Table of contents

Billing fees

Billing fees are one of those "small percent" costs that can quietly eat a meaningful chunk of profit—especially in self-serve SaaS where most customers pay by card and invoices are small. If you're optimizing for Gross Margin or trying to improve capital efficiency, billing fees are one of the few levers that can move margin without changing product scope.

Billing fees are the costs you pay to charge, collect, and reconcile customer payments—primarily payment processing fees (card/ACH), billing platform fees, and dispute-related fees. In plain terms: it's what it costs to get paid.

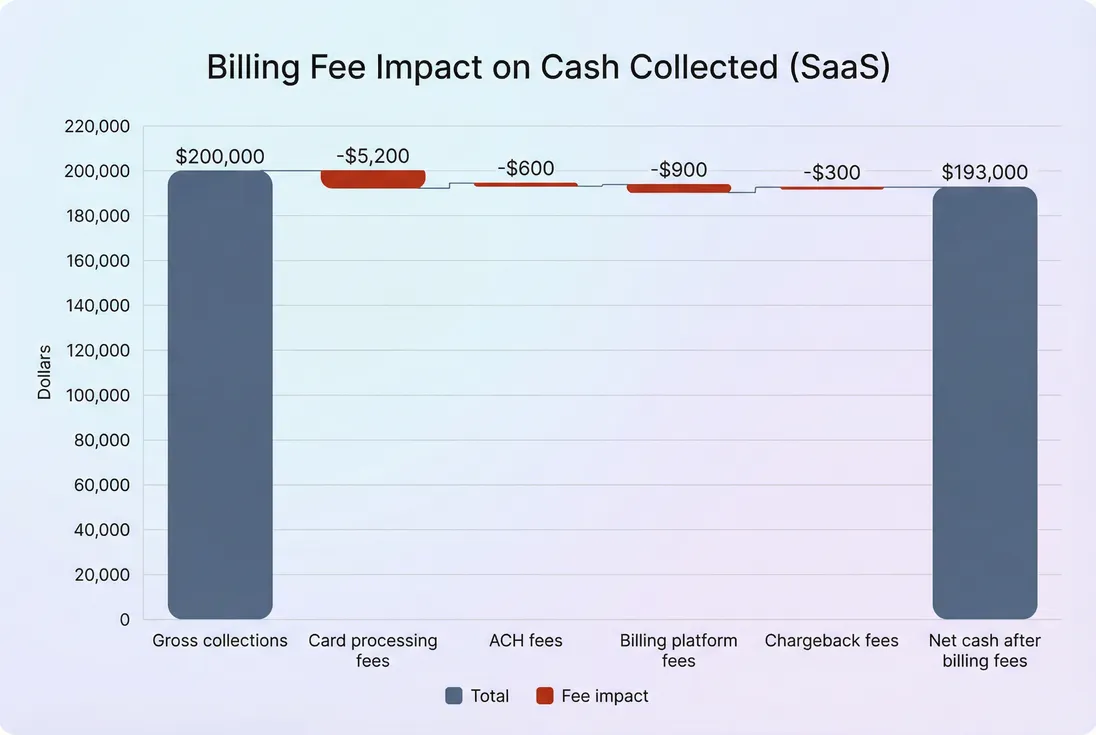

A simple bridge from gross collections to net cash shows why billing fees matter: the biggest driver is usually card volume, but disputes and platform fees add up.

What billing fees include

Billing fees aren't a single line item in the real world. They're a bundle of costs that show up across your processor statements, bank activity, and accounting categories. Founders get into trouble when they only track one piece (like Stripe fees) and miss the rest.

Typical components include:

- Payment processing fees

- Card fees (percentage + fixed fee per transaction)

- ACH fees (often lower, sometimes capped)

- International card uplifts, currency conversion, cross-border fees

- Billing platform fees

- Subscription fees for billing tooling

- Per-invoice or per-transaction platform charges (varies by vendor)

- Dispute and risk fees

- Chargeback/dispute fees (often fixed per dispute)

- Radar/fraud tooling costs (sometimes embedded)

- Payout and banking fees

- Instant payout fees

- Wire fees (more common for enterprise invoicing workflows)

What billing fees are not: discounts, refunds, taxes, or bad debt. Those are separate forces that affect cash and revenue and deserve separate tracking—see Discounts in SaaS, Refunds in SaaS, and Chargebacks in SaaS. Taxes are particularly tricky in fee-rate math; see VAT handling for SaaS.

