When should you recognize churn in SaaS

I was reviewing metrics dashboards with a SaaS founder when we hit what seemed like a simple question: when exactly should they count a customer as churned?

The founder wanted to recognize churn at cancellation because it aligned with their revenue recognition. Their CFO wanted to wait until the end of the billing cycle since customers often changed their minds. Their VP of Growth argued for recognizing it when payment failed, since that's when they actually lost the revenue.

All three approaches were reasonable, but they painted completely different pictures of the business. Depending on which method they used, their monthly churn rate varied by as much as 2 percentage points. For a company doing around $5M ARR, that difference meant looking either healthy or concerning to investors.

This isn't just an academic accounting question. How you recognize churn affects every major business decision, from cash flow projections to customer success team sizing to product development priorities. Get it wrong, and you're flying blind.

The three approaches to churn recognition

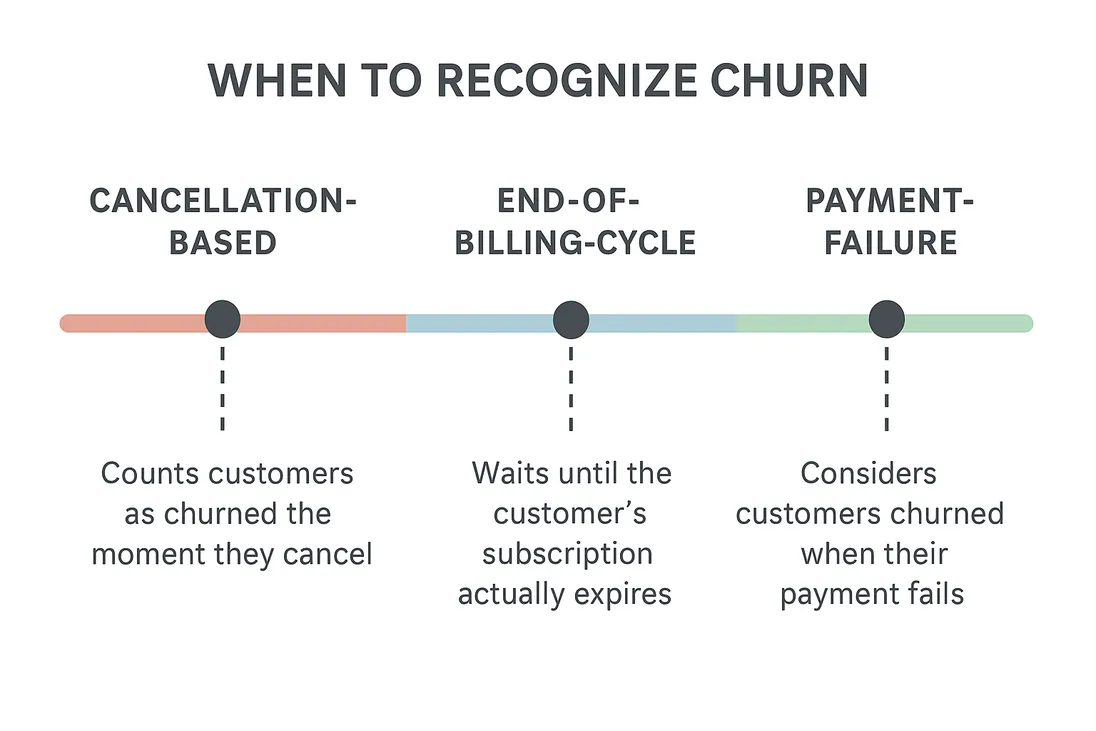

Most SaaS companies recognize churn using one of three methods, each with distinct implications for how you understand your business:

Cancellation-based recognition counts customers as churned the moment they cancel, even if they still have remaining time on their subscription. This gives you the earliest signal of customer intent but can make your immediate churn rate look artificially high.

End-of-billing-cycle recognition waits until the customer's subscription actually expires before counting them as churned. This matches revenue recognition more closely but creates a lag in your ability to respond to churn trends.

Payment-failure recognition considers customers churned when their payment fails or when you can no longer collect revenue from them. This aligns with cash flow but misses voluntary churn signals that could be addressed proactively.

I've seen compelling cases for each approach depending on the business model, but most companies don't consciously choose their method. They just inherit whatever their billing system defaults to, which often leads to confusion later when metrics don't align with business reality.

Why cancellation timing matters more than you think

The choice of churn recognition timing becomes critical when you factor in how SaaS customers actually behave during cancellation.

