Table of contents

Average contract length (ACL)

Founders feel "churn risk" most intensely at renewal time. Average contract length (ACL) tells you how often those renewal moments happen—and how much of your revenue can actually walk out the door in a given period. It directly affects forecast accuracy, renewal workload, discounting behavior, and how fast you can safely invest.

Average contract length (ACL) is the average time customers are committed to your product before they can cancel without penalty, typically measured in months. It is a commitment metric, not a billing metric.

What does ACL reveal?

ACL is a shortcut to understanding the shape of your revenue risk.

- Renewal pressure: Short ACL means more frequent renewal decisions (more chances to churn).

- Forecast confidence: Longer ACL increases forward visibility—closely related to the idea behind CMRR (Committed Monthly Recurring Revenue).

- Growth strategy signals: Monthly-heavy ACL usually pairs with product-led motions; annual/multi-year often pairs with sales-led motions (see Product-Led Growth and Sales-Led Growth).

- Discount dynamics: Longer commitments often come with concessions. If ACL rises while Discounts in SaaS rise faster, you may be buying predictability at too high a price.

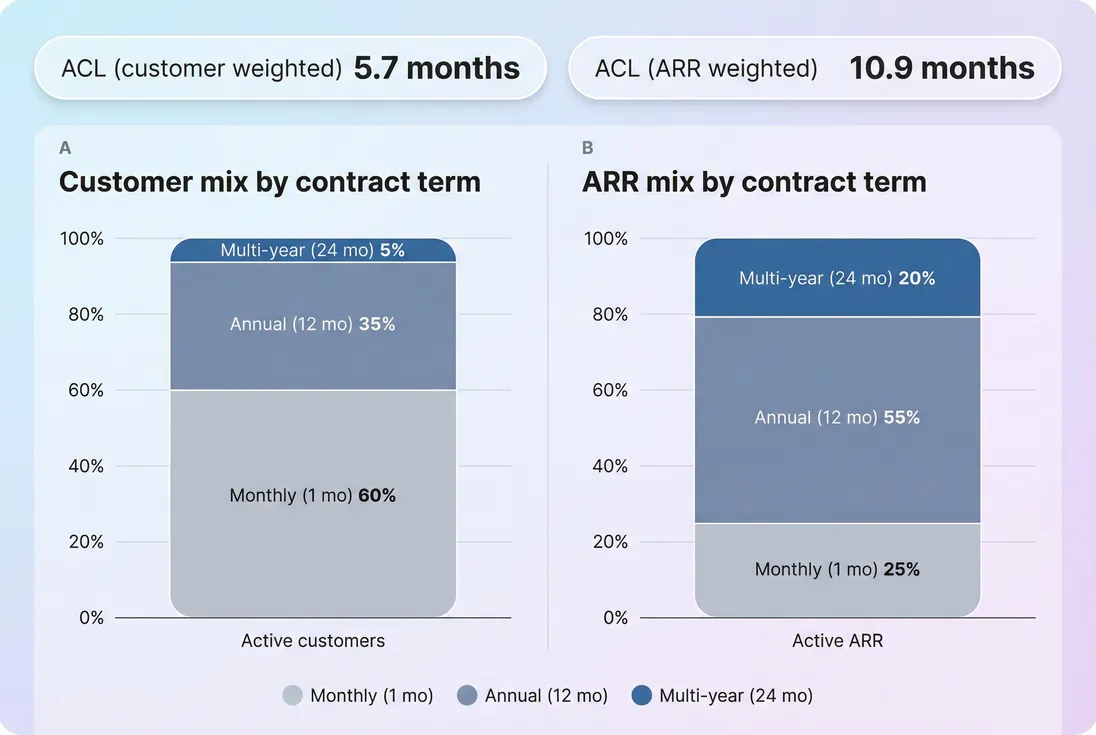

ACL can look very different depending on whether you weight by customers or by revenue—both views matter for different decisions.

The Founder's perspective: ACL is a leverage point. If you can increase commitment without excessive discounting or sales friction, you reduce churn exposure and stabilize planning. If you increase commitment by force or concessions, you may create a future renewal cliff that hits cash flow and growth at the same time.

How do you calculate ACL?

