Table of contents

Conversion rate

Conversion rate is one of the fastest ways to tell if growth is "working" or just getting louder. When it improves, you can scale acquisition with less waste. When it slips, your CAC quietly spikes, forecasts miss, and teams argue about whether the problem is product, marketing, or sales.

In plain English: conversion rate is the percentage of people who move from one defined stage to the next (for example, visitor to signup, trial to paid, lead to customer).

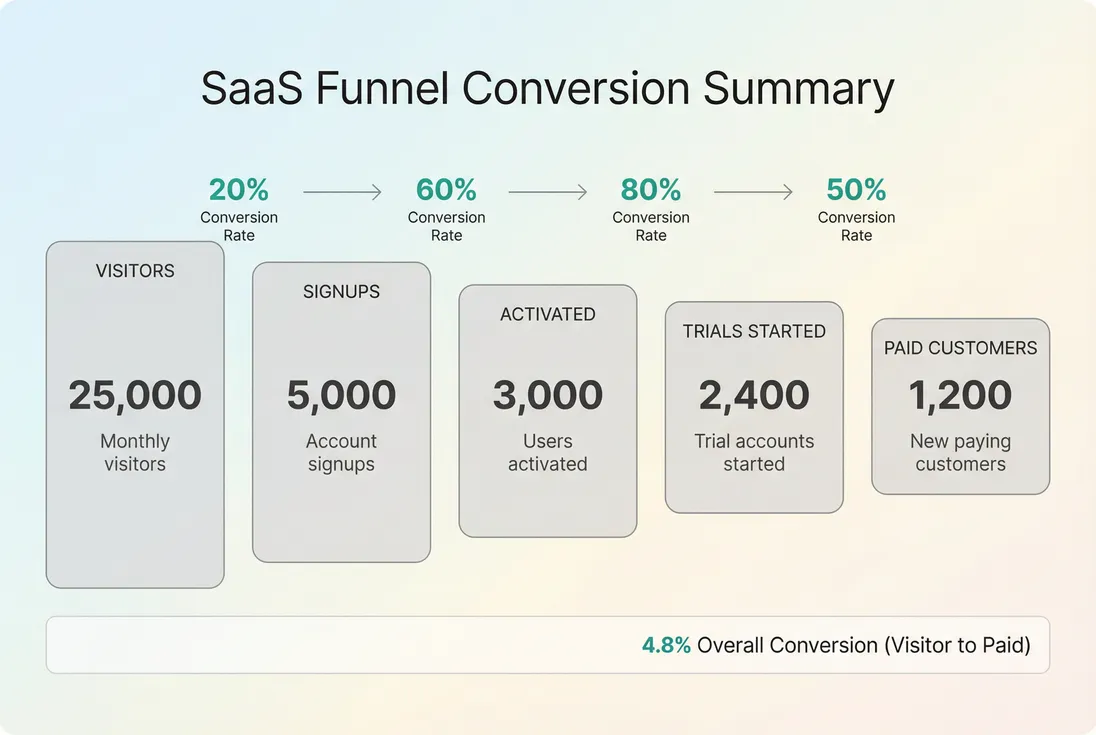

A simple funnel makes conversion concrete: you can see exactly where volume drops and which step is worth fixing first.

What conversion rate should you track?

"Conversion rate" isn't one metric. It's a family of rates across your funnel. The right one depends on your go-to-market motion and where money is actually made.

Common SaaS conversion rates

Acquisition to signup

- Visitor → signup

- Click → signup (for paid channels)

Useful when you're optimizing landing pages, positioning, and channel quality.

Activation

- Signup → activated (where "activated" means they reached first value)

Activation is often the leading indicator of retention and expansion later. Tie "activated" to a real outcome (not "logged in once"). Pair this with Time to Value (TTV) thinking: fast value usually converts better.

Trial and checkout

- Trial → paid

- Checkout started → paid (payment success)

Critical for PLG and self-serve. This is where pricing, packaging, and friction show up. Changes in Discounts in SaaS can also move this rate (sometimes by pulling forward deals you would have won anyway).

Sales funnel (sales-led)

- MQL → SQL

- SQL → closed-won (often called win rate; see Win Rate)

For enterprise, these are usually more actionable than "website conversion."

