Table of contents

Win rate

Founders care about win rate because it directly controls how much revenue you can produce from the pipeline you already paid to create. If win rate drops, you can miss a quarter even with "enough pipeline." If it rises, you can hit targets without adding headcount or spend.

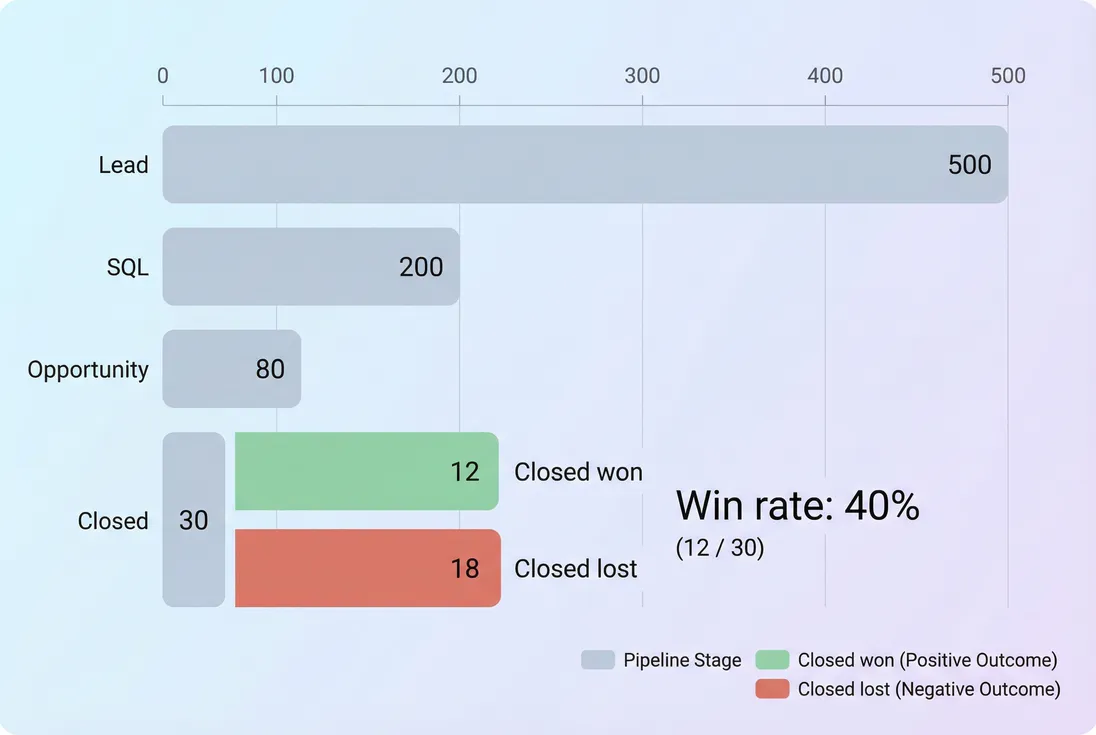

Win rate is the percentage of sales opportunities that become closed-won customers over a defined period.

A simple funnel view keeps win rate grounded in counts: wins only matter relative to how many opportunities actually reached a close decision.

What win rate reveals

Win rate is not just "sales effectiveness." It's a diagnostic for three things founders routinely misjudge:

- Pipeline quality: Are you creating real opportunities or just activity?

- Market pull and positioning: Are buyers choosing you when they compare options?

- Execution: Are reps qualifying, running discovery, and closing consistently?

The practical implication: win rate is one of the fastest ways to tell whether to fix top-of-funnel (targeting, messaging, lead sources) or bottom-of-funnel (pricing, proof, objection handling, product gaps).

The Founder's perspective

If win rate is trending down, assume your next quarter is already at risk. Your fastest lever is usually qualification and focus (tighten ICP, disqualify earlier), not "more leads." If win rate is trending up, protect it: avoid flooding reps with lower-intent leads that dilute performance.

How to calculate it

The cleanest definition is closed-won divided by all closed decisions (won plus lost) in the period.

Pick the denominator you will defend

Win rate becomes useless when teams change definitions quarter to quarter. The most common options:

Closed-deal win rate (recommended): Won / (Won + Lost).

