Table of contents

MQL (Marketing Qualified Lead)

Most SaaS founders do not fail because they cannot "get leads." They fail because they spend time and money on the wrong leads, then build a sales process around false hope. MQL is the metric that's supposed to prevent that.

An MQL (Marketing Qualified Lead) is a lead that has shown enough fit and intent that your business considers it worth moving from "marketing nurture" to a sales-relevant next step (handoff to SDR/AE, prioritized follow-up, or a more direct conversion path).

Done well, MQL creates alignment: marketing is accountable for quality, not just volume, and sales is accountable for speed and follow-through on the best inbound demand.

What an MQL really represents

An MQL is not a universal standard. It is a contract between marketing and sales that says: "If a lead meets these criteria, we agree it deserves a high-quality follow-up."

Most strong MQL definitions combine two elements:

Fit (who they are)

Signals that the lead matches your ICP: company size, industry, geography, tech stack, role/seniority, compliance needs, and so on.Intent (what they did)

Signals that the lead is actively evaluating a solution: demo request, pricing page behavior, trial activation milestones, repeated high-value visits, webinar attendance with engagement, security questionnaire request, etc.

If you only use fit, you'll flag passive leads that never buy. If you only use intent, you'll overload sales with high-interest leads that cannot buy.

The Founder's perspective: Treat MQL as a throughput control for your go-to-market. If you define MQL too loosely, sales wastes time and CAC climbs. If you define it too tightly, pipeline starves and growth slows. Your job is to tune it so sales time is spent where it produces revenue.

MQL vs SQL (and why the difference matters)

The common handoff sequence is:

- Lead → MQL (marketing says "worth attention")

- MQL → SQL (Sales Qualified Lead) (sales says "worth active pursuit")

- SQL → opportunity → closed-won

This is why MQL should be evaluated alongside SQL (Sales Qualified Lead) and Qualified Pipeline. If your MQL count is rising but SQL creation or qualified pipeline is flat, your MQL definition is not doing its job.

How MQL is calculated (and what to report)

At the simplest level, MQL is a count: how many leads entered the MQL stage in a period. But founders rarely make decisions from the count alone. You want a small set of ratios that reveal whether you have a volume problem, a quality problem, or a follow-up problem.

Core calculations

MQL rate (lead-to-MQL conversion) tells you how much of your lead flow reaches your qualification bar.

Cost per MQL connects MQL production to spend.

MQL-to-SQL conversion is the fastest "quality check" because it reflects whether sales agrees the MQLs are real.

If you want one additional metric that prevents a lot of bad decisions, track median time from MQL to first sales touch. Many "MQL quality" debates are actually speed-to-lead problems.

A simple funnel view (what you want to see)

What changes in MQL usually mean

Founders often overreact to MQL count changes because it feels like "demand." In reality, MQL movement can come from very different sources, and they imply different actions.

If MQLs go up

This can be great—or a trap.

Common causes:

- More top-of-funnel volume (more traffic, higher Conversion Rate, more spend).

- Lower qualification threshold (you redefined MQL, adjusted scoring, or added a new "easy" trigger like a webinar signup).

- Channel mix shift (more leads from a channel that converts to MQL easily but doesn't close).

How to interpret:

- If MQL-to-SQL and win rate hold steady, more MQLs usually means more pipeline soon.

- If MQL-to-SQL drops, you likely inflated MQLs, or sales capacity is saturated and not following up.

If MQLs go down

This can indicate a real pipeline risk, but sometimes it is a healthy correction.

Common causes:

- Tighter definition (raising the bar to protect sales time).

- Offer mismatch (your lead magnet attracts the wrong persona).

- Demand cooling (seasonality, competitive moves, channel fatigue).

How to interpret:

- If MQLs drop but SQLs and pipeline stay flat, you probably removed junk leads and improved focus.

- If MQLs drop and SQLs drop with a lag, you have an inbound demand problem and should diagnose by channel.

The Founder's perspective: The only "good" MQL trend is one that improves sales productivity or reduces CAC. Don't celebrate MQL growth until you see stable or improving MQL-to-SQL and win rate, or faster CAC Payback Period.

Where MQL breaks as a metric

MQL becomes a vanity metric when it stops predicting revenue.

Here are the most common failure modes in SaaS:

1) You changed the definition without documenting it

If you tweak scoring rules, form requirements, or routing logic, your historical trend line is no longer comparable. The fix is operational: version your MQL definition like you version pricing.

