Table of contents

Chargebacks in SaaS

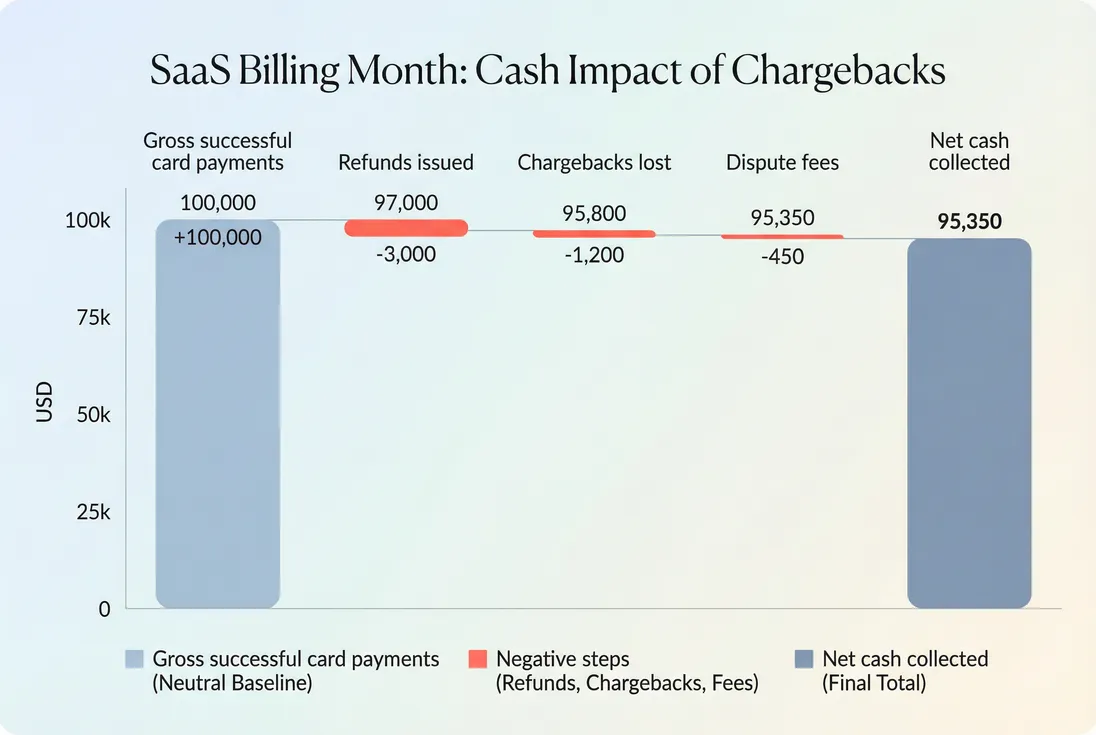

Chargebacks don't just claw back revenue. They also increase payment fees, create support load, and—if they cross thresholds—can put your payment processing at risk. For founders, that means chargebacks can quietly raise your "real" churn and add volatility to cash flow when you can least afford it.

A chargeback is a payment reversal initiated by the customer through their bank/card issuer, typically by disputing a card transaction. Unlike a refund, you don't control the timeline, you often pay a fee either way, and you may lose both the money and the product access already delivered.

What chargebacks reveal

Chargebacks are a lagging signal of something that went wrong in your revenue engine. The tricky part is that "wrong" can mean very different things:

- Product/value mismatch: customer didn't get what they expected, or onboarding failed.

- Billing confusion: unclear descriptor, renewal surprise, hard-to-find cancellation flow.

- Operational mistakes: duplicate charges, proration bugs, tax/VAT mishandling, invoice errors.

- Fraud: stolen cards, account takeover, card testing, reseller abuse.

- Policy gaps: weak terms, missing evidence, inconsistent refunds.

