Can usage-based pricing be counted as MRR?

I was reviewing metrics dashboards with a SaaS founder when we hit a tricky question:

"Can you count usage-based revenue as Monthly Recurring Revenue?"

The founder who runs a restaurant booking platform had recently added a usage-based component to their product. Customers paid a base subscription plus a fee for text messages (which the founder pays for himself on a per-message basis). Some months usage was steady, other months it surged or dropped by up to 15-20%. We were discussing whether it still made sense to talk about "MRR" at all, as one concern was if a potential exit would be based on a better valuation if the usage-based items were included.

It's a fair question. For most of SaaS history, MRR has been built on predictability: the same amount billed every month until a customer upgrades, downgrades, or churns. But as software pricing shifts toward usage-based models, that predictability is eroding – and it's changing how we think about metrics like churn, NRR, LTV, and cohorts.

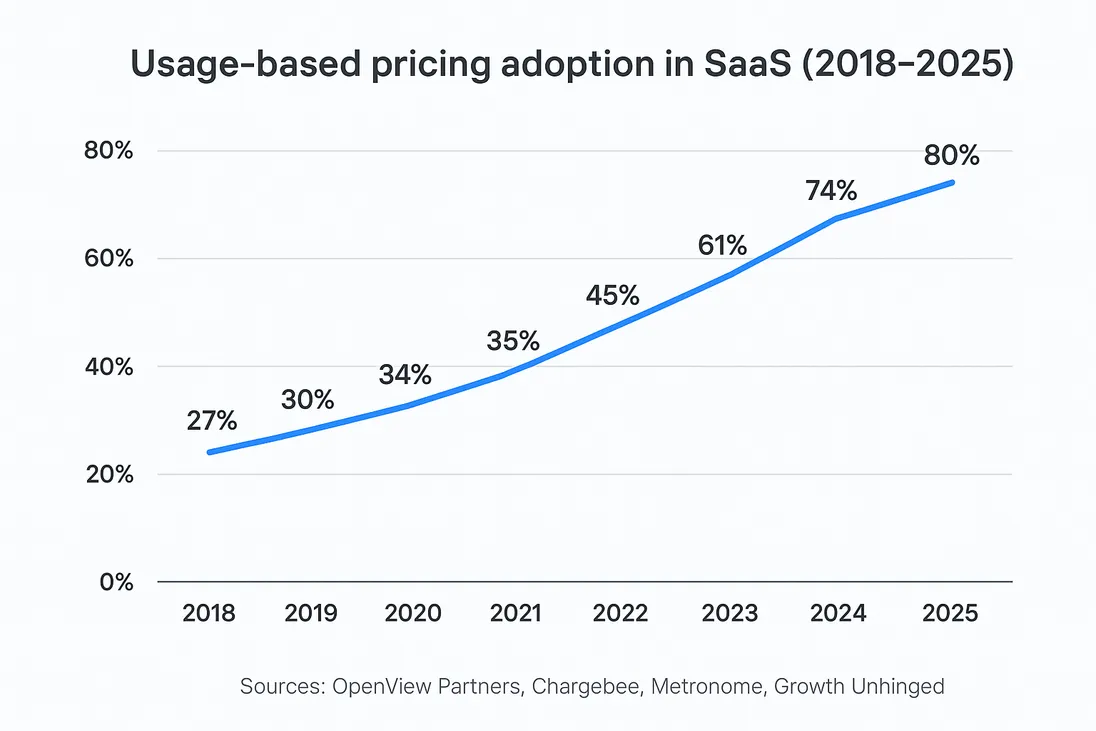

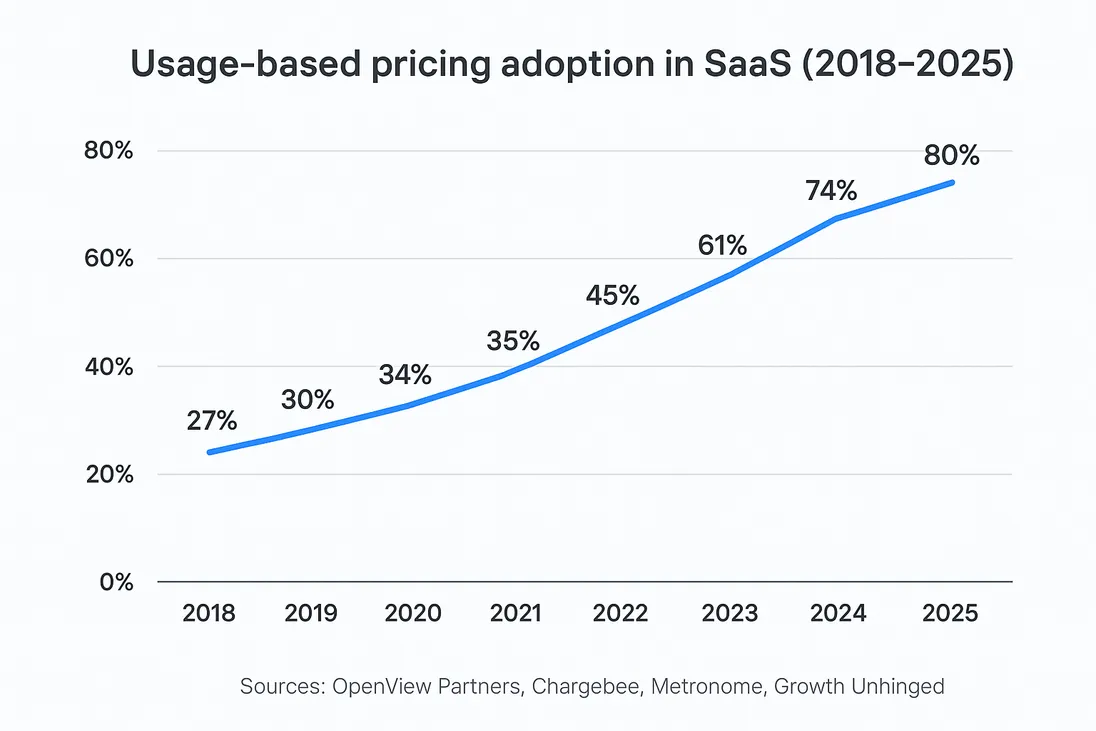

The shift toward usage-based pricing

The move toward usage-based pricing isn't a fad – it's a structural shift in how software captures value. Instead of charging flat fees, more companies now align price directly with how much customers use or benefit from the product, or use a combination of fixed and usage-based pricing.

AI platforms like ChatGPT, OpenAI API, and Anthropic's Claude charge per token or per compute hour. Cloud infrastructure companies have done this for years with storage and bandwidth. Even traditional B2B software is following suit: CRMs charge per record processed, analytics tools per event tracked, and email platforms per message sent.

The upside is obvious: customers pay for what they use, and the pricing scales naturally with their success. But the downside is volatility. One customer's monthly bill might jump 40% if they had a good month – or drop 40% if they paused usage. That variability makes it hard to define what "recurring" really means.

