Table of contents

VAT handling for SaaS

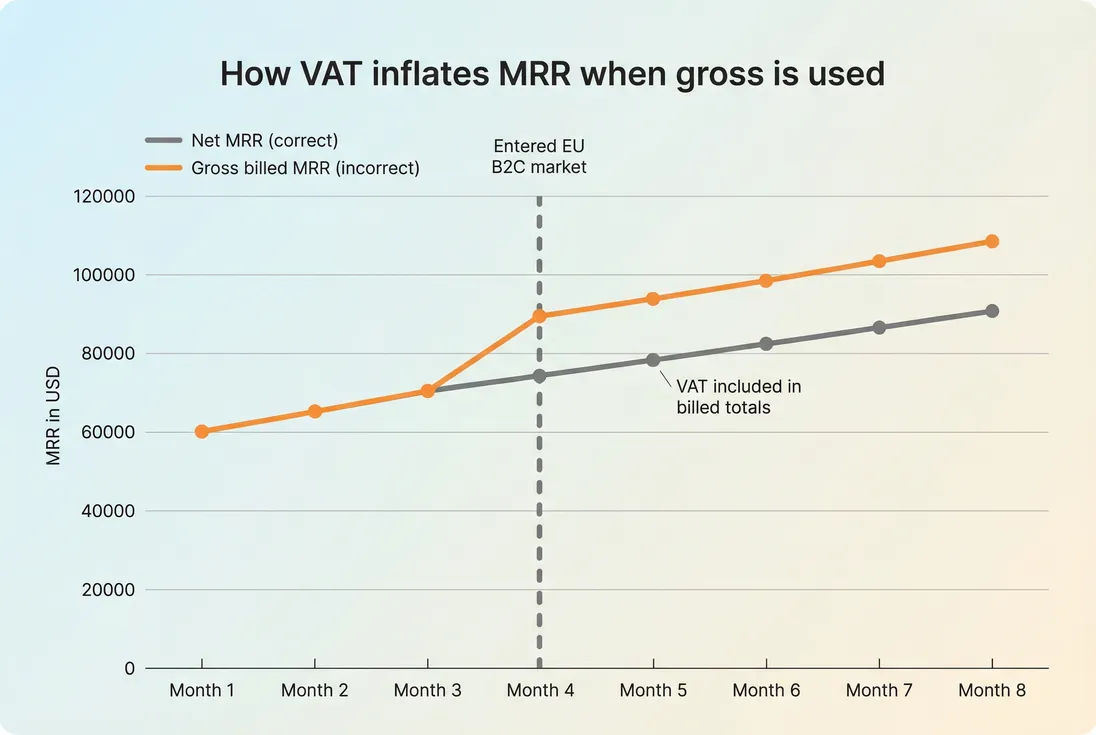

If you're selling SaaS internationally, VAT mistakes don't usually show up as "tax problems" first. They show up as bad business decisions: inflated MRR, misleading ARPA, confused discounting, messy refunds, and forecasting that's off by exactly the tax rate in your fastest-growing region.

VAT handling for SaaS means separating value-added tax from your subscription revenue in billing, accounting, and analytics—so your growth and retention metrics reflect what you actually earn, not what you collect on behalf of governments.

The Founder's perspective

If VAT is mixed into revenue, you'll think pricing is improving when it's not, you'll misjudge retention in new markets, and you'll argue with investors about "why Stripe revenue doesn't match MRR." Clean VAT handling is an analytics hygiene issue as much as a compliance issue.