The Founder's perspective

Treat billing fees as a "margin tax" on how you monetize. Pricing changes, annual prepay pushes, and enterprise invoicing policies can all improve margin without adding headcount—if you can see the fee impact clearly.

How to calculate them

The core challenge isn't the arithmetic—it's defining a numerator and denominator that match how you make decisions.

The basic metric

At minimum, track total billing fees in a period (month/quarter) and an effective billing fee rate.

- Billing fees: all processor, platform, and dispute fees incurred in the period.

- Gross collections: the customer payments you attempted and successfully collected (cash in), before subtracting fees.

In practice, some teams use net collections (after refunds) in the denominator. That can be useful for cash forecasting, but it can also make fee rate look worse during refund-heavy periods. The key is consistency and clear labeling.

Building a usable definition

A pragmatic approach for founders:

- Start with processor-reported fees (the easiest reliable source).

- Add dispute fees explicitly (they're often separated).

- Add billing platform subscription fees if they're material.

- Report two numbers:

- Processor fee rate (pure payment cost)

- All-in billing fee rate (includes platform + disputes)

That separation helps you avoid blaming "Stripe fees" for what's really chargebacks or tooling.

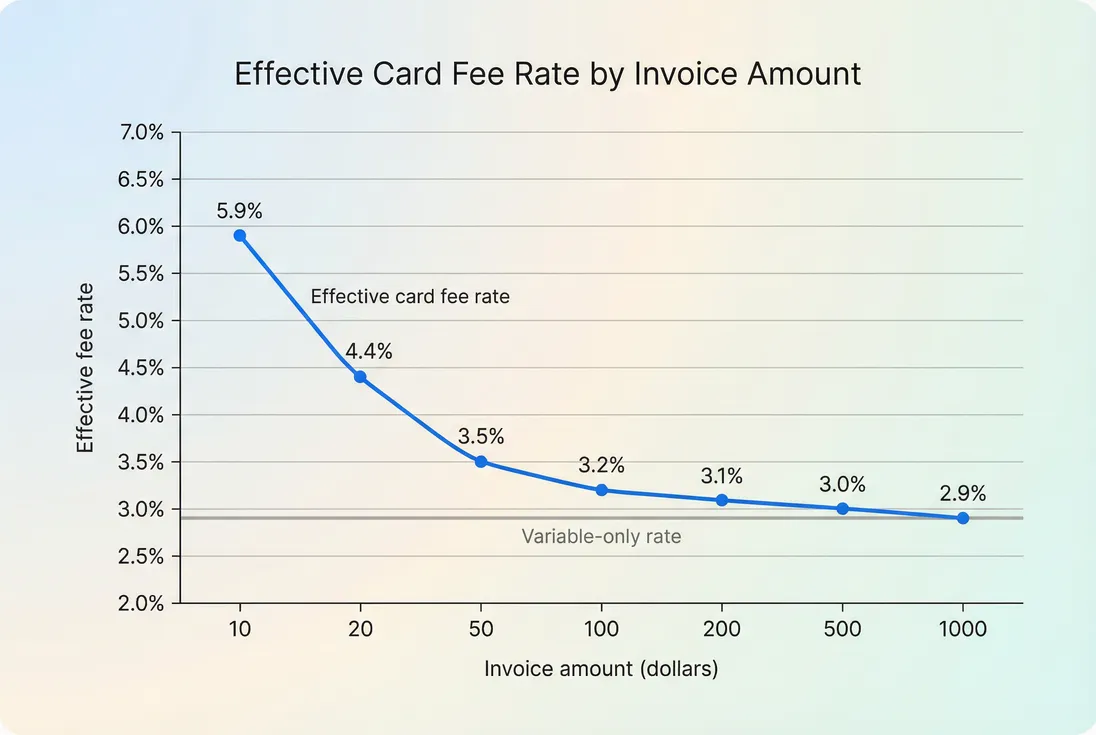

Why small invoices get punished

Most card pricing has:

- a variable percent of the charge amount, and

- a fixed per-transaction fee

That means the smaller the invoice, the higher the effective percentage.