Best when you want a stable measure of competitive performance and sales execution.Pipeline win rate: Won / Total created opportunities.

This blends qualification quality with closing skill. It can be helpful, but it is easier to game by changing what counts as an "opportunity."Stage-to-stage conversion rates: For each stage, what percent advances.

This is often the quickest way to find where the process is breaking.

Count-based vs revenue-weighted win rate

If you sell multiple deal sizes, count-based win rate can look healthy while revenue suffers.

- Count-based win rate answers: "How often do we win?"

- Revenue-weighted win rate answers: "How much of the dollars we pursue do we win?"

A practical revenue-weighted approach:

This is especially important when you move upmarket and your ASP (Average Selling Price) starts spreading out. A team can win many small deals (high count win rate) but lose a few large deals (low revenue win rate), which is what shows up in ARR.

Make it forecast-friendly

At a high level, bookings are driven by how many real opportunities you create, how large they are, and how often you win.

If you already track Qualified Pipeline, this simple relationship is the backbone of most founder-level forecasting conversations: do we need more pipeline, higher win rate, higher ASP, or faster closes?

What influences win rate

Win rate is the output. To improve it, you need to know the inputs that usually move it (and how they fail in real life).

ICP fit and targeting

The single most reliable driver is how close your opportunities are to your ideal customer profile.

- Strong ICP fit increases win rate because urgency, budget, and product fit are naturally higher.

- Weak ICP fit creates "polite no" losses late in the cycle, after you've burned time.

A classic failure pattern: you broaden targeting to increase pipeline, win rate drops, and you end up with the same bookings but more cost and longer cycles. That shows up later in CAC Payback Period and Sales Efficiency.

Lead source mix

Win rate changes often come from mix shifts, not rep performance.

Examples:

- Partner referrals might win at 40% while outbound wins at 15%.

- Trials with clear activation might win at 30% while "request a demo" with weak intent wins at 18%.

If you're running a motion with trials, connect win rate to your Free Trial design and onboarding completion. "More leads" from a new channel can be negative if it drags down the quality bar.

Sales process and qualification

Most early-stage teams lose win rate because they delay disqualification.

Common qualification issues that lower win rate:

- No clear definition of an opportunity (everything becomes a deal).

- Discovery happens too late (you only uncover deal-killers after the demo).

- Mutual action plans are inconsistent (buyers stall and quietly choose another vendor).

A simple rule: if your pipeline win rate (won / created) is falling but closed-deal win rate (won / closed) is stable, you likely have an opportunity creation problem, not a closing problem.

Pricing, packaging, and discounting

Pricing changes almost always move win rate, but the direction depends on what you changed.

- Raising price can reduce win rate, but might increase revenue if ASP rises enough.

- Tightening packaging can improve win rate if it clarifies value, or hurt it if it removes what buyers considered "table stakes."

- Aggressive discounting can inflate win rate while damaging long-term unit economics and positioning.

If discounting is creeping up to "save" win rate, review Discounts in SaaS and make sure you're not trading short-term wins for lower-quality customers and higher churn later.

Product readiness and proof

Teams often mislabel product gaps as "sales execution."

Signals your product or proof is the issue:

- Many late-stage losses tied to missing features, security, compliance, or integrations.

- Frequent "build it and we'll sign" outcomes.

- Deals that stall after stakeholders beyond the champion get involved.

This is where win rate becomes a product prioritization input: not "what customers request," but what repeatedly blocks revenue.

How to interpret changes (without fooling yourself)

Win rate is easy to misread. Founders get into trouble when they treat it as a weekly KPI without context.

Use the right time window

Win rate is lumpy because closes are lumpy. Monthly can work for high-velocity SMB. For mid-market and enterprise, you'll often want quarterly views.

Also decide whether you measure by:

- Close date (best for forecasting and quarter performance), or

- Cohort by created date (best to evaluate changes in qualification, messaging, and early stages)

If you recently changed ICP, messaging, or pricing, a cohort view can show the truth earlier than close-date reporting.

