Table of contents

Signups count

Signups count is one of the fastest ways to tell whether growth is being "fed" at the top of your funnel—or whether you're about to miss pipeline and revenue targets a few weeks from now. It's also one of the easiest metrics to misread, because a signup is not the same thing as intent, activation, or revenue.

Definition (plain English): Signups count is the number of new, unique users or accounts that successfully create a product account during a specific time period.

What counts as a signup

Before you analyze trends, you need a definition that matches your business model and can be implemented consistently.

Pick the unit: user or account

Most SaaS teams should explicitly choose one of these:

- Account signups (recommended for B2B): a new workspace/company/account is created.

- User signups (common for B2C or bottoms-up): a new individual user registers.

If you sell to companies, an "account signup" is usually the better leading indicator because it maps more cleanly to eventual revenue and to downstream metrics like ARPA (Average Revenue Per Account).

The Founder's perspective

If you measure user signups in a B2B product, a single motivated champion can create 20 users and make growth look amazing—while revenue stays flat. Account signups force the conversation back to how many new buying entities you're actually adding.

Decide which events qualify

A signup should be a completed registration event, not just "landed on the signup page." Common rules:

- Email verified (or not)

- SSO user created (or not)

- Trial started (or not)

- Required fields completed (or not)

If you run a Free Trial, be clear whether "signup" means "trial started" or "account created." Teams often unintentionally mix these.

Handle duplicates and spam up front

Signups count becomes noisy when you have:

- multiple signups from the same company (different emails)

- bots/spam (especially on freemium)

- test accounts from your own team

- re-signups after churn (should be "reactivations," not "new")

Your goal isn't perfection—it's consistency and segmentability (so you can exclude or isolate noise quickly).

How to calculate it cleanly

At its core, signups count is a distinct count over time.

Practical implementation notes

Choose the timestamp that matches behavior.

Use the moment the account is created (or registration completes). Don't use "first seen," which shifts when tracking breaks.Use distinct IDs, not emails.

Emails change; accounts merge; aliases exist. If you can only use email, normalize (lowercase, trim, remove plus addressing if appropriate).Separate "new" from "returning."

If a churned customer signs up again, track that separately from net-new acquisition. Otherwise you'll overstate growth and under-diagnose Churn rate.Always segment.

Overall signups is a headline number. Decisions require slices: channel, campaign, geo, ICP vs non-ICP, plan, and intent tier (e.g., business email vs personal email).

What signups count reveals

Signups count is a leading indicator—but only when you interpret it in context.

When an increase is good news

An increase is meaningful when it's paired with one or more of the following:

- stable or improving downstream Conversion rate (signup to activation, activation to paid)

- stable acquisition efficiency (e.g., CAC not blowing up; see CAC (Customer Acquisition Cost))

- consistent mix of signups by channel and ICP fit

In that case, rising signups often means your acquisition engine is expanding in a way that will show up in revenue later.

When an increase is a warning

More signups can be bad if:

- paid conversion drops (you bought low-intent traffic)

- support or sales gets swamped with unqualified users

- activation rate collapses due to onboarding friction

- spam/bots inflate counts

This is where founders get misled: "We doubled signups" can still lead to missed targets if quality moved against you.

The Founder's perspective

If signups go up but the team feels busier without more revenue, treat it as a quality regression until proven otherwise. Your job is to find the segment where signups increased and paid outcomes did not—and either fix targeting or stop buying that traffic.

When a decrease matters

A drop is actionable when it persists beyond normal volatility and aligns with:

- a channel disruption (ad account issues, SEO rankings, partner pause)

- product/website friction introduced

- seasonality (true in some verticals)

- positioning change or pricing change

If you can't tie a signup dip to a specific segment, it often means tracking broke. Treat instrumentation issues as operational emergencies; you can't manage the business blind.

