Table of contents

Burn in SaaS

Burn is the clock your company is racing against. If you misread it, you'll hire too early, overcommit to paid acquisition, or start a fundraise with less time (and leverage) than you thought. If you manage it well, you buy time to find product-market fit, improve retention, and grow on your terms.

Definition (plain English): Burn is how much cash your SaaS company consumes over a period (usually per month). When people say "our burn is $200k," they almost always mean net burn per month: cash out minus cash in.

What burn actually reveals

Burn is not just "how much we spend." It's a compact signal that combines your revenue collection reality with your cost structure.

Burn answers one core question

How much time are we buying with our current plan?

That time shows up as runway (covered later), but the deeper value is diagnostic:

- If burn rises because you're scaling a proven channel with fast payback, that can be rational.

- If burn rises because churn is climbing or onboarding is failing, you're paying to fill a leaky bucket.

- If burn falls because you delayed vendor payments or collected annual prepaids, you may be masking an underlying cost problem.

The Founder's perspective: Burn is less about "cutting cost" and more about maintaining decision-making power. With adequate runway, you can fix retention, reprice, or reposition deliberately. With short runway, you're forced into rushed hires, desperate pipeline tactics, or a fundraise under pressure.

Burn is a cash metric, not an accrual metric

SaaS founders commonly confuse burn with losses on the P&L.

- Net income includes non-cash items (like depreciation) and timing differences.

- Burn is about cash movement.

That's why burn can worsen even when MRR (Monthly Recurring Revenue) improves, especially in invoiced or annual contracts where cash timing differs from revenue recognition.

How to calculate burn

There are two useful versions: net burn and gross burn. Most runway and fundraising conversations use net burn.

Net burn (most common)

Net burn is your net cash outflow over a period.

In monthly practice, many teams compute net burn as the absolute value of negative free cash flow:

If cash from operations plus capex is positive, you're not "burning" that month—you're generating cash.

What to include (typical):

- Payroll, benefits, contractor spend

- Hosting and infrastructure

- Sales and marketing spend (ads, commissions paid, events)

- Rent, tools, G&A

- Capex (if material)

What to keep separate (so you don't fool yourself):

- One-time financing events (equity raised, debt draws)

- Extraordinary one-offs (legal settlement, acquisition costs)

Gross burn (cost structure lens)

Gross burn ignores revenue and focuses on monthly cash expenses.

Gross burn is useful because it tells you how fast you can reduce spend if needed. If you only track net burn, a temporary spike in collections can make you think you "fixed" burn.

A simple worked example

Assume this month:

- Cash collected from customers: $180,000

- Cash operating expenses: $420,000

- Capex: $30,000

Net burn:

Interpretation: you consumed $270k of cash this month to operate and invest.

What drives burn month to month

Burn moves for reasons that are either healthy (deliberate investment) or unhealthy (unit economics or execution issues). You need to separate the two.

Revenue collection timing (often overlooked)

Two companies with identical ARR (Annual Recurring Revenue) can have very different burn because of collection timing.

Common drivers:

- Annual prepay seasonality (cash comes in lumpy)

- Moving upmarket to invoiced billing (slower collections)

- Rising refunds or chargebacks (see Refunds in SaaS and Chargebacks in SaaS)

- Higher billing friction and fees (see Billing Fees)

- Taxes and compliance handling (see VAT handling for SaaS)

If you sell annual contracts and bill upfront, burn can look "better" than the underlying business because customers are financing you. That's not bad—just don't confuse it with profitability.

Related: if you're scaling invoiced enterprise deals, review Accounts Receivable (AR) Aging to understand whether burn is being driven by slower cash conversion.

Retention and expansion (the leaky bucket problem)

A large share of burn "mystery" comes from churn and weak expansion.

If churn rises, you're forced to spend more to stand still:

- More pipeline needed for the same net growth

- More onboarding and support load per retained dollar

Use retention metrics to diagnose:

- GRR (Gross Revenue Retention) for how much revenue you keep before expansion

- NRR (Net Revenue Retention) for expansion's ability to offset churn

- Net MRR Churn Rate to see the net revenue decay or growth in existing customers

- Cohort Analysis to isolate whether newer cohorts retain worse (often a sign of acquisition quality problems)

Opex scaling (hiring and commitments)

Burn increases are often straightforward:

- Hiring ahead of revenue (especially Sales, CS, and Engineering)

- Longer-term commitments (annual tools, leases, minimum cloud commits)

- Professional services creep (agencies, contractors)

Founders should also watch fixed vs variable burn:

- Fixed burn reduces your ability to adapt quickly

- Variable burn lets you throttle spend when reality changes

Gross margin and COGS pressure

If gross margin drops, burn rises—even at the same revenue.