Example (illustrative, not a universal rate):

- $20 monthly invoice: fixed fee matters a lot → high effective rate

- $2,000 annual invoice: fixed fee becomes negligible → lower effective rate

Fixed per-transaction fees make small monthly invoices materially more expensive to collect than larger annual invoices—one reason annual prepay can improve margin even before churn benefits.

Reconcile to the cash story

Billing fees sit at the intersection of revenue metrics (like MRR (Monthly Recurring Revenue) and ARR (Annual Recurring Revenue)) and cash metrics (net deposits).

A simple reconciliation mindset:

- Revenue metrics explain what you earned

- Billing fees explain what it cost to collect

- AR metrics explain what you haven't collected yet (see Accounts Receivable (AR) Aging)

If you sell invoiced plans, billing fees may be lower (wires/ACH), but AR and collection effort become more important.

What moves the fee rate

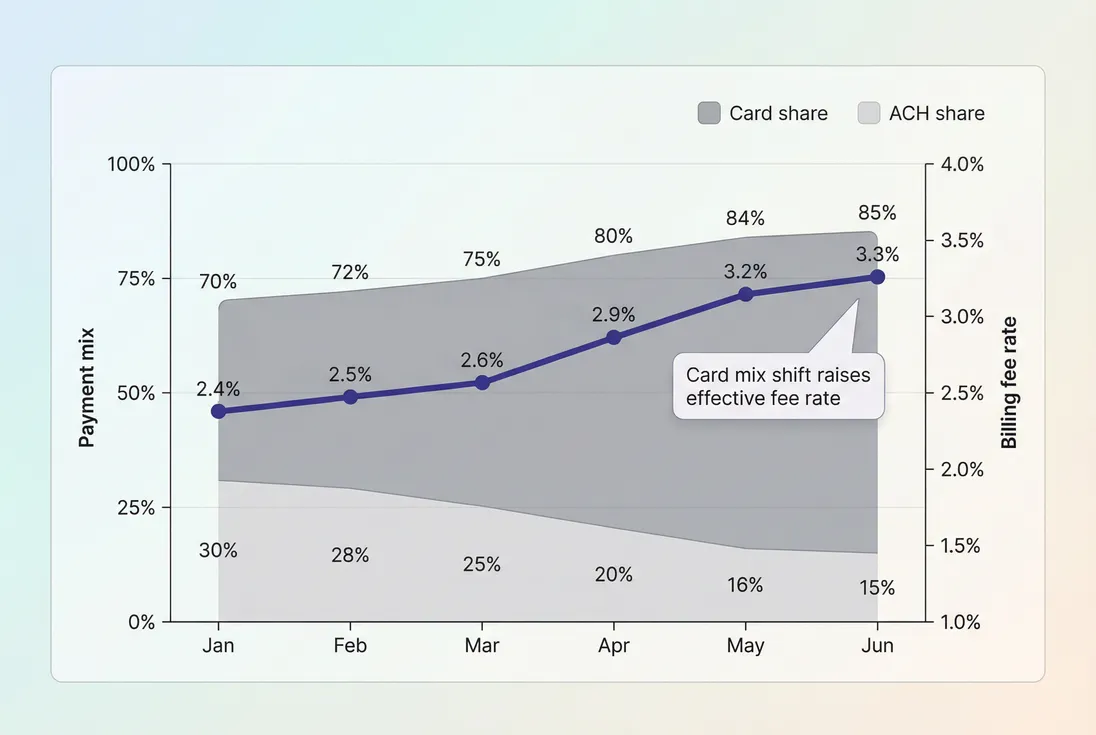

Billing fee rate changes are usually a signal of mix and behavior—not "random variance." Here are the drivers that actually matter.

