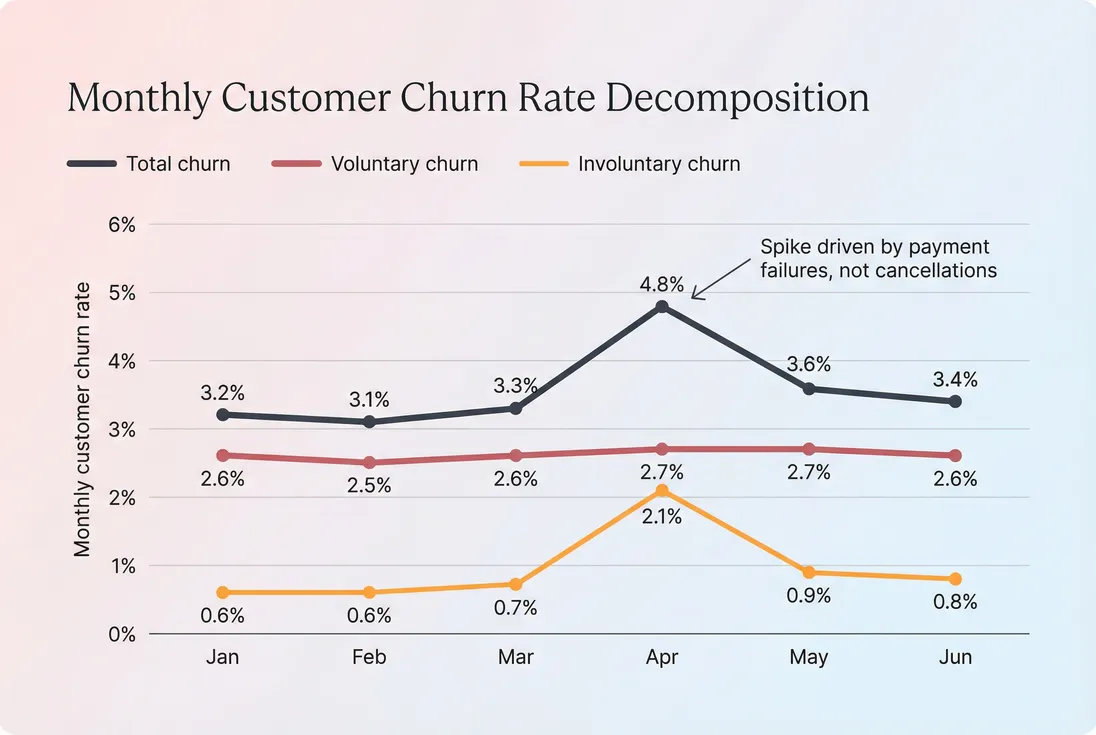

Voluntary vs involuntary churn

Separate churn into two buckets:

- Voluntary churn: customer chooses to cancel (product, value, pricing, competition).

- Involuntary churn: payment failures, expired cards, billing system issues.

This isn't just bookkeeping. It changes your action plan and who owns the fix. If churn rises but it's mostly involuntary, your product may be fine—your billing ops are not (see Involuntary Churn and Refunds in SaaS).

Segment mix can "change churn" without real improvement

Your churn rate can improve simply because you sold more of a low-churn segment (for example, larger customers). That's not bad—but it's different from improving retention within a segment.

Always check churn by:

- Plan / package

- Tenure (0–30 days, 31–90, 90+)

- Acquisition channel

- Industry or use case

- Customer size proxy (ARPA/ASP bands; see ARPA (Average Revenue Per Account) and ASP (Average Selling Price))

The Founder's perspective: I don't celebrate lower churn until I see it improve in at least one stable segment. Otherwise it might just be mix shift—and mix can shift back.

What good looks like

Benchmarks are useful for sanity checks, but your contract length, customer size, and go-to-market motion matter more than any generic target. For a deeper dive into benchmarks by segment, see What is a good customer churn rate for SaaS?

Here are practical ranges founders commonly use as a starting point:

| Segment (typical motion) | Typical monthly customer churn | Notes |

|---|---|---|

| Self-serve SMB (PLG) | 3%–7% | High volume smooths volatility; focus on early-life churn and activation. |

| SMB sales-assist | 2%–5% | Often improves with better onboarding and tighter ICP. |

| Mid-market (sales-led) | 1%–2% | Watch renewal cohorts; churn often clusters at contract boundaries. |

| Enterprise (annual contracts) | 0.2%–1% | Monthly view can be noisy; annual logo churn is often the primary lens. |

Two important caveats:

A "good" churn rate depends on your gross margin and CAC.