The hard part isn't the arithmetic—it's agreeing on a definition that matches how your business works.

Step 1: define contract length

For each active customer (or each active contract), determine the committed term in months:

- Monthly subscription with cancel-anytime: 1 month

- Annual contract: 12 months

- Two-year deal: 24 months

- Evergreen after an initial term: use the initial committed term for "bookings ACL," and track post-term behavior separately (more on this later)

Important: billing frequency is not commitment. An annual contract billed monthly is still a 12-month commitment.

Step 2: choose weighting

You typically want two ACLs:

Customer-weighted ACL (logo-weighted)

Best for renewal operations and customer success workload.Revenue-weighted ACL (ARR-weighted)

Best for forecasting and business risk, because it answers "how much committed revenue is locked in for how long."

The formula

Use a weighted average:

Where:

- For customer-weighted ACL, set

- For revenue-weighted ACL, set (or ACV, depending on how you manage contracts)

If you're early-stage and don't have clean ARR per contract, you can approximate with MRR and multiply by 12 to get ARR-consistent weights (see MRR (Monthly Recurring Revenue) and ARR (Annual Recurring Revenue)).

A concrete example

Say you have 100 customers:

- 60 on monthly (1 month)

- 35 on annual (12 months)

- 5 on two-year (24 months)

Customer-weighted ACL:

That equals 5.7 months.

But if those 5 two-year customers represent 20% of ARR, your revenue-weighted ACL could be ~11 months or higher—meaning your financial churn exposure is lower than your customer churn exposure.

What changes ACL in practice?

ACL moves when your contracts, packaging, or buying motion moves. The most common drivers are straightforward—and measurable.

Pricing and packaging decisions

- Annual prepay incentive: "Pay annually, get 2 months free" increases annual adoption, raising ACL, but it's functionally a discount (tie this to Discounts in SaaS).

- Minimum term introduced: Adding a 3-month minimum term immediately raises ACL, but may reduce conversion and increase support load.

- Plan gating: Enterprise features only on annual or multi-year terms raises ARR-weighted ACL quickly if enterprise expands.

Packaging interacts strongly with ASP (Average Selling Price) and ARPA (Average Revenue Per Account). Higher price points usually justify longer procurement and longer terms.

Segment and channel mix shifts

Your ACL can rise even if you didn't change a thing—because your mix changed:

- Landing more mid-market/enterprise customers increases ACL.

- Partner and reseller deals often come with longer terms.

- Self-serve and SMB skew short unless you've nailed annual conversion.

If your go-to-market is evolving, interpret ACL alongside Go To Market Strategy and Sales Cycle Length. It's common to see sales cycle length rise before ACL rises—procurement slows you down, then rewards you with longer commitments.

Procurement and legal friction

Longer terms often require:

- Security reviews

- Legal redlines

- Vendor onboarding

If you push for multi-year too early, you can inflate sales cycle length and hurt win rate (see Win Rate).

Discounting and concessions

Multi-year deals are frequently "purchased" with:

- Bigger discounts

- More favorable termination clauses

- Price locks that limit expansion later

That trade can still be good—but you should model it explicitly using CAC Payback Period and LTV (Customer Lifetime Value). A longer contract is only valuable if contribution margin and retention make it profitable.

Expansion and co-terming effects

If you expand an account mid-term (upsell seats, add modules), the contract term might not change, but the revenue weight changes—raising ARR-weighted ACL if expansions happen more in long-term contracts.

Pair ACL trends with Expansion MRR and Net MRR Churn Rate. A healthy pattern is: longer commitments and strong expansion, not longer commitments masking weak retention.

How founders use ACL

ACL is most useful when it changes what you do next month—not when it's a vanity KPI on a dashboard.