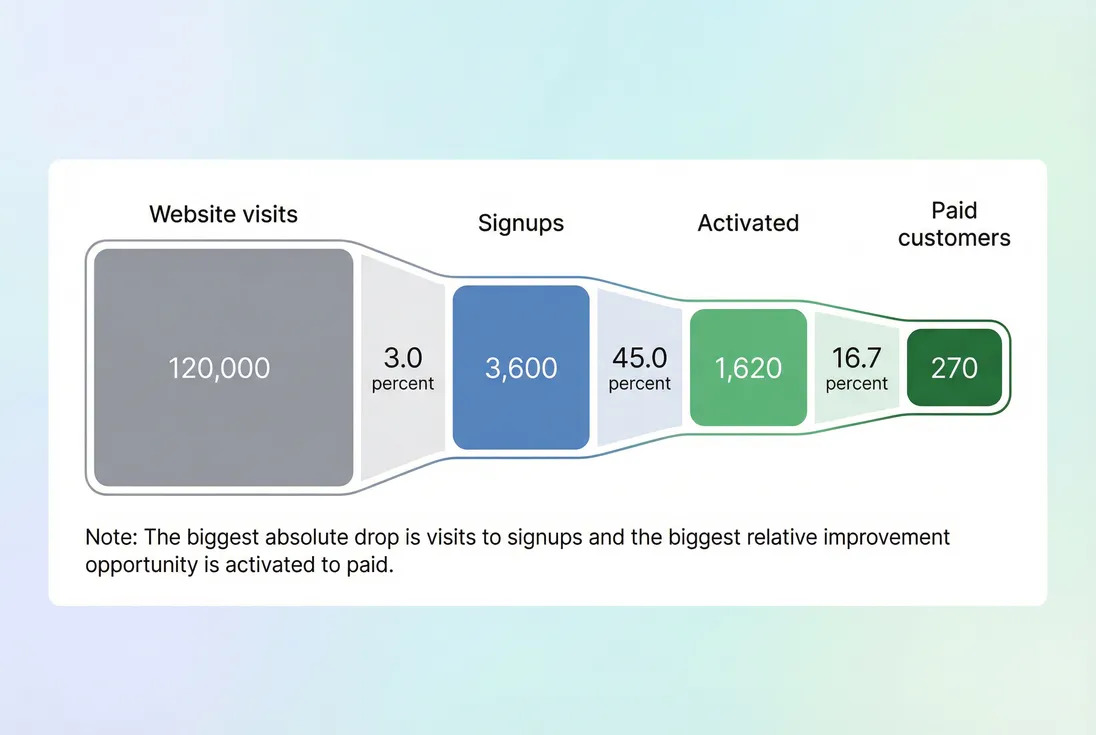

Turning signups into revenue forecasts

Founders care about signups because it's the earliest measurable input to revenue. The trick is to translate signups into a forecast with conversion and time lag.

The simple revenue bridge

For a self-serve or trial-led motion, a rough planning relationship is:

This does not replace your revenue analytics (see MRR (Monthly Recurring Revenue) and ARR (Annual Recurring Revenue)), but it's a useful operating model.

Why time lag changes everything

Two companies can have identical signups and conversion rates but very different growth outcomes because of time-to-value:

- If most customers convert within 3 days, signups predict revenue this week.

- If conversion typically happens in 30–60 days (common in B2B with approvals), signups predict revenue next month or next quarter.

This is why it's dangerous to celebrate signup growth without also tracking onboarding and activation speed (see Time to Value (TTV) and Onboarding Completion Rate).