The Founder's perspective

If you don't name the stage, you can't manage the business. "Conversion is down" is not a diagnosis. "Trial to paid is down in agencies on the Pro plan since the pricing page redesign" is.

Pick a "primary" conversion rate

Founders do best with:

- One primary conversion rate tied to revenue (trial → paid, lead → customer, SQL → won)

- Two to three supporting conversion rates that explain it (signup → activated, activation → trial start, checkout started → paid)

If you track ten conversion rates weekly, you'll optimize none.

How do you calculate it correctly?

The formula is easy. The mistakes are not.

Start with a clean definition

A conversion rate must specify:

- Eligible: who is included in the denominator

- Converted: the event that counts as success

- Window: how long you give someone to convert

- Unit: users, accounts, or opportunities

Example: "Trial to paid conversion" could mean:

- Trials started in March that became paid within 14 days (cohort-based), or

- People who were in trial at any time in March and paid in March (period-based)

Those can produce very different answers.

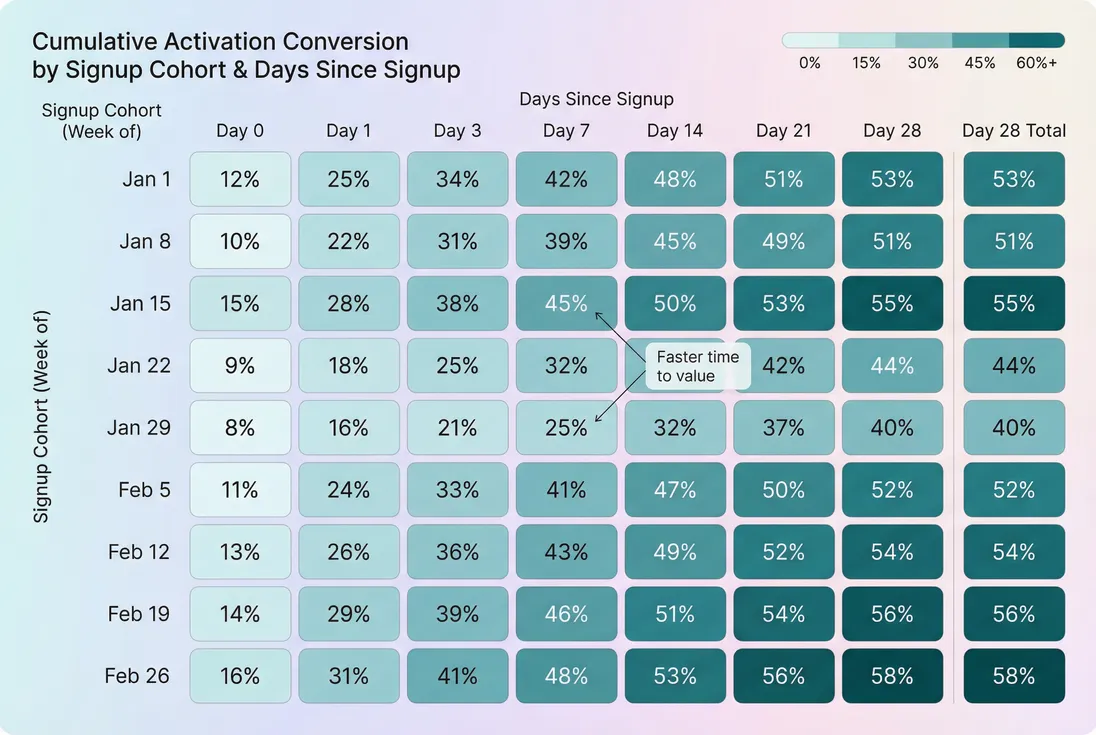

Cohort-based conversion is usually what you want

For most SaaS funnels, cohort-based conversion is the decision-grade view because it respects time lag.

If your trial is 14 days, then "trial to paid within 14 days" is coherent. If you instead use calendar months, you will misread conversion whenever volume spikes near month-end.

A practical way to operationalize this is to view conversion by signup week or trial start week, then compare cohorts over the same conversion window. This is the same mindset that makes Cohort Analysis valuable across retention and funnel performance.