What VAT handling really changes

Founders usually encounter VAT through two operational questions:

- What should the customer be charged? (depends on location, customer type, and evidence)

- What should you count as revenue? (should be net of VAT)

That second question is where analytics gets contaminated. VAT is typically a liability you collect and remit. It affects cash collected and invoice totals, but it should not inflate:

- MRR (Monthly Recurring Revenue)

- ARR (Annual Recurring Revenue)

- ARPA (Average Revenue Per Account)

- ASP (Average Selling Price)

- Recognized Revenue

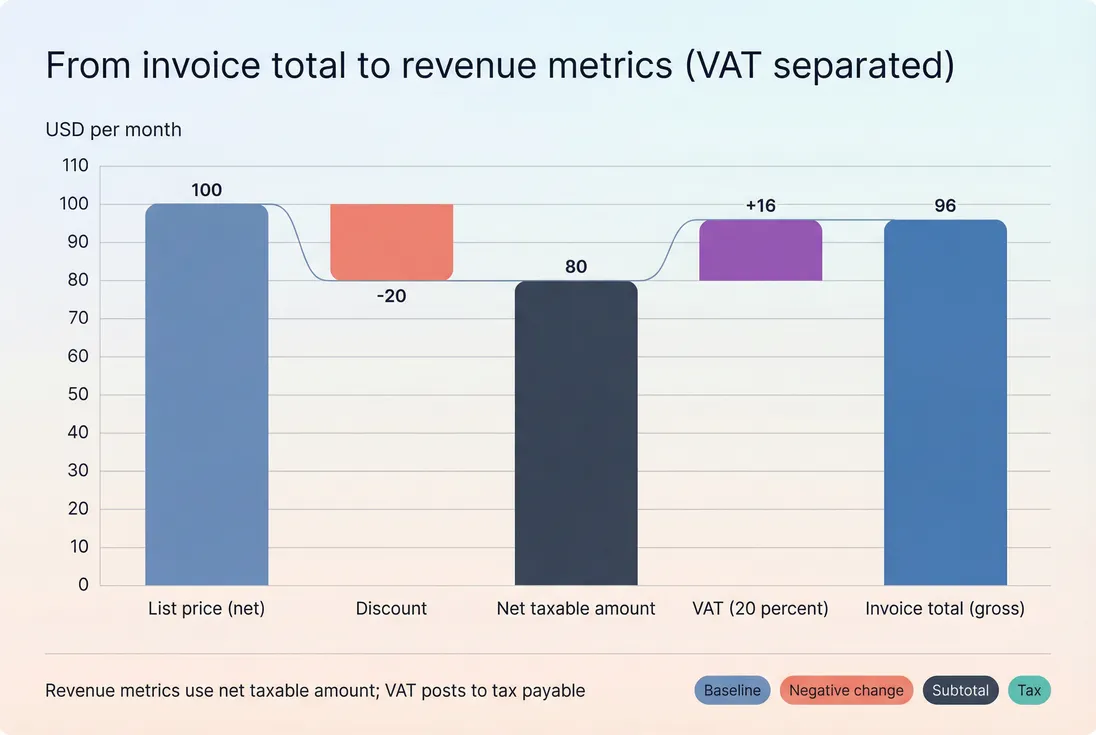

The basic VAT math (keep it simple)

If you show VAT-inclusive pricing (common in B2C), you need the inverse:

In practice: store net, VAT, and gross as separate fields per invoice line item. If you only store gross, your revenue analytics will eventually lie to you.

Should metrics be net or gross?

For SaaS analytics, the rule is straightforward:

- Revenue metrics should be net of VAT

- Billing and cash metrics may be gross

- Your data model must reconcile net, VAT, gross, and cash

Here's a practical mapping that avoids confusion:

| Amount | What it represents | Use it for | Do not use it for |

|---|---|---|---|

| Net subscription amount | Value of SaaS service | MRR, ARR, ARPA, ASP, retention | Cash collection reporting |

| VAT amount | Tax collected | Tax payable reconciliation, audit trail | Any "revenue" metric |

| Gross invoice total | Net + VAT | Dunning, receipts matching, AR follow-up | MRR/ARR, expansion analysis |

| Cash received | Payment actually collected | Cash forecasting, Accounts Receivable (AR) Aging | Revenue recognition |

Two common failure modes:

- Gross MRR: you build MRR from invoice totals. Your MRR jumps when you enter high-VAT regions even if pricing didn't change.