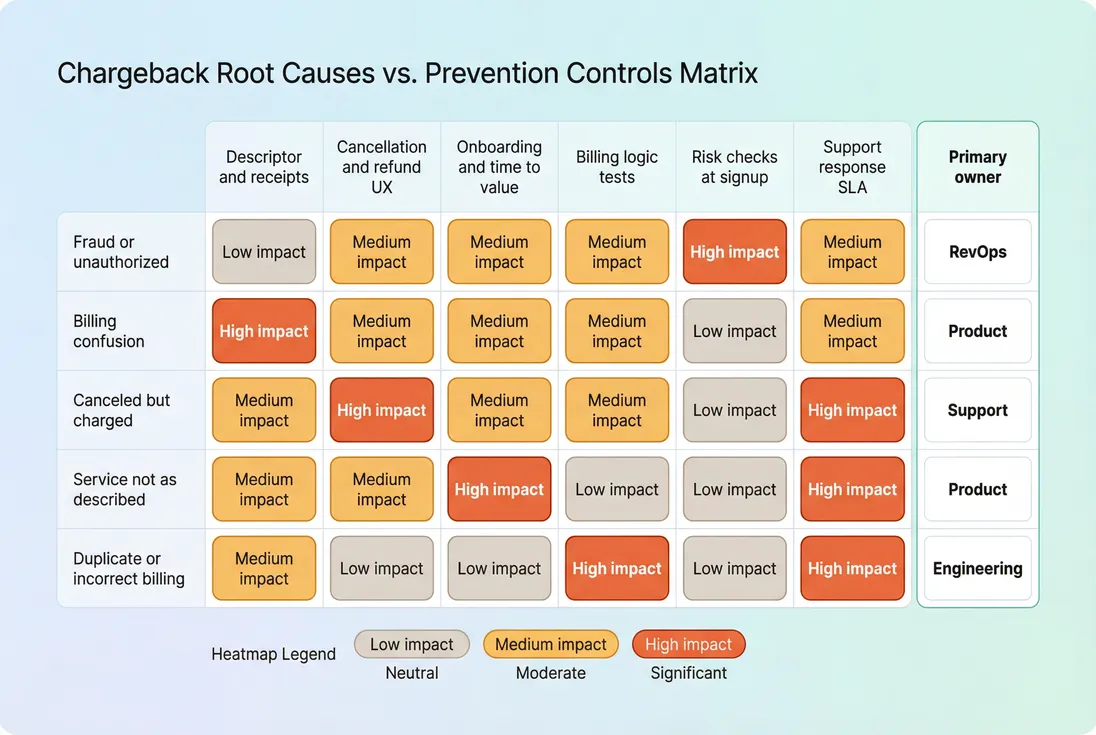

The founder-level takeaway: chargebacks aren't merely a finance metric. They're a cross-functional quality metric spanning marketing promises, checkout UX, billing logic, support responsiveness, and fraud controls.

The Founder's perspective

If chargebacks rise while growth looks fine, you're often "buying" revenue with future reversals. That distorts real retention, inflates cash forecasts, and can force painful changes later (stricter signup friction, paused campaigns, even payment processor escalation).

How to calculate chargebacks

There isn't one universal "correct" way; there are two practical versions founders should track:

Rate by dollar amount (revenue impact)

Use this to understand margin and cash impact. It answers: How much collected cash is being clawed back?

Rate by count (processor risk)

This is closer to what card networks and processors watch (typically with volume thresholds). It answers: Are we at risk of monitoring programs, reserves, or termination?

Also track "net chargeback loss"

Chargebacks are often recoverable (you can win disputes), but outcomes lag. For operating decisions, track:

Many teams miss the fee piece. Pair this with Billing Fees to understand true payment costs.

Measurement window pitfalls

Chargebacks can arrive weeks after the original charge, which creates false alarms (or false comfort). Avoid these two mistakes:

- Comparing disputes opened this month to payments this month without acknowledging lag.

- Mixing "opened" with "lost" outcomes in the same KPI.

A practical approach:

- Track opened dispute count-rate for early detection.

- Track lost dispute amount-rate for financial impact.

- Review both on a trailing average (e.g., trailing 3-month) when volume is low.

What changes usually mean

Chargebacks rarely move for "no reason." Here's how to interpret common patterns.