If CAC is high and churn is high, your payback breaks (see CAC Payback Period and CAC (Customer Acquisition Cost)).Revenue expansion can mask customer churn.

You can lose customers and still grow revenue if remaining customers expand. That might be fine—unless the churned customers represent your future expansion pool. Use Expansion MRR and Net Negative Churn to understand the full picture.

Churn and "how long customers last"

A quick-and-useful approximation for expected lifetime:

If monthly churn is 5% (0.05), expected lifetime is ~20 months. If you reduce churn to 4% (0.04), expected lifetime becomes ~25 months. That's a meaningful jump—and it flows directly into LTV (Customer Lifetime Value) and how aggressive you can be on acquisition.

Use trailing averages to avoid overreacting

Churn is volatile in early-stage SaaS, especially if you have fewer than a few hundred customers. A single cancellation can swing the rate.

Operationally, many founders track:

- Monthly churn (for immediacy)

- Trailing 3-month average for trend (see T3MA (Trailing 3-Month Average))

This helps you avoid "strategy whiplash" after one bad week.

How founders act on churn

Churn gets valuable when it changes what you do: what you build, who you sell to, and how you support customers.

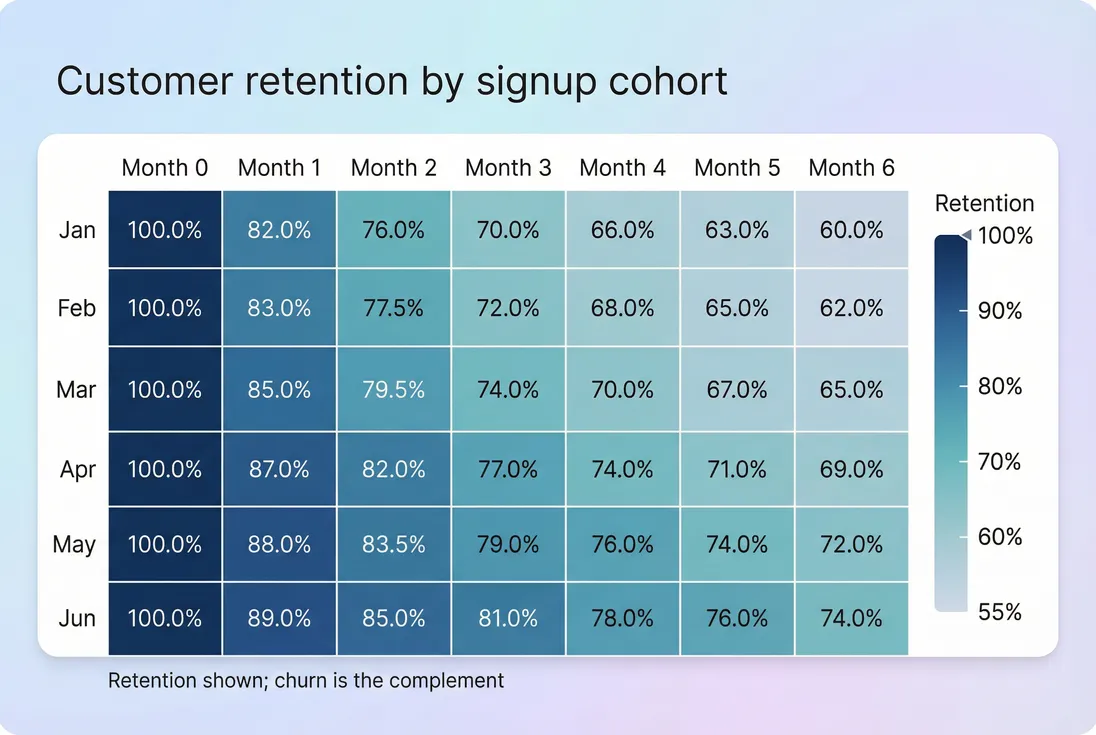

Start with cohorts, not averages

Overall churn blends customers at different lifecycles. Cohorts show whether newer customers are healthier than earlier ones.