Track:

- COGS (Cost of Goods Sold)

- Gross Margin

- Where margin is being lost (infrastructure, support load, third-party APIs)

A common pattern: usage grows faster than pricing, especially in usage-based or API-heavy products. Burn rises even though "growth" looks good.

How founders use burn to manage runway

Burn becomes actionable when you tie it to runway and a forward plan.

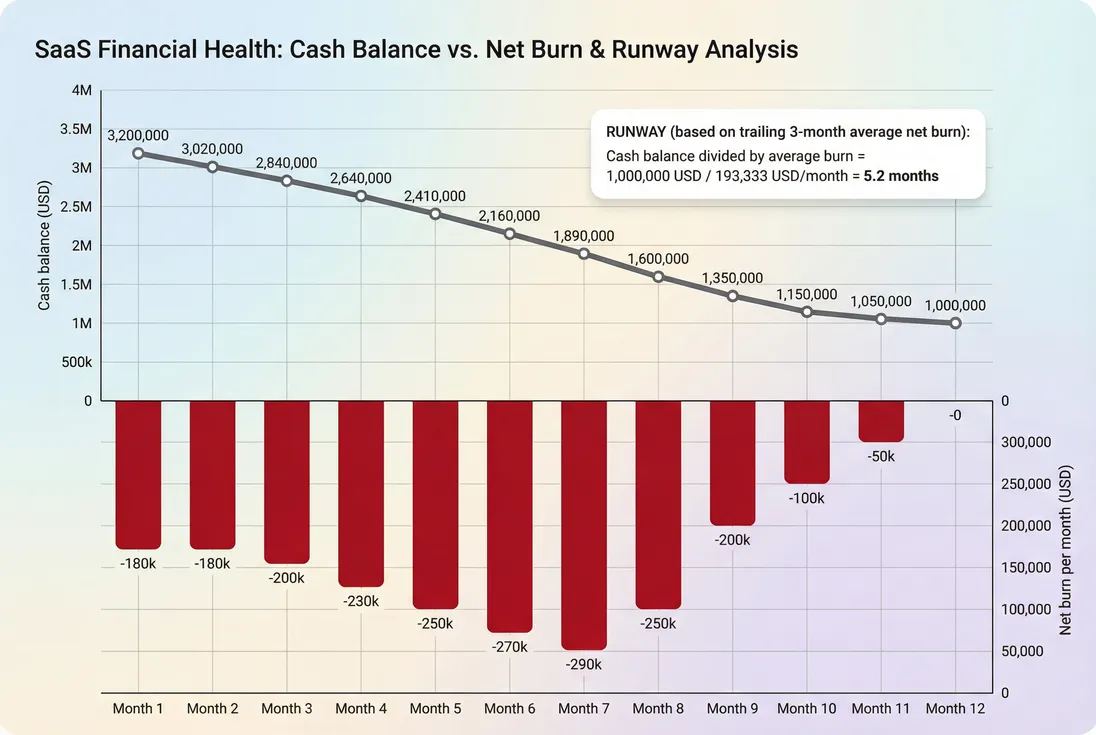

Runway (the non-negotiable companion metric)

Runway is how many months you can operate before cash hits zero (or a minimum safety buffer).

Use a trailing average, not a single month. A common approach is trailing three-month average (T3MA), especially for businesses with annual prepay spikes:

- If you have seasonal collections, a single "good month" can make runway look artificially long.

- If you just ramped hiring, a single "bad month" can look worse than the new steady state.

(For smoothing concepts, see T3MA (Trailing 3-Month Average).)

Burn planning: pick the constraint you'll live by

Most SaaS teams operate with one of these constraints:

- Runway constraint: Maintain 18–24 months runway (common pre-Series A).

- Milestone constraint: Maintain runway to hit a measurable target (e.g., NRR stability, enterprise pipeline conversion).

- Fundraising constraint: Maintain enough runway to start raising before you must (often 6–9 months before cash-out).

A practical rule: if fundraising is plausible but not guaranteed, don't let runway fall below what you need to run a full process plus buffer.