- Mixed refund logic: you subtract gross refunds from net revenue, which overstates churn/contraction during high-refund periods.

The Founder's perspective

If you're debating a price increase, you need clean net ARPA and ASP. If VAT is included, your "effective price" varies by country tax rate, and you'll end up optimizing pricing based on geography instead of willingness to pay.

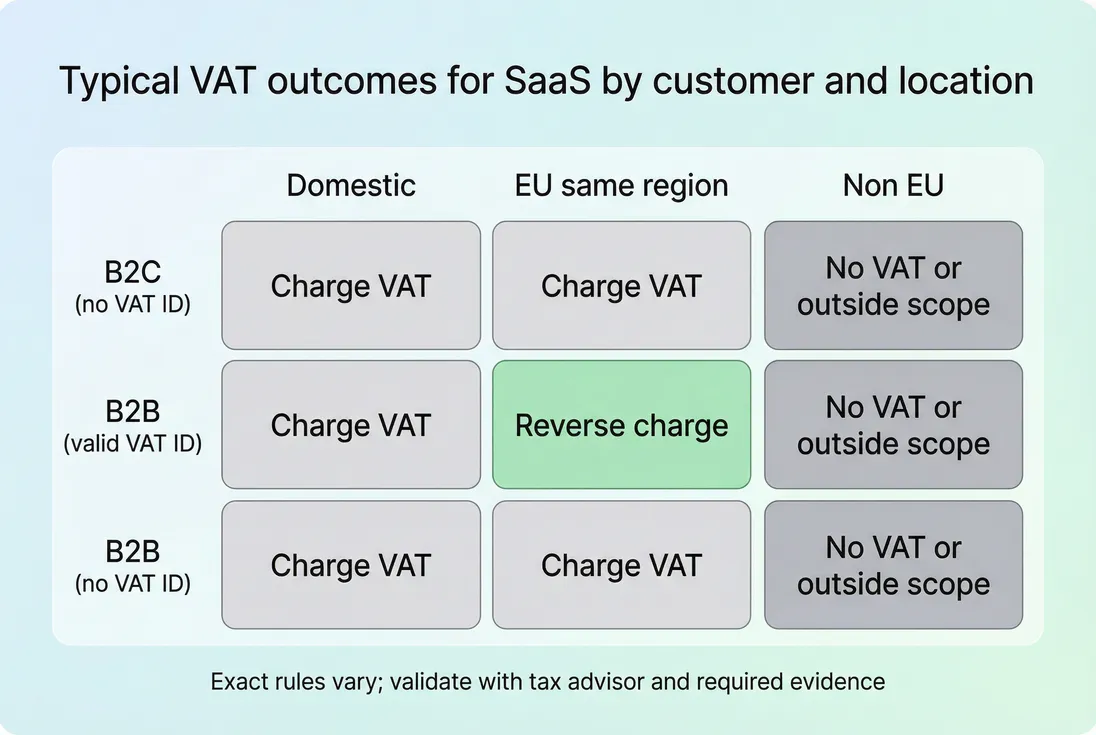

What drives VAT on a SaaS invoice

VAT treatment varies by jurisdiction, but founders should understand the inputs that determine outcomes. VAT calculation is not a single "rate"—it's a rule engine.

The three inputs that matter most

Customer location

Usually determined by billing address, IP, bank country, and other evidence requirements.Customer type (B2B vs B2C)

Often decided by whether the customer provides a valid VAT ID (or local equivalent).Place of supply rules for digital services

For many SaaS products, especially in the EU/UK, "electronically supplied services" rules apply and can require VAT based on the customer's country.

Your analytics takeaway: VAT is not random noise. It's systematic variation by segment. If you don't segment cleanly, you'll misread performance.

Why this matters for segmentation

When you look at MRR movement, expansion, or churn by geography, VAT can create false signals:

- B2C in VAT-heavy countries can look like "higher ARPA" if you accidentally use gross.