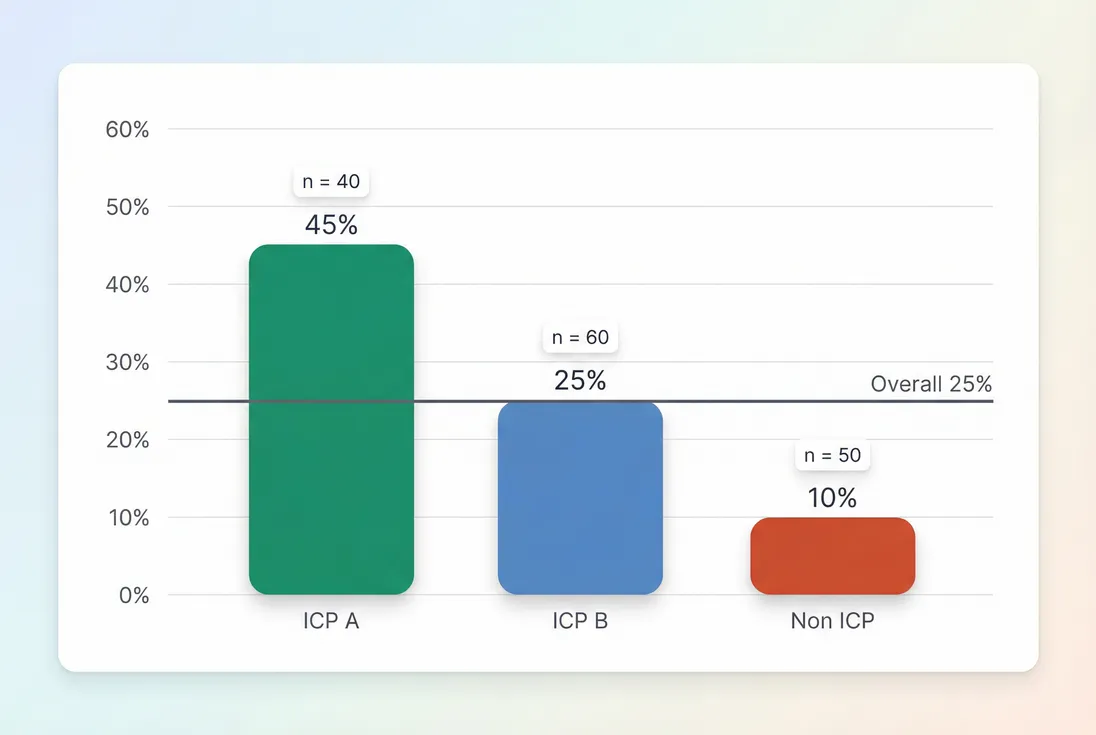

Segment before you react

A flat overall win rate can hide major movement underneath.

Segment win rate at minimum by:

- ICP tier (A, B, non-ICP)

- ACV band (small, medium, large)

- Lead source (inbound, outbound, partner)

- Competitor present vs not present

Segmented win rate prevents overreacting to mix shifts and makes ICP focus an evidence-based decision.

Account for sample size

If you close 10 deals per month, your win rate will swing hard. Treat small samples as a signal to look deeper, not to declare victory or failure.

If you want a simple way to sanity check variance, win rate behaves like a proportion. The standard error shrinks as the number of closed deals grows:

You don't need to run statistics weekly, but you do need the discipline: if the denominator is small, segmenting and qualitative loss reviews matter more than the raw percent.

Watch win rate with sales velocity

Win rate alone can tempt you into the wrong optimization.

Use it alongside:

- Sales Cycle Length (are you winning, but slower?)

- ASP (Average Selling Price) (are you winning smaller deals?)

- CAC (Customer Acquisition Cost) and CAC Payback Period (are you buying pipeline efficiently?)

A common anti-pattern: win rate rises because reps stop pursuing harder, larger deals. Great for this quarter's percentage, bad for long-term ARR.

When win rate "breaks"

Win rate becomes unreliable when the underlying process is inconsistent. Here are the most frequent failure modes and the fix.

1) Opportunity definition is fuzzy

If marketing, SDRs, and AEs all create opportunities differently, win rate is meaningless.

Fix: write a one-paragraph definition of "sales opportunity" with required entry criteria (budget signal, use case, stakeholder, timeline). Enforce it.