In a B2B software company I worked with, we analyzed 18 months of cancellation data and found that 12% of customers who cancelled their subscription renewed before their billing cycle ended. These customers had valid business reasons for cancelling early - budget approval processes, seasonal usage patterns, or simply wanting to pause before their next billing cycle.

If you recognize these customers as churned at cancellation, your churn metrics spike unnecessarily and your team might panic about problems that don't actually exist. But if you wait until the billing cycle ends, you miss early warning signals that could help you save other at-risk customers.

The timing gap also affects your customer success operations. Teams that rely on cancellation-based churn often waste time trying to "save" customers who were never really leaving, while teams that wait for billing cycle completion might miss opportunities to intervene with genuinely at-risk customers.

"The companies that get churn recognition right are usually the ones that separate customer intent from actual revenue impact. They track both, but use them for different purposes."

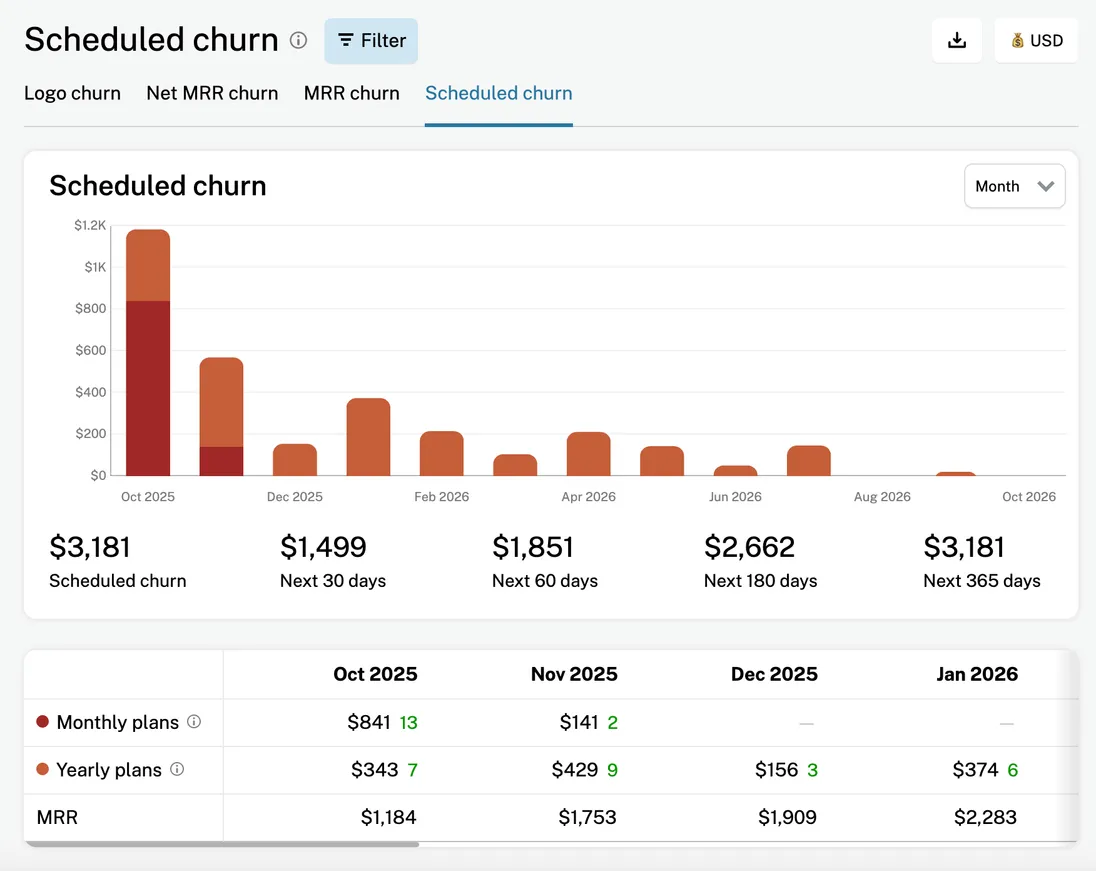

Scheduled churn: the missing piece of the puzzle

This is where most SaaS analytics platforms fall short, and why we built the scheduled churn report in GrowPanel. Instead of just looking at historical churn, you need visibility into future churn commitments.

Scheduled churn shows exactly how much MRR is committed to churn in future periods, regardless of when you recognize it in your financial metrics. This gives you a forward-looking view of revenue impact that's separate from the customer behavior signals you get from cancellations.