1) Forecast churn and renewals realistically

Short ACL means renewals are constantly in play. Longer ACL usually means:

- Fewer renewals each month

- Bigger renewal events when they hit

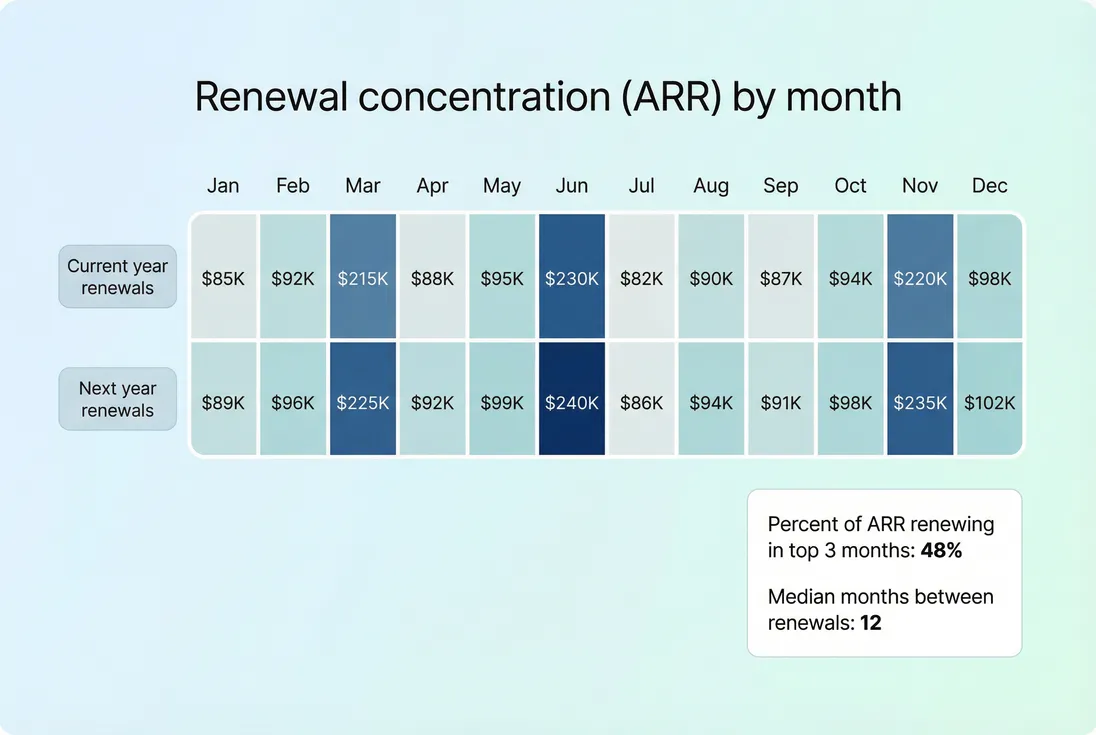

That's why ACL should be paired with renewal concentration: if a large share of ARR renews in the same quarter, you've built a cliff.

Even with a healthy ACL, renewal concentration can create quarters where churn risk is structurally higher—plan pipeline and CS coverage around those months.

Operationally, founders use this to:

- Staff renewals and customer success around peak months

- Set pipeline targets to offset expected renewal exposure

- Decide when to push annuals versus prioritize fast monthly conversion

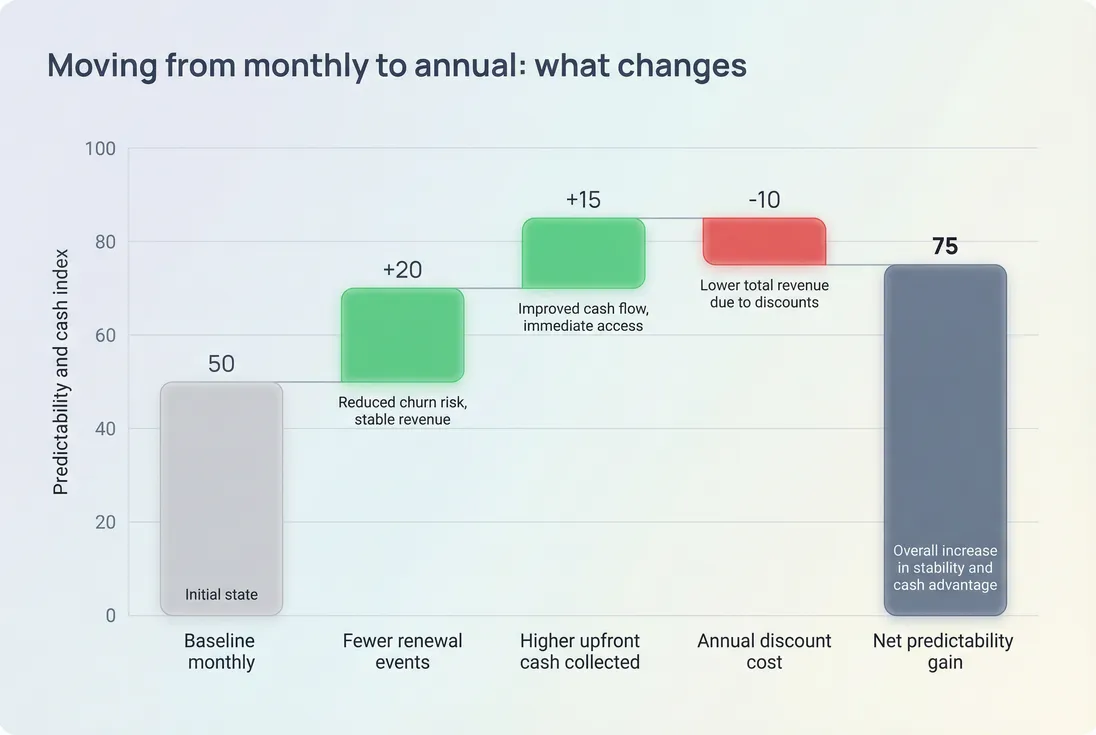

2) Make CAC payback less fragile

If customers can churn in month 1, your CAC (Customer Acquisition Cost) payback is inherently fragile. Increasing ACL (through annual commitments or minimum terms) can improve the certainty of recovering CAC—even if the customer later churns at renewal.

But don't confuse "longer commitment" with "higher LTV." If customers only stay for one term and then leave, you may have simply delayed churn.

A practical check:

- If ACL rises and logo churn falls sustainably, great.

- If ACL rises but churn just shifts to renewal months (spiky churn), you've changed timing, not product value. Use Logo Churn and Customer Churn Rate to validate.

3) Improve cash planning and reduce surprises

Longer terms can improve cash collection timing (especially with annual prepay), but they also introduce accounting and operational complexity:

- More deferred revenue (see Deferred Revenue)

- Larger invoices that may age in receivables (see Accounts Receivable (AR) Aging)

- Higher exposure to refund disputes or chargebacks in consumer-ish segments (see Refunds in SaaS and Chargebacks in SaaS)

This is where founders get tripped up: ACL improves predictability of commitment, not necessarily predictability of cash. Payment terms and collections discipline determine cash.

4) Decide when to offer multi-year

Multi-year contracts are a tool, not a default. They tend to make sense when:

- Product value is already proven in the account

- Expansion is likely and you have a pricing model that can capture it

- You can avoid excessive discounting

- You can operationally support enterprise requirements (security, uptime commitments)

Use multi-year strategically to reduce concentration risk or secure lighthouse logos—but track the trade-offs.

Here's a simple decision table founders actually use:

| Contract term push | Good when | Watch-outs |

|---|---|---|

| Move monthly → annual | Strong activation and retention, clear ROI, clean onboarding | Annual discount becomes permanent pricing; churn hides until renewal |

| Add 2-year option | Mature product, enterprise procurement, stable roadmap | Renewal cliff in 24 months; price locks block ASP growth |

| Enforce minimum term | High support/onboarding costs, high early churn | Conversion drops; negative sentiment; more disputes |

Tie these choices back to Burn Rate and Runway: longer commitments can justify higher fixed costs only if retention quality holds.

When ACL misleads (and how to fix it)

ACL is easy to corrupt unintentionally. Most "bad ACL" comes from definition errors.

Mistake 1: treating billing cycle as contract length

- Annual invoice on a cancel-anytime plan is not a 12-month commitment.

- Monthly invoice on an annual contract is a 12-month commitment.

Fix: store commitment terms explicitly (start date, end date, renewal terms). If you can't, treat ACL as "billing interval average" and label it honestly.