Practical tip: whenever you change the definition, annotate reporting and compare new-definition cohorts separately for 30 to 60 days.

2) Sales ignores MQLs (or cherry-picks)

If sales does not consistently work MQLs, MQL-to-SQL becomes a measure of behavior, not quality.

What to do:

- Track "first touch within X hours" by rep/team.

- Separate "worked MQLs" vs "unworked MQLs" in your analysis.

3) Duplicate and recycled leads inflate counts

B2B SaaS is full of repeats: same person downloads three assets, signs up for a webinar, then starts a trial. If each action creates a "new MQL," you'll overstate volume and understate conversion.

Operational rule: treat MQL as a status on a person/account, not an event counter, and define a re-qualification window (for example, 30 or 90 days).

4) Your MQL is not aligned to your sales motion

If you are truly self-serve PLG, a content download may not be a sales handoff at all. Your "qualified" moment might be a high-usage milestone or an upgrade intent signal.

This is where aligning MQL with your Go To Market Strategy, and whether you are closer to Product-Led Growth or Sales-Led Growth, matters more than any benchmark.

How founders use MQL to make decisions

MQL is most useful when it directly informs operating decisions: budget allocation, headcount, and funnel design.

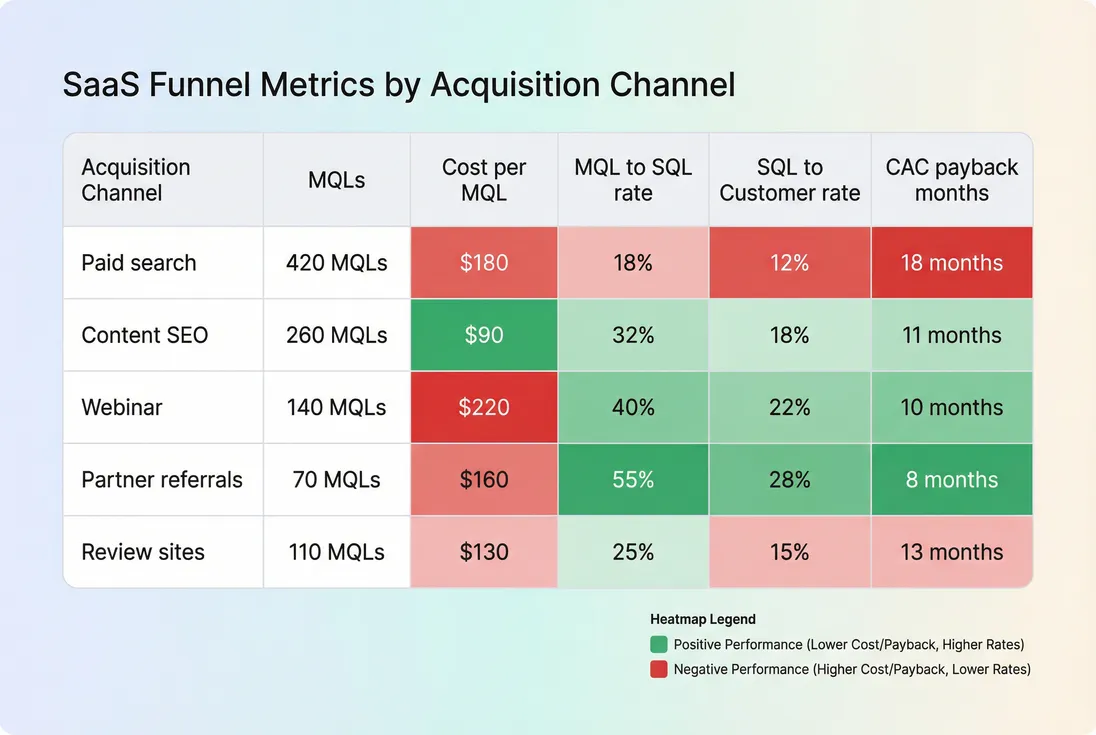

Decision 1: Where to spend (and what to cut)

Instead of asking "Which channel produces the most MQLs?" ask:

- Which channel produces MQLs with the highest MQL-to-SQL?

- Which channel produces SQLs with the best win rate?

- Which channel produces customers with the best CAC payback?

That naturally connects MQL analysis to CPL (Cost Per Lead) and CAC (Customer Acquisition Cost): cheap MQLs are not a win if they create expensive customers.