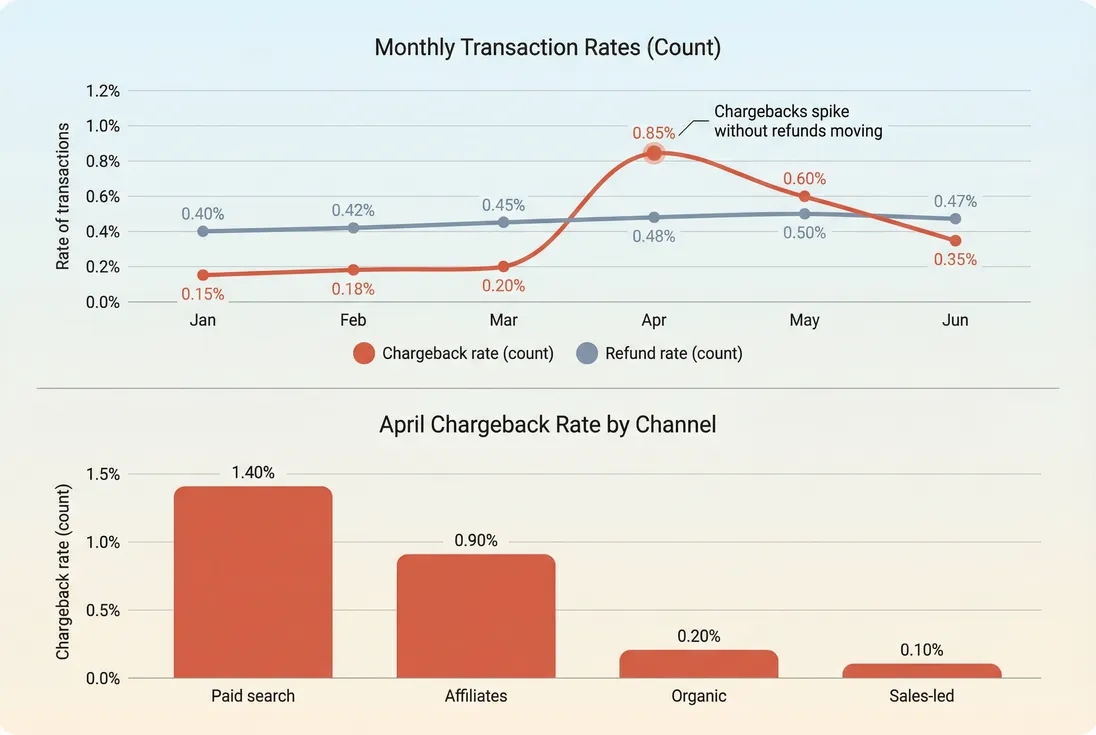

If chargebacks rise but refunds don't

This often means customers are skipping your support/refund path and going straight to the bank. Common reasons:

- They couldn't find cancellation or refund options quickly.

- Support response time is too slow.

- The descriptor doesn't match your brand, so the charge looks unfamiliar.

- The customer is committing friendly fraud (they did use it, but dispute anyway).

This is when reviewing your Refunds in SaaS policy and response times pays off.

If both refunds and chargebacks rise

This is usually product/market, pricing, or promise mismatch:

- New positioning brings in the wrong customers.

- A price increase triggers dissatisfaction.

- Trial-to-paid conversion is surprising (timing, amount, or communication).

- Onboarding quality dipped (new flow, bug, or support backlog).

Correlate with onboarding completion and retention; use Cohort Analysis to see if specific signup weeks or channels deteriorated.

If chargebacks spike suddenly

Think "breakage" or "fraud wave" before anything else:

- Billing bug caused duplicate charges.

- Tax/VAT logic changed (see VAT handling for SaaS).

- Checkout change increased card testing or abusive signups.

- A new affiliate or campaign attracted high-risk traffic.

When the spike is sharp, look for a single common factor: plan, country, BIN ranges (if available), acquisition channel, or billing cadence.

Benchmarks and thresholds founders use

Benchmarks vary heavily by audience and payment model. A self-serve B2C-ish SaaS with monthly card billing will naturally see more disputes than an invoice-based B2B SaaS.

Use this table as a directional guide, not a law:

| SaaS context | Healthy (count-rate) | Watch zone | Act now |

|---|---|---|---|

| Low-risk B2B (clear buyer, higher ACV, strong onboarding) | < 0.10% | 0.10%–0.30% | > 0.30% |

| Self-serve SMB (monthly cards, high volume) | < 0.30% | 0.30%–0.60% | > 0.60% |

| Higher-risk (consumer-like use, affiliates, free trial abuse exposure) | < 0.60% | 0.60%–0.90% | > 0.90% |

Operationally, two additional "benchmarks" matter more than industry averages:

- Your processor's tolerance (they can impose reserves or monitoring actions).