Here's how it works in practice. Let's say you have $100k in MRR at the start of January:

- $15k MRR cancelled during January (but subscriptions end at various dates through March)

- $8k MRR actually lost in January due to January cancellations plus previous cancellations coming due

- $12k MRR scheduled to churn in February from January and previous cancellations

- $7k MRR scheduled to churn in March from January and previous cancellations

With traditional churn metrics, you might see either 15% churn (if recognizing at cancellation) or 8% churn (if recognizing at billing cycle end). But the scheduled churn report shows you that your true revenue impact will be spread across three months, with total committed churn of $27k.

This forward-looking view changes everything about how you manage the business. Instead of reacting to churn after it happens, you can plan for it and take action while you still have time.

Scheduled churn also has its more colorful cousin: scheduled expansion. Depending on your business, customers might have a scheduled expansion when a temporary discount expires after a year, or simply from a planned upgrade after the current billing cycle. The combination of these two is usually referred to as Committed MRR (CMRR).

Industry patterns and what they mean for your timing

Different SaaS business models typically benefit from different churn recognition approaches, based on customer behavior patterns I've observed across dozens of companies:

Annual contract SaaS companies usually benefit from cancellation-based recognition because the time lag between cancellation and subscription end is significant. If an enterprise customer cancels in month 3 of a 12-month contract, you want to know about it immediately, even though you'll keep collecting revenue for 9 more months.

Monthly subscription companies often find end-of-billing-cycle recognition more useful because the time lag is short and customer behavior change is common. A customer who cancels on the 15th might renew on the 30th if you handle the situation well.

Usage-based or seat-based companies frequently use a hybrid approach, recognizing voluntary cancellations immediately but waiting for failed payments to resolve before recognizing involuntary churn. This reflects the reality that usage can fluctuate and payment issues are often temporary.

Freemium companies typically recognize churn only when customers downgrade from paid plans, not when they cancel entirely (since they might remain as free users). This reflects the different value of customer relationships in freemium models.

The key insight is that your churn recognition should match your customer relationship model, not just your billing system's default behavior.

Implementation challenges most companies face

The biggest challenge in implementing thoughtful churn recognition isn't conceptual - it's operational. Most billing systems and analytics tools force you to choose a single approach, when what you really need is multiple views of the same data.

I've seen companies spend weeks building complex Excel models to reconcile different churn metrics, usually because their tools weren't designed to handle the nuance of SaaS subscription behavior.

In GrowPanel, we solve this by tracking multiple churn recognition methods simultaneously. You can see cancellation-based churn for early warning signals, end-of-cycle churn for revenue accuracy, and scheduled churn for forward planning, all in the same dashboard.

This multi-dimensional view helps you understand not just what happened, but what's going to happen and why. It also eliminates the confusion that often arises when different teams in your company are looking at different churn metrics and drawing different conclusions.

Handling edge cases and complications

Real SaaS businesses have messy edge cases that complicate clean churn recognition:

Paused subscriptions: Some customers pause rather than cancel. Should this count as temporary churn or extended billing cycle? The answer depends on typical pause duration and reactivation rates.

Failed payment recovery: If a payment fails a few months, but is recovered later, was there ever churn? For cash flow purposes, yes. For business purposes, maybe not.

Refunds and credits: When you refund a customer mid-cycle, the timing of churn recognition affects whether the refund appears as negative expansion or reduced churn impact.

The solution isn't to create increasingly complex rules, but to be explicit about how you handle these cases and consistent in your approach. Document your methodology and stick to it, so your trends remain comparable over time.

Start with clarity, add sophistication later

If your current churn recognition is inconsistent or unclear, start by simply documenting what you're doing now and why. Most companies can't even clearly articulate their current approach, which makes it impossible to improve.

Once you have clarity on your current method, evaluate whether it serves your key business decisions well. If your customer success team is constantly surprised by churn, or your cash flow forecasts are consistently off, your recognition timing might be part of the problem.

Tools like GrowPanel can help you experiment with different approaches without disrupting your existing reporting. You can run parallel metrics to see how different recognition methods would affect your understanding of trends and patterns.

The goal is to match your churn measurement approach to your business model and decision-making needs, not to follow what other companies do or what your tools make easy.

Remember: churn recognition timing isn't just an accounting decision. It's a strategic choice that affects how quickly you can respond to problems, how accurately you can plan for the future, and how well you understand your customers. Get it right, and everything else becomes clearer.

Founder & CEO

Lasse is the founder of GrowPanel. He previously founded Mouseflow, scaling it from $0 to $10M ARR before exiting. He also co-founded Soundvenue and actively invests in SaaS startups.

View full profile →