Valuation concerns

As mentioned earlier, some founders worry that excluding usage-based revenue from MRR could hurt their valuation because many of them have heard that SaaS businesses are often sold on an ARR multiple. But investors increasingly understand that predictable usage patterns can be just as valuable as fixed subscriptions. As long as you show strong retention and clear reporting, usage-based revenue can still command SaaS-level multiples - even if it's not technically counted as MRR.

Why usage-based pricing challenges classic SaaS metrics

Classic SaaS metrics were built for stability. MRR assumes a fixed recurring amount. Churn measures how much of that fixed amount is lost. NRR shows how much you expand existing recurring revenue. LTV projects what that steady stream is worth over time.

Usage-based billing breaks that framework.

If a customer's monthly usage fluctuates wildly, you can't easily say whether they've expanded, contracted, or churned. A 20% revenue drop might be seasonal or random – not necessarily a loss of commitment. Likewise, a spike in revenue might not mean true expansion if it's tied to one-off usage peaks.

In other words, with usage-based pricing, your MRR becomes an average run rate – a reflection of typical behavior, not a guaranteed future figure.

Two worlds of usage-based revenue

Not all usage-based billing behaves the same way. Broadly speaking, there are two worlds:

1. Predictable usage:

In some businesses, usage scales with customer size or product engagement in a consistent way. Think of an analytics API that tracks events – the number of events correlates closely with the customer's user base. These patterns make usage-based revenue fairly predictable, even if it fluctuates slightly month to month. The example mentioned in the beginning – text messages sent in a restaurant booking platform – would fall in this category.