- Your own unit economics tolerance (how much reversal + fees your margin can absorb).

If you're optimizing CAC (Customer Acquisition Cost) and CAC Payback Period, a rising chargeback rate is a direct hit: it reduces realized revenue while acquisition spend stays fixed.

Where chargebacks hit the business

Chargebacks show up in more places than founders expect.

1) Cash flow volatility

Refunds are controllable; chargebacks are not. You might see "booked" revenue that doesn't translate into cash, and you may lose funds after you've already paid vendors and payroll. Pair chargebacks monitoring with Burn Rate and Runway planning.

2) Artificially inflated retention metrics

If you treat a chargeback as a refund but keep the subscription "active," you can overstate retention. If you cancel access immediately, you might classify it as Involuntary Churn. Whichever you choose, be consistent—and reconcile to Recognized Revenue.

3) Operational drag

Disputes require evidence gathering: invoices, terms acceptance, login/usage logs, communications, delivery confirmation (for any add-ons). That work competes with customer success and product priorities.

4) Processor and network risk

Sustained high dispute ratios can trigger additional monitoring, rolling reserves, delayed payouts, or account closure. Founders usually feel this as "payments suddenly got harder" (more declines, longer payout times), not as a neat KPI.

The Founder's perspective

A chargeback problem is rarely solved by "winning more disputes." It's solved by reducing disputes created in the first place—by tightening expectations, fixing billing edges, and improving cancellation/refund paths. Winning is a bonus; prevention is the strategy.

How founders investigate chargebacks fast

When chargebacks rise, speed matters. Here's a practical investigation sequence that usually gets to root cause quickly.

Step 1: Separate three buckets

Don't lump everything together. Create three buckets from dispute reason codes and support context:

- Fraud/unauthorized

- Service not as described / dissatisfaction

- Billing confusion / canceled but charged

Each bucket has different fixes. Fraud wants risk controls. Dissatisfaction wants onboarding/value delivery. Billing confusion wants comms, receipts, and cancellation clarity.

Step 2: Segment the spike

Segment by:

- Acquisition channel (especially affiliates and paid social)

- Plan and price point (high ticket vs low ticket behave differently)

- Geo/currency and payment method

- Trial vs no-trial, monthly vs annual

- Time since signup (same-day disputes are a fraud smell)

If you're also tracking revenue quality metrics like ARPA (Average Revenue Per Account) or ASP (Average Selling Price), check whether the spike is concentrated in low-ARPA cohorts (often higher friction, more confusion) or high-ASP plans (higher incentive to dispute).

Step 3: Inspect the customer experience "evidence trail"

Ask: If I were an issuer reviewing this, what proof exists that the customer knowingly purchased and received value?

Evidence that tends to matter:

- Clear invoice/receipt and recognizable merchant descriptor

- Terms acceptance timestamp and IP

- Login timestamps and usage depth (feature access, API calls, exports)

- Support interactions (especially resolved tickets)

- Cancellation attempt logs (if you have them)

Step 4: Compare disputes to complaints

If disputes are high but complaints are low, you likely have:

- Descriptor confusion (customers don't recognize the charge)

- Refund path invisibility

- Fraud/abuse

If complaints are high first, then disputes follow, you likely have:

- Product issue

- Onboarding issue

- Poor support response time

This is where Churn Reason Analysis can complement dispute analysis—often the same drivers show up in different language.

Prevention: what actually reduces chargebacks

Chargeback reduction is mostly unglamorous execution. The best levers are simple and measurable.

Reduce "billing confusion" disputes

- Fix your descriptor: match your brand name and include a support URL if possible.

- Send immediate receipts: include plan name, billing cadence, and next renewal date.

- Pre-renewal reminders for annual plans (and some monthly cases if your audience is sensitive).

- Make cancellation findable: don't hide the path; friction increases disputes.

- Proration clarity: if you prorate, show the math in the invoice line items.

- Tighten sales-to-billing handoff: ensure what was sold matches what was charged.

Reduce dissatisfaction disputes

- Improve time-to-value and onboarding clarity. (A customer who realizes value rarely disputes.)

- Align marketing promises with the product reality.

- Offer fast, human refund resolution for obvious mismatches. Many disputes happen because the customer felt ignored.