Payment method mix

This is the biggest lever in most SaaS businesses:

- More card share → higher fee rate

- More ACH/wire share → lower fee rate

- More instant payouts → higher fee rate

A healthy pattern is: self-serve stays card-heavy, but as accounts grow, you nudge them to ACH or invoicing.

Average invoice size and billing cadence

All else equal:

- Monthly billing increases transaction count → fixed fees add up

- Annual prepay reduces transaction count → effective fee rate drops

This is one reason annual plans can improve Contribution Margin even if you offer a modest discount.

International exposure and currency effects

If your customer base shifts toward:

- international cards,

- certain card types (corporate, rewards),

- multi-currency settlement,

…your fee rate often rises.

This is also where VAT and sales tax can confuse your analysis. If your "collections" denominator includes tax, your fee rate can look artificially low or inconsistent across regions. Decide whether to compute fee rate pre-tax or including tax, then stick to it.

Disputes, fraud, and involuntary churn

Disputes create a double hit:

- you lose the revenue (often), and

- you pay dispute fees

Dispute rate spikes can happen during pricing changes, plan packaging shifts, or when fraud slips through. If you see fee rate rising alongside churn or support complaints, don't treat it as a finance-only issue—loop in product and support. (Related: Involuntary Churn.)

Refund behavior and policy changes

Refunds can increase effective fee rate because processors may not fully return original fees. So a "generous refunds month" can look like a fee-rate problem when it's really a policy/support problem. Track refunds explicitly (see Refunds in SaaS) and avoid mixing definitions midstream.

Benchmarks and rules of thumb

Benchmarks vary by geo, volume, and business model, but founders need a practical target to sanity-check.

Here's a useful directional table for all-in billing fee rate (processor + disputes + platform), measured against gross collections:

| SaaS model | Typical payment mix | Common fee-rate band |

|---|---|---|

| Self-serve SMB | Mostly card, low invoice size | ~2.5% to 4.0% |

| SMB + annual push | Card + some annual prepay | ~2.0% to 3.2% |

| Mid-market | Card + meaningful ACH/invoice | ~1.2% to 2.5% |

| Enterprise invoiced | ACH/wire dominant | ~0.5% to 1.5% |

Two "smell tests":

- If you're card-heavy and under ~2%, confirm you're not missing platform or dispute fees.

- If you're invoiced-heavy and over ~3%, you likely have disputes, international card leakage, or lots of small residual card transactions.

The Founder's perspective

Billing fees are a pricing and packaging feedback loop. If your best customers are stuck paying monthly by card, you're paying a margin penalty for not having a clean path to annual/ACH. Fixing the path often improves margins faster than negotiating a better rate.

How founders use this metric

Billing fees become actionable when you use them to make real decisions, not just track a percent.

1) Pricing and plan design

Billing fees influence what price points make sense.

If you sell a $10–$20 plan, fixed transaction fees can consume an outsized share of revenue. That's not automatically wrong—but you should plan for it in margin targets.

Practical moves:

- Set a minimum price floor that preserves margin.

- Offer annual prepay as the default toggle (without forcing it).

- For usage-based billing, consider monthly invoicing thresholds so you don't run hundreds of tiny charges (see Usage-Based Pricing).

2) Payment method strategy (without killing conversion)

The goal isn't "everyone must pay by ACH." It's "right method for the right segment."

A common policy that works:

- Self-serve: card-first

- Mid-market: card allowed, but strongly encourage ACH for high spend

- Enterprise: invoice + ACH/wire

Then track whether the mix shift changes:

- conversion rate,

- churn,

- support load,

- and net revenue retention (see NRR (Net Revenue Retention)).

3) Margin reporting and investor narratives

Billing fees can materially change your margin story, especially at scale. Decide how you treat them and be consistent:

- If you include processing fees in cost of revenue, your Gross Margin reflects the true cost of monetization.

- If you exclude them (and keep them in operating expense), your gross margin looks better, but your operating margin takes the hit (see Operating Margin).