- A mix of B2B and B2C can make discounting look inconsistent (because VAT changes the denominator).

- Switching a customer from B2C to B2B (after VAT ID capture) can look like contraction if you use gross totals.

If you're analyzing retention or growth, segment by:

- Country (or VAT region)

- Customer type (business vs consumer proxy)

- Tax status (VAT charged vs reverse charged)

This is also where analytics tooling that supports slicing by dimensions (e.g., filters) becomes practically useful for diagnosing anomalies rather than just reporting them.

How to keep MRR clean

Your goal is: MRR reflects the service value delivered per month. VAT doesn't change service value; it changes tax liability.

A simple MRR definition that avoids VAT contamination:

Annual prepay example (where VAT causes confusion)

Suppose you sell an annual plan:

- Net annual: $1,200

- VAT rate: 20 percent

- Gross charged: $1,440

- Cash collected today: $1,440

Correct analytics:

- MRR should be $100 (net)

- VAT payable: $240

- Deferred revenue depends on revenue recognition timing (see Deferred Revenue and Recognized Revenue)

If you compute MRR from gross charges, you'll report $120 MRR for that customer—20% too high.

Refunds and credits: separate net and VAT

Refunds are where teams accidentally "fix" VAT in the wrong place.

A clean split:

- Refund gross = Refund net + Refund VAT

- Net portion should reduce revenue metrics (and affect churn/contraction logic)

- VAT portion should reduce VAT payable

If you're building churn and retention, keep refunds conceptually separate from subscription changes where possible (see Refunds in SaaS and Chargebacks in SaaS).

The Founder's perspective

If refunds spike after a pricing change, you want to know whether customers rejected the product value or whether you created billing friction. If VAT-inclusive pricing isn't messaged clearly, "refunds" may be a checkout surprise problem, not a product problem.

Where VAT handling breaks in real life

Most VAT problems aren't "wrong rate." They're data integrity problems that later show up as metric volatility.

1) VAT-inclusive pricing mixed with VAT-exclusive pricing

If some plans are marketed VAT-inclusive (common in B2C) while others are VAT-exclusive (common in B2B), and you store only a single "amount," then:

- ARPA comparisons become meaningless across segments

- Discount reporting becomes inconsistent

- Expansion analysis gets skewed if customers switch plans

Fix: always store and report net amount as the canonical price for analytics.

2) Customer evidence changes after signup

A customer may:

- enter a new billing address

- provide a VAT ID later

- change entity type (contract reassignment)

This causes tax treatment to flip. If your system issues credits and re-invoices, you'll see one-time invoice anomalies.

Analytics best practice:

- Tag these events as "tax status change"

- Exclude from churn/contraction narratives unless the subscription itself changed

3) Proration and mid-cycle changes

Proration can generate partial-month line items with their own VAT amounts. If you summarize at invoice-level only, you'll blur:

- net subscription changes

- VAT adjustments

- one-time credits

For subscription analytics, line-item level data is usually required to keep MRR movements interpretable (see Discounts in SaaS for why line items matter even outside VAT).

4) Multi-currency effects

VAT is applied in the invoice currency, but your reporting currency may differ. If you convert gross and net at different times or rates, you can create small reconciliation gaps.

Practical control: reconcile at invoice currency first, then convert.

5) Fees misclassified as taxable revenue

Payment processor fees and billing fees are not VAT, but they commonly show up near VAT in reports and can be misclassified.

- Keep VAT separate from Billing Fees

- Don't net fees against revenue if you want clean gross margin work (see COGS (Cost of Goods Sold) and Gross Margin)

How to detect VAT contamination fast

You don't need a tax audit to spot VAT in metrics. You need a few analytics checks.

A simple "implied tax rate" check

For a segment where you expect VAT to be charged:

Red flags:

- implied rate varies widely within the same country/customer type

- implied rate is near zero for B2C in a VAT region

- implied rate appears in "no VAT" regions

Trend check: MRR vs billed totals

If you expanded into a VAT-heavy geography and you accidentally use gross, your reported MRR will drift upward relative to net reality.

Reconciliation check (monthly close)

At minimum, your finance/ops close should reconcile:

- Sum of net invoices (subscription lines)

- Sum of VAT amounts

- Sum of gross invoices

- Sum of cash received

- Open invoices for Accounts Receivable (AR) Aging

If these don't tie, don't trust ARPA, ASP, or any retention analysis built on top.

How founders operationalize VAT without slowing growth

VAT handling becomes manageable when you treat it like a repeatable system: data inputs, rules, and controls.

Set up your "source of truth" fields

At the invoice line level, ensure you can report:

- Net amount

- VAT amount

- VAT rate

- Tax jurisdiction / country

- Customer tax status (B2B vs B2C proxy, VAT ID present)

- Currency and FX rate used (if applicable)

Align pricing, checkout, and reporting

Decide explicitly:

- Are prices displayed VAT-inclusive for B2C markets?

- Do you support reverse charge flows for B2B?

- What evidence do you collect to support location rules?

Then make sure analytics uses net consistently for:

- MRR (Monthly Recurring Revenue)

- ARR (Annual Recurring Revenue)

- ARPA (Average Revenue Per Account)

- ASP (Average Selling Price)

Put guardrails around "one-time adjustments"

Tax status changes, backdated credits, and re-invoicing should be tagged so they don't get interpreted as product-driven churn.

When you review churn, pair VAT cleanup with:

The key is narrative discipline: tax corrections are accounting events, not customer behavior.

The Founder's perspective

Your board doesn't care whether VAT was 19% or 21%. They care if your "MRR growth" is real. The operational win is being able to say: net retention is stable, expansion is real, and billing complexity isn't polluting the story.

Practical benchmarks and expectations

VAT handling isn't about "good performance," but there are reasonable operating benchmarks for cleanliness:

- Revenue vs billing reconciliation gap: aim for <0.5% of billed amount each month; investigate anything larger.

- Tax status change events: should be rare; if frequent, your VAT ID capture and validation flow likely needs work.

- Refund accuracy: net and VAT reversals should match the original proportions unless rules require otherwise.

If you're optimizing go-to-market or pricing, treat any VAT-driven variation as a reporting artifact until proven otherwise.

Founder checklist for clean VAT analytics

Use this as a quick implementation and audit list:

- Confirm MRR/ARR use net amounts only

- Store net, VAT, gross separately for every invoice line

- Segment reporting by geography and customer type to catch rule mismatches

- Split refunds into net and VAT reversals (don't let gross refunds hit net metrics)

- Reconcile monthly across invoices, VAT totals, cash, and AR

If you do those five things, VAT stops being a constant source of metric noise—and becomes a predictable operational layer that doesn't interfere with growth decisions.

Frequently asked questions

No. Treat VAT as a tax liability, not revenue. If you include VAT in MRR or ARR, you will overstate growth, misread ARPA and ASP, and distort retention. The only time VAT appears in metrics is as a reconciliation item between cash collected and net revenue.

You typically need to correct tax treatment from that point forward and sometimes issue a credit note and re-invoice for prior periods, depending on local rules and your evidence. Analytically, expect a one-time adjustment in billed amounts that should not be interpreted as churn or contraction.

Refunds usually require reversing the VAT portion as well, often via a credit note. If you track refunds as negative revenue without separating VAT, you can double-count the impact. Always split a refund into net revenue reversal and VAT reversal to keep retention and MRR churn clean.

Often for B2C, yes, especially in many European markets where consumer prices are expected VAT inclusive. For B2B, pricing is commonly shown net with VAT added at checkout or on the invoice. The key is consistency: your analytics should always store net price and VAT amount separately.

Look for sudden ARPA or ASP jumps after expanding into VAT regions, mismatches between cash receipts and net revenue, and inconsistent discount percentages across geographies. A quick check is to compute implied tax rate from invoices; wide variance for similar customer types signals mapping issues.