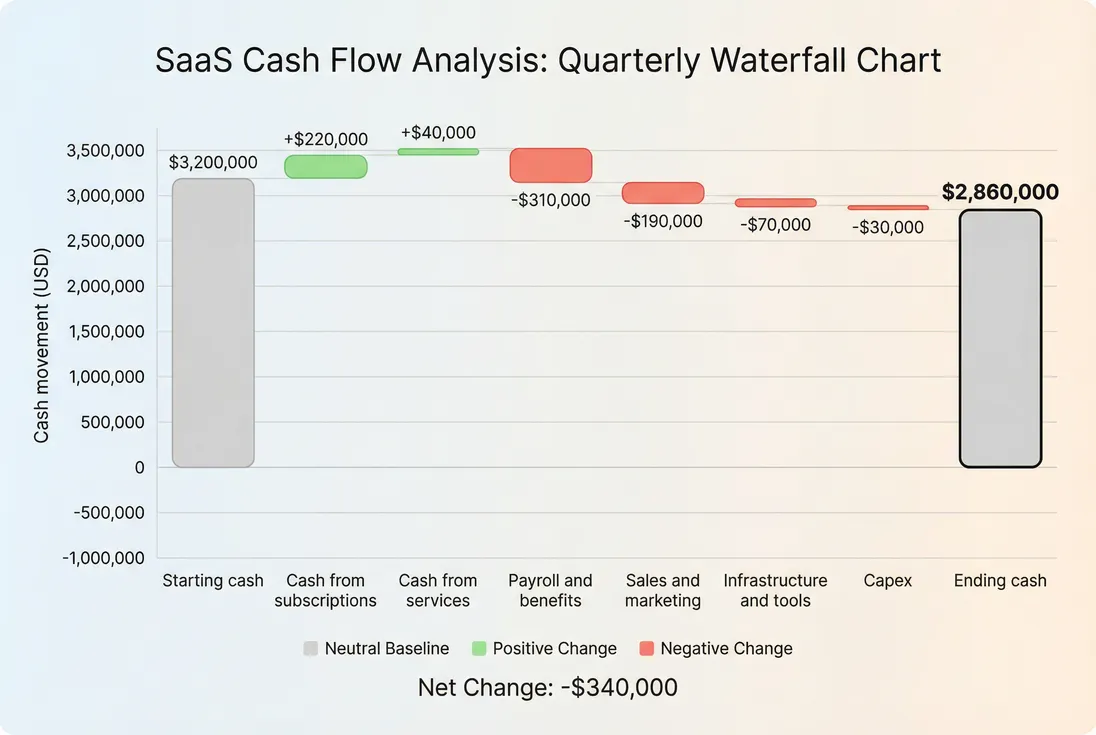

A burn reconciliation view (to avoid false narratives)

A burn number without a reconciliation is how teams fool themselves. Build a simple bridge from starting cash to ending cash.

The Founder's perspective: I want a burn story I can defend in one slide: what changed, whether it's temporary, and what we expect for the next 2–3 months. If I can't explain burn simply, I can't control it.

When burn is good vs dangerous

Burn isn't inherently bad. The goal is to ensure burn is buying durable progress.

Good burn: you're paying for learning or scaling

Examples:

- Scaling a channel with clear CAC Payback Period and stable retention

- Investing in onboarding to reduce churn and improve Time to Value (TTV)

- Building a product capability that supports higher ASP (Average Selling Price) or higher ARPA (Average Revenue Per Account)

Dangerous burn: you're paying to hide a structural issue

Red flags:

- Burn rises while NRR falls (you're spending into churn)

- Burn rises because support and infra costs scale faster than revenue (margin compression)

- Burn falls only due to deferred payments, one-time collections, or cutting essential go-to-market capacity

- You can't connect spend increases to leading indicators (activation, conversion, qualified pipeline)

A quick diagnostic pairing:

- Burn + Contribution Margin tells you if growth is fundamentally profitable per customer.

- Burn + retention tells you if growth compounds or resets each month.

Benchmarks founders actually use (rules of thumb)

These are not universal truths—use them as starting points:

| Stage / situation | Typical runway target | Burn interpretation |

|---|---|---|

| Pre-seed / seed finding PMF | 18–24 months | Burn is acceptable if it accelerates learning and retention improvements |

| Early growth (repeatable sales motion emerging) | 15–21 months | Burn should increasingly track measurable growth efficiency |

| Approaching Series A / B | 12–18 months | Burn needs a credible plan tied to pipeline, retention, and margin |

| Flat growth with meaningful burn | Immediate action | Either reduce burn or fix the growth engine fast |

For efficiency framing, pair burn with Burn Multiple and Capital Efficiency.

How burn connects to growth efficiency

Burn alone tells you time. Efficiency tells you whether the time is well-spent.

Burn multiple (burn per unit of growth)

A common framing is burn multiple: how much net burn you spend to generate net new ARR.

If burn is high but net new ARR is accelerating with strong retention, that can be acceptable. If burn is moderate but net new ARR is stagnant, you have a growth problem.