Decision 2: Whether you have a quality issue

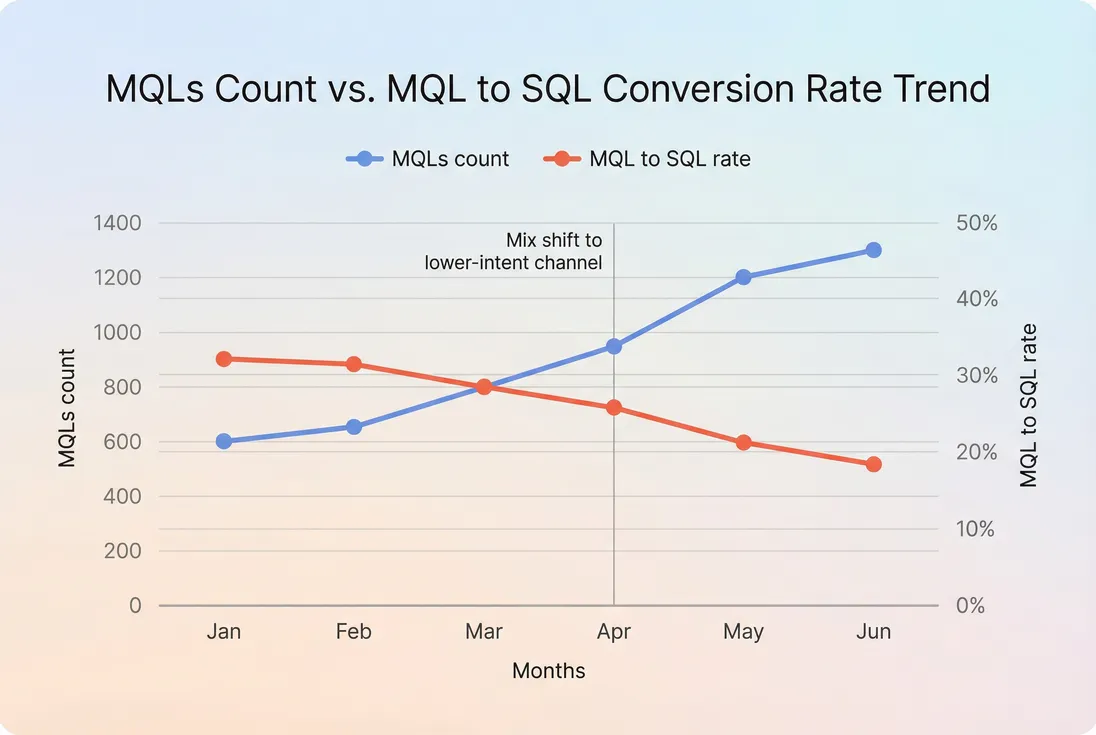

A common pattern: marketing scales spend, MQL count rises, but sales complains leads "got worse."

Here is the diagnostic: plot MQL volume against MQL-to-SQL.

Interpretation framework:

- MQL up, MQL-to-SQL down: dilution (channel mix, definition loosened, or sales overwhelmed).

- MQL down, MQL-to-SQL up: tighter qualification (often good if SQL volume holds).

- MQL flat, MQL-to-SQL down: sales follow-up or routing issue, or ICP drift in inbound.

Decision 3: When to hire SDRs or add sales capacity

MQL is also a capacity planning input. If you can estimate:

- MQLs per month

- workable MQLs per SDR per day (given your motion)

- expected MQL-to-SQL

…you can forecast whether sales is about to bottleneck.

If MQLs are rising but SQLs are not, don't immediately blame marketing. First ask: did speed-to-lead slip? Did reps stop working the queue? Are you under-resourced for inbound?

Connect this analysis to Sales Rep Productivity and Sales Cycle Length if your motion is sales-led.

How to set an MQL definition that holds up

A durable MQL definition is built backward from closed-won, not forward from lead gen tactics.

Step 1: Start with your best customers

Pull your last 20 to 50 closed-won deals and ask:

- What firmographic patterns repeat?

- What early behaviors preceded the sales conversation?

- What disqualifiers were obvious in hindsight?

This is where you avoid "activity scoring" that rewards clicks instead of buying signals.

Step 2: Decide the purpose of MQL

Pick one primary purpose (or you'll end up with a messy compromise):

- Sales handoff: MQL means "call/email now."

- Fast-track nurture: MQL means "higher-intent nurture sequence."

- Routing: MQL means "send to the right segment/team."