2. Volatile usage:

In other businesses, usage is entirely discretionary or external. AI model inference, advertising spend, or financial transaction volume can swing drastically with outside factors. These models produce revenue that's technically "recurring" but practically unpredictable.

The distinction matters more than the billing model itself. A predictable usage-based business might have more reliable revenue than a flat-fee subscription company with high churn. But a volatile one might look healthy on paper while masking major swings underneath.

How to treat usage-based revenue in MRR reporting

There's no single correct answer to whether usage-based billing should be included in MRR. It depends on your goals and how you interpret the data. But in practice, most SaaS companies should use one of these three approaches:

Option 1: Exclude usage-based billing from MRR

This gives you a clean, stable view of recurring subscription revenue – your true baseline. It's easier to track churn, NRR, and expansion because the numbers won't fluctuate due to random usage variance. The downside is that you lose sight of an increasingly important revenue stream.

Option 2: Include it in MRR, but label it

This approach acknowledges that usage-based revenue is real and recurring in practice, but less predictable. You can include it in total MRR while labeling it as "metered," so you know that some variation is natural.

Option 3: Include it in MRR

Track fixed MRR and metered MRR side by side. Analyze them together when you need a complete picture, or separately when you want clarity on trends.

Example scenarios:

- You run an AI product with a $99 base plan plus usage overages. Include the base plan in MRR, track overages as metered.

- You're fully usage-based (no base fee). Use a trailing 3–6 month average to calculate "blended MRR," understanding it's an approximation.

Predictive metrics in a metered world

Metrics like churn, NRR, and LTV don't disappear in a usage-based world – they just need reinterpretation.

Logo churn:

Logo churn tracks how many customers / accounts that stop paying you. This metric is unaffected by having usage-based pricing.

NRR (net retention rate) and Net MRR churn:

These two metrics will still work relatively well even if you have usage-based pricing. It may be a good idea to look at an average figure over the past 6 months because the metrics may vary month to month.

MRR churn If you have a lot of usage-based billing with high volatility, we recommend against using MRR churn because the contraction component will be unnaturally high. Instead we recommend either logo churn and Net MRR churn.

LTV:

Customer lifetime value is based on the average revenue per customer (ARPA) and the logo churn, averaged over the past 6 months. The logo churn is unaffected by usage-based pricing, but the ARPA may value month to month. But the metric is still relatively useful, especially if you average over the past 6 months.

How GrowPanel handles metered billing

In GrowPanel, you can decide how usage-based revenue appears in your MRR metrics.

You can choose to include metered billing in your MRR reports, or exclude it for a cleaner view of predictable recurring revenue. If you include it, you can still filter by pricing model – fixed, usage-based, hybrid, or one-off – to see trends in isolation.

In the cashflow reports, metered billing is shown as its own category, alongside one-off payments and subscription terms like monthly, quarterly, or annual billing. This keeps your recurring revenue clear while still giving visibility into how usage-based income contributes to your financial health.

Some companies have highly predictable metered revenue. Others have completely random usage. The key is flexibility – you decide how to interpret it.

Closing thoughts

SaaS is evolving. Pricing models are shifting from static subscriptions to dynamic, usage-linked value capture. That's great for alignment between product and customer – but it challenges the traditional language of MRR, churn, and retention.

Whether you include usage-based billing in your MRR or not isn't a right-or-wrong decision. What matters is clarity and consistency. As long as you understand what your numbers mean – and communicate that clearly – you can still make confident, data-driven decisions.

The future of SaaS metrics isn't about forcing new models into old boxes. It's about adapting the way we measure success to match how modern businesses actually earn it.

That's ultimately what GrowPanel aims to help with – giving you flexible, transparent metrics that reflect the real structure of your business.

Whether your revenue is fully recurring, partially metered, or entirely usage-based, you should be able to analyze it with the same clarity. The goal isn't to chase perfect definitions, but to understand what's actually happening beneath the surface: where growth comes from, what drives volatility, and how predictable your business truly is.

Usage-based pricing isn't the end of MRR – it's just a new chapter in how we measure and understand it.

Founder & CEO

Lasse is the founder of GrowPanel. He previously founded Mouseflow, scaling it from $0 to $10M ARR before exiting. He also co-founded Soundvenue and actively invests in SaaS startups.

View full profile →