A simple operating quadrant

This is a useful mental model for board discussions: burn on one axis, growth on the other.

The Founder's perspective: I don't need perfect benchmarks. I need to know which quadrant we're in and what single move gets us into a better one within 60–90 days.

Practical ways to improve burn (without guessing)

Improving burn is not "cut 10% everywhere." It's choosing the few levers that change the trajectory.

1) Fix retention before scaling acquisition

If churn is elevated, every growth dollar works harder just to replace losses.

Actions:

- Review Churn Reason Analysis to find top drivers you can actually fix

- Segment churn by cohort and plan tier using Cohort Analysis

- Track expansion vs contraction via Expansion MRR and Contraction MRR

If you're already instrumenting revenue movements, a "what changed" view like MRR movements is ideal for pinpointing whether burn is being wasted on replacing churn versus compounding expansion.

2) Improve cash conversion (especially invoiced B2B)

Two founders can run the same business; the one who manages collections survives longer.

Actions:

- Implement tighter invoicing and follow-ups; monitor Accounts Receivable (AR) Aging

- Reduce refund drivers (billing confusion, onboarding mismatch)

- Revisit discounting discipline (see Discounts in SaaS)

3) Reprice for margin and willingness to pay

If burn is driven by margin compression, pricing can be a cleaner fix than layoffs.

Actions:

- Increase price where value is clear (test elasticity; see Price Elasticity)

- Align packaging to cost drivers (seats, usage, premium support)

- Watch ARPA and ASP shifts using ARPA (Average Revenue Per Account) and ASP (Average Selling Price)

4) Align hiring pace with leading indicators

Hiring is the most common irreversible burn decision.

Actions:

- Tie headcount plans to pipeline quality (see Qualified Pipeline) and conversion rates

- Require each new role to have a measurable outcome within 1–2 quarters (not vague "support growth")

5) Separate "must win" spend from "nice to have"

Do a burn review that forces categorization:

- Must win: directly supports activation, retention, or a proven acquisition channel

- Supports must win: essential systems and compliance

- Nice to have: everything else

Then cut or pause nice-to-have first. This is how you reduce burn without destroying the engine.

Common burn mistakes to avoid

Using one month as truth

Smooth with trailing averages and reconcile to cash movements.Ignoring working capital

Collections, prepaids, and payables can swing burn without changing the product.Counting financing as operating health

A funding round improves cash balance, not burn quality.Celebrating burn reduction that breaks growth

Cutting customer success and seeing churn spike is not a win; it's delayed burn.Not pairing burn with retention and margin

Burn without retention and gross margin is a time metric only—not a strategy metric.

A founder operating rhythm for burn

If you want burn to guide decisions (instead of creating anxiety), adopt a cadence:

- Weekly: cash balance, collections, major spend variances

- Monthly: net burn (smoothed), gross burn, runway, key retention and growth metrics

- Quarterly: reset burn target based on strategy (hire plan, GTM motion, pricing changes)

For related concepts that often show up in the same board conversation, see Burn Rate, Runway, and Free Cash Flow (FCF).

Quick takeaway

Burn is the monthly cash cost of your current plan. Treat it as a steering metric: reconcile it to cash movements, tie it to runway, and judge it against retention, margin, and growth efficiency. That's how burn stops being scary and starts being useful.

Frequently asked questions

In practice, founders often use burn and burn rate interchangeably to mean monthly net cash outflow. To stay precise, treat burn as the cash you are consuming and burn rate as the rate you are consuming it per month. The key is consistency and tying it to runway.

Use net burn for runway and fundraising because it reflects your true cash consumption after revenue collections. Use gross burn to understand your cost structure and how hard it will be to reduce spend quickly. If net burn improves only because collections spiked, gross burn will reveal that risk.

Healthy burn depends on growth efficiency and runway. Many seed stage teams aim for 18 to 24 months of runway with a burn that supports focused execution. A burn that forces constant fundraising is usually unhealthy. Pair burn with capital efficiency metrics like burn multiple and CAC payback.

Burn can rise while MRR grows if expenses scale faster than cash receipts. Common causes include hiring ahead of revenue, higher COGS, annual prepay timing reversing, higher refunds, or slower collections from invoiced customers. Reconcile burn to the cash flow statement and review retention and expansion trends.

Start by separating growth investment from waste. Protect the few channels with strong payback, fix churn and expansion levers, and remove spend that does not move qualified pipeline or activation. Renegotiate tools and cloud, slow hiring, and improve billing and collections. Track impact weekly and avoid across the board cuts.