Don't average conversion rates naively

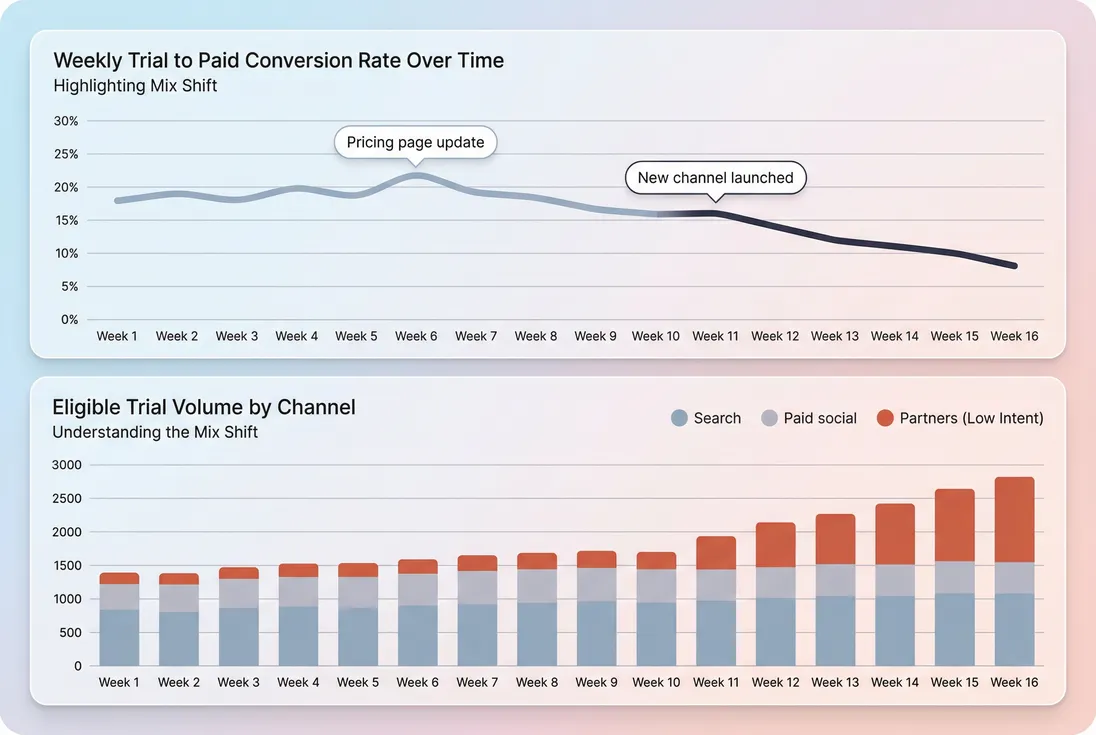

If you have segments or channels, the combined conversion rate is weighted by volume, not an average of segment rates.

This matters because "conversion is down" is often just mix shift:

- You added a new channel with low intent traffic.

- You expanded to a new persona that needs more onboarding.

- You pushed a cheaper plan that attracts different buyers.

Beware denominator pollution

Conversion rates get quietly distorted by:

- Bots and spam signups

- Duplicate leads/opportunities

- Unqualified inbound (bad targeting)

- Free users who were never meant to convert (freemium misuse)

- Re-activations counted as new (see Number of Reactivations for how reactivation can complicate "new" flows)

Fixing your definitions can "improve conversion" overnight—without improving the business. Treat that as a data correction, not a win.

What actually moves conversion rate?

Conversion is the output. The levers are upstream and usually cross-functional.

The big buckets of conversion drivers

1) Intent and targeting (quality in)

- Channel match (search intent vs social curiosity)

- ICP alignment (wrong persona converts poorly no matter what)

- Message match (ad promise vs product reality)

This is why conversion rate is inseparable from CAC (Customer Acquisition Cost) and CPL (Cost Per Lead). Cheap leads that don't convert are not cheap.

2) Perceived value (why buy)

- Clear "before/after" outcome

- Proof (case studies, reviews, security signals)

- Differentiation (why you vs status quo)

If you're competing in a crowded category, conversion often moves more from positioning than UI tweaks.

