Table of contents

Recognized revenue

Cash collected can make you feel rich. Recognized revenue tells you whether the business actually performed.

Recognized revenue is the amount of revenue you record on the income statement for a period based on what you delivered (the service provided), regardless of when you invoiced or collected cash. In subscription SaaS, it's usually recognized ratably over the subscription term.

Recognized revenue is a smoothing layer: billings can surge from annual prepay, while recognition follows delivery over time.

Why founders track it

Founders usually discover recognized revenue when something "doesn't add up":

- You push annual prepay to improve cash, but your income statement barely moves.

- You land a big enterprise invoice, but revenue ramps slowly.

- You cut discounting, billings jump, but revenue shows a delayed lift.

Recognized revenue matters because it's the number that drives:

- Profitability metrics (gross margin, operating margin, EBITDA).

- Investor reporting and diligence narratives.

- Planning and efficiency calculations like Burn Rate and Burn Multiple, which rely on income statement performance more than Stripe cash timing.

The Founder's perspective

If you optimize for cash only, you can accidentally hide weak retention or overstate "growth" with prepayments. Recognized revenue forces you to ask a harder question: did we deliver enough value this month to earn what we charged?

Recognized revenue vs MRR vs billings

These terms get mixed up because they're all "revenue-ish," but they answer different questions.

| Measure | What it represents | Timing basis | Best used for |

|---|---|---|---|

| Recognized revenue | What you earned by delivering service | Delivery (accounting) | P&L performance, margins, investor reporting |

| MRR (Monthly Recurring Revenue) | Normalized recurring run-rate | Subscription state | Growth, retention, expansion, pricing effectiveness |

| Billings | What you invoiced | Invoice date | Collections planning, AR management, sales execution |

| Cash receipts | What customers paid | Payment date | Runway, cash management, liquidity |

Two common founder mistakes:

- Treating billings as revenue. This inflates growth in annual-prepay businesses and collapses when renewals slow.

- Treating MRR as GAAP revenue. MRR is a great operating metric, but it is not an accounting statement number—especially with usage, credits, and multi-year contracts.

If you want a clean operating view of recurring commitments, pair recognized revenue with ARR (Annual Recurring Revenue) and CMRR (Committed Monthly Recurring Revenue)—each answers a different planning question.

How recognized revenue is calculated

In most SaaS subscriptions, recognized revenue is calculated by allocating the transaction price over the service period (often straight-line). The exact rules depend on your accounting policy (ASC 606 / IFRS 15), but founders can understand the mechanics without becoming accountants.

The contract-level intuition

For a fixed-price subscription, the common allocation is proportional to time delivered:

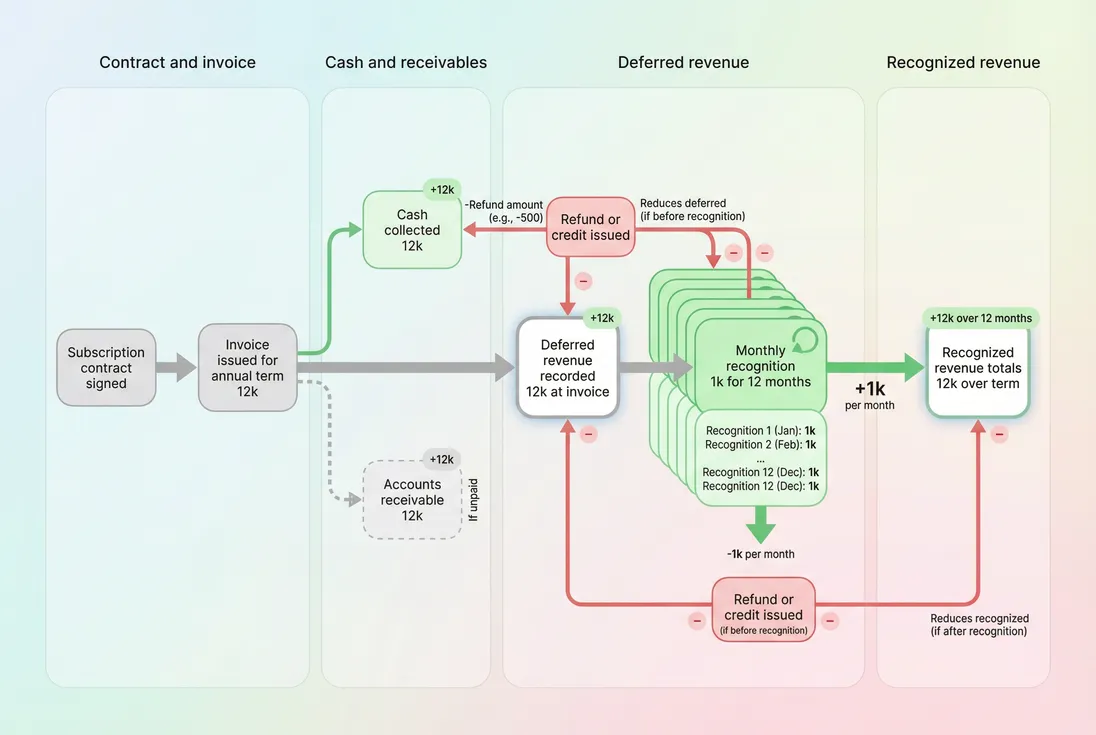

Example: A customer prepays $12,000 for a 12‑month subscription starting January 1.

- Cash received in January: $12,000

- Recognized revenue each month (straight-line): $1,000

- The remaining $11,000 sits on the balance sheet as deferred revenue (a liability) after January recognition.

This is why a big upfront invoice does not instantly increase revenue.

The financial statement identity founders should know

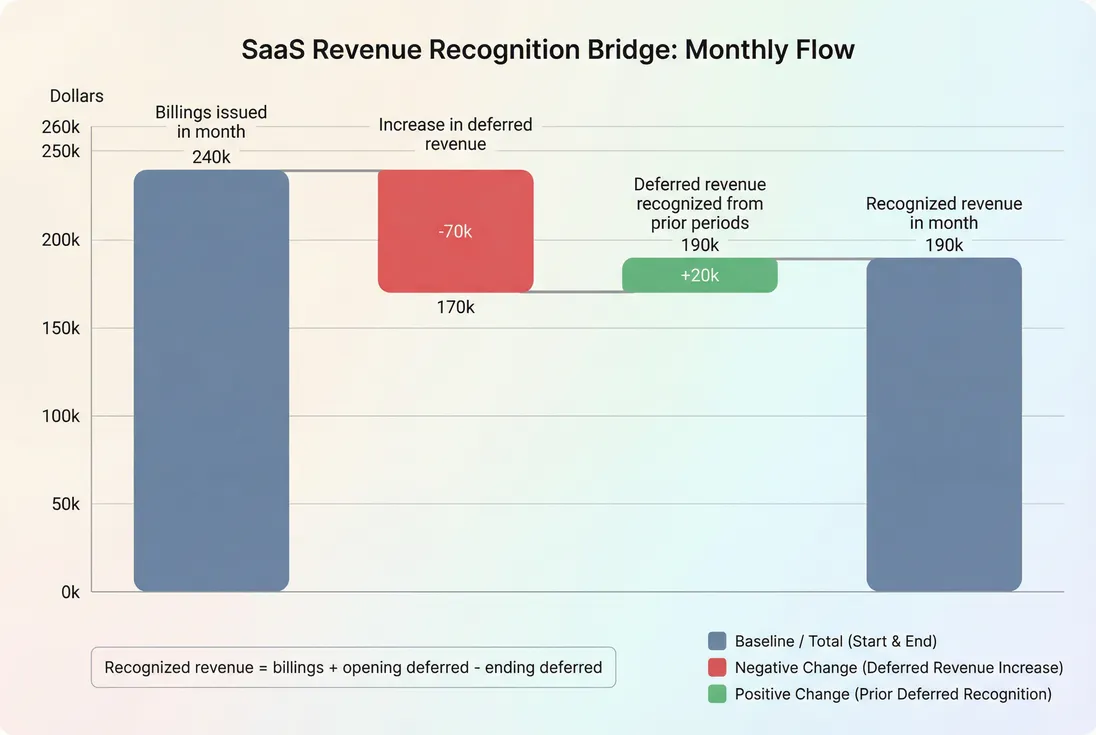

At the aggregate level, recognized revenue ties tightly to deferred revenue movements:

This identity is useful for sanity checks:

- If billings are greater than recognized revenue, deferred revenue usually increases (you're getting paid ahead of delivery).