If MQL is a sales handoff, the bar must be high enough that sales trusts it.

Step 3: Define explicit criteria, not vibes

Good MQL definitions are readable in one page. Example structure:

- Hard fit filters (must have)

- geo, minimum company size, business email, relevant role

- Intent triggers (any one qualifies)

- demo request

- trial started + activation milestone

- pricing page visited twice in 7 days + requested integrations doc

- Disqualifiers (never qualifies)

- students, competitors, unsupported regions

Then pressure-test the definition by computing:

- MQL-to-SQL rate

- SQL win rate

- time-to-first-touch

Step 4: Maintain a "definition integrity" dashboard

Your MQL definition will be "attacked" by reality: new channels, new ICP experiments, and human incentives.

A simple integrity view is a channel table showing cost and conversion at each step:

This is where founders make confident cuts: you can reduce MQL volume intentionally if it improves sales throughput and unit economics.

Practical benchmarks (use carefully)

Benchmarks are only useful when your definition is stable and your motion is comparable. Use them as a "sanity check," not a target.

Here are rough starting ranges many B2B SaaS teams see:

| Motion | Typical MQL rate | Typical MQL-to-SQL rate | What "good" looks like |

|---|---|---|---|

| Self-serve / PLG hybrid | 2%–10% | 10%–25% | MQLs are high-intent product behaviors; sales touches are selective |

| Mid-market sales-led | 5%–15% | 20%–40% | MQL definition filters hard on ICP; SDR follow-up is fast |

| Enterprise sales-led | 3%–12% | 25%–50% | Fewer MQLs, but higher agreement with sales and higher ACV |

If you are far outside these ranges, it's not automatically bad. It's a prompt to check your definition, channel mix, and follow-up process.

A simple weekly operating cadence

For most early and growth-stage SaaS founders, this cadence keeps MQL useful without consuming your week:

Weekly (30 minutes):

- MQL count, MQL-to-SQL, median speed-to-lead

- top channels by SQL created (not just MQLs)

Monthly (60–90 minutes):

- cost per MQL by channel

- MQL cohort conversion to customer (lagging)

- alignment check with sales: are we calling these, or not?

Quarterly (planning):

- revisit ICP and disqualifiers

- decide whether MQL should be tighter or looser based on sales capacity and growth goals

The Founder's perspective: The goal of MQL is not to "increase MQLs." The goal is to increase the amount of sales time spent on buyers who will actually buy, at a CAC you can afford. If MQL is not serving that goal, change the definition or stop using it.

Related metrics to pair with MQL

MQL becomes far more decision-useful when you intentionally pair it with:

- CPL (Cost Per Lead) to see whether you are buying leads efficiently

- Lead Conversion Rate to understand where lead flow is coming from

- SQL (Sales Qualified Lead) to validate quality and sales agreement

- Lead-to-Customer Rate to connect early funnel to outcomes

- CAC (Customer Acquisition Cost) and CAC Payback Period to confirm unit economics

If you remember one rule: MQL is only "real" when it predicts revenue. Everything else is busy work.

Frequently asked questions

Yes, but redefine what qualifies. In PLG, a generic content lead is rarely sales-ready. Your MQL should reflect high-intent behaviors like hitting an activation milestone, inviting teammates, or requesting security docs. If MQLs do not correlate with pipeline or revenue, you are measuring noise.

It depends on your sales motion and MQL definition. For many B2B SaaS teams, 20 to 40 percent is a reasonable starting band, but the real test is trend and downstream economics. If MQL-to-SQL rises while CAC stays flat or drops, your qualification is improving.

In most SaaS businesses, quarterly is frequent enough to iterate without breaking comparability. Change sooner when you launch a new ICP, add a new acquisition channel, or shift from founder-led sales to an SDR team. Always document changes and compare performance before and after the change.

Tie the MQL definition to downstream outcomes: SQL creation, qualified pipeline, and closed-won. Add hard disqualifiers like non-ICP geos or student emails. Monitor MQL-to-SQL and SQL win rate by channel. If MQLs rise but those rates fall, someone optimized the wrong objective.

MQLs are an input to CAC, not the outcome. Use cost per MQL as an early signal, then follow MQL cohorts into opportunity and customer conversion. If cheaper MQLs convert worse, CAC will rise. Connect MQL cohorts to [CAC (Customer Acquisition Cost)](/academy/cac/) and [CAC Payback Period](/academy/cac-payback-period/).