3) Friction (how hard it is)

- Form length, steps, required fields

- SSO, invite flows, integrations

- Payment failures and dunning (see Involuntary Churn for what happens after you finally convert)

Friction shows up strongly in trial start and checkout conversion.

4) Time to value (how fast it clicks)

- Onboarding completion (see Onboarding Completion Rate)

- Templates and guided setup

- Fast path for the common use case

Many "conversion problems" are really "value realization is too slow" problems.

5) Pricing and packaging (who it's for)

- Price sensitivity, minimum viable plan, feature gates

- Annual vs monthly presentation

- Over-discounting (it can lift conversion while lowering payback quality)

Tie pricing changes back to monetization metrics like ARPA (Average Revenue Per Account) and ultimately MRR (Monthly Recurring Revenue). A conversion lift that cuts ARPA can still be a net loss.

A concrete scenario founders face

You reduce your entry plan from $49 to $29:

- Trial → paid conversion rises from 12% to 18% (good)

- ARPA drops 25% (bad)

- Support load rises because you attract smaller customers (hidden cost)

- Expansion slows because lower-tier customers churn earlier

Conversion improved, but the business might not. Always evaluate conversion alongside payback and retention metrics like NRR (Net Revenue Retention) and Customer Churn Rate.

How founders diagnose a change

A conversion rate change is only useful if you can explain it fast enough to act.

Blended conversion can fall even when nothing "broke" in product—channel mix shifts change the denominator and pull down the average.

A fast diagnosis checklist (in order)

1) Verify the definition didn't change

- Did you change what counts as "trial started" or "activated"?

- Did tracking events change names?

- Did you start excluding internal users or not?

2) Check volume and segmentation Look at the conversion rate split by:

- Channel/source

- Plan selected

- Geo

- Persona or company size proxy

- New vs returning

Mix shift is the most common cause of "mysterious" conversion movement.

3) Inspect each step conversion If you have a multi-step funnel, isolate where it moved:

- Visitor → signup stable, signup → activated down (activation issue)

- Signup → activated stable, trial → paid down (pricing/checkout/sales follow-up)

This prevents teams from optimizing the wrong surface.

4) Align the time window to the buying cycle If your typical sales cycle is 45 days (see Sales Cycle Length), don't judge lead → customer conversion on a 14-day window. You will call "conversion is down" when deals are simply still open.

5) Tie it back to dollars Conversion rate is a means. The end is efficient growth:

- CAC and payback: CAC Payback Period

- Revenue quality: ARPA and retention

- Growth predictability: pipeline and close rates

The Founder's perspective

Don't let conversion become a beauty metric. If conversion rises but CAC payback worsens, you bought low-quality demand. If conversion falls but qualified pipeline and close rates improve, you might be moving upmarket intentionally.

Using cohorts to avoid false conclusions

When conversion is tied to a time lag (trial, nurture, sales cycle), cohort views reduce noise because you're comparing like with like.

If you use GrowPanel, use filters and cohorts to compare segments consistently over time, rather than eyeballing blended averages. Relevant docs: filters and cohorts.

How to use conversion rate in decisions

Conversion rate becomes powerful when you use it to choose what to do next: fix product friction, change targeting, adjust pricing, or scale spend.

Decision 1: Should we scale acquisition?

A practical rule: don't scale a funnel you can't explain.

Before increasing spend, confirm:

- The primary conversion rate is stable or improving for your best segment

- The conversion rate holds across recent cohorts (not just one great week)

- CAC payback works with current conversion (model it)

A simple planning relationship:

If you double eligible volume by scaling spend and conversion drops due to quality dilution, you can end up with the same customers for more cost.

Decision 2: Where is the highest leverage fix?

Work from the step with the biggest "customer yield" opportunity.

Example funnel (weekly):

- 2,000 trials started

- 240 become paid (12%)

If you can raise trial → paid from 12% to 15%:

- New paid customers go from 240 to 300 (+60)

- That's a 25% increase in paid adds without increasing acquisition

Compare that to a landing page tweak that increases visitor → signup but doesn't improve activation; you may just create more unqualified signups.