- If recognized revenue is greater than billings, deferred revenue decreases (you're delivering service previously billed).

To go one level deeper operationally, you also need to understand what's happening with receivables—especially if you invoice net 30 or net 60. That's where Accounts Receivable (AR) Aging becomes a founder-grade control surface.

What influences recognized revenue in SaaS

Recognized revenue moves with delivery patterns, not just "sales momentum." Here are the drivers that most often surprise founders.

Subscription term mix

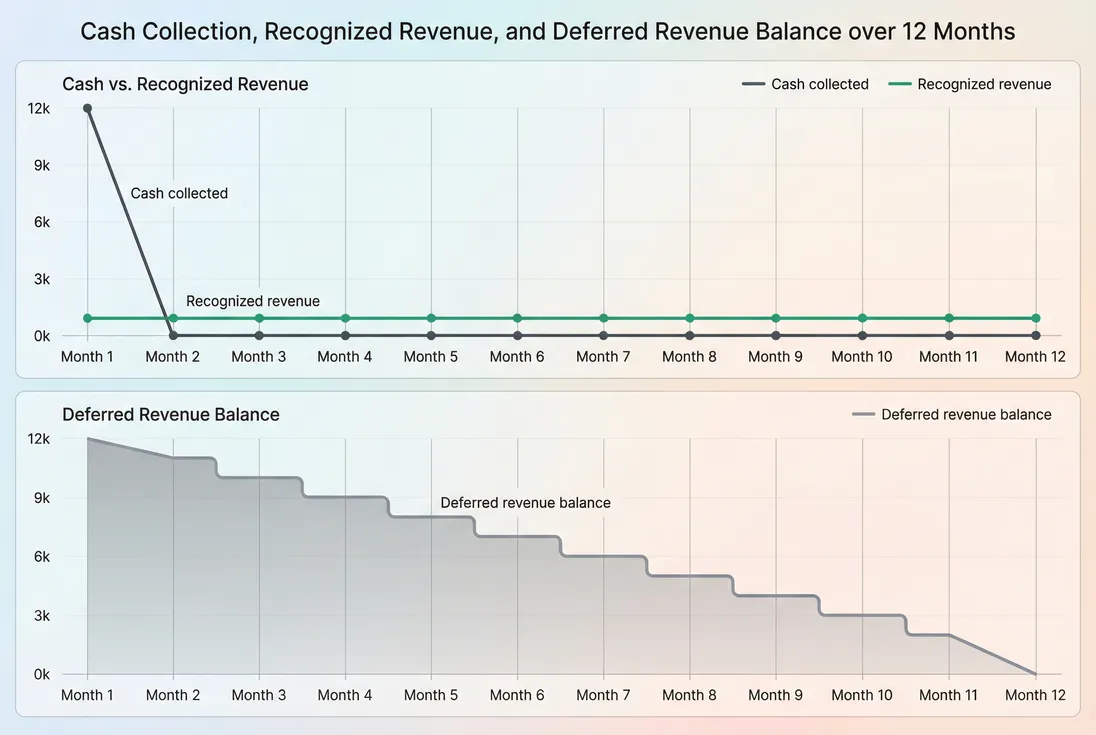

If you shift from monthly to annual prepay:

- Cash receipts go up immediately.

- Billings go up at invoice time.

- Recognized revenue barely changes in the short term (it spreads over the year).

This can be a good strategy for runway—just don't mistake it for improved unit economics. Pair it with Free Cash Flow (FCF) and runway planning, not just a "revenue growth" story.

Annual prepay improves cash now, but recognized revenue follows delivery month by month while deferred revenue drains down.

Usage-based and metered components

With Usage-Based Pricing or Metered Revenue, timing becomes trickier:

- If usage is billed in arrears, you might deliver value in March, invoice in April, and collect in May.