2) Stage hygiene is poor

If deals jump stages or sit in stage 2 for 120 days, stage conversion rates can't diagnose anything.

Fix: define stage exit criteria and require close-lost reasons. Your win rate is only as good as your CRM discipline.

3) The team is sandbagging

Reps may delay closing deals to protect win rate, or prematurely close-lost deals to clean the pipeline.

Fix: inspect aging, enforce close plans, and review deal progression. Tie comp and coaching to behaviors and cycle health, not just a percent.

4) Discounting is masking problems

If win rate only improves when discounting increases, you have either a positioning problem or a champion enablement problem.

Fix: review loss reasons, especially "price," and compare against segments where you win without discounts. Use Discounts in SaaS to set guardrails.

How founders use win rate

Win rate becomes powerful when it drives specific decisions, not just reporting.

Decision 1: Where to focus go-to-market

If ICP A wins at 45% and Non-ICP wins at 10%, your strategy is not "get better at sales." It's "stop creating Non-ICP opportunities."

Concrete actions:

- Narrow outbound lists and inbound qualification.

- Adjust messaging to repel weak-fit buyers.

- Move budget toward channels that produce ICP A opportunities.

This often improves not just win rate, but also CAC Payback Period because you stop spending time and money converting the wrong customers.

The Founder's perspective

If you're resource-constrained, optimize for the segment with the highest win rate times ASP, not the highest win rate alone. A lower win rate segment can still be your best growth lever if deal size and retention are meaningfully better.

Decision 2: When to hire (and what kind)

Win rate is a key input into whether adding reps will actually add bookings.

If win rate is low because of poor qualification or weak product proof, hiring more AEs scales inefficiency. In that case, prioritize:

- tighter opportunity criteria

- better enablement and proof assets

- product fixes that eliminate repeated late-stage losses

If win rate is healthy but bookings are low, you probably need more qualified pipeline or more closing capacity.