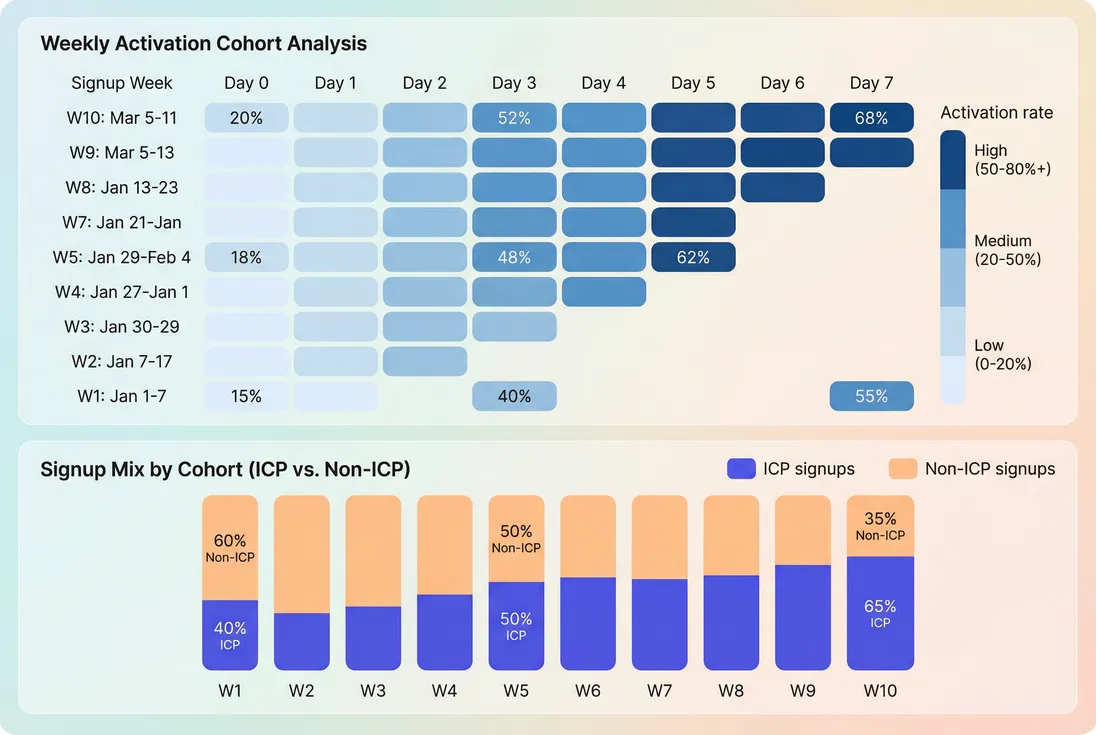

Use cohorts to validate signup quality

Cohorting signups by week (or by acquisition source) helps you answer the only question that matters: Do newer signups behave like earlier signups?

If newer cohorts activate less or convert slower, your signup growth is likely coming from weaker channels or diluted targeting. This is exactly what Cohort Analysis is for.

Account for sales capacity in sales-led motions

In Sales-Led Growth, "signup" may be less important than "qualified pipeline," but it can still matter if signups feed inbound.

If sales cannot work the volume, more signups won't translate into more closed-won; it will translate into slower follow-up and lower win rates. In that world, track signups alongside:

- lead qualification rates (e.g., MQL → SQL)

- Sales cycle length

- Win rate

- Qualified Pipeline

The decision isn't "get more signups." It's "get the right signups at a rate we can process."

What drives signups up or down

Most signup movements come from one of four buckets. Diagnosing the right bucket prevents wasted optimization.

1) Traffic volume changed

Examples: SEO lift, new partnership, paid spend increase, viral moment.

What to do:

- check visitor trends and signup page traffic

- segment signups by channel and campaign

- compare signup conversion rate; if it stayed stable, it's a volume story

2) Visitor-to-signup conversion changed

Examples: new homepage messaging, pricing page change, form friction, performance issues.

What to do:

- review signup flow changes and A/B tests

- look for device/browser breakages

- track signup conversion separately (see Conversion Rate)

3) Targeting or mix shifted

Examples: expanding to new geos, running broad-match ads, adding a lower-priced plan.

What to do:

- compare downstream behavior by segment (activation, paid conversion, retention)

- watch for ARPA dilution (see ASP (Average Selling Price) and Discounts in SaaS)

4) Measurement changed

Examples: tracking pixel blocked, backend event renamed, SSO flow not tracked.