Investors mainly want consistency and an explanation of what you include.

4) Cash forecasting and runway sensitivity

Billing fees are a direct reducer of cash receipts. If your fee rate is 3% and you collect $500k/month, that's $15k/month—often equivalent to a tool, a contractor, or part of a senior hire.

This matters when you're managing burn and runway (see Burn Rate and Runway). It also shows up in efficiency metrics like Burn Multiple, because fees reduce the net cash your growth creates.

5) Diagnosing operational issues

A fee-rate spike is often an early warning indicator:

- More chargebacks → product mismatch, unclear positioning, or poor onboarding

- More failed payments and retries → dunning gaps, involuntary churn risk

- More international uplift → new geo expansion or affiliate channel mix

Billing fees won't tell you the full story—but they can tell you where to look.

Fee-rate changes are usually mix changes. When card share rises, effective billing fees rise—even if revenue stays flat.

Controls and common pitfalls

Pitfall: mixing taxes into collections

If your "collections" include VAT/sales tax, your fee rate may look artificially low and vary by region. Decide whether your denominator is:

- collections including tax (cash view), or

- collections excluding tax (unit economics view)

If you sell internationally, excluding tax is often more decision-useful. (See VAT handling for SaaS.)

Pitfall: treating refunds as "fee problems"

Refund spikes make fee rate look worse if processor fees aren't refunded. Don't "optimize fees" when the real issue is refund policy, onboarding quality, or expectation-setting. Use a separate refunds view and review it with support/product (see Refunds in SaaS).

Pitfall: ignoring dispute fees until it hurts

Chargebacks are rare—until they're not. Build a habit of monitoring disputes and dispute fees monthly, even at low volume (see Chargebacks in SaaS). A single fraud wave can erase months of "fee optimization."

Control: segment your fee rate

A single blended fee rate is useful, but it hides what's actionable. Segment by:

- payment method (card vs ACH),

- region (domestic vs international),

- plan (low vs high ASP; see ASP (Average Selling Price)),

- customer segment (SMB vs mid-market; see ARPA (Average Revenue Per Account))

This is how you find the one lever that matters (usually payment method for your top decile customers).

Control: use billing fees in pricing reviews

When you run pricing reviews, add a line for "cost to collect" next to:

- churn and retention metrics (see Retention),

- expansion behavior (see Expansion MRR),

- and discounting impact (see Discounts in SaaS).

If you don't include fees, you can accidentally pick price points or billing cadences that look good in MRR, but underperform in cash and margin.

Billing fees are rarely the most exciting metric in a SaaS dashboard—but they're one of the most controllable. Track an all-in fee rate, watch it by segment, and use it to shape how customers pay you. The best outcome isn't simply "lower fees." It's lower fees without sacrificing conversion, retention, or customer trust.

Frequently asked questions

Most self-serve SaaS businesses land around 2.5% to 4.0% of collected revenue when card-heavy, especially with low invoice sizes. Companies that move larger customers to ACH, invoicing, or annual prepay often get closer to 1% to 2%. The right target depends on payment mix and average charge size.

For SaaS, treat payment processing fees as cost of revenue when they scale with revenue and are required to deliver the service. That makes gross margin more comparable month to month and across plans. Some teams keep platform subscription fees in operating expense. What matters is consistency and explaining the policy to investors.

The usual causes are mix shifts and small-charge effects: more customers paying by card vs ACH, more international cards, more monthly vs annual billing, or a lower average invoice amount (fixed per-transaction fees become a larger percentage). Refunds and chargebacks can also increase effective fees if processor fees are not returned.

Refunds often reduce collected revenue, but the original processing fee may not be fully refunded by the processor, which increases your effective fee rate. Chargebacks add dispute fees and can remove revenue entirely. Track refunds and disputes separately, then reconcile them into a single net collections view so you can see true cash impact.

The highest-leverage moves are increasing average invoice size (annual prepay, minimums), shifting large accounts to ACH or invoicing, and improving dunning to reduce retries and dispute volume. Rate negotiation matters once volume is meaningful, but product and billing design usually beat negotiation early on.