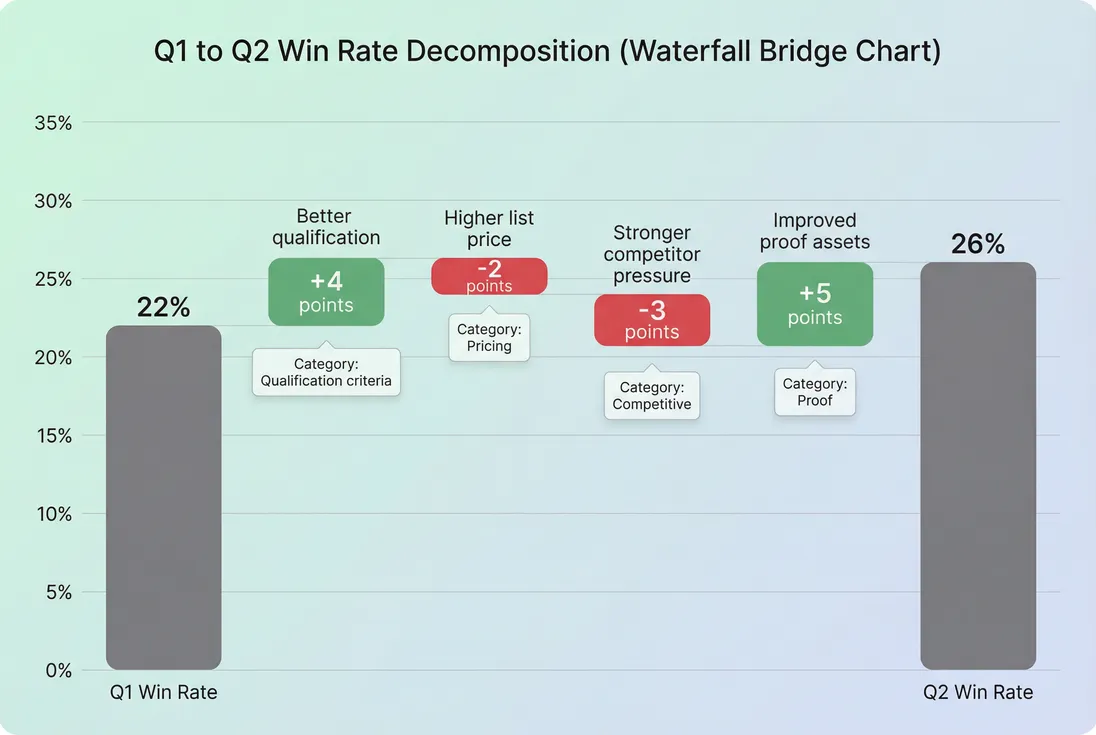

Decision 3: Whether a pricing change is working

Pricing tests should be evaluated on a bundle of outcomes:

- win rate

- ASP

- cycle length

- retention later (via GRR (Gross Revenue Retention) and NRR (Net Revenue Retention) once cohorts mature)

A price increase that drops win rate from 30% to 24% can still be a win if ASP rises enough and cycle length doesn't deteriorate.

Decision 4: Where the process is failing

Use stage-based win rates to decide where to invest:

- If early stage conversion drops: targeting, qualification, messaging.

- If late stage conversion drops: pricing, security/compliance, competitive positioning, ROI proof, procurement readiness.

This is where "win rate" turns from a scoreboard into a roadmap.

A win rate bridge forces the real question: what changed in the business, not just what changed in the metric.

Practical benchmarks (use carefully)

Benchmarks vary heavily by market, ACV, and definition. Use these as rough orientation, then anchor on your own trend line and segmentation.

| Motion and typical ACV | Typical closed-deal win rate | Notes |

|---|---|---|

| High-velocity SMB (low ACV) | 20% to 35% | Sensitive to lead source quality and onboarding; seasonality can be strong. |

| Mid-market (medium ACV) | 15% to 30% | Strongly affected by ICP focus, security review readiness, and multithreading. |

| Enterprise (high ACV) | 10% to 25% | Competitive bake-offs, procurement, and timing risk drive variance. |

If you're significantly below range, don't jump to "reps are bad." First validate opportunity quality and segment mix.

A simple operating cadence

If you want win rate to drive action (not debate), run it with a consistent cadence:

- Weekly (tactical): review late-stage deals, stuck stages, and top close-lost reasons.

- Monthly (operational): win rate by segment (ICP tier, lead source, ACV band) and by rep.

- Quarterly (strategic): cohort by created date to evaluate changes in targeting, messaging, and pricing.

Tie each review to one decision: what will we stop doing, start doing, or change in qualification?

Key takeaways

- Win rate is the percent of closed opportunities you win; it controls how much revenue your existing pipeline can produce.

- Track both count-based and revenue-weighted win rate if deal sizes vary.

- Always segment before reacting; mix shifts often explain "mysterious" changes.

- Interpret win rate alongside Sales Cycle Length, ASP (Average Selling Price), and CAC Payback Period to avoid optimizing the wrong thing.

- The fastest improvements usually come from tighter qualification and ICP focus, not more activity.

Frequently asked questions

A good win rate depends on deal size and how you define an opportunity. For SMB self-serve assisted motions, 20 to 35 percent from SQL to closed won is common. For mid-market, 15 to 30 percent is typical. Enterprise often runs 10 to 25 percent due to competition and complexity.

Track both. Count-based win rate tells you how effective the sales process is across opportunities. Revenue-weighted win rate tells you how reliable big deals are and is better for forecasting bookings and ARR impact. If the two diverge, your team may be winning small deals while struggling with higher ACV deals.

Win rate is only one lever. New ARR can stay flat if qualified pipeline shrank, if ASP dropped, or if deal cycles lengthened so fewer deals closed this period. Segment mix also matters: you might win more in low-ACV segments while losing fewer large deals.

Use minimum sample thresholds and rolling averages. If you only close ten deals in a month, one deal swings win rate by ten points. Review quarterly win rate, and segment by ICP tier and ACV band. Also watch stage conversion rates to diagnose where performance changed.

Split win rate by stage. If early stage progression is weak, you have a targeting or qualification issue. If deals reach late stages and then die, it is usually pricing, competition, security, or ROI proof. Require consistent close lost reasons and analyze patterns by segment and rep.