If you see the effect in retention, tie this back to Retention and GRR (Gross Revenue Retention). Chargebacks are often a shadow form of churn.

Reduce fraud-driven disputes

- Add friction where it matters (not everywhere): step-up verification for risky signups.

- Watch for patterns: many signups from the same domain, IP clusters, rapid-fire card attempts.

- Shorten value exposure for brand-new accounts if abuse is common (rate limits, watermarking exports, limited seats until verification).

- Consider requiring stronger payment methods for high-risk segments.

How to operationalize chargebacks weekly

Chargebacks become manageable when you treat them like a routine operating metric, not an occasional emergency.

A simple weekly cadence:

- Review opened disputes (count-rate) for early warning.

- Review lost disputes (amount) for financial impact.

- Top 10 disputed customers: what plan, channel, geography, time-to-dispute?

- Root cause classification: fraud vs confusion vs dissatisfaction.

- One fix per week: choose the most common preventable driver and ship a change.

And one monthly practice:

- Reconcile chargebacks and refunds to finance reporting, especially if you're tracking MRR (Monthly Recurring Revenue) and ARR (Annual Recurring Revenue). The goal is consistency between SaaS metrics and bookkeeping reality.

When chargebacks "break" your reporting

Chargebacks create messy edge cases that can distort dashboards if you don't set rules.

Common pitfalls:

- Counting chargebacks as churn without canceling access (inflates churn, keeps "active" users).

- Leaving subscriptions active after a chargeback (inflates retention and active customer counts).

- Mixing dispute fees into chargeback amounts (hides true fee burden).

- Not separating payment methods (ACH disputes and card chargebacks behave differently).

A pragmatic rule many SaaS teams use:

- Treat a lost chargeback like a refund for revenue reporting.

- Treat the account as canceled (or at least access-limited) until payment method is updated.

- Track dispute fees as payment costs (again, see Billing Fees).

If you invoice customers (true B2B billing), also keep an eye on Accounts Receivable (AR) Aging. Chargebacks may be rare, but disputes and non-payment show up as aging risk instead.

The decision lens: what to do with the metric

Chargebacks aren't just "lower is better." They tell you where to intervene:

- High fraud share: tighten risk checks, slow down risky channels, improve screening.

- High confusion share: fix descriptor, receipts, cancellation visibility, renewal comms.

- High dissatisfaction share: fix onboarding/time-to-value, align promises, speed up support.

- Spike after pricing changes: revisit packaging clarity and customer comms.

The Founder's perspective

The best use of chargebacks is as a forcing function for crisp ownership: one person accountable for dispute prevention, and clear owners for each root cause category. If chargebacks are "finance's problem," they will keep coming back—because the real drivers live in product, growth, and support.

If you keep the definitions stable, segment aggressively, and connect each dispute bucket to a concrete control, chargebacks stop being scary. They become another operating metric that improves retention quality, reduces wasted support effort, and stabilizes cash.

Frequently asked questions

For most SaaS, aim to stay well under 0.5 percent of transactions disputed, and ideally below 0.1 to 0.3 percent if you are low risk B2B. Networks and processors often care about transaction based ratios plus volume thresholds. Treat any sustained upward trend as an operational risk.

Track both. Card network monitoring programs are typically triggered by dispute counts relative to total transactions, while finance teams feel the impact in dollars through reversed revenue and fees. Count tells you risk of processor action. Amount tells you margin and cash impact. Use both to diagnose root causes.

A chargeback is a forced reversal of a payment, so it reduces cash collected and can behave like a refund in revenue reporting. For subscription metrics, decide whether you treat it as a refund adjustment or as churn plus delinquency. Keep the rule consistent and reconcile to recognized revenue.

If the customer is unhappy and the amount is small, refunding is often cheaper than a lost dispute plus fees and time. Fight disputes when you have strong evidence of authorization and usage, the customer is clearly fraudulent, or the pattern is systematic. Optimize for reducing future disputes, not winning arguments.

Common causes are descriptor confusion, unclear cancellation or renewal terms, a pricing or packaging change, a buggy checkout, duplicate billing, trial to paid surprise, or a fraud wave. Spikes can also be timing artifacts because disputes arrive weeks after the original charge. Always segment by plan, channel, and geography.