Decision 3: Should we change pricing or packaging?

Pricing changes are conversion experiments with second-order effects. When evaluating:

- Track conversion by plan and by segment, not just blended

- Watch ARPA and downstream retention, not just initial conversion

- If you push annual, track whether conversion moves from monthly to annual (and how refunds behave; see Refunds in SaaS)

Conversion can rise because you made the decision easier—or because you made the product cheaper than it should be.

Decision 4: What should the team do this week?

A useful weekly operating cadence:

- Marketing: channel-level conversion and mix

- Product: activation and time-to-value drivers

- Sales: stage conversion and Win Rate

Keep the conversation grounded in one primary conversion rate and the step that moved.

Cohort heatmaps show whether conversion is improving because more users convert—or because they convert faster.

When conversion rate breaks

Some situations make conversion rate easy to misread.

Multi-product or multi-persona funnels

If you sell to two different ICPs, a blended conversion rate becomes meaningless. Segment conversion by persona and treat them as separate funnels with separate targets.

Long sales cycles

For enterprise sales, "lead → customer conversion this month" is often a lagging artifact. Use stage conversion with consistent aging, and complement it with pipeline health metrics like Qualified Pipeline and Average Sales Cycle Length.

Freemium and expansion-led businesses

If most revenue comes from expansion, initial conversion can be less important than retention and growth inside accounts. In that world, you may accept lower initial conversion if NRR (Net Revenue Retention) and Expansion MRR are strong.

Instrumentation drift

Conversion rates are fragile to tracking changes. Any time you ship:

- New onboarding

- New paywall logic

- New billing flows Run a "conversion reconciliation" for two weeks to confirm counts match reality.

Practical benchmarks (use carefully)

Benchmarks only help once you segment by motion and price point. Use ranges to sanity-check, then focus on improving your own baseline.

| Motion / step | Typical range (directional) | What usually drives the range |

|---|---|---|

| PLG signup → activated | 20%–60% | Time to value, onboarding quality, ICP fit |

| PLG trial → paid | 8%–25% | Pricing, paywall design, perceived value, support |

| Freemium → paid (monthly) | 1%–5% | Upgrade triggers, feature gating, usage limits |

| Sales-led SQL → closed-won | 10%–30% | Qualification, competition, deal size, sales execution |

| Outbound lead → customer | 0.5%–3% | List quality, offer, follow-up, sales cycle |

If you're outside these ranges, it's a prompt to investigate definitions and segmentation—not an automatic problem.

The takeaway

Conversion rate is your efficiency meter. Define it tightly (stage, unit, window), view it by cohort when time lag exists, and segment it before you react. Then use it the way founders actually win: to pick the one funnel step that will produce more revenue with the least additional spend.

For related metrics that sharpen conversion decisions, see Lead-to-Customer Rate, CAC Payback Period, and Time to Value (TTV).

Frequently asked questions

Track the conversion rate that represents your current bottleneck. For PLG, that is often trial to paid or signup to activated. For sales led, it is usually SQL to closed won or demo to close. Pick one primary rate, then a small set of supporting rates that explain it.

Benchmarks vary massively by price point, audience, and motion, so treat them as sanity checks, not goals. A strong PLG trial to paid might be 10 to 25 percent for self serve SMB, while enterprise sales win rates can be 10 to 30 percent depending on qualification and deal size. Segment before comparing.

Maybe. A higher volume top of funnel can dilute conversion if you broaden targeting, add new channels, or go viral with lower intent traffic. Check converted volume, not just the percentage, and segment by channel and persona. If paid conversions and payback worsened, fix quality fast.

First, confirm tracking and definitions did not change. Then look at sample size and time window consistency. A 2 point swing on 50 trials is noise; the same swing on 5,000 trials is meaningful. Finally, isolate mix effects by comparing channel level conversion rates and volumes.

Conversion rate directly affects CAC because it changes how many paid customers you get from the same spend. If lead to customer conversion falls, CAC rises even if CPL stays flat. Model payback using your conversion rate, [CAC (Customer Acquisition Cost)](/academy/cac/), and [ARPA (Average Revenue Per Account)](/academy/arpa/) to see the impact.