- Recognized revenue depends on when the performance obligation is satisfied (often as usage occurs), but collectability and estimation policies can shift the exact timing.

Founder takeaway: if usage is growing, recognized revenue may lead billings, which can strain cash unless collections are tight.

One-time payments and implementation work

One-time charges aren't "automatically recognized immediately." It depends on what they represent:

- A true setup fee that does not deliver a distinct service may need to be recognized over the subscription term.

- A distinct implementation project might be recognized as milestones are delivered.

This is why One Time Payments can create confusing spikes if you treat them casually in dashboards.

Discounts, fees, taxes, and refunds

These items don't just affect cash—they change what you can recognize:

- Discounts in SaaS reduce the transaction price and therefore reduce recognized revenue across the covered period.

- Billing Fees may be netted or expensed depending on treatment; founders should avoid mixing fee-inclusive "gross receipts" with revenue.

- VAT handling for SaaS matters because VAT is typically not revenue—it's tax collected on behalf of authorities.

- Refunds in SaaS reduce revenue (or increase contra-revenue) based on policy and timing.

If you're looking at recognized revenue and it suddenly dips without obvious churn, credits and refunds are often the culprit.

What changes in recognized revenue mean

Recognized revenue is lagging but honest. It's slower to react than bookings, but it's hard to "game" with invoice timing.

Here's how to interpret the most common patterns founders see.

Pattern: billings up, recognized revenue flat

Most likely causes:

- More annual prepay (deferred revenue increasing)

- Longer contract terms (more deferral)

- Bigger upfront invoices for future service

What to do:

- Track deferred revenue growth and renewal concentration.

- Confirm retention is strong enough that you're not "borrowing from the future."

The Founder's perspective

If billings are surging but recognized revenue is not, I assume we changed terms (annuals, longer contracts) until proven otherwise. Then I ask: are we increasing future obligations faster than our ability to deliver and retain?

Pattern: recognized revenue up, billings down

Most likely causes:

- Deferred revenue "coverage" from prior prepayments

- A temporary dip in new bookings

- Billing delays or invoicing process issues

What to do:

- Separate current performance from forward demand.

- Look at pipeline, renewals, and collection timing.

This is also where LTM framing helps. Investors often ask for LTM (Last Twelve Months) Revenue because it smooths short-term billing noise.

Pattern: recognized revenue volatility in a "recurring" business

Subscription SaaS recognized revenue should be relatively smooth. Volatility usually indicates:

- Non-recurring revenue is material (implementation, overages, one-time)

- Refund/credit events are spiky

- Usage-based components are growing

- Contract start dates are clustered (e.g., many annual renewals in Q1)

Operational fix: segment revenue streams and report them separately in your internal reviews.

How founders use recognized revenue in real decisions

1) Planning headcount and spend

If you're hiring against "growth," hire against a metric that reflects durable earning power, not invoice timing.

A practical approach:

- Use MRR/ARR for go-to-market capacity planning (sales coverage, CS load).

- Use recognized revenue (and gross margin) for burn and runway planning.

Tie this back to Contribution Margin and Gross Margin if you want to pressure-test whether growth is actually profitable.

2) Pricing and packaging evaluation

A price increase can show up in different places at different times:

- MRR responds as customers upgrade or renew.

- Billings respond when invoices go out.

- Recognized revenue ramps as the higher price is earned across the service term.

If you're evaluating price elasticity, don't conclude "the price increase failed" just because recognized revenue hasn't moved yet—look at renewal cohorts and committed run-rate.

Related reading that helps founders connect the dots: Price Elasticity, ASP (Average Selling Price), and ARPA (Average Revenue Per Account).

3) Investor narrative and diligence readiness

Investors want to understand:

- Is revenue real (earned), not just collected?

- How much future revenue is already contracted (deferred revenue, remaining performance obligations)?

- What happens if growth slows?

Recognized revenue provides credibility because it aligns with audited statements. It also forces you to explain the bridge from operating metrics like MRR to GAAP performance.

4) Cash discipline and collections

Recognized revenue doesn't pay the bills—cash does. But recognized revenue helps you identify when cash results are being propped up by prepayments.