What to do:

- reconcile signups from product database vs analytics tool

- run a daily sanity check: "accounts created" in DB should match "signup events" within a narrow tolerance

The Founder's perspective

If signups change sharply overnight, assume instrumentation or a broken flow before assuming demand changed. Real demand shifts usually show up as a trend over days and weeks, and they show up in specific channels first.

Benchmarks and operating cadence

There is no universal "good" signups count. A founder should care about signups count relative to your growth target, your conversion rates, and your economics.

Useful benchmark ranges (with caveats)

These are directional ranges founders commonly see for visitor → signup on a focused landing page:

| Motion / context | Typical visitor → signup range | Notes |

|---|---|---|

| High-intent demo request | 2%–10% | Higher intent, lower volume; sales capacity matters |

| Self-serve trial | 1%–5% | Sensitive to friction and clarity of value |

| Freemium | 2%–15% | Can be inflated by low intent and spam; quality varies |

For signup → paid, ranges vary even more based on pricing, onboarding, and time lag. Track your own cohorts and aim for steady improvement, not an external number.

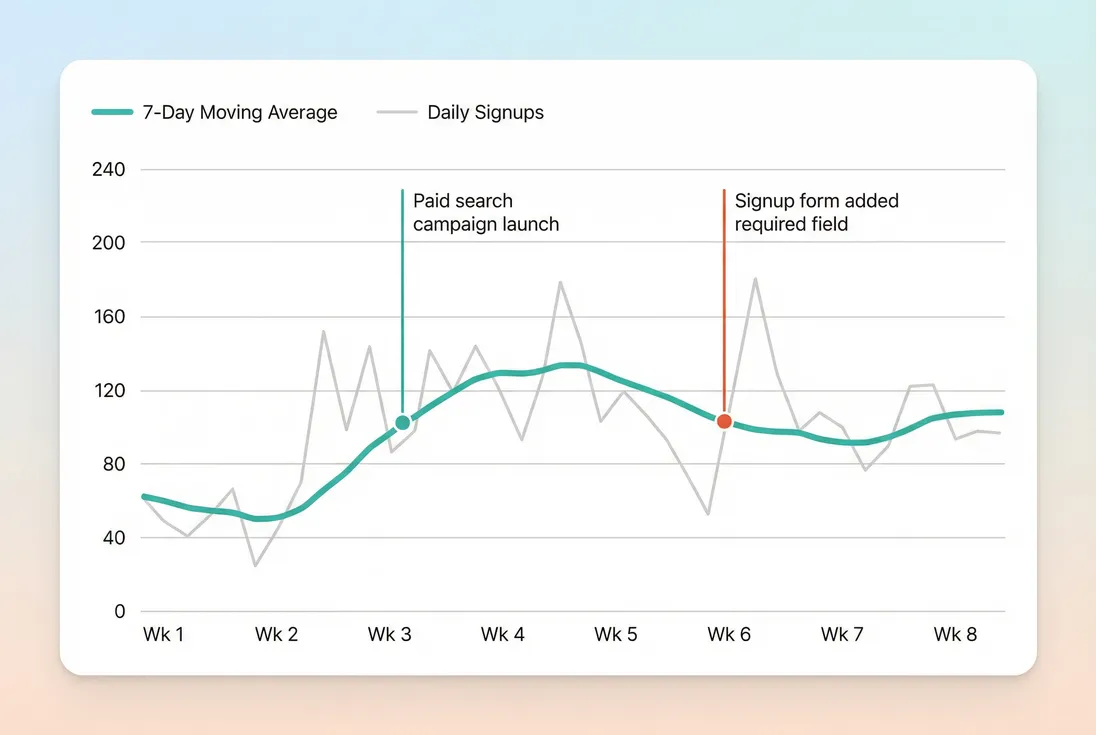

A practical weekly cadence

For most founders, the best operating loop is weekly:

- Trend: signups (daily) with a 7-day moving average

- Mix: signups by top channels and by ICP vs non-ICP

- Quality: activation and early engagement by signup cohort

- Economics: estimated CAC and payback directionally (see CAC Payback Period)

- Decision: one concrete change to test (channel, message, flow)

If your signups are volatile, use a trailing average such as a 7-day or 28-day window. If you're trying to understand whether growth is accelerating, pair signups with Lead Velocity Rate (LVR).