Mistake 2: averaging across incomparable segments

If you sell to both self-serve and enterprise, a single ACL number will oscillate with mix. The fix is to segment:

- By plan (self-serve vs enterprise)

- By channel (sales-led vs self-serve)

- By customer size or ACV band (see ACV (Annual Contract Value))

- By cohort (see Cohort Analysis)

A useful operating view is:

- Bookings ACL (new deals signed in the period)

- Installed base ACL (active contracts today)

Those answer different questions: sales strategy vs renewal risk.

Mistake 3: ignoring early termination realities

Some contracts are "annual" on paper but routinely terminate early via:

- Termination for convenience clauses

- Non-renewal notice loopholes

- Service credits or disputes that effectively shorten terms

Fix: track a separate metric: effective realized term (how long customers actually stayed) using churn data and Customer Lifetime. ACL should represent contractual commitment; customer lifetime represents behavior.

Mistake 4: multi-year deals creating hidden cliffs

Multi-year increases ACL now, but it can concentrate future risk. A common failure mode:

- You sign many 24-month deals during a strong year

- Two years later, a large portion of ARR renews in the same quarter

- Any product or market issue becomes an existential event

Fix: monitor renewal concentration (like the heatmap above) and diversify renewal timing via:

- Co-terming rules that spread renewals

- Controlled multi-year volume per quarter

- Proactive renewal and expansion motions well before the cliff

Increasing ACL usually boosts predictability, but the discount you trade for that predictability is real—model it explicitly instead of celebrating a higher ACL in isolation.

Practical benchmarks and targets

Benchmarks depend more on your motion than your "stage." Use these as starting expectations, not goals:

| Motion / segment | Typical customer-weighted ACL | Typical ARR-weighted ACL |

|---|---|---|

| Self-serve SMB | 1–3 months | 2–6 months (if annual adoption exists) |

| SMB sales-assist | 3–12 months | 6–12 months |

| Mid-market | 12 months | 12–18 months |

| Enterprise | 12–24+ months | 18–36 months |

A "good" ACL is one that:

- Improves forward visibility and reduces churn exposure frequency, and

- Does not rely on discounting that permanently harms unit economics.

If you want one simple operating target: aim for ARR-weighted ACL to increase over time, while keeping discounting and sales cycle length under control (see Average Sales Cycle Length and Sales Efficiency).

A simple operating cadence for founders

- Review both ACLs monthly: customer-weighted and ARR-weighted.

- Segment quarterly: by ACV band, channel, and new bookings vs installed base.

- Pair with retention: monitor GRR (Gross Revenue Retention) and NRR (Net Revenue Retention) to ensure higher commitment isn't masking weak value.

- Track renewal concentration: identify cliff months and plan CS coverage plus pipeline targets.

- Pressure-test discounts: ensure longer terms aren't quietly lowering ASP and payback performance.

ACL is a contract metric that becomes powerful when you treat it as an input to decisions—how you price, who you sell to, and how you plan renewals—not as a scoreboard number.

Frequently asked questions

Billing frequency is how often you invoice or collect cash. ACL is the minimum commitment term before a customer can leave without penalty. You can have an annual contract billed monthly, or a monthly subscription paid annually. Mixing these up leads to bad churn forecasts and misleading cash planning.

Track both, but use revenue weighted ACL for forecasting and investor narratives because it reflects how much committed revenue is locked in. Customer weighted ACL is useful for operational workload like renewals and customer success touchpoints. If the two diverge sharply, your enterprise deals behave very differently than self serve.

There is no universal target. Self serve and SMB often land near 1 to 3 months unless annual incentives work. Mid market commonly clusters around 12 months. Enterprise frequently sits at 12 to 36 months. A good ACL is one that improves predictability without forcing discounting or slowing growth.

Not automatically. Longer terms can improve predictability and reduce near term churn, but they can also hide weak product value, increase discount pressure, and create renewal cliffs. Validate that higher ACL comes from stronger willingness to commit, not from heavy concessions or overly restrictive terms.

Count the committed term the customer is legally obligated to, and track early termination separately as churn or contraction depending on your revenue policy. For multi year deals, avoid overstating stability by also monitoring renewal concentration by month and customer. Pair ACL with [Renewal Rate](/academy/renewal-rate/) and [Churn Reason Analysis](/academy/churn-reason-analysis/).