Combine:

- Recognized revenue (earnings)

- Billings (invoicing execution)

- AR aging (collections reality)

If AR is expanding while recognized revenue rises, you may have a collections problem disguised as "growth."

A founder-friendly mental model: invoices create deferred revenue, recognition drains it over time, and cash depends on collections.

When recognized revenue "breaks"

Recognized revenue is reliable, but only if your inputs and policies are consistent. The most common breakpoints in SaaS:

Mixing net and gross revenue

If you sometimes treat processor fees or pass-through costs as reductions to revenue and sometimes as expenses, your recognized revenue trend becomes hard to interpret. Be consistent, and use COGS (Cost of Goods Sold) to keep margin analysis clean.

Ignoring credits, concessions, and disputes

Credits and concessions often reflect product gaps, not accounting noise. If you see a pattern:

- segment by plan, cohort, or sales rep

- treat it like a retention and quality problem, not just a billing issue

Treating churn timing inconsistently

In metrics land, churn is a date on a timeline. In accounting, cancellation and revenue reversals depend on contract terms, refunds, and service delivery. If you want a clean operational view alongside recognition, keep your churn definitions consistent in systems and review them with finance. (If you're wrestling with timing, see Churn Reason Analysis and your own cancellation policy rules.)

Practical checks founders should run monthly

You don't need a full accounting team to catch issues early. Add these checks to your month-end review:

Recognized revenue vs MRR sanity check

If your business is mostly fixed subscriptions, big deviations usually mean annual prepay mix shifts, one-time items, or credits.Deferred revenue trend

Rising deferred revenue can be good (more prepaid commitment) or risky (obligations outpacing retention). Read it alongside GRR (Gross Revenue Retention) and NRR (Net Revenue Retention).AR aging and collections

If recognized revenue is rising but AR is ballooning, your cash story is weaker than your P&L.Refund and dispute rate

Spikes are often a product or policy regression, not random variance.

The Founder's perspective

I care less about whether recognized revenue is "high" and more about whether it is explainable. If the finance lead cannot bridge it from billings and deferred revenue in two minutes, forecasting and hiring decisions are being made on shaky ground.

A simple way to communicate it internally

When you share numbers with your team, avoid accounting language. A clear framing is:

- Billings: what we asked customers to pay this month

- Cash: what customers actually paid this month

- Recognized revenue: what we delivered this month

- Deferred revenue: what customers paid for that we still owe them

That vocabulary keeps Sales, CS, and Finance aligned—especially when you change contract terms, add annual incentives, or introduce usage pricing.

Key takeaways

- Recognized revenue is the best "earned performance" measure for the month, independent of invoice timing and cash timing.

- In SaaS, shifts toward annual prepay usually increase cash and deferred revenue first, with recognized revenue following smoothly.

- Use recognized revenue for profitability and investor-grade reporting; use MRR/ARR for operating cadence.

- Monthly bridges (billings ↔ deferred ↔ recognized) prevent most founder-level forecasting mistakes.

Frequently asked questions

Recognized revenue is what hits your income statement for the period based on delivery, not billing or cash. For SaaS subscriptions, that usually means straight line recognition over the service term. Use it to explain why cash can spike from annual prepay while revenue grows smoothly.

In a simple monthly subscription business, recognized revenue for the month is close to MRR plus any non recurring revenue that is recognized that month. The gap grows with annual prepayments, usage based billing timing, and one time items. Use MRR for run rate; use recognized revenue for GAAP performance.

There is no universal benchmark because it depends on prepayment behavior. If billings are persistently above recognized revenue, you are likely building deferred revenue, which can be healthy if retention is strong. If billings fall below recognized revenue for long, watch renewals and cash pressure.

Recognized revenue can keep rising even if bookings slow when you have a large deferred revenue balance from annual or multi year contracts. That is a lagging effect. Founders should separate short term P and L strength from forward demand by tracking pipeline and renewal timing alongside deferred revenue coverage.

Refunds and credits typically reduce recognized revenue in the period they relate to, depending on accounting treatment and materiality. Disputes can delay recognition if collectability is uncertain. Operationally, spikes often trace to product issues, billing errors, or policy changes. Track them with Refunds in SaaS and Chargebacks in SaaS context.