A simple cohort heatmap often reveals:

- A big drop in month 1 (activation problem)

- A step down at month 12 (renewal or annual contract issue)

- A flat, healthy curve after initial setup (good sign)

If you want to go deeper, use Cohort Analysis and (for concentrated revenue risk) Cohort Whale Risk.

Run a churn investigation like a decision tree

When churn rises, don't jump straight to "we need more features." Use a simple sequence:

Is the churn voluntary or involuntary?

If involuntary is rising, fix billing and dunning first.Is churn concentrated in a segment?

Filter by plan, tenure, acquisition channel, and ARPA bands.Is churn preceded by contraction or usage decline?

If yes, your leading indicators exist—you can intervene earlier.Did something change operationally?

Examples: pricing change, onboarding flow update, product outages, support backlog, or a new competitor.

To make this repeatable, keep a lightweight process for Churn Reason Analysis—but don't let "reasons" become a dumping ground. A reason taxonomy only helps if it drives action.

The Founder's perspective: I treat churn spikes like incident response: classify the type, isolate the segment, find the earliest leading indicator, then assign a single owner and a measurable fix.

Translate churn into an execution plan

Different churn patterns imply different investments:

- High churn in first 30 days: onboarding, activation, positioning, trial-to-paid flow (see Free Trial and Product-Led Growth).

- High churn at renewal: customer success motions, ROI proof, packaging, contract structure, and expectations set during sales (see Sales-Led Growth and Go To Market Strategy).

- High churn in one channel: your channel is sending the wrong customers; revisit targeting and messaging (see Conversion Rate and Lead-to-Customer Rate).

- High churn with low engagement: prioritize product reliability, usability, and the "core job" feature set over edge-case requests.

Use churn to set growth expectations

Churn determines your "leaky bucket" replacement burden. A practical planning step:

- If you start the month with 1,000 customers and churn is 4%, you will lose ~40 customers.

- If your sales and marketing can only add 35 new customers per month, your customer base shrinks—even if pipeline "feels busy."

This is why churn is tied to capital efficiency metrics like Burn Multiple and Capital Efficiency: high churn forces higher spend just to stand still.

Where to see it in GrowPanel

GrowPanel's subscription analytics makes it easy to track churn alongside the metrics that matter. If you're using GrowPanel, you'll typically analyze churn alongside adjacent views:

- Churn reporting: /docs/reports-and-metrics/churn/

- Logo churn breakdown: /docs/reports-and-metrics/churn/logo-churn/

- Filtering into segments: /docs/reports-and-metrics/filters/

- Cohorts and retention views: /docs/reports-and-metrics/cohorts/ and /docs/reports-and-metrics/retention/

(Keep the operational habit: when churn changes, go to the customer list, isolate the segment, and read the actual cancellations—numbers point, customers explain.)

Quick recap

- Customer churn rate measures the percent of customers lost from the starting base in a period.

- It's most useful when split by voluntary vs involuntary and analyzed by segment and cohort.

- Don't chase a benchmark. Chase improving retention in your target ICP, because that's what makes growth durable.

Frequently asked questions

Track churn on the same cadence you make operating decisions. Monthly churn is best for SMB and product-led SaaS because it moves quickly and shows onboarding and product issues early. Annual churn fits enterprise with annual contracts. Many teams track monthly plus a trailing 3-month average for stability.

Good depends on contract length and customer size. Self-serve SMB often lands in the 3 to 7 percent monthly range, while mid-market might be 1 to 2 percent monthly, and enterprise can be below 1 percent monthly. Compare against your own cohorts and segment mix, not a single internet benchmark.

Classify churn events by cause: voluntary is a customer deciding to cancel, involuntary is payment failure, card expiry, or billing issues. You want both rates because the fixes are different. Involuntary churn is often solvable with dunning and retry logic, while voluntary churn requires product value and success work.

Price changes often shift churn timing, not just churn level. Expect elevated churn at renewal dates, especially if you removed discounts or changed packaging. Segment the churn by plan, tenure, and acquisition channel to see who is price-sensitive. Pair churn with ARPA changes to judge net impact.

Churn is a primary driver of LTV because it determines how long revenue persists. Even small churn improvements compound: lowering monthly churn from 5 percent to 4 percent increases expected lifetime materially. That typically improves LTV and shortens CAC payback, giving you room to spend more on acquisition without hurting capital efficiency.