Common traps and how to avoid them

Treating signups as growth

Signups are input. Revenue and retention are outcomes. If you only optimize signups, you can accidentally drive growth that increases costs and churn.

Pair signups with retention and churn metrics like Logo Churn and NRR (Net Revenue Retention) to make sure you're not scaling a leaky bucket.

Ignoring segmentation

Overall signups can hide the truth. Two channels can move in opposite directions and net to "flat," while your best channel quietly dies.

Minimum segments most founders should review:

- channel (paid search, organic, partner, referral)

- ICP vs non-ICP proxy (company size, email domain type, role)

- geo (if you sell regionally)

- plan or entry point (trial vs freemium vs demo)

Counting invited users as signups

If one account invites 30 teammates, you'll see a "signup spike" that has nothing to do with acquisition. Treat invites as activation/expansion signals, not acquisition.

Letting spam pollute the metric

If you run freemium, you will get spam. Don't fight it emotionally—design for it operationally:

- add bot controls (rate limits, CAPTCHA where needed)

- require email verification for "counted" signups (or track both verified and unverified)

- create an internal "clean signups" view that excludes obvious spam patterns

How founders use signups count to decide

Signups count becomes powerful when it's tied to a specific decision:

- Budgeting paid acquisition: If paid signups rise but paid conversion drops, you're buying the wrong clicks—fix targeting or pause spend before CAC runs away. Use CAC (Customer Acquisition Cost) and Burn rate to keep the economics honest.

- Prioritizing onboarding work: If traffic is steady but signups fall after a flow change, revert quickly. If signups are steady but activation drops, prioritize onboarding and TTV.

- Choosing a growth motion: In Product-Led Growth, signups are often the primary top-of-funnel metric. In Sales-Led Growth, signups matter mainly as inbound supply; pipeline quality and speed may matter more.

- Setting realistic targets: Work backward from ARR goals using your funnel rates and lag. If the required signups imply unrealistic traffic or spend, you need a different plan (pricing, conversion, or sales motion), not just "more marketing."

If you treat signups count as a measurable supply line—and consistently connect it to activation, conversion, and revenue—you'll make faster, calmer decisions about growth.

Frequently asked questions

Start with quality if your activation or trial to paid conversion is weak, because more signups will mostly add support load and noise. Optimize for volume once the funnel is stable and predictable. Track signups by source and follow them to activation and paid conversion to see which signups are actually valuable.

It depends on motion and pricing. Self-serve B2B often sees low single digits to low teens, while strong product-led motions can do better with tight onboarding and clear value. The key is consistency by channel and cohort. If conversion drops after a signup increase, the problem is usually traffic quality or onboarding friction.

Decide whether you measure user signups or account signups, then enforce it everywhere. For B2B, founders usually care about new accounts because revenue attaches to the account. Use a dedupe rule like one account per verified domain or workspace, and treat invited users as activation signals, not new signups.

Common causes are low-intent traffic, bot or spam signups, a shift toward smaller customers, or longer time-to-value creating conversion lag. Segment signups by channel, plan, and persona, then compare cohort conversion and time to purchase. If signups rose but paid conversion fell, you likely bought volume, not demand.

Work backward from revenue. Estimate paid conversion, average revenue per account, and the time lag from signup to purchase. Then compute required signups to generate the needed new MRR each month. Recalculate monthly using cohort conversion data, because small changes in conversion or ARPA